PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836619

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836619

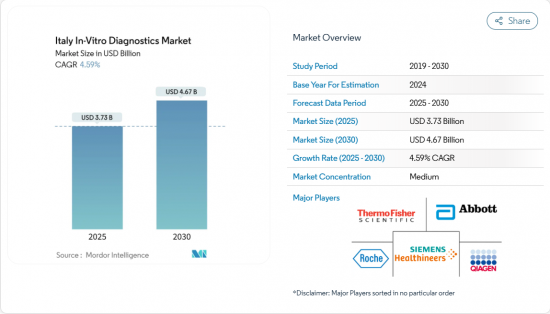

Italy In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy in vitro diagnostics market is valued at USD 3.73 billion in 2025 and is forecast to reach USD 4.67 billion by 2030, expanding at a 4.59% CAGR.

Growth is sustained by the rising prevalence of chronic diseases, steady gains in preventive health screening, and rapid uptake of advanced molecular platforms that cut turnaround times and broaden test menus. Regulatory alignment with the EU IVDR is adding short-term certification costs yet is expected to improve product quality and patient safety over the forecast horizon. Technology convergence, particularly the pairing of microfluidics with artificial intelligence, continues to lower sample-volume requirements while boosting diagnostic accuracy, a trend most visible in oncology-focused liquid biopsy and multiplex PCR assays. Meanwhile, demand for point-of-care (POC) solutions is accelerating as regional authorities push diagnostics closer to primary-care and home settings to relieve capacity constraints in the hospital network.

Italy In-Vitro Diagnostics Market Trends and Insights

Rising Burden of Chronic & Lifestyle Diseases (Diabetes, CVD, Cancer)

Chronic conditions now affect a growing share of Italy's population, with 3.9 million residents living with diabetes in 2024 and cardiovascular disease remaining the top cause of mortality. Larger case volumes have spurred demand for continuous glucose-monitoring, high-sensitivity cardiac-marker assays, and multi-parameter panels that profile several risk factors in one run. Payers see diagnostics as a lever to curb treatment costs exceeding EUR 20 billion per year, fostering favorable reimbursement for early-detection tools. Laboratories increasingly deploy integrated platforms that simultaneously analyze metabolic and inflammatory markers, improving patient stratification while conserving reagents. This long-term epidemiological shift underpins steady increases in routine test volumes, thereby stabilizing reagent demand across the Italy in vitro diagnostics market.

Rapid Technological Innovation in Molecular & Immunodiagnostics

Next-generation sequencing and multiplex PCR have reached cost and throughput thresholds suited for routine use in tertiary centers, cutting time-to-result and enabling wider gene panels. Microfluidic cartridges now process smaller sample volumes, a crucial advantage in pediatrics and oncology biopsies. Italian labs are retrofitting COVID-era PCR instruments for oncology, sepsis, and antimicrobial-resistance panels, which lifts system utilization and lowers per-test costs. Immunodiagnostics benefit from chemiluminescent platforms that automate up to 240 tests per hour, expanding menus into fertility, thyroid, and autoimmune markers. As genomic and proteomic data converge, clinicians gain richer insights that feed into personalized-medicine protocols, sustaining above-market growth for molecular assays.

Stringent & Evolving EU IVDR Regulatory Landscape

The IVDR recasts most assays into higher-risk classes that demand stricter clinical-evidence dossiers and ongoing post-market surveillance. Only 12 notified bodies were approved for IVDR certification by 2024, creating application backlogs that slow product launches. Compliance expenses can absorb 5-15% of annual revenue for smaller firms, prompting some to withdraw niche tests rather than fund new studies. Larger multinationals use this window to consolidate share by acquiring domestic peers struggling with documentation upgrades. Although transition deadlines stretch to 2029 for low-risk assays, market-access uncertainty weighs on near-term investment decisions.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Point-of-Care Testing Across Primary & Home Settings

- Government & EU Investment Programs for Digital Lab Modernization

- Regional Reimbursement Delays & Budget Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immunodiagnostics commanded 28% of 2024 revenue, underpinning routine panels for thyroid disorders, fertility, and infectious-disease serology. The stable reimbursement environment and broad installed base of chemiluminescent analyzers anchor segment growth at mid-single-digit rates. Molecular diagnostics, though starting from a smaller base, is charting a 7.8% CAGR as next-generation sequencing migrates from reference labs to tertiary hospitals, extending coverage into oncology minimal-residual-disease monitoring. The Italy in vitro diagnostics market size attributed to molecular assays is expected to double between 2025 and 2030, reflecting expanded syndromic respiratory panels and liquid biopsy uptake. Convergence trends see multiplex platforms combining nucleic-acid detection with immuno-capture technologies, enabling laboratories to consolidate instrument fleets while widening their menus.

COVID-19 infrastructure-high-throughput PCR cyclers and automated extractors-is now repurposed for sexually transmitted infections and antimicrobial-resistance testing, lifting utilization rates. Italian start-ups innovate in microfluidic chip fabrication that slashes reagent volumes, appealing to budget-conscious regional health systems. Immunodiagnostic suppliers respond with high-sensitivity assays targeting neurodegeneration and emerging zoonoses, while molecular vendors court oncology centers with bundled assay-plus-bioinformatics offerings. Such dynamics reinforce technology pluralism and foster cross-segment collaboration within the Italy in vitro diagnostics market.

Reagents and consumables generated 65% of turnover in 2024, a share driven by recurring demand patterns that stabilize cash flows for suppliers. Rising test volumes in chronic-disease monitoring lift lot sizes, helping laboratories negotiate bulk-purchase discounts. Still, the closed-system philosophy of many analyzers preserves vendor pricing power and sustains gross margins that often exceed 60%. Instruments and analyzers post a 6.5% CAGR as facilities modernize to automated track systems capable of 3,000 tubes per hour, mitigating staff shortages and lowering per-sample cost. Software and informatics solutions-ranging from middleware to AI-enabled decision support-emerge as the highest-margin category and are frequently bundled under reagent-rental contracts that shift capital expenditure into operating budgets.

Total-laboratory-automation lines gain favor in university hospitals, where they drive 20% reductions in manual handling errors. Cloud-delivered quality-control dashboards help regional health authorities monitor laboratory performance, a feature aligning well with new IVDR post-market surveillance rules. Open-platform advocates push for reagent interoperability to reduce costs, yet proprietary-reagent strategies remain prevalent as suppliers prioritize life-cycle revenue streams.

The Italy In-Vitro Diagnostics Market Report is Segmented by Test Type (Clinical Chemistry, Molecular Diagnostics, and More), Product (Instruments & Analyzers, and More), Usability (Disposable IVD Devices and Reusable IVD Devices), Application (Infectious Disease, Diabetes, and More. ), Mode of Testing (Laboratory-Based Testing and Point-Of-Care Testing), and End-Users (Diagnostic Laboratories, Hospitals and Clinics, and More).

List of Companies Covered in this Report:

- Roche

- Abbott Laboratories

- Siemens Healthineers

- Danaher Corp. (Beckman Coulter & Cepheid)

- DiaSorin

- bioMerieux

- Thermo Fisher Scientific

- Sysmex

- QIAGEN

- Beckton Dickinson

- Werfen S.A.

- Menarini Diagnostics S.r.l.

- Sentinel Diagnostics S.p.A.

- Alfa Wassermann Diagnostic Technologies

- Sentinel CH S.p.A.

- Luminex (DiaSorin Group)

- Randox Laboratories

- Bio-Rad Laboratories

- Illumina

- Agilent Technologies

- DIESSE Diagnostica Senese S.p.A.

- Sclavo Diagnostics International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Chronic & Lifestyle Diseases (Diabetes, CVD, Cancer)

- 4.2.2 Rapid Technological Innovation in Molecular & Immunodiagnostics

- 4.2.3 Expansion of Point-of-Care Testing Across Primary & Home Settings

- 4.2.4 Government & EU Investment Programs for Digital Lab Modernization

- 4.2.5 Growth of Precision Medicine & Companion Diagnostics Adoption

- 4.3 Market Restraints

- 4.3.1 Stringent & Evolving EU IVDR Regulatory Landscape

- 4.3.2 Regional Reimbursement Delays & Budget Constraints

- 4.3.3 Shortage of Skilled Laboratory Personnel & Training Gaps

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry Intensity

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Test Type

- 5.1.1 Clinical Chemistry

- 5.1.2 Immunodiagnostics

- 5.1.3 Molecular Diagnostics

- 5.1.4 Hematology

- 5.1.5 Microbiology

- 5.1.6 Coagulation

- 5.1.7 Point-of-Care (POC) Tests

- 5.2 By Product

- 5.2.1 Instruments & Analyzers

- 5.2.2 Reagents & Consumables

- 5.2.3 Software & Services

- 5.3 By Usability

- 5.3.1 Disposable IVD Devices

- 5.3.2 Reusable IVD Devices

- 5.4 By Mode of Testing

- 5.4.1 Laboratory-Based Testing

- 5.4.2 Point-of-Care Testing

- 5.5 By Application

- 5.5.1 Infectious Disease

- 5.5.2 Diabetes

- 5.5.3 Oncology (Cancer)

- 5.5.4 Cardiology

- 5.5.5 Autoimmune Disorders

- 5.5.6 Other Applications

- 5.6 By End-User

- 5.6.1 Hospitals & Clinics

- 5.6.2 Diagnostic Laboratories

- 5.6.3 Academic & Research Institutes

- 5.6.4 Home-Care / Ambulatory POC Settings

- 5.6.5 Other End-Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 F. Hoffmann-La Roche AG

- 6.3.2 Abbott Laboratories

- 6.3.3 Siemens Healthineers AG

- 6.3.4 Danaher Corp. (Beckman Coulter & Cepheid)

- 6.3.5 DiaSorin S.p.A

- 6.3.6 BioMerieux SA

- 6.3.7 Thermo Fisher Scientific Inc.

- 6.3.8 Sysmex Corporation

- 6.3.9 QIAGEN N.V.

- 6.3.10 Becton, Dickinson and Company

- 6.3.11 Werfen S.A.

- 6.3.12 Menarini Diagnostics S.r.l.

- 6.3.13 Sentinel Diagnostics S.p.A.

- 6.3.14 Alfa Wassermann Diagnostic Technologies

- 6.3.15 Sentinel CH S.p.A.

- 6.3.16 Luminex (DiaSorin Group)

- 6.3.17 Randox Laboratories Ltd

- 6.3.18 Bio-Rad Laboratories Inc.

- 6.3.19 Illumina Inc.

- 6.3.20 Agilent Technologies Inc.

- 6.3.21 DIESSE Diagnostica Senese S.p.A.

- 6.3.22 Sclavo Diagnostics International

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment