PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836623

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836623

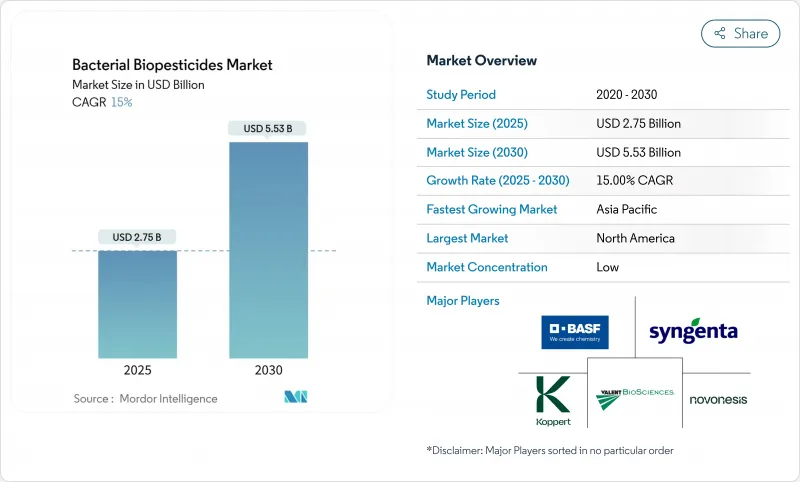

Bacterial Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Bacterial Biopesticides Market size is estimated at USD 2.75 billion in 2025, and is anticipated to reach USD 5.53 billion by 2030, at a CAGR of 15% during the forecast period (2025-2030).

The market growth is driven by expedited regulatory approvals, increasing consumer demand for residue-free produce, expansion of organic farming, and technological advancements that enhance formulation stability and field efficacy. According to FiBL, the global organic farming area reached 98.9 million hectares in 2023, representing a 2.6% increase. Bacillus thuringiensis (Bt) dominates the market with a 74% revenue share, while Bacillus subtilis shows rapid growth due to its combined pest control and plant growth promotion capabilities. Precision seed treatment applications, liquid formulations for controlled-environment agriculture, and the consolidation of portfolios among major agrochemical companies support the market expansion. Adoption rate of the bacterial biopesticides is affected by cold-chain storage requirements and slower efficacy compared to chemical alternatives, as companies work to address these challenges in an increasingly competitive market.

Global Bacterial Biopesticides Market Trends and Insights

Regulatory and Policy Support

The European approval process for biopesticides has reduced from nine years to approximately three years, addressing a backlog of over 100 pending substances. The European Commission intends to implement new EU regulations in 2025 to optimize biopesticide approval processes by Q4. The 2026 Biotech Act will focus on filling current regulatory gaps. Brazil has demonstrated similar progress by approving bio-insecticidal products derived from inactivated Burkholderia cells. The United States Environmental Protection Agency (EPA) is reducing application backlogs under FIFRA (Federal Insecticide, Fungicide, and Rodenticide Act). These regulatory changes expand registration opportunities, reduce compliance costs, and enable smaller companies to enter the bacterial biopesticides market.

Rising Awareness of the Harms of Conventional Pesticides

Research demonstrating biodiversity loss and soil degradation from synthetic pesticides influences purchasing decisions in premium retail channels. A 2025 Massachusetts Institute of Technology study revealed that 31% of global agricultural soils faced high risks from pesticide contamination. North American and European retailers implement strict residue limits, favoring zero-residue biological products. As growers adapt to these requirements, bacterial agents have evolved from organic-only solutions to essential components of integrated pest management programs. This transition drives growth in the bacterial biopesticides market, especially for crops with short pre-harvest intervals.

Cold-Chain Logistics Limiting Shelf-Life of Biologicals

Live spore formulations typically lose viability at temperatures above 25°C, necessitating refrigerated transport and storage, which increases the final cost. This challenge is particularly significant in equatorial markets where small-scale distribution networks lack temperature-controlled storage facilities. While new encapsulation technologies are improving cell viability at room temperature and reducing distribution constraints, the processes for scale-up and regulatory approval require multiple growing seasons. These logistical limitations restrict market penetration, reducing the competitiveness of bacterial biopesticides against chemical pesticides that offer extended shelf life and minimal storage requirements.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Residue-Free Produce Driving Bt Solutions

- Expansion of Controlled-Environment Agriculture Boosting Liquid Formulations

- Perceived Slower Knock-Down Reducing Adoption in Farms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bt accounted for 74% of 2024 revenue, maintaining its dominant position in the bacterial biopesticides market. This market leadership stems from its targeted toxicity against lepidopteran larvae, extensive organic certifications, and regulatory acceptance worldwide. The market size for Bt products is projected to expand due to new encapsulation technologies that improve field persistence in high-UV conditions. A 2024 study confirmed Bt toxins' effectiveness against lepidopteran, coleopteran, hemipteran, dipteran, and nematode pests.

Bacillus subtilis shows strong growth potential with a projected 17% CAGR, driven by its dual benefits of disease suppression and plant growth promotion, particularly in high-value horticulture. Pseudomonas fluorescens has established its role in controlling soil-borne pathogens, while Serratia and Streptomyces species are gaining traction in specialized applications through their chitinase activity and antibiotic metabolite production capabilities.

The Bacterial Biopesticides Market Report is Segmented by Product Type (Bacillus Thuringiensis, Bacillus Subtilis, Pseudomonas Fluorescens, and Other Types), Mode of Application (Seed Treatment, Foliar Spray, and More ), Crop Type (Grains and Cereals, Oilseeds and Pulses, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintained its dominant position with a 38% share of the 2024 global revenue. The United States drives market volumes through widespread integration of bacterial solutions in large-scale corn and soybean operations. Canadian greenhouse clusters strengthen regional demand by utilizing liquid inoculants compatible with hydroponic fertigation systems. In 2023, Canada's 920 commercial greenhouse vegetable operations produced 802,163 metric tons of vegetables, a 7% increase from 2022.

Asia-Pacific demonstrates the strongest growth trajectory with an anticipated 18% CAGR through 2030. China's five-year green pest-control plan and India's bio-input subsidy programs encourage domestic production and adoption. Japan and Singapore's vertical farming operations provide established markets for liquid formulations specifically developed for controlled environment agriculture.

Europe maintains strict regulations for biopesticides, though recent changes have accelerated their adoption. The European Commission's 2025 fast-track regulation reduced dossier review times to align with North American standards, enabling more product registrations and encouraging manufacturers to expand their EU product labels. The demand for biopesticides has increased through Scandinavian public procurement policies for school meals and Germany's Farm-to-Fork pesticide reduction targets, particularly benefiting Bt and B. subtilis foliar products. Eastern European grain producers have initiated Bacillus-based seed treatment trials in response to export markets' stricter residue requirements, expanding beyond traditional high-value horticultural applications.

- Certis Biologicals

- Valent BioSciences

- Bayer CropScience AG

- Syngenta AG

- Corteva Agriscience

- BASF SE

- UPL Limited

- FMC Corporation

- Nufarm Limited

- Koppert Biological Systems

- Novonesis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory and Policy Support

- 4.2.2 Rising Awareness of the Harms of Conventional Pesticides

- 4.2.3 Demand for residue-free produce driving Bt solutions

- 4.2.4 Expansion of controlled-environment agriculture boosting demand for liquid bacterial formulations

- 4.2.5 Increasing adoption of integrated pest management (IPM) strategies

- 4.2.6 Technological advancements in formulation and delivery systems

- 4.3 Market Restraints

- 4.3.1 Cold-chain logistics limiting shelf-life of Biological biopesticides

- 4.3.2 Production and Formulation Challenges

- 4.3.3 Perceived slower knock-down reducing adoption in farms

- 4.3.4 Higher costs compared to conventional pesticides

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Bargaining Power of Buyers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Bacillus thuringiensis

- 5.1.2 Bacillus subtilis

- 5.1.3 Pseudomonas fluorescens

- 5.1.4 Other Types

- 5.2 By Mode of Application

- 5.2.1 Foliar Spray

- 5.2.2 Seed Treatment

- 5.2.3 Soil Treatment

- 5.2.4 Post-Harvest Treatment

- 5.3 By Crop Type

- 5.3.1 Fruits and Vegetables

- 5.3.2 Cereals and Grains

- 5.3.3 Oilseeds and Pulses

- 5.3.4 Turf and Ornamentals

- 5.3.5 Plantation Crops

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Rest of Europe

- 5.4.4 Africa

- 5.4.4.1 South Africa

- 5.4.4.2 Egypt

- 5.4.4.3 Rest of Africa

- 5.4.5 Asia-Pacific

- 5.4.5.1 China

- 5.4.5.2 India

- 5.4.5.3 Japan

- 5.4.5.4 South Korea

- 5.4.5.5 Australia

- 5.4.5.6 Rest of Asia-Pacific

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Certis Biologicals

- 6.3.2 Valent BioSciences

- 6.3.3 Bayer CropScience AG

- 6.3.4 Syngenta AG

- 6.3.5 Corteva Agriscience

- 6.3.6 BASF SE

- 6.3.7 UPL Limited

- 6.3.8 FMC Corporation

- 6.3.9 Nufarm Limited

- 6.3.10 Koppert Biological Systems

- 6.3.11 Novonesis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS