PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836597

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836597

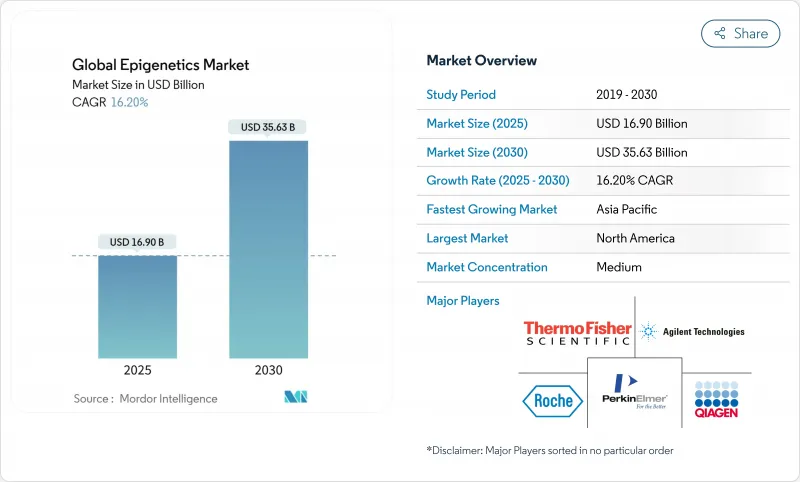

Global Epigenetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Epigenetics market is valued at USD 16.90 billion in 2025 and is projected to reach USD 35.63 billion by 2030, advancing at a 16.20% CAGR in the same period.

Advancing artificial-intelligence algorithms that mine DNA-methylation signatures, long-read sequencing breakthroughs that map complex epigenomic patterns, and faster regulatory clearance for blood-based companion diagnostics are converging to lift demand. Pharmaceutical alliances that embed epigenetic controllers into metabolic and immunological pipelines reinforce near-term commercial traction. The Epigenetics market also benefits from stronger intellectual-property filings around single-cell multi-omics platforms, while venture capital inflows accelerate laboratory automation and cloud bioinformatics ecosystems. North America continues to dominate, yet Asia Pacific shows the steepest uptake as governments subsidize precision-medicine infrastructure and local start-ups adopt pay-per-use sequencing models.

Global Epigenetics Market Trends and Insights

Growing Cancer Incidence & Precision-Medicine Adoption

Escalating global cancer prevalence amid aging populations fuels demand for epigenetic biomarkers that stratify patients and track minimal residual disease. Illumina's expanded TruSight Oncology portfolio now reports methylation-informed variant calls that refine therapy selection. Multi-cancer early detection blood tests that read methylation signatures, such as Galleri, move from research to clinics, enabling earlier intervention. In hematological malignancies, integrated epigenomic-genomic profiling is identifying resistance-associated subtypes, thereby broadening indications for epigenetic drugs. The cumulative momentum positions methylation panels as foundational elements in next-generation companion diagnostics.

Expansion of Epigenetic Applications in Non-Oncology Application

Breakthrough studies show long non-coding RNAs regulate neuroinflammation in Alzheimer's disease, opening therapeutic windows for epigenetic editing. Novo Nordisk and Omega Therapeutics are co-creating epigenomic controllers that modulate thermogenesis for obesity treatment. Cardiometabolic pipelines now incorporate integrated genetic-epigenetic risk algorithms that outperform standard lipid tests. Epigenetic re-writing tools that suppress mutant alleles without DNA cuts are entering early-phase trials for Huntington's disease. Such cross-disciplinary momentum diversifies revenue streams for the Epigenetics market beyond its oncology core.

High Cost of NGS & Single-Molecule Instruments

Even as whole-genome sequencing trends toward the USD 100 threshold, comprehensive epigenomic workflows still need higher coverage, specialized library kits, and robust long-read platforms that keep per-sample costs elevated. Oxford Nanopore's PromethIon, for instance, requires sophisticated fluidics upkeep and high-end GPUs. Single-cell methylome pipelines add separate tagmentation steps, proprietary reagents, and expanded compute clusters. Depreciation charges and recurring service contracts strain clinical labs in Brazil, South Africa, and Indonesia, slowing adoption in those high-burden cancer territories. Bundled leasing and reagent-rental schemes are emerging but have yet to close the affordability gap fully.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Multi-Omics R&D Funding & Collaborative Consortia

- Regulatory Support for Companion Diagnostics

- Shortage of Skilled Bioinformaticians

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Reagents and kits accounted for 41.4% of the epigenetics market share in 2024, propelled by continued bulk purchasing of bisulfite-conversion chemistries and chromatin-immunoprecipitation reagents. Instruments ranked second owing to rising demand for long-read sequencers that detect 5mC, 5hmC, and 6mA directly. The bioinformatics sub-segment, however, is projected to record a 20.1% CAGR through 2030, underpinned by AI-powered cloud pipelines that translate raw signal data into actionable biomarker insights. Advanced analytics vendors now offer pay-as-you-go methylome pipelines, lowering entry barriers for mid-tier hospitals. New patents around machine-learning models for epigenetic age, immune status, and treatment response continue to command premium licensing fees, reflecting the data gravity shift inside the Epigenetics market.

The Epigenetics industry is witnessing a pivot from hardware to software differentiation as sequencing accuracy plateaus. Multi-omics dashboards integrate methylation, chromatin accessibility, and long-read transcript counts in a single user interface. Subscription revenues from informatics suites are outpacing reagent sales growth. Consequently, instrument suppliers have begun bundling analytics credits with sequencer purchases, a tactic that influences total cost-of-ownership decision calculus among clinical labs. Given these currents, bioinformatics platforms are positioned to overtake consumables in revenue contribution by the late forecast horizon.

The Epigenetics Market is Segmented by Product (Instruments, Reagents & Kits, and More), Application (Oncology, Neurology & CNS Disorders, Metabolic Diseases, Autoimmune Diseases, and More), Technology (DNA Methylation Analysis, Histone Modification-Acetylation, Methylation, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 43.4% of the Epigenetics market share in 2024, thanks to FDA clearances for methylation-informed diagnostics and NIH funding that subsidizes multi-omics population studies. Venture investors pumped unprecedented capital into platform start-ups, exemplified by Tune Therapeutics' USD 175 million raise, securing rapid clinical translation tracks for hepatitis B epigenome-silencing therapies. Academic clusters in Boston, San Francisco, and Durham incubate cross-disciplinary talent pools that sustain regional dominance.

Asia Pacific is forecast to grow at 17.0% CAGR through 2030 as aging demographics elevate cancer incidence and governments underwrite precision-oncology test reimbursements. China anchors regional sequencing capacity with industrial-scale nanopore facilities, while Japan's national whole-genome program stimulates secondary epigenome analysis demand. Start-ups in Singapore and India are launching culturally tailored prostate-cancer methylation panels that align with local screening norms. Such initiatives expand the Epigenetics market penetration into previously underserved populations.

Europe exhibits balanced expansion. GDPR-compliant data federations delay cross-border joint analyses, yet the European Health Data Space regulation is harmonizing consent clauses, thereby unlocking consortium trials that integrate epigenomic endpoints. The United Kingdom's GBP 250 million bilateral project with Oxford Nanopore to profile 50,000 biobank epigenomes exemplifies public-private investment intensity. Germany and France sustain pharmaceutical research into LSD1 and EZH2 inhibitors, amplifying regional Epigenetics market engagement despite reimbursement heterogeneity across member states.

- Abcam

- Active Motif

- Hologic Inc (Diagenode)

- Roche

- Illumina

- Merck

- QIAGEN

- Thermo Fisher Scientific

- Zymo Research Corp.

- PerkinElmer

- Bio-Rad Laboratories

- New England Biolabs

- Agilent Technologies

- Pacific Biosciences

- Oxford Nanopore Technologies

- NanoString Technologies

- EpiCypher Inc.

- Guardant Health

- Base Genomics

- Bioneen Inc.

- Element Biosciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Cancer Incidence & Precision-Medicine Adoption

- 4.2.2 Expansion Of Epigenetic Applications In Non-Oncology Application

- 4.2.3 Surge In Multi-Omics R&D Funding & Collaborative Consortia

- 4.2.4 Regulatory Support For Companion Diagnostics

- 4.2.5 AI-Enabled Epigenetic Biomarker Discovery Accelerators

- 4.2.6 Venture Investments In Single-Cell & Long-Read Epigenomics Platforms

- 4.3 Market Restraints

- 4.3.1 High Cost Of NGS & Single-Molecule Instruments

- 4.3.2 Shortage Of Skilled Bioinformaticians

- 4.3.3 Data-Privacy Hurdles For Population-Scale Epigenomic Datasets

- 4.3.4 Limited Reimbursement Pathways For Epigenetic Diagnostics

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.2 Reagents & Kits

- 5.1.3 Bioinformatics Tools & Services

- 5.1.4 Consumables & Accessories

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Neurology & CNS Disorders

- 5.2.3 Metabolic Diseases

- 5.2.4 Autoimmune Diseases

- 5.2.5 Cardiovascular Diseases

- 5.2.6 Infectious Diseases

- 5.2.7 Others

- 5.3 By Technology

- 5.3.1 DNA Methylation Analysis

- 5.3.2 Histone Modification (Acetylation, Methylation, Phosphorylation)

- 5.3.3 Non-coding RNA Analysis

- 5.3.4 Chromatin Accessibility & Conformation

- 5.3.5 Other Technologies

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abcam PLC

- 6.3.2 Active Motif

- 6.3.3 Hologic Inc (Diagenode)

- 6.3.4 F. Hoffmann-La Roche Ltd

- 6.3.5 Illumina Inc.

- 6.3.6 Merck KGaA (Sigma-Aldrich)

- 6.3.7 QIAGEN N.V.

- 6.3.8 Thermo Fisher Scientific

- 6.3.9 Zymo Research Corp.

- 6.3.10 PerkinElmer Inc.

- 6.3.11 Bio-Rad Laboratories

- 6.3.12 New England Biolabs

- 6.3.13 Agilent Technologies

- 6.3.14 Pacific Biosciences

- 6.3.15 Oxford Nanopore Technologies

- 6.3.16 NanoString Technologies

- 6.3.17 EpiCypher Inc.

- 6.3.18 Guardant Health

- 6.3.19 Base Genomics

- 6.3.20 Bioneen Inc.

- 6.3.21 Element Biosciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment