PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836626

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836626

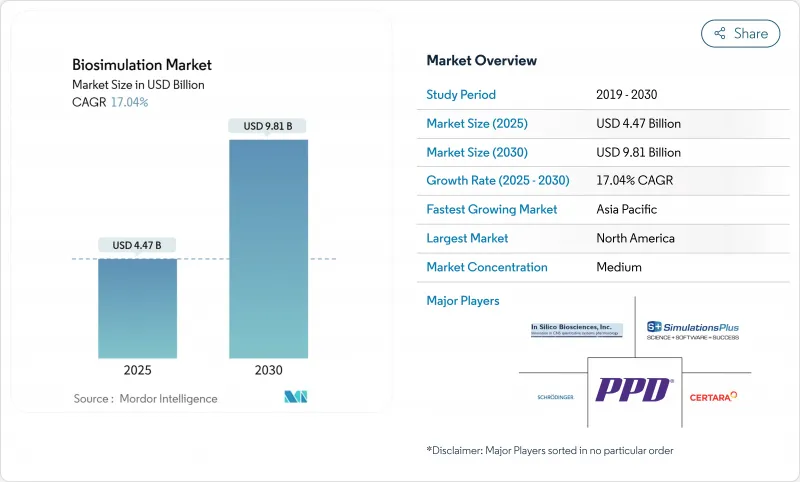

Biosimulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Biosimulation Market size is estimated at USD 4.47 billion in 2025, and is expected to reach USD 9.81 billion by 2030, at a CAGR of 17.04% during the forecast period (2025-2030).

Strong growth stems from the pharmaceutical sector's rising use of in-silico modeling to curb escalating R&D expenses, from regulators' formal endorsement of model-informed drug development, and from rapid progress in cloud-delivered high-performance computing. Adoption also receives momentum from the FDA's Quantitative Medicine Center of Excellence, the finalized ICH M15 guideline, and the broadening use of virtual twin studies to reduce animal testing requirements fda.gov. Wider corporate IT budgets, artificial intelligence integration, and expanding precision-medicine pipelines further reinforce demand, while moderate fragmentation allows vendors to differentiate on analytics depth, therapeutic-area expertise, and regulatory familiarity.

Global Biosimulation Market Trends and Insights

Increasing Healthcare-Sector IT Budgets

Life-sciences CIO surveys show that a majority of firms raised technology allocations in 2024, with one quarter prioritizing artificial-intelligence projects. Larger budgets translate into stronger demand for integrated biosimulation platforms that merge PBPK, QSP, and AI algorithms. Pfizer and Novo Nordisk publicly report measurable cost savings tied to cloud-native modeling investments, reinforcing the business case for broader rollouts. Elevated spending also accelerates cloud infrastructure upgrades that permit extensive virtual twin studies and real-time collaboration among globally dispersed teams. The trend supports sustained double-digit growth for the biosimulation market over the medium term.

Growing Adoption of Biosimulation Platforms by Regulators

Regulatory momentum has reached a critical threshold. The FDA notes that QSP-based submissions now double every 1.4 years, while its permanent MIDD-paired-meeting program offers structured advice on quantitative models. The ICH M15 guideline, finalized in 2024, harmonizes international expectations for model-informed drug development and reduces uncertainty for sponsors. The EMA and PMDA publish detailed PBPK guidance, and agencies increasingly accept simulation data in lieu of animal studies for monoclonal antibodies. This official endorsement creates a feedback loop: each successful filing builds confidence, prompting still more sponsors to embed biosimulation into development plans.

Limited Awareness Among Clinicians & Trial Teams

Many trial investigators remain unfamiliar with quantitative modeling outputs, hindering full integration of virtual insights into protocol design and decision making. Educational curricula often lack advanced pharmacometrics modules, and operational staff face tight timelines that favor traditional practices. Companies respond with internal academies and e-learning modules, yet adoption still varies by therapeutic area and geography. The gap is widest in emerging markets where digital infrastructure lags and local regulators are only beginning to reference ICH M15. Until practical know-how spreads, some sponsors will under-utilize biosimulation's potential.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Drug-Development Costs

- Cloud-Based High-Performance Computing Cuts Simulation TCO

- Shortage of Skilled PBPK/QSP Modelers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions held 67.87% revenue in 2024, reflecting the preference for integrated modeling environments that streamline visualization, verification, and regulatory reporting. Certara's Phoenix release and Dassault Systemes' BIOVIA upgrades underscore a race to embed AI modules that speed compound screening. The biosimulation market continues to reward vendors that couple PBPK and QSP engines with intuitive dashboards and extensive compound libraries. Services, while smaller in absolute value, grow steadily as sponsors seek consulting expertise to customize workflows and interpret complex outputs.

Services, though niche today, are projected to post an 18.41% CAGR by 2030 as real-time biosensor data feed directly into digital twins for chronic-disease management. This expansion broadens the biosimulation market beyond drug development into clinical decision support. Services providers benefit from the complexity of integrating sensor streams with QSP models, a task that demands both domain knowledge and data-engineering skills. Vendors that combine platform software with wraparound advisory offerings are positioned to capture higher share of wallet in late-stage projects.

Ownership-based deployments still account for 47.45% revenue because large pharmaceutical companies maintain sophisticated internal data centers. However, subscription services grow at 19.19% CAGR as firms value elastic compute and lower capital outlay. The biosimulation market reflects a larger life-sciences trend in which regulated workloads shift to validated cloud environments certified for Good Practice guidelines. Continuous algorithm updates and embedded compliance features appeal to small and mid-sized sponsors that lack specialist IT staff.

Security and data-sovereignty remain reasons for some enterprises to remain on-premise, especially when handling proprietary monoclonal-antibody sequences or trial data subject to regional privacy rules. Hybrid models therefore persist, with sensitive workloads staying behind the firewall and burst compute sent to the cloud. Platform providers respond with containerized deployments that move seamlessly between environments, ensuring identical validation documentation in either setting. Increased clarity from regulators regarding electronic-records controls will further unlock cloud use for pivotal-study models.

The Biosimulation Market Report Segments the Industry Into by Product (Software, Services), Delivery Model (Subscription, Ownership / On-Premise), Application (Preclinical and Clinical Drug Development, and More), by End User (Pharmaceutical and Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated with 44.56% revenue share in 2024, supported by the FDA's proactive stance on model-informed development and deep local venture funding. Europe follows, fueled by the EMA's extensive PBPK guidance, robust data-privacy laws that encourage secure cloud adoption, and strong industrial ties between software vendors and research hospitals. Both regions host many early adopters of QSP for complex biologics.

Asia-Pacific registers the fastest 23.49% CAGR, benefiting from regulatory harmonization and an expanding biosimilar pipeline. Japan's PMDA approved 35 biosimilar products by early 2024, several of which leveraged modeling to justify abbreviated clinical datasets. China's multi-year plan for pharmaceutical innovation has attracted global platform providers to establish regional centers, while India's emerging biotech corridor adds capacity for cost-efficient model building. Lower labor costs and a growing pool of data scientists enable local firms to operate dedicated biosimulation centers, reinforcing regional independence.

Latin America, the Middle East, and Africa contribute smaller shares today but display accelerating interest as multinational sponsors extend virtual-study methodology to diverse populations. Technology-transfer programs seed local know-how, and cloud infrastructure rollouts lower entry barriers. Over time, broader real-world-data availability will unlock the full potential of biosimulation in these underserved markets.

- Certara

- Dassault Systemes (BIOVIA)

- Simulations Plus

- Schrodinger

- Genedata

- Leadscope

- Entelos

- In Silico Biosciences

- Pharmaceutical Product Development

- Compugen

- Applied BioMath

- GNS Healthcare

- VeriSIM Life

- Insilico Medicine

- Syntekabio

- Simcyp

- Garuda Therapeutics

- Ansys (subsidiary MEDINI)

- Cadence Design Systems

- EMD Serono

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Healthcare-Sector IT Budgets

- 4.2.2 Growing Adoption of Biosimulation Platforms by Regulators

- 4.2.3 Escalating Drug-Development Costs

- 4.2.4 Cloud-Based High-Performance Computing Cuts Simulation TCO

- 4.2.5 FDA MIDD Program Mainstreams Model-Based Submissions

- 4.2.6 Expansion of Real-World-Data-Driven 'Virtual-Twin' Studies

- 4.3 Market Restraints

- 4.3.1 Limited Awareness Among Clinicians & Trial Teams

- 4.3.2 Shortage of Skilled PBPK/QSP Modelers

- 4.3.3 Lack of Global Data-Format & Model-Validation Standards

- 4.3.4 Regulatory Uncertainty Around AI-Generated Models

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Delivery Model

- 5.2.1 Subscription

- 5.2.2 Ownership / On-premise

- 5.3 By Application

- 5.3.1 Pre-clinical & Clinical Drug Development

- 5.3.2 Drug Discovery & Lead Optimization

- 5.3.3 Precision-medicine & Companion-diagnostics Design

- 5.4 By End User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Contract Research Organizations

- 5.4.3 Academic & Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Certara

- 6.3.2 Dassault Systemes (BIOVIA)

- 6.3.3 Simulations Plus

- 6.3.4 Schrodinger

- 6.3.5 Genedata

- 6.3.6 Leadscope

- 6.3.7 Entelos

- 6.3.8 In Silico Biosciences

- 6.3.9 Pharmaceutical Product Development

- 6.3.10 Compugen

- 6.3.11 Applied BioMath

- 6.3.12 GNS Healthcare

- 6.3.13 VeriSIM Life

- 6.3.14 Insilico Medicine

- 6.3.15 Syntekabio

- 6.3.16 Simcyp

- 6.3.17 Garuda Therapeutics

- 6.3.18 Ansys (subsidiary MEDINI)

- 6.3.19 Cadence Design Systems

- 6.3.20 EMD Serono

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment