PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836629

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836629

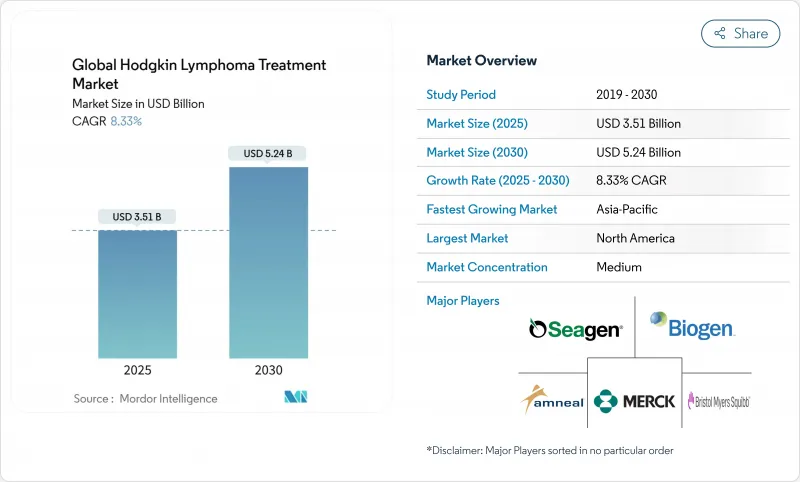

Global Hodgkin Lymphoma Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Hodgkins lymphoma treatment market size reached USD 3.51 billion in 2025 and is forecast to climb to USD 5.24 billion by 2030, advancing at an 8.33% CAGR.

This robust expansion mirrors the rapid uptake of checkpoint inhibitors, antibody-drug conjugates, and CAR-T therapies that together are redefining standard care across stages and geographies. The hodgkins lymphoma treatment market is also benefiting from precision diagnostics such as PET-adaptive protocols and liquid biopsy monitoring that improve disease stratification and support earlier intervention. Capacity additions worth USD 3.5 billion from global and Asian contract manufacturers are easing recent supply bottlenecks for ADC linker payloads, while 15 FDA approvals since early 2024 shorten launch cycles and broaden drug availability. Parallel regulatory incentives, notably breakthrough therapy and orphan-drug designations, are lowering evidence thresholds for conditional approvals and allowing companies to recoup R&D costs more swiftly, reinforcing the attractiveness of the Hodgkins lymphoma treatment market to both incumbents and new entrants.

Global Hodgkin Lymphoma Treatment Market Trends and Insights

Rising Global Disease Burden & Survivorship Improvements

An expanding incidence curve, particularly in aging societies, is swelling the patient pool and generating recurring therapy demand as relapse rates hover between 30% and 40%. Five-year survival for early-stage disease now exceeds 90%, yet longer life spans mean many survivors require multiple lines of therapy over decades. Targeted agents and checkpoint inhibitors with favorable tolerability profiles are increasingly chosen for elderly patients unable to tolerate intensive chemotherapy. As a result, the Hodgkins lymphoma treatment market is gaining a demographic dividend that reinforces long-term revenue visibility.

PET-adaptive Regimens Accelerating Adoption of Novel Drugs

Interim PET scanning guides therapy intensification or de-escalation in real time, driving faster integration of novel agents. The Phase III S1826 study showed nivolumab-AVD achieving a 92% two-year progression-free survival versus 83% for brentuximab vedotin-AVD, reshaping frontline standards. PET-adaptive protocols support more precise drug selection, particularly favoring agents that elicit rapid metabolic responses. In parallel, AI-enhanced image analysis is lifting diagnostic accuracy and further accelerating uptake of precision regimens within the Hodgkins lymphoma treatment market.

Treatment-related Long-term Toxicities

Secondary malignancies and cardiovascular events associated with legacy regimens constrain aggressive therapy use, especially in younger patients whose projected survival exceeds five decades. Checkpoint inhibitors introduce immune-related adverse events that often require prolonged immunosuppression, while CAR-T procedures carry neurotoxicity and cytokine-release risks. Such toxicities compel clinicians to weigh cure rates against quality-adjusted life years, tempering adoption in certain subgroups and moderating Hodgkins lymphoma treatment market growth.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Fixed-dose Subcutaneous Checkpoint Inhibitors Enabling Day-care Therapy

- AI-powered Pathology & Liquid Biopsies Guiding Personalized Regimens

- High Total-care Costs & Reimbursement Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immunotherapy captured 38.46% of the Hodgkins lymphoma treatment market share in 2024 and remains the dominant modality thanks to checkpoint inhibitors that combine high response rates with favorable tolerability. Two-year progression-free survival of 92% for nivolumab-AVD positions immunotherapy as a backbone for future combination strategies. Chemotherapy still underpins many frontline regimens, but its growth rate trails targeted and cellular approaches. The hodgkins lymphoma treatment market size attributed to targeted therapy is set to expand at an 8.95% CAGR as ADCs such as brentuximab vedotin and next-generation CD30 conjugates penetrate earlier lines. Radiotherapy grows modestly as PET-adapted protocols trim field sizes, while autologous stem-cell rescue maintains a niche in highly refractory cases. Emerging CAR-T constructs (HSP-CAR30) attest to the expanding immunotherapy toolbox, delivering complete remission in 50% of heavily pre-treated patients.

A second wave of innovation is unfolding around subcutaneous and fixed-dose formulations that slash chair time and improve patient convenience. The hodgkins lymphoma treatment market is therefore likely to see increasing regimen diversity, with optimized combinations tailored to genetic markers, age cohorts, and toxicity tolerances. Real-world evidence will play a growing role in refining sequencing decisions as payers seek clear survival and quality-of-life gains before approving high list-price drugs.

Advanced-stage disease held 45.78% of the hodgkins lymphoma treatment market size in 2024 and is forecast to grow at 8.83% CAGR, capturing a rising share as novel modalities address complex tumor biology. Advanced cases often require multi-agent regimens that command premium pricing, bolstering topline growth for manufacturers. Early-stage disease benefits from de-escalation initiatives that strive to minimize late toxicities without sacrificing cure rates, thereby marginally tempering revenue potential. Relapsed or refractory presentations continue to generate disproportionate value as patients cycle through successive lines of increasingly specialized therapy, each with higher per-treatment costs.

Stage-specific personalization gains momentum with PET-guided escalation and circulating tumor DNA surveillance. These technologies help clinicians pinpoint residual disease early, facilitating timely switches to next-line agents and improving overall outcomes. Consequently, the hodgkins lymphoma treatment market sees steady demand across disease stages, though advanced cases remain the primary engine of absolute dollar growth.

The Hodgkin Lymphoma Treatment Market is Segmented by Treatment Type (Chemotherapy, Radiotherapy, and More), Stage of Disease (Early Stage (I-II), Advanced Stage (III-IV), and More), Patient Age Group (Pediatric & Adolescent, Adult, and More), Route of Administration (Intravenous, Oral, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.34% of total revenue in 2024, powered by 311 accredited CAR-T centers, rapid regulatory approvals, and premium reimbursement frameworks that absorb high list prices. Breakthrough designations such as the 2025 status for pembrolizumab streamline U.S. launch timelines and reinforce the region's early-adopter profile. Nevertheless, capacity constraints at high-volume centers and payer scrutiny over budget impact are nudging stakeholders toward subcutaneous and community-based care models, gradually decentralizing the North American delivery landscape.

Asia-Pacific is the fastest-growing region, expanding at 9.12% CAGR through 2030 on the back of rising disease incidence, local manufacturing hubs, and government-sponsored oncology programs. China's projected incidence of 5.57 per 100,000 by 2035 underscores the region's long-term demand pool. Biosimilar uptake and cross-border clinical collaborations allow earlier access to innovation while containing costs. Manufacturing expansions by WuXi Biologics and Samsung Biologics shift global supply chains eastward, giving local markets preferential access to fresh ADC capacity.

Europe maintains steady growth, helped by EMA conditional approvals such as odronextamab in August 2024. Cross-border treatment protocols improve care continuity across member states, yet market uptake still hinges on country-level health technology assessments that weigh clinical value against fiscal restraint. Latin America and the Middle East/Africa show emerging momentum, supported by medical tourism and public-private partnerships, though lingering reimbursement and diagnostic-access hurdles keep adoption levels below global averages.

- Actiza Pharmaceutical Pvt Ltd

- Alkem Laboratories

- Amneal Pharmaceuticals

- Biogen

- Bristol-Myers Squibb

- Roche

- Incyte

- LGM Pharma

- Merck

- Seagen

- Teva Pharmaceutical Industries

- Pfizer

- AstraZeneca

- Novartis

- Gilead Sciences

- Abbvie

- Kite Pharma (Gilead)

- Amgen

- BeiGene

- Regeneron Pharmaceuticals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Disease Burden & Survivorship Improvements

- 4.2.2 Increasing Public- & Clinician-awareness Initiatives

- 4.2.3 PET-adaptive Regimens Accelerating Adoption of Novel Drugs

- 4.2.4 Shift to Fixed-dose SC Checkpoint Inhibitors Enabling Day-care Therapy

- 4.2.5 Orphan-drug & Accelerated-approval Incentives Boosting New Launches

- 4.2.6 AI-powered Pathology & Liquid Biopsies Guiding Personalized Regimens

- 4.3 Market Restraints

- 4.3.1 Treatment-related Long-term Toxicities

- 4.3.2 High Total-care Costs & Reimbursement Hurdles

- 4.3.3 ADC Manufacturing Bottlenecks & CD30-linker Supply Gaps

- 4.3.4 Unequal PET/biomarker Access in Low-income Regions

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value-USD)

- 5.1 By Treatment Type

- 5.1.1 Chemotherapy

- 5.1.2 Radiotherapy

- 5.1.3 Targeted Therapy

- 5.1.4 Immunotherapy

- 5.1.5 Stem-Cell Transplant

- 5.2 By Stage of Disease

- 5.2.1 Early Stage (I-II)

- 5.2.2 Advanced Stage (III-IV)

- 5.2.3 Relapsed / Refractory

- 5.3 By Patient Age Group

- 5.3.1 Pediatric & Adolescent (0-19 yrs)

- 5.3.2 Adult (20-59 yrs)

- 5.3.3 Geriatric (60 yrs +)

- 5.4 By Route of Administration

- 5.4.1 Intravenous

- 5.4.2 Oral

- 5.4.3 Subcutaneous

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Actiza Pharmaceutical Pvt Ltd

- 6.3.2 Alkem Laboratories

- 6.3.3 Amneal Pharmaceuticals Inc.

- 6.3.4 Biogen Inc.

- 6.3.5 Bristol Myers Squibb Co.

- 6.3.6 F. Hoffmann-La Roche Ltd

- 6.3.7 Incyte Corp

- 6.3.8 LGM Pharma

- 6.3.9 Merck & Co. Inc.

- 6.3.10 Seagen Inc.

- 6.3.11 Teva Pharmaceutical Industries Ltd

- 6.3.12 Pfizer Inc.

- 6.3.13 AstraZeneca plc

- 6.3.14 Novartis AG

- 6.3.15 Gilead Sciences Inc.

- 6.3.16 AbbVie Inc.

- 6.3.17 Kite Pharma (Gilead)

- 6.3.18 Amgen Inc.

- 6.3.19 BeiGene Ltd

- 6.3.20 Regeneron Pharmaceuticals Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment