PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836614

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836614

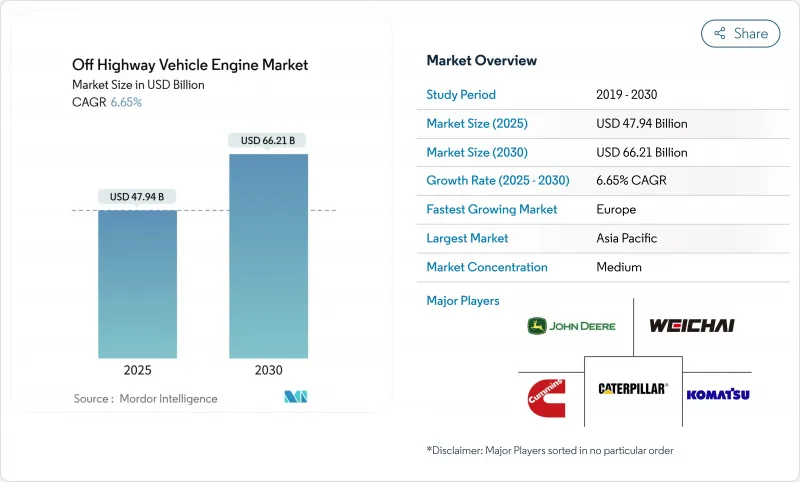

Off Highway Vehicle Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Off Highway Vehicle Engine Market size is estimated at USD 47.94 billion in 2025, and is expected to reach USD 66.21 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030).

Increasing infrastructure spending, tighter emission rules, and rising mechanization across agriculture, mining, and material-handling applications are reshaping engine demand. Growth remains anchored in diesel technology but hybrid-electric and fuel-agnostic platforms are widening their footprint, helped by rapid progress in telematics, predictive maintenance, and compatibility with hydrotreated vegetable oil and renewable diesel fuels.

Global Off Highway Vehicle Engine Market Trends and Insights

Massive Global Infrastructure Pipeline (G7 & BRI)

The USD 1.2 trillion Infrastructure Investment and Jobs Act is driving annual construction equipment sales growth of 10% across the US Midwest states. Parallel investments under China's Belt and Road Initiative stimulate demand for heavy excavators and bulldozers across Africa, Southeast Asia, and Eastern Europe. Chinese exporters shipped more construction machines abroad than they sold domestically for the first time in 2023, rebalancing global supply chains and reinforcing volume in the off-highway vehicle engine market. Multi-year funding windows enable manufacturers to scale capacity and refine hybrid-ready designs with confidence.

Growing Mechanization of Agriculture in Asia-Pacific and Africa

Tractor penetration reached 74% of South Asian farms in 2024, while water pumps and threshers exceeded 65% adoption. Rising rural wages across India and China push farms toward capital-intensive practices, creating steady replacement demand in the 30-120 HP range. Sub-Saharan Africa still trails South America in mechanization, signaling a sizeable addressable pool for compact, fuel-efficient engines that perform reliably in harsh field conditions. Service-oriented business models allow smallholders to access machinery without ownership, broadening market reach for engine suppliers and further supporting the off-highway vehicle engine market.

Accelerating Electrification of Compact Equipment

Electric wheel loaders captured 10% of Chinese sales in 2024, with 6,000-7,000 electric construction machines sold worldwide. Cost parity achieved by several Chinese OEMs pressures legacy engine providers in the sub-100 HP class. European urban zones restrict diesel, accelerating battery adoption for indoor demolition and waste-handling tasks. However, long-haul mining, forestry, and 24-hour quarry operations still rely on diesel due to energy density and quick refueling needs, preserving core demand inside the off highway vehicle engine market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Stage V / Tier 5 Norms Triggering Pre-buy & Retrofit Cycles

- OEM Shift to Modular Hybrid-Ready Engine Platforms

- Escalating After-treatment Cost vs. Price-Sensitive Buyers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Construction equipment generated 58.36% of 2024 off-highway vehicle engine market revenue, a position fortified by government stimulus in roads, bridges, and transit systems. Asia Pacific megaprojects, together with the US funding surge, sustain demand for excavators, dozers, and loaders that rely on 121-400 HP blocks. Mining equipment shows renewed momentum because copper, lithium, and nickel projects expand to meet battery supply chains. Forestry and materials-handling niches favor engines like the John Deere PowerTech(TM) PSS 9.0 L delivering up to 330 hp in steep terrain. Electric compact loaders post a 6.27% CAGR, illustrating early electrification success where duty cycles and charging access are predictable. Nevertheless, high-horsepower diesel remains essential for round-the-clock mining shovels and underground haulage, upholding volume in the off highway vehicle engine market.

Compact construction fleets in Europe adopt telematics to trim idle hours, cutting fuel burn by 12% and extending overhaul intervals. Asian rental operators prefer modular engines with easy service access, keeping downtime low on busy urban sites. Belt and Road projects in Africa pull demand for mid-range 90-200 kW engines that balance fuel efficiency and toughness. Mining majors in Latin America request EU Stage V compliant powertrains to future-proof assets against tightening local rules. Together, these dynamics keep construction equipment in pole position while mining gradually widens its share of the off highway vehicle engine market.

The 31-70 HP category held 64.51% of off-highway vehicle engine market share in 2024 and records a 7.02% CAGR to 2030, fueled by compact excavators, skid-steers, and mid-size tractors used in rice paddies and horticulture. Urban densification calls for maneuverable machinery that fits narrow streets and reduces collateral damage on finished surfaces. OEMs integrate start-stop functions and advanced fuel maps, claiming double-digit consumption cuts that appeal to fleet managers. Telematics platforms visualize idle time and enable over-the-air parameter tweaks to meet local noise or emission constraints without dealership visits.

Higher brackets above 400 HP serve mining trucks and large hydraulic shovels, segments where Caterpillar's 3512B-EUI at 1,450 hp remains a benchmark. Despite lower unit volumes, these engines command premium pricing and aftermarket parts revenue. Conversely, sub-30 HP platforms suffer most from electrification encroachment because battery packs now deliver full-shift performance for lawn care, golf course, and small municipal tasks. The resulting polarization directs R&D spending toward mid-range products that anchor the off highway vehicle engine market while preserving high-horsepower prestige lines.

The Off Highway Vehicle Engine Market Report is Segmented by Vehicle Type (Agricultural Machinery and More), Power Output (Less Than or Equal To 30 HP, 31-70 HP, and More), Fuel Type (Diesel, Gasoline, and More), Engine Displacement (Less Than or Equal 2 L, 2. 1 To 3. 5 L, and More), Propulsion Technology (Conventional ICE and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific retained 38.17% revenue in 2024 due to large-scale infrastructure programs and accelerating farm mechanization. China exported more construction equipment than it sold at home during 2023, cushioning domestic softness and creating a global channel for engines produced in Changsha and Xuzhou. India's government subsidies improve tractor affordability, lifting 2025 retail volumes despite monsoon variability. Demand skews toward 31-120 HP units maneuvering in congested urban job sites or small farm plots. Regional OEMs favor modular engines certified for both Tier 3 and Stage V so they can ship to Africa or Europe without re-engineering, reinforcing the scalability of the off-highway vehicle engine market.

Europe, growing at 7.19% CAGR, benefits from Stage V compliance investments and the Green Deal's focus on rail, renewable energy, and circular economy facilities. Customers prioritize particulate filters with passive regeneration and telematics, integrating carbon accounting dashboards. Komatsu's Stage V portfolio demonstrates maintenance-free operation for a longer duration, a compelling proposition for rental firms facing tight utilization targets. European municipalities also pilot hydrogen ICE refuse trucks, supporting supplier R&D in alternative fuels.

North America capitalizes on the Infrastructure Investment and Jobs Act, which underwrites sustained engine demand for interstate highway revamps, bridge replacements, and port dredging. California's forthcoming Tier 5 rules set the strictest global bar, pushing OEMs to test next-generation SCR and ammonia sensors several years ahead of enforcement. South America, the Middle East, and Africa represent high-growth but cost-sensitive regions. Currency headwinds and financing gaps limit immediate penetration yet offer upside as commodity cycles improve and multilateral lenders sponsor roads, power plants, and irrigation schemes that rely on reliable medium-horsepower engines imported from Asia or remanufactured in Brazil.

- AGCO Corporation

- Caterpillar Inc.

- Cummins Inc.

- Deere & Company

- Deutz AG

- Komatsu Ltd

- Mahindra Powertrain

- Scania AB

- Volvo Penta

- Yanmar Co.

- Weichai Power

- Kubota Corporation

- Perkins Engines

- MAN Engines

- Rolls-Royce Power Systems (MTU)

- Doosan Infracore

- FPT Industrial

- Kohler Engines

- Hatz Diesel

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Massive global infrastructure pipeline (G7 & BRI)

- 4.2.2 Growing mechanization of agriculture in Asia-Pacific and Africa

- 4.2.3 Stricter Stage V / Tier 5 norms triggering pre-buy & retrofit cycles

- 4.2.4 OEM shift to modular hybrid-ready engine platforms

- 4.2.5 Telematics-driven predictive maintenance shortening replacement cycles

- 4.2.6 HVO/renewable-diesel compatibility extending ICE relevance

- 4.3 Market Restraints

- 4.3.1 Accelerating electrification of compact equipment

- 4.3.2 Escalating after-treatment cost vs. price-sensitive buyers

- 4.3.3 Commodity-price volatility squeezing engine margins

- 4.3.4 Rental fleets extending overhaul intervals

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Agricultural Machinery

- 5.1.2 Construction Equipment

- 5.1.3 Mining Equipment

- 5.1.4 Forestry & Material-Handling Equipment

- 5.2 By Power Output (HP)

- 5.2.1 Less than or equal to 30 HP

- 5.2.2 31-70 HP

- 5.2.3 71-120 HP

- 5.2.4 121-400 HP

- 5.2.5 More than 400 HP

- 5.3 By Fuel Type

- 5.3.1 Diesel

- 5.3.2 Gasoline

- 5.3.3 Natural-/Bio-Gas

- 5.3.4 Hybrid-Electric & Fuel-Cell

- 5.4 By Engine Displacement (L)

- 5.4.1 Less than or equal 2 L

- 5.4.2 2.1 to 3.5 L

- 5.4.3 3.6 to 7 L

- 5.4.4 More than 7 L

- 5.5 By Propulsion Technology

- 5.5.1 Conventional ICE

- 5.5.2 Hybrid

- 5.5.3 Battery-Electric

- 5.5.4 Fuel-Cell Electric

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Russia

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.6 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.3.1 AGCO Corporation

- 6.3.2 Caterpillar Inc.

- 6.3.3 Cummins Inc.

- 6.3.4 Deere & Company

- 6.3.5 Deutz AG

- 6.3.6 Komatsu Ltd

- 6.3.7 Mahindra Powertrain

- 6.3.8 Scania AB

- 6.3.9 Volvo Penta

- 6.3.10 Yanmar Co.

- 6.3.11 Weichai Power

- 6.3.12 Kubota Corporation

- 6.3.13 Perkins Engines

- 6.3.14 MAN Engines

- 6.3.15 Rolls-Royce Power Systems (MTU)

- 6.3.16 Doosan Infracore

- 6.3.17 FPT Industrial

- 6.3.18 Kohler Engines

- 6.3.19 Hatz Diesel

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment