PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836605

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836605

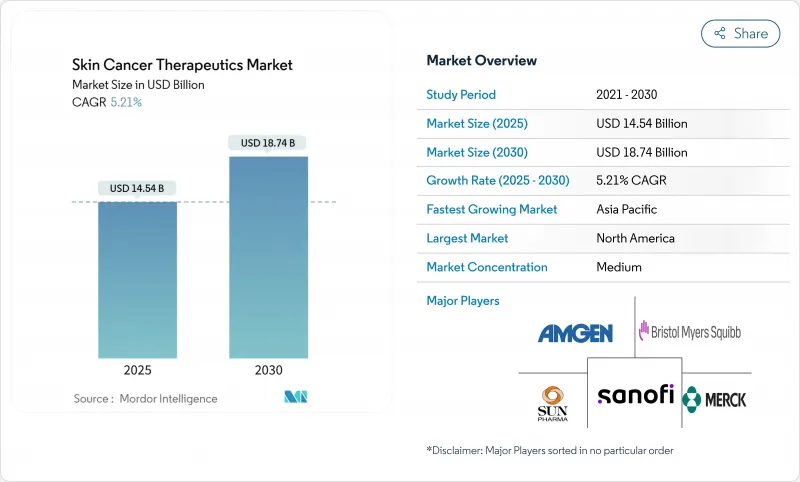

Skin Cancer Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The skin cancer therapeutics market reached USD 14.54 billion in 2025 and is forecast to advance to USD 18.74 billion by 2030, registering a 5.21% CAGR.

The adoption of precision medicine, real-time molecular tests, and artificial-intelligence (AI) decision support is moving care away from stand-alone surgery and toward data-guided therapy selection. AI diagnostic platforms now match specialist performance, posting 96% sensitivity, while mRNA-based vaccines have cut melanoma recurrence rates by 49% in late-stage studies. Regulators are fast-tracking novel agents, payers are broadening reimbursement for tele-dermatology, and investors are funding outpatient delivery models that lower procedure costs. Supply-side dynamics are equally important: pharmaceutical alliances combining checkpoint inhibitors with personalized vaccines, manufacturers embedding AI into therapeutics, and practice consolidations backed by private equity are together reshaping competitive positioning.

Global Skin Cancer Therapeutics Market Trends and Insights

Increasing Incidence of Skin Cancer

Melanoma cases rose 42% from 2015 to 2025, confirming that aging populations, lifestyle shifts, and environmental pollutants jointly heighten disease burden. Urban pollution hotspots show unexpectedly high incidence, hinting that airborne carcinogens add to ultraviolet exposure risks. Earlier detection through high-resolution imaging increases case counts yet improves survival, sustaining demand for both diagnostics and therapy. Emerging economies now mirror Western sun-exposure patterns, assuring that the skin cancer therapeutics market will keep expanding even as prevention campaigns intensify.

Growing Approvals of Immune-Oncology Drugs

Regulators accelerate access to novel agents. In 2024, the FDA cleared subcutaneous nivolumab for all solid tumors, the first PD-1 inhibitor delivered outside an infusion suite. China's nod for toripalimab as frontline melanoma therapy illustrates regulatory harmonization with Western standards. The ten-year survival of 43% for the nivolumab-ipilimumab doublet sustains premium pricing. Broader indications and simplified dosing support continued uptake across the skin cancer therapeutics market.

High Therapy & Device Capital Cost

Checkpoint inhibitors exceed USD 23,000 per dose, while tumor-infiltrating lymphocyte therapy can run USD 100,000 per course. MOH's surgery costs climbed even as U.S. Medicare reimbursement fell 46% in real terms from 2007 to 2024. In low-income nations, these prices dwarf annual health budgets, limiting adoption and dragging on the skin cancer therapeutics market. Practice consolidation creates operational savings but can raise patient fees as investors seek returns.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Combination mRNA-IO Vaccines

- Emergence of Personalized Neoantigen Cell Therapies Personalized neoantigen cell

- Severe Immune-Related Adverse Events

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Melanoma controlled 48.0% of the skin cancer therapeutics market in 2024, a commanding position given that the tumor accounts for only 1% of overall cases. Premium drug prices and multidisciplinary management underpin that share. Combination nivolumab-ipilimumab costs exceed USD 100,000 per patient year, reinforcing revenue concentration. Rare entities such as Merkel cell carcinoma are forecast to rise to 13.4% CAGR as diagnostic awareness improves and targeted agents enter the pipeline. Basal cell carcinoma maintains growth through sheer volume, while cutaneous squamous cell carcinoma gains from newly approved antibodies that post 47.4% response rates.

Precision-biopsy tests shrink unnecessary surgery. Castle Biosciences' DecisionDx-Melanoma guides sentinel-node decisions, cutting morbidity without impairing control. Neoadjuvant therapy trials and mRNA vaccines widen the treatable population to earlier stages. Collectively, these advances protect melanoma's revenue importance even as other subtypes accelerate.

The Skin Cancer Therapeutics Market is Segmented by Disease Type (Melanoma, Basal Cell Carcinoma, and More), Treatment Modality (Surgery, Chemotherapy, Immunotherapy, and More), End User (Hospitals, Dermatology Clinics, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 40.1% share in 2024 through early technology adoption, dense specialist networks, and favorable reimbursement. Europe follows with harmonized rules and universal-care funding mechanisms.

Asia Pacific records the fastest 10.3% CAGR: China's NMPA accepted toripalimab for first-line melanoma, and Japan is pioneering boron neutron capture therapy, treating more than 500 patients to date, nature.com.

The Middle East and Africa rely on medical-tourism corridors, while South America benefits from rising public-health budgets. Supply chains are localizing: Chinese contract manufacturers now produce PD-1 antibodies, and Indian device firms supply dermoscopy units. These shifts highlight regional self-sufficiency trends within the skin cancer therapeutics market, even as global companies drive technology transfer alliances.

- Amgen

- Pfizer

- Bristol-Myers Squibb

- Iovance Biotherapeutics

- Sanofi

- Merck

- Novartis

- Regeneron

- Sun Pharmaceuticals Industries

- Evaxion Biotech

- InxMed

- MediWound

- Roche

- AstraZeneca

- Moderna

- Castle Biosciences

- DermTech

- Squaremind

- Medicus Pharma

- Canfield Scientific

- Danaher

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence Of Skin Cancer

- 4.2.2 Growing Approvals Of Immune-Oncology Drugs

- 4.2.3 Expansion Of Targeted BRAF/MEK Inhibitor Therapies

- 4.2.4 Rising Adoption Of Hedgehog Pathway Inhibitors In Advanced BCC

- 4.2.5 Emergence Of Personalized Neoantigen Cell Therapies

- 4.2.6 Breakthrough Therapy Designations For Topical Oncolytic Patches

- 4.3 Market Restraints

- 4.3.1 High Therapy & Device Capital Cost

- 4.3.2 Severe Immune-Related Adverse Events

- 4.3.3 Global Shortage Of Trained Dermatologists

- 4.3.4 AI-Algorithm Racial Bias & Data-Privacy Gaps

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Disease Type

- 5.1.1 Melanoma

- 5.1.2 Basal Cell Carcinoma

- 5.1.3 Cutaneous Squamous Cell Carcinoma

- 5.1.4 Other Rare Skin Cancers

- 5.2 By Treatment Modality

- 5.2.1 Surgery

- 5.2.2 Chemotherapy

- 5.2.3 Immunotherapy

- 5.2.4 Targeted Therapy

- 5.2.5 Photodynamic Therapy

- 5.2.6 Others

- 5.3 By End-user

- 5.3.1 Hospitals

- 5.3.2 Dermatology Clinics

- 5.3.3 Cancer Centers

- 5.3.4 Ambulatory Surgical Centers

- 5.3.5 Research & Academic Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Amgen

- 6.3.2 Pfizer

- 6.3.3 Bristol-Myers Squibb

- 6.3.4 Iovance Biotherapeutics

- 6.3.5 Sanofi

- 6.3.6 Merck & Co.

- 6.3.7 Novartis

- 6.3.8 Regeneron

- 6.3.9 Sun Pharma

- 6.3.10 Evaxion Biotech

- 6.3.11 InxMed

- 6.3.12 MediWound

- 6.3.13 Roche

- 6.3.14 AstraZeneca

- 6.3.15 Moderna

- 6.3.16 Castle Biosciences

- 6.3.17 DermTech

- 6.3.18 Squaremind

- 6.3.19 Medicus Pharma

- 6.3.20 Canfield Scientific

- 6.3.21 Leica Microsystems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment