PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836628

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836628

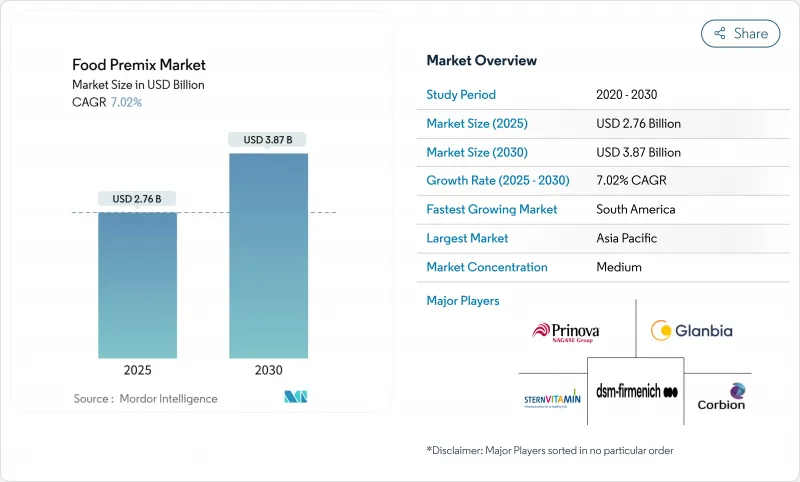

Food Premix - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The food premix market reached USD 2.76 billion in 2025 and is projected to grow to USD 3.87 billion by 2030, at a CAGR of 7.02%.

Government-mandated fortification programs, increasing health awareness, and advancements in nutrient-delivery technologies drive the demand for premix solutions. Mandatory wheat flour fortification regulations across various countries and new folic acid requirements in the United Kingdom create stable demand for suppliers. The Asia-Pacific region maintains its position as the primary demand center, while South America experiences the fastest growth, driven by Brazil's expanding feed and food processing industries investing in fortified ingredients. The vitamin premix segment maintains its market leadership across various applications. Vitamin premixes, extensively used in food and beverage formulations and dietary supplements, enable manufacturers to fortify products with essential nutrients, including vitamins A, D, E, and B-complex. The dietary supplements segment has emerged as a significant growth area for premix manufacturers, as consumers across different age groups focus on preventive health measures, driving demand for premix solutions targeting fitness, mental wellness, and healthy aging.

Global Food Premix Market Trends and Insights

Rising Demand for Functional and Fortified Food Products

The growing inclination toward health and wellness is a key driver fueling the demand for functional and fortified food products in the food premix market. Modern lifestyles characterized by increased automation, reduced physical activity, and various socio-economic pressures have led to a surge in chronic health conditions. As a result, consumers are prioritizing health and nutrition, which is accelerating the shift toward foods enriched with essential nutrients. Functional foods fortified with vitamins, minerals, prebiotics, and amino acids are increasingly viewed as necessary for maintaining optimal bodily functions. Manufacturers are responding by expanding their product portfolios with nutrient-rich premixes to attract health-conscious consumers. According to the International Food Information Council (IFIC), in 2023, 28% of U.S. respondents identified a "good source of nutrients" as a key indicator of healthy food, while 33% associated healthiness with being a "good source of protein/amino acids" . These statistics underscore the increasing consumer awareness and demand for fortified products, positioning the functional food segment as a key growth area within the food premix market.

Growing Adoption of Preventive Healthcare Practices Among Consumers

The preventive healthcare approach has transformed consumer behavior, as individuals increasingly view nutrition as a proactive health management tool rather than a response to illness. This transformation creates consistent and sustained demand for nutrient-dense products across all age demographics, generating stable and recurring revenue streams for food premix suppliers. Increasing healthcare costs in developed economies strengthen the demand for nutrition-based preventive measures. According to the OECD, the United States spent USD 13,432 per person on healthcare in 2023, the highest among member countries, significantly exceeding Switzerland, the second-highest spender. Norway, Germany, and Austria also demonstrate consistently high healthcare expenditure, indicating a broader pattern across developed nations . The market continues to experience significant growth through personalized nutrition, which provides comprehensive dietary recommendations based on individual genetic data. This approach has gained substantial adoption in developed markets where consumers demonstrate heightened awareness of the connection between diet, genetics, and disease prevention. The personalized nutrition trend enables premium pricing strategies, particularly in the dietary supplements segment, where customized premix formulations command higher price points.

Fluctuating Prices of Raw Materials Used in Premix Formulations

Raw material prices experienced significant volatility, with vitamin markets facing major disruptions in 2024. According to DSM-Firmenich's Q3 2024 vitamin market update, multiple vitamin categories saw substantial price increases, with vitamin E prices reaching five-year highs due to supply disruptions and production facility incidents. The high concentration of vitamin production in China presents a systemic risk, prompting the American Feed Industry Association to advocate for domestic production investment. The supplement industry faces additional challenges from potential tariffs of 25% on Canadian and Mexican goods and 10% on Chinese imports, affecting ingredient sourcing costs. These market conditions have led premix manufacturers to implement hedging strategies and diversify their supply chains, which may limit their growth investments and margin expansion efforts.

Other drivers and restraints analyzed in the detailed report include:

- Rising Prevalence of Micronutrient Deficiencies

- Accelerated Growth of Sports and Active-Nutrition Supplements

- Limited Shelf Life of Certain Premix Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vitamins premix holds a 35.15% market share in 2024, driven by its essential role in mandatory fortification programs and widespread consumer recognition. The segment's dominance is supported by regulatory requirements in 85 countries that mandate wheat flour fortification, enabling efficient large-scale production and consistent market demand. Amino acids premix is projected to grow at 9.14% CAGR (2025-2030), primarily due to increased demand in sports nutrition and personalized health solutions across global markets.

Minerals premix maintains consistent demand through fortification applications, while the "Others" category includes bioactive compounds and specialized formulations for diverse nutritional needs. The growth in amino acid premix is supported by extensive research validating its effectiveness in muscle recovery and cognitive function, allowing manufacturers to implement premium pricing strategies in various market segments. The market is evolving from basic nutrition supplementation to targeted health solutions, with amino acids emerging as a key segment for performance-focused applications and specialized nutritional requirements.

The Report Covers the Global Food Premix Market is Segmented by Type (Vitamins Premix, Minerals Premix, and More), by Form (Powder, and Liquid), by Application (Food and Beverage, Dietary Supplements, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific maintains a 38.15% market share in 2024, supported by comprehensive government fortification initiatives, ongoing urbanization trends, and increasing health awareness among the expanding middle-class population. The Asia-Pacific market operates under varied regulatory frameworks, with multiple growth opportunities. India's extensive school-meal programs and Japan's stringent Food for Specified Health Uses regulations maintain consistent market demand. Indonesia, Vietnam, and the Philippines have implemented simplified regulations for vitamin-mineral blends, reducing market entry timelines. Companies with strong regulatory compliance capabilities continue to gain competitive advantages in these dynamic markets.

South America records the highest growth at 9.15% CAGR (2025-2030), with Brazil's strong animal nutrition market and expanding food processing industry driving regional expansion. The region benefits from Feedlatina's regulatory harmonization efforts across Latin American animal feed industries, enabling sustained market growth and standardization that supports premix suppliers' regional operations.

North America and Europe maintain stable market positions with well-defined regulatory frameworks and sustained demand for premium formulations. The United Kingdom's 2024 flour fortification legislation updates, actively supported by Nutrition International, demonstrate ongoing regulatory developments that create substantial market opportunities in developed regions. The varied growth patterns across regions indicate that successful premix manufacturers must implement comprehensive region-specific approaches while effectively balancing global operational efficiency with local compliance requirements and evolving market preferences.

- DSM-Firmenich

- Glanbia PLC

- Bioven Ingredients

- Prinova Group LLC

- Corbion N.V.

- SternVitamin GmbH and Co. KG

- Vitablend Nederland B.V.

- Pristine Organics Group

- Fermenta Biotech Ltd.

- Jubilant Ingrevia Ltd.

- Spansules Pharmatech Pvt. Ltd.

- Barentz International

- Hexagon Nutrition Ltd.

- Farbest Brands

- Richen Nutritional Technology Co., Ltd.

- Intercorp Biotech

- Fenchem

- S. A. Pharmachem Pvt. Ltd

- Lycored

- SternLife GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for functional and fortified food products

- 4.2.2 Growing adoption of preventive healthcare practices among consumers

- 4.2.3 Rising prevalence of micronutrient deficiencies

- 4.2.4 Accelerated growth of sports and active-nutrition supplements

- 4.2.5 Government-led mandatory fortification programs

- 4.2.6 Growth in personalized nutrition

- 4.3 Market Restraints

- 4.3.1 Fluctuating prices of raw materials used in premix formulations

- 4.3.2 Limited shelf life of certain premix ingredients

- 4.3.3 Competition from alternative fortification methods

- 4.3.4 Risk of over-fortification

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vitamins Premix

- 5.1.2 Minerals Premix

- 5.1.3 Amino Acids Premix

- 5.1.4 Others

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Food and Beverage

- 5.3.1.1 Dairy Products

- 5.3.1.2 Bakery and Confectionery

- 5.3.1.3 Beverages

- 5.3.1.4 Others

- 5.3.2 Dietary Supplements

- 5.3.3 Pharmaceutical

- 5.3.4 Others

- 5.3.1 Food and Beverage

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Netherlands

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 DSM-Firmenich

- 6.4.2 Glanbia PLC

- 6.4.3 Bioven Ingredients

- 6.4.4 Prinova Group LLC

- 6.4.5 Corbion N.V.

- 6.4.6 SternVitamin GmbH and Co. KG

- 6.4.7 Vitablend Nederland B.V.

- 6.4.8 Pristine Organics Group

- 6.4.9 Fermenta Biotech Ltd.

- 6.4.10 Jubilant Ingrevia Ltd.

- 6.4.11 Spansules Pharmatech Pvt. Ltd.

- 6.4.12 Barentz International

- 6.4.13 Hexagon Nutrition Ltd.

- 6.4.14 Farbest Brands

- 6.4.15 Richen Nutritional Technology Co., Ltd.

- 6.4.16 Intercorp Biotech

- 6.4.17 Fenchem

- 6.4.18 S. A. Pharmachem Pvt. Ltd

- 6.4.19 Lycored

- 6.4.20 SternLife GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK