PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836618

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836618

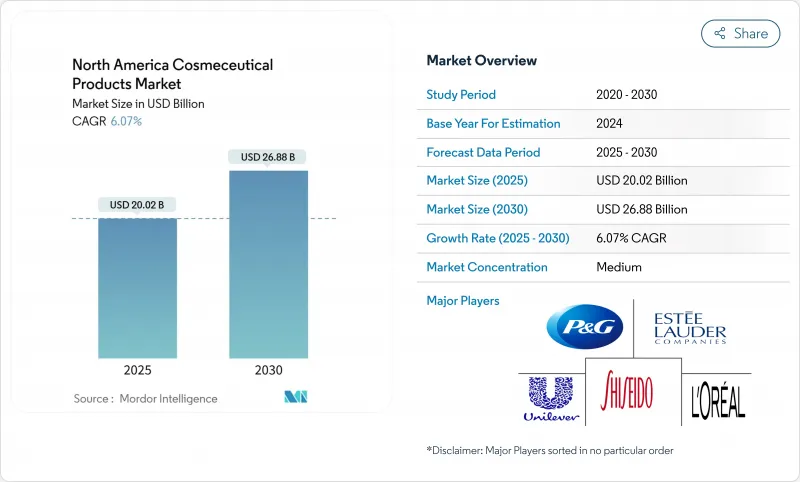

North America Cosmeceuticals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America cosmeceuticals market size is estimated at USD 20.02 billion in 2025, and is expected to reach USD 26.88 billion by 2030, representing a compound annual growth rate (CAGR) of 6.07%.

This market segment integrates pharmaceutical efficacy with cosmetic applications through advanced bioactive ingredients and formulation technologies to serve consumer requirements across the United States, Canada, and Mexico. Market expansion is primarily attributed to the increasing consumer preference for clinically validated products targeting age-related concerns while maintaining adherence to regulatory safety protocols. Other key factors driving market expansion include the FDA's Modernization of Cosmetics Regulation Act (MoCRA), which has strengthened industry compliance requirements and benefited companies with established quality management systems.

North America Cosmeceuticals Market Trends and Insights

Growing Demand for Anti-Aging and Skin Repair Solutions in Global Markets

The anti-aging cosmeceuticals segment is growing rapidly due to demographic changes and advances in peptide and retinoid formulations. The integration of nanotechnology with active ingredients improves peptide stability and bioavailability, overcoming previous formulation limitations. At the 2024 SCALE Conference, Estee Lauder's Clinique and La Mer brands presented marine-derived compounds that provide retinol-like anti-aging benefits without causing inflammation. In April 2025, Promura GmbH invested USD 3 million in Sirona Biochem through unsecured, convertible debentures to advance research, development, and commercialization of anti-aging skincare products, specifically TFC-1326. This development has particular significance in North American markets, where aging populations have higher disposable incomes and demonstrate greater interest in scientifically proven skincare products.

Innovation in Bioactive Ingredient Development and Advanced Formulation Technologies

The integration of biotechnology in cosmeceutical formulations has advanced through enhanced delivery systems and bioactive compounds from sustainable sources. The application of nanotechnology enables better penetration of unstable ingredients, such as vitamin C and retinoids, while nanostructured lipid carriers improve product effectiveness and user experience. Plant-derived metabolites, including flavonoids, phenolic acids, and terpenoids, are increasingly used for their antioxidant and photoprotective properties. The adoption of Natural Deep Eutectic Solvents (NaDES) in extraction methods has improved the stability and bioactivity of these compounds. Pierre Fabre demonstrates this industry transition with its goal to achieve 90% natural-origin ingredients by the end of 2025, supported by over 1,000 annual clinical studies across six research centers . Companies that invest in developing proprietary delivery systems and bioactive compounds gain competitive advantages in the market.

High Costs Associated with Research, Testing, And Product Development Processes

As investment demands for cosmeceutical development rise, new entrants face daunting barriers, while established firms with robust research and development infrastructures solidify their dominance. Regulatory standards, particularly concerning safety, efficacy, and labeling, especially for products teetering on pharmaceutical claims, intensify these challenges. In the U.S., the FDA oversees cosmetic safety under the Federal Food, Drug, and Cosmetic Act. Recent moves, like the Modernization of Cosmetics Regulation Act (MoCRA), hint at a trend towards heightened scrutiny. Furthermore, the adoption of nanotechnology and sophisticated delivery systems necessitates hefty investments in specialized manufacturing and stringent quality control. These challenges weigh heavily on smaller entities without the cushion of economies of scale, often sparking heightened merger and acquisition interest from private equity. Firms boasting diversified portfolios can more efficiently distribute research and development expenses across various markets and categories, securing a competitive advantage.

Other drivers and restraints analyzed in the detailed report include:

- Increased Focus on Preventive Skincare Through Scientific Advancements

- Social Media's Significant Impact on Beauty Product Selection Worldwide

- Stringent Regulatory Guidelines for Product Safety and Market Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, skin care products hold a 56.34% share of the North American cosmeceuticals market, maintaining dominance. Lip care shows the highest growth rate at 8.84% CAGR through 2030. The skin care segment leads due to demand for anti-aging, anti-acne, and sun protection products offering both cosmetic and therapeutic benefits. Anti-aging products utilize peptide technology, with acetyl hexapeptide-8 and palmitoyl pentapeptide-4 reducing wrinkles and boosting collagen. Anti-acne products focus on natural antimicrobials and probiotics to regulate the skin microbiome, while sun protection blends UV filters with antioxidants. Market growth is supported by an aging demographic, with 17.43% of the American population aged 65+ in 2023, according to World Bank data .

Hair care products, including shampoos, conditioners, and colorants, are evolving through bioactive ingredients and sustainable formulations. Natural pigments extracted from neem, fenugreek, and hibiscus flowers provide alternatives to synthetic hair dyes. The lip care segment's 8.84% growth rate reflects increased focus on lip health and advanced formulations with peptides and botanical extracts. Oral care cosmeceuticals show potential growth, particularly in products for enamel strengthening and gum health. The integration of pharmaceutical and cosmetic technologies across segments creates opportunities for companies focused on clinical testing and delivery system development.

Conventional formulations hold 72.33% market share in 2024, while natural/organic alternatives grow at 8.21% CAGR, indicating changing consumer preferences toward clean-label products with transparent ingredients. The conventional segment maintains its dominance through established supply chains, proven efficacy, and lower costs that appeal to price-sensitive consumers and mass retailers. The natural/organic segment's growth rate suggests a market shift toward sustainable formulations driven by environmental and health consciousness.

Improvements in extraction methods and stabilization techniques address previous limitations of natural formulations, including efficacy and shelf life. Major companies are adopting sustainability targets, with L'Oreal and Unilever committing to 100% sustainable palm oil and 90% natural-origin ingredients by 2025. Natural Deep Eutectic Solvents (NaDES) technology improves natural formulation stability and effectiveness while maintaining clean-label standards. Natural/organic products command premium prices, offering higher margins for companies that effectively demonstrate their efficacy and sustainability benefits to consumers.

The North America Cosmeceuticals Market Report is Segmented by Product Type (Skin Care, Hair Care, and More), Category (Conventional, and Natural/Organic), End-User (Male and Female), Distribution Channel (Supermarkets/Hypermarkets, Beauty and Health Stores, and More), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal S.A.

- The Estee Lauder Companies Inc.

- Shiseido Company, Limited

- Procter & Gamble Company

- Unilever PLC

- Coty Inc.

- Revlon Inc.

- Henkel AG & Co. KGaA

- Kenvue Inc.

- Amorepacific Corp.

- Groupe Clarins SA

- Galderma Holding SA

- AbbVie Inc.

- Perrigo Company plc

- Colgate-Palmolive Company

- Beiersdorf AG

- Natura &Co Holding S.A

- Kao Corporation

- Church & Dwight Co. Inc.

- Haleon plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Anti-Aging and Skin Repair Solutions in Global Markets

- 4.2.2 Innovation in Bioactive Ingredient Development and Advanced Formulation Technologies

- 4.2.3 Increased Focus on Preventive Skincare Through Scientific Advancements

- 4.2.4 Social Media's Significant Impact on Beauty Product Selection Worldwide

- 4.2.5 Consumer Preference for Clinically Validated Products and Research-Based Solutions

- 4.2.6 Rising Adoption of Natural and Clean-Label Formulations Across Markets

- 4.3 Market Restraints

- 4.3.1 High Costs Associated with Research, Testing, And Product Development Processes

- 4.3.2 Stringent Regulatory Guidelines for Product Safety and Market Approvals

- 4.3.3 Risk of Adverse Effects and Potential Product Recalls

- 4.3.4 Intense Competition from Established Conventional Cosmetics and Personal Care Brands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Product Type

- 5.1.1 Skin Care

- 5.1.1.1 Anti-ageing

- 5.1.1.2 Anti-acne

- 5.1.1.3 Sun Protection

- 5.1.1.4 Other Skin-care Types

- 5.1.2 Hair Care

- 5.1.2.1 Shampoos and Conditioners

- 5.1.2.2 Hair Colorants and Dyes

- 5.1.2.3 Other Hair-care Types

- 5.1.3 Lip Care

- 5.1.4 Oral Care

- 5.1.1 Skin Care

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Natural/Organic

- 5.3 By End-User

- 5.3.1 Male

- 5.3.2 Female

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Beauty and Health Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 L'Oreal S.A.

- 6.4.2 The Estee Lauder Companies Inc.

- 6.4.3 Shiseido Company, Limited

- 6.4.4 Procter & Gamble Company

- 6.4.5 Unilever PLC

- 6.4.6 Coty Inc.

- 6.4.7 Revlon Inc.

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Kenvue Inc.

- 6.4.10 Amorepacific Corp.

- 6.4.11 Groupe Clarins SA

- 6.4.12 Galderma Holding SA

- 6.4.13 AbbVie Inc.

- 6.4.14 Perrigo Company plc

- 6.4.15 Colgate-Palmolive Company

- 6.4.16 Beiersdorf AG

- 6.4.17 Natura &Co Holding S.A

- 6.4.18 Kao Corporation

- 6.4.19 Church & Dwight Co. Inc.

- 6.4.20 Haleon plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK