PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836617

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836617

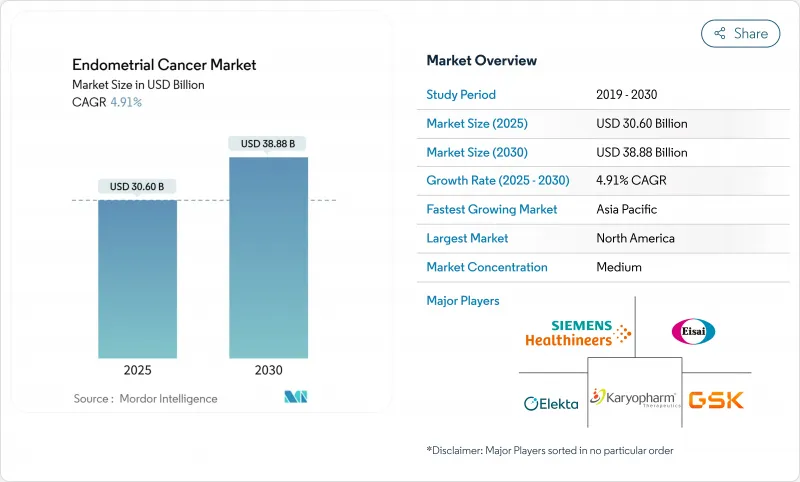

Endometrial Cancer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global endometrial cancer market size reached USD 30.60 billion in 2025 and is forecast to climb to USD 38.88 billion by 2030, advancing at a 4.91% CAGR.

Growth is propelled by the rapid uptake of immunotherapy-chemotherapy combinations that markedly improve overall survival, wider molecular testing that guides targeted prescribing, and supportive reimbursement policies in high-income countries. Diagnostic innovation-including artificial-intelligence image analysis and proteomic biomarker panels-broadens early detection while minimally invasive procedures make screening more acceptable to patients. Meanwhile, supply chain investments in domestic radioisotope production ease bottlenecks for imaging and brachytherapy, ensuring treatment capacity keeps pace with rising incidence. Competitive dynamics are dominated by three checkpoint inhibitors, and their combination trial programs sustain a high rate of new label expansions that reinforce brand loyalty across oncology networks.

Global Endometrial Cancer Market Trends and Insights

Rising Prevalence Linked to Obesity & Ageing Women

Global increases in obesity and longer female life expectancy enlarge the treated population, straining oncology services and creating sustained demand for therapies and diagnostics. Metabolic comorbidities such as diabetes and hypertension raise surgical risk and complicate perioperative management, encouraging earlier adoption of systemic therapy options. Endometrial thickness readings above 14 mm quadruple concurrent malignancy risk, prompting more frequent gynecologic oncology referrals for staging. Healthcare systems respond by scaling multidisciplinary clinics and leveraging tele-oncology to manage rising caseloads, especially in suburban and rural settings. Insurers increasingly recognize obesity-linked risk, approving preventive screening benefits that feed newly diagnosed cases into the treatment pipeline. As high-BMI cohorts enter the 60-65 year age band, the endometrial cancer market is set for long-run expansion.

Rapid Adoption of Immunotherapy-Chemotherapy Combinations

Three checkpoint inhibitor combinations won regulatory clearance between January 2024 and March 2025, each showing superior survival to platinum doublet chemotherapy. Dostarlimab plus carboplatin-paclitaxel extended median overall survival to 44.6 months versus 28.2 months for chemotherapy alone. Pembrolizumab regimens improved progression-free survival by 70% in mismatch-repair-deficient tumors, while durvalumab cut disease-progression risk by 58% in the DUO-E trial. Such data reset clinical expectations, and national guidelines now recommend combination therapy as frontline care for advanced disease. The shift forces expansion of molecular testing, because biomarker-guided eligibility determines reimbursement and optimizes outcomes. Rapid approvals in Canada and the European Union illustrate global harmonization, enabling multinational trial readouts to convert swiftly into commercial revenue.

High Treatment Costs of Novel Agents

Checkpoint inhibitor combinations command premium list prices, leading to incremental cost-effectiveness ratios above USD 150,000 per quality-adjusted life year for mismatch-repair-proficient tumors. Pharmacoeconomic studies show dostarlimab plus chemotherapy requires a 15% price trim to meet willingness-to-pay thresholds in China. Recurrent-disease management adds USD 84,562 in excess annual costs per patient compared with non-recurrent cases. In lower-income regions, reimbursement delays of up to seven years exacerbate survival gaps, constraining the endometrial cancer market despite clinical breakthroughs.

Other drivers and restraints analyzed in the detailed report include:

- Favourable Reimbursement for Targeted Therapies

- Growth in Minimally-Invasive Diagnostic Procedures

- Drug-Related Toxicities Limiting Adherence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endometrial carcinoma anchored the endometrial cancer market with a 73.55% revenue share in 2024, supported by the largest patient pool and extensive evidence for checkpoint inhibitor combinations. Uterine sarcomas, though accounting for a minority of cases, are on an 8.25% CAGR trajectory as precision-surgery techniques and off-label targeted agents improve outcomes. Carcinosarcoma guidelines now recommend dostarlimab-based regimens, reflecting solid survival benefits across mismatch-repair status. Advanced adenocarcinoma responds especially well to pembrolizumab plus carboplatin-paclitaxel, which demonstrated a 70% progression-free survival gain, consolidating physician preference. Molecular sub-typing reveals p53-like NSMP tumors with unexpectedly aggressive behavior; these lesions are enrolling rapidly in next-generation trials exploring double-checkpoint blockade.

AI-enabled histopathology platforms flag high-risk clones previously misclassified, allowing earlier systemic therapy. Lenvatinib-pembrolizumab, studied in carcinosarcoma case series, achieved disease-control rates above 60% with manageable hypertension and fatigue, offering a salvage option when platinum regimens fail. With biomarker testing now routine, therapeutic choice shifts from histology to mutation-based algorithms, deepening segmentation and pushing demand for companion diagnostics within the endometrial cancer market.

The Endometrial Cancer Market Report is Segmented by Type of Cancer (Endometrial Carcinoma [Adenocarcinoma, Carcinosarcoma, and More], and Uterine Sarcomas), Type of Therapy (Immunotherapy, Radiation Therapy, and More), Diagnosis Method (Biopsy, Pelvic Ultrasound, Hysteroscopy, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the endometrial cancer market size with 37.72% share in 2024 on the strength of broad immunotherapy insurance coverage, high screening penetration, and concentration of specialized oncology centers. Uptake of molecular diagnostics is near-universal, and Health Canada's 2025 approvals of pembrolizumab and dostarlimab within weeks of each other confirm swift regulatory throughput. Price negotiation mechanisms such as Outcomes-Based Agreements ensure timely public-payer listing while managing budget impact.

Europe remains an innovation-friendly but cost-aware environment. The CHMP's positive opinion for dostarlimab expansion to all advanced cases sets the stage for continent-wide reimbursement, yet national bodies scrutinize cost-effectiveness ratios, sometimes mandating risk-sharing deals before inclusion. Eastern European markets show slower uptake, but EU cohesion funds now subsidize molecular pathology labs, closing access gaps.

Asia-Pacific exhibits the fastest 9.22% CAGR through 2030, reflecting both demographic pressure and government action. Japan and South Korea integrate immunotherapy into national guidelines, while China leverages domestic manufacturing to lower prices and accelerate approvals via the Hainan Real-World Evidence pilot. A broader disease burden study predicts continuous incidence growth until 2050, especially in women aged 60-64, underscoring sustained demand.

In South America, expanding private insurance and medical-tourism flows influence adoption patterns. Patients from Andean and Central American countries often travel to Brazil for checkpoint inhibitors unavailable locally. Sub-Saharan Africa faces the largest care gaps; 92% of providers surveyed report outbound medical travel for gynecologic oncology, spotlighting unmet need. International aid programs that sponsor pathology-lab upgrades are beginning to narrow the diagnostic divide, which will translate into measurable market growth over the next decade.

- Merck

- Eisai

- Novartis

- Elekta

- Siemens Healthineers (Varian)

- GlaxoSmithKline

- Karyopharm Therapeutics

- Takeda Pharmaceuticals

- Bristol-Myers Squibb

- Roche

- Context Therapeutics

- AstraZeneca

- Pfizer

- Hologic

- Myriad Genetics

- GE Healthcare

- Medtronic

- Astellas Pharma

- Clovis Oncology

- Seagen Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Linked To Obesity & Ageing Women

- 4.2.2 Rapid Adoption Of Immunotherapy-Chemotherapy Combinations

- 4.2.3 Favourable Reimbursement For Targeted Therapies

- 4.2.4 Growth In Minimally-Invasive Diagnostic Procedures

- 4.2.5 Outpatient Shift For Brachytherapy Expanding Access

- 4.3 Market Restraints

- 4.3.1 High Treatment Costs Of Novel Agents

- 4.3.2 Drug-Related Toxicities Limiting Adherence

- 4.3.3 Radio-Isotope Supply Constraints For Imaging/Therapy

- 4.4 Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Cancer

- 5.1.1 Endometrial Carcinoma

- 5.1.1.1 Adenocarcinoma

- 5.1.1.2 Carcinosarcoma

- 5.1.1.3 Squamous Cell Carcinoma

- 5.1.1.4 Other Types

- 5.1.2 Uterine Sarcomas

- 5.1.1 Endometrial Carcinoma

- 5.2 By Type of Therapy

- 5.2.1 Immunotherapy

- 5.2.2 Radiation Therapy

- 5.2.3 Chemotherapy

- 5.2.4 Other Therapies

- 5.3 By Diagnosis Method

- 5.3.1 Biopsy

- 5.3.2 Pelvic Ultrasound

- 5.3.3 Hysteroscopy

- 5.3.4 CT Scan

- 5.3.5 Other Methods

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Merck KGaA

- 6.3.2 Eisai Co Ltd

- 6.3.3 Novartis AG

- 6.3.4 Elekta AB

- 6.3.5 Siemens Healthineers (Varian)

- 6.3.6 GSK plc

- 6.3.7 Karyopharm Therapeutics

- 6.3.8 Takeda Pharmaceutical

- 6.3.9 Bristol Myers Squibb

- 6.3.10 F. Hoffmann-La Roche

- 6.3.11 Context Therapeutics

- 6.3.12 AstraZeneca PLC

- 6.3.13 Pfizer Inc

- 6.3.14 Hologic Inc

- 6.3.15 Myriad Genetics

- 6.3.16 GE HealthCare

- 6.3.17 Medtronic plc

- 6.3.18 Astellas Pharma

- 6.3.19 Clovis Oncology

- 6.3.20 Seagen Inc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment