PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836632

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836632

Automotive Clutch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

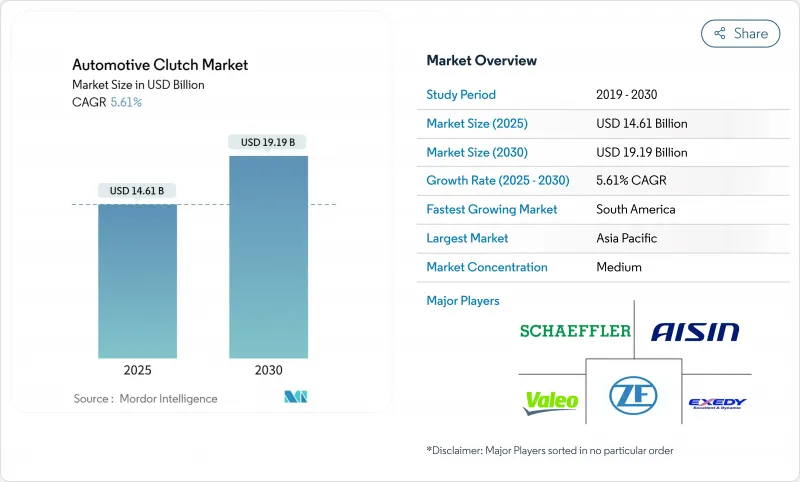

The automotive clutch market is valued at USD 14.61 billion in 2025 and is forecast to reach USD 19.19 billion by 2030, expanding at a 5.61% CAGR.

DCT technology adoption, tightening global CO2 rules, and steady light-vehicle production growth, particularly in Asia-Pacific, underpin this outlook. OEM-level demand dominates because new models increasingly pair mild-hybrid systems with electronic actuation that improves shift speed and efficiency. Meanwhile, aftermarket volumes remain resilient as vehicle fleets age well past 12 years, sustaining replacement demand even as battery-electric vehicles (BEVs) reduce installations of conventional friction clutches. Competitive dynamics are changing: leading suppliers are bundling mechanical know-how with software and electronics to protect their share while positioning for hybrid architectures, most visibly in Schaeffler's merger with Vitesco Technologies, which folds power electronics into a historic clutch portfolio.

Global Automotive Clutch Market Trends and Insights

Rapid OEM Shift Toward Dual-Clutch & Automated Transmissions

DCT efficiency advantages of up to 28% over torque-converter automatics allow carmakers to hit fleet CO2 targets without detracting from performance, prompting broad migration from premium to mass-market segments. Unit costs fall as component commonality rises, making six- and eight-speed DCTs viable for B- and C-segment cars. Hybrid variants such as Magna's 48 V DCT merge combustion and electric propulsion within tight packaging, enabling smoother engine-off coasting. Commercial-vehicle OEMs adopt hybrid automated manuals to cut fuel burn on long-haul routes, reinforcing demand for heavy-duty clutches with higher thermal capacity.

Rising Light-Vehicle Production in Emerging Economies

Expanding assembly volumes in China and India sustain core demand as automakers localize drivetrains and leverage regional supply chains. Government incentives in India encourage new plants that specify high-volume manual clutches, yet rising trim levels integrate automated options, adding premium friction-material opportunities. In China, output stabilized after 2024 turbulence, and local brands now adopt DCTs to stay competitive, driving incremental unit value. Outside Asia, Brazil and Mexico collectively field a base that fuels a dependable parts replacement cycle. Urbanization accelerates ride-hailing fleets in Tier-2 and Tier-3 cities, where stop-and-go duty accelerates wear and lifts aftermarket volumes.

Escalating BEV Penetration Eliminating Conventional Clutches

China targets a 45% EV share of new-vehicle sales by decade-end, and European OEMs deploy aggressive electric roadmaps, directly substituting the traditional friction clutch with fixed-ratio e-drive couplings. Nonetheless, hybrid architectures still use disconnect clutches to de-link engines at highway cruise. Patent activity from General Motors on clutch-based hybrid gearsets demonstrates the ongoing need for sophisticated engagement systems even in electrified drivelines.

Other drivers and restraints analyzed in the detailed report include:

- Stringent CO2 Targets Driving Demand for Fuel-Efficient Clutches

- Adoption of 48-V e-Clutch Systems for Mild-Hybrid Architectures

- Rising Popularity of CVT Powertrains in Entry-Level Cars

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manual units still represented 65.10% of the automotive clutch market in 2024, yet the dual-clutch transmissions emerged as the fastest-growing segment at 9.19% CAGR from 2025-2030. That growth rides on mainstream adoption in compact cars, where cost gaps have narrowed and regulatory pressure rewards efficiency. The automotive clutch market size for dual-clutch systems is forecast to rise in tandem with eight-speed designs that maintain performance while controlling engine speed more tightly.

Across two-pedal architectures, suppliers are re-engineering friction packs with low-inertia hubs and high-conductivity liners that limit drag torque at idle. ZF's 8-speed wet DCT illustrates the technology shift, offering 28% loss reduction and supporting mild-hybrid P2 configurations. Automated manual transmissions (AMTs) in heavy trucks deploy single or twin countershafts coupled with high-heat organic linings, giving fleet operators a fuel-saving alternative without the cost of full hybrids. Together, these trends sustain broad diversity in clutch technology and preserve overall automotive clutch market momentum through the decade.

Passenger cars delivered 74.57% of demand in 2024, but medium and heavy trucks are the fastest-rising slice, expanding at 7.88% CAGR as hybrid drivetrains proliferate in regional haul and urban delivery. The automotive clutch market size attached to heavy-duty platforms benefits from higher unit value per vehicle, since multi-plate packs and greater thermal mass are needed to handle torque peaks during launch on grades.

Eaton's heavy-duty clutches, engineered for automated manuals such as DT12 and I-Shift, underscore this opportunity and include high-velocity airflow designs that dissipate heat under stop-start duty. Hydrogen-fuel truck pilots pair single-stage gearboxes with disconnect clutches that isolate pumps and compressors, offering another niche. In passenger cars, hybrid powertrains extend clutch relevance by inserting P2 or P3 modules between the engine and transmission to enable electric sailing. Consequently, the automotive clutch market maintains a balanced exposure across vehicle classes even as BEVs expand.

The Automotive Clutch Market Report is Segmented by Transmission Type (Manual, Automatic, AMT, DCT, and More), Vehicle Type (Passenger Cars, LCV, and More), Clutch Component (Clutch Disc and Hub, Pressure Plate and Cover, Release Bearing/Slave Cylinder, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific maintained a 49.65% share of the automotive clutch market in 2024, underpinned by China's production scale and India's policy-fueled manufacturing uptick. Regional CAGR of 5.41% through 2030 reflects stable internal combustion demand plus accelerating hybrid rollouts. Japan and South Korea, leaders in electronic actuation, drive higher average unit value by specifying integrated e-clutch modules. ASEAN assemblers attract new investment as global OEMs diversify supply chains, ensuring localized clutch sourcing at scale.

South America is the fastest-growing geography at 6.77% CAGR, fueled by a larger vehicle population in Brazil and other South American countries that sustains robust replacement volumes. New regional trade incentives spark fresh capacity commitments, while urban freight electrification trials integrate hybrid AMTs that lift content per vehicle. Argentina's aging fleet leans heavily on the independent aftermarket, widening supplier exposure beyond OEM channels.

North America and Europe show modest 3.21% and 2.81% CAGRs, respectively, yet both regions impose the toughest emissions and particulate rules. CAFE mandates in the United States stipulate 2% annual efficiency gains, encouraging OEMs to pair mild-hybrid modules with high-efficiency clutches. European Euro 7 standards limit brake and clutch wear particles, accelerating the adoption of copper-free linings and lightweight plates. Russia and the Middle East and Africa contribute incremental growth tied to localized assembly and rising urban ownership.

- Schaeffler AG

- Valeo SA

- ZF Friedrichshafen AG

- EXEDY Corporation

- Aisin Corporation

- Eaton Corporation plc

- BorgWarner Inc.

- Magneti Marelli SpA

- Continental AG

- LuK

- WABCO (ZF CV Systems)

- Setco Automotive Ltd.

- FCC Co., Ltd.

- Zhejiang Tieliu Clutch Co., Ltd.

- Nissin Kogyo Co., Ltd.

- Haldex AB

- Twin Disc Inc.

- Transtar Industries Inc.

- Helix Auto Transmission

- Sachs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid OEM shift toward dual-clutch and automated transmissions

- 4.2.2 Rising light-vehicle production in emerging economies

- 4.2.3 Stringent CO2 targets driving demand for fuel-efficient clutches

- 4.2.4 Adoption of 48-V e-clutch systems for mild-hybrid architectures

- 4.2.5 Lightweight composite friction materials to meet fleet-wide MPG norms

- 4.2.6 Growing retrofit demand in Tier-2/3 cities for emission-compliant taxis

- 4.3 Market Restraints

- 4.3.1 Escalating BEV penetration eliminating conventional clutches

- 4.3.2 Rising popularity of CVT powertrains in entry-level cars

- 4.3.3 Dual-mass-flywheel reliability issues causing warranty cost spikes

- 4.3.4 Upcoming copper-free friction-material mandates disrupting supply chains

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Billion)

- 5.1 By Transmission Type

- 5.1.1 Manual

- 5.1.2 Automatic (Torque-Converter)

- 5.1.3 Automated Manual Transmission (AMT)

- 5.1.4 Dual-Clutch Transmission (DCT)

- 5.1.5 Others (e-Clutch, CVT Clutch Packs, etc.)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Off-Highway (Agricultural and Construction)

- 5.3 By Clutch Component

- 5.3.1 Clutch Disc and Hub

- 5.3.2 Pressure Plate and Cover

- 5.3.3 Release Bearing/Slave Cylinder

- 5.3.4 Flywheel (Single and Dual-Mass)

- 5.3.5 Actuation Systems (Hydraulic, Electro-Hydraulic, Electronic)

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Schaeffler AG

- 6.4.2 Valeo SA

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 EXEDY Corporation

- 6.4.5 Aisin Corporation

- 6.4.6 Eaton Corporation plc

- 6.4.7 BorgWarner Inc.

- 6.4.8 Magneti Marelli SpA

- 6.4.9 Continental AG

- 6.4.10 LuK

- 6.4.11 WABCO (ZF CV Systems)

- 6.4.12 Setco Automotive Ltd.

- 6.4.13 FCC Co., Ltd.

- 6.4.14 Zhejiang Tieliu Clutch Co., Ltd.

- 6.4.15 Nissin Kogyo Co., Ltd.

- 6.4.16 Haldex AB

- 6.4.17 Twin Disc Inc.

- 6.4.18 Transtar Industries Inc.

- 6.4.19 Helix Auto Transmission

- 6.4.20 Sachs

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment