PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836634

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836634

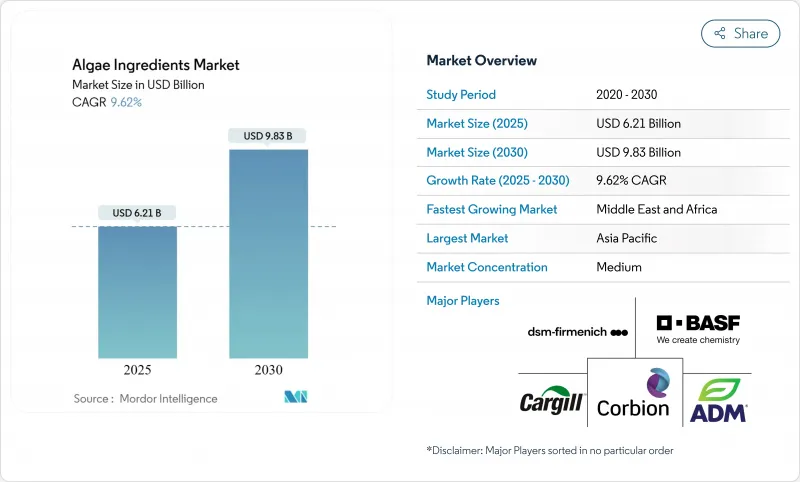

Algae Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The algae ingredients market reaches USD 6.21 billion in 2025, expanding at a robust 9.62% CAGR to achieve USD 9.83 billion by 2030, driven by accelerating demand for sustainable omega-3 alternatives and biotechnological breakthroughs in cultivation efficiency.

Manufacturers are adopting vertically integrated bioprocessing platforms to reduce production costs and ensure a contaminant-free supply. Food, beverage, and pharmaceutical companies value algae's clean-label properties and consistent nutrient content. The Asia-Pacific region maintains its market leadership due to established aquaculture infrastructure and efficient manufacturing capabilities. The Middle East and Africa region shows significant growth potential as investments in the blue economy increase. The market remains competitive as mid-sized companies establish niche positions through strain development, while large companies focus on omega-3 applications and form strategic partnerships to expand their market presence.

Global Algae Ingredients Market Trends and Insights

Nutritional Benefits of Algae-Derived Products

Algae ingredients provide higher bioavailability and concentration of essential nutrients compared to conventional sources, making them effective alternatives in functional foods and dietary supplements. The enhanced nutrient absorption and concentrated delivery mechanisms make algae-based ingredients particularly valuable for manufacturers and consumers. The FDA's GRAS Notice 1185 for DHA-rich oil from Schizochytrium sp. validates its safety for infant formulas and general foods, allowing consumption of up to 1.5 grams of DHA per person daily . This regulatory approval strengthens market confidence and expands application possibilities across various food categories. The nutritional benefits enable premium pricing and market differentiation, as demonstrated by DSM-Firmenich's life'sDHA(R) B54-0100, which contains 545 mg of pure DHA per gram, allowing for smaller capsules and efficient formulations. The high concentration of DHA in these products reduces manufacturing costs and improves product development flexibility for food and supplement manufacturers.

Biotechnology and Cultivation Advancements

Innovations in photobioreactors and genetic engineering are transforming algae production by improving productivity and enabling commercial viability. Advanced cultivation systems with automated monitoring and precise controls enhance biomass yields and product quality. In May 2025, BGG doubled astaxanthin production capacity in Yunnan Province, reducing carbon emissions through efficiency and renewable energy. The facility uses advanced photobioreactors, harvesting techniques, AI, and data analytics to optimize strain selection and growth conditions. BASF's research into micro-algae for bio-based chemicals highlights integrated biorefinery models, diversifying product streams like biofuels, nutritional supplements, and specialty chemicals.

High Production and Processing Cost

Algae cultivation for high-value ingredients like omega-3 fatty acids, proteins, and pigments (astaxanthin and beta-carotene) requires controlled environments, such as photobioreactors or open ponds, which demand significant capital investment. Precise control of temperature, light, CO2 levels, and nutrients, along with continuous monitoring to prevent contamination, increases production costs compared to traditional crops and synthetic alternatives. Post-cultivation, harvesting, drying, and compound extraction involve costly processes like bead milling, sonication, supercritical CO2 extraction, and solvent-based techniques, requiring expensive solvents, high energy input, and specialized equipment. Purifying the final ingredient to food-grade or pharmaceutical-grade standards involves multiple energy-intensive steps, resulting in high unit costs.

Other drivers and restraints analyzed in the detailed report include:

- Increase Use of Algae in Animal Nutrition

- Consumer Awareness About Health Benefits of Omega-3

- Contamination Risk and Safety Concern

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Omega Fatty Acids command a 39.24% market share in 2024 and exhibit an 11.43% CAGR through 2030. This growth stems from their established market position and improvements in algal-derived EPA and DHA formulations. The continuous research and development in extraction technologies have enhanced the quality and bioavailability of these fatty acids, making them more appealing to manufacturers. Carrageenan and Alginate serve distinct functions in food texturing and pharmaceutical applications, offering versatile solutions for product formulation and stability. Carotenoids gain traction in cosmetics and nutraceuticals through enhanced extraction techniques, with manufacturers focusing on improving yield and purity levels.

BGG expanded its facility to double the production of Certified Organic Haematococcus pluvialis astaxanthin, addressing rising demand for natural antioxidants. This reflects growing consumer preference for natural ingredients and sustainable production. FDA approvals for algae-based color additives boost growth by expanding applications in food, beverages, and dietary supplements. The market's demand for omega fatty acids remains strong, driven by documented health benefits and regulatory support. Clinical research on their cardiovascular and cognitive benefits further drives adoption. Additionally, beta-glucans from Euglena gracilis show potential in immune and metabolic health applications.

The Algae Ingredients Market Report is Segmented by Ingredient Type (Spirulina, Chlorella, Omega Fatty Acids, and More), Source (Red, Green, and Brown Algae), Application (Food and Beverages, Pharmaceuticals, Animal Nutrition, Personal Care and Cosmetics, and Other Applications), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific holds a 42.34% market share, driven by its strong aquaculture sector, manufacturing capabilities, and established seaweed cultivation infrastructure. Growing consumer acceptance of algae-based products and China's demand for fishmeal alternatives, as noted in the FAO's 2024 fisheries report, further strengthens the region's position . The Asia-Pacific Aquaculture 2024 conference highlights algae's role in the blue economy. Integrated supply chains, government support, and advancements in cultivation technologies by Japan and Australia, along with India's spirulina trials targeting malnutrition, showcase the region's market leadership.

The Middle East and Africa region projects the highest growth rate at 12.01% CAGR through 2030. This growth stems from comprehensive sustainability programs and strategic blue economy investments, particularly Saudi Arabia's large-scale regenerative aquaculture initiatives. The African continent presents substantial opportunities in coastal cultivation and directly addresses regional food security needs. However, the market growth in these regions remains dependent on the development of essential infrastructure, including processing facilities, transportation networks, and storage capabilities.

North America and Europe maintain strong market positions through their focus on premium applications and comprehensive regulatory frameworks. European regulations provide detailed guidelines for macroalgae products across multiple categories, including medicinal applications, food supplements, and agricultural fertilizers. The CEN/TC 454 standardization efforts enhance market access by implementing unified standards across member states. These regions establish global benchmarks for product safety and effectiveness through rigorous testing protocols and quality control measures, influencing international market practices and standards.

- DSM-Firmenich AG

- Cargill Inc.

- Corbion N.V.

- BASF SE

- Archer Daniels Midland Company (ADM)

- Cyanotech Corporation

- Fuji Chemical Industries Co. Ltd.

- Aliga Microalgae A/S

- Allmicroalgae (Secil Group)

- DIC Corp.(Earthrise Nutritionals)

- Roquette Freres

- Dupont-IFF (Danisco)

- Evonik Industries AG

- Fermentalg SA

- Parry Nutraceuticals (Murugappa)

- Solabia Group

- Cellana Inc.

- Alltech Inc.

- Syngenta Group

- Qingdao Seawin Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Nutritional Benefits of Algae-Derived Products

- 4.2.2 Biotechnology and Cultivation Advancements

- 4.2.3 Increase Use of Algae in Animal Nutrition

- 4.2.4 Consumer Awareness About Health Benefits of Omega-3

- 4.2.5 Growing Demand from the Cosmetics Industry

- 4.2.6 Inclination Towards Natural Food Additives

- 4.3 Market Restraints

- 4.3.1 High Production and Processing Cost

- 4.3.2 Seasonal and Environmental Sensitivity

- 4.3.3 Lack of Standardization in Algae-Based Ingredients

- 4.3.4 Contamination Risk and Safety Concern

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Ingredient Type

- 5.1.1 Spirulina

- 5.1.2 Chlorella

- 5.1.3 Omega Fatty Acids

- 5.1.4 Carageenan

- 5.1.5 Alginate

- 5.1.6 Caretonoids

- 5.1.7 Other Ingredient Type

- 5.2 By Source

- 5.2.1 Red Algae

- 5.2.2 Green Algae

- 5.2.3 Brown Algae

- 5.3 By Application

- 5.3.1 Food and Beverages

- 5.3.2 Pharmaceutical

- 5.3.3 Animal Nutrition

- 5.3.4 Personal Care and Cosmetics

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 Spain

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 DSM-Firmenich AG

- 6.4.2 Cargill Inc.

- 6.4.3 Corbion N.V.

- 6.4.4 BASF SE

- 6.4.5 Archer Daniels Midland Company (ADM)

- 6.4.6 Cyanotech Corporation

- 6.4.7 Fuji Chemical Industries Co. Ltd.

- 6.4.8 Aliga Microalgae A/S

- 6.4.9 Allmicroalgae (Secil Group)

- 6.4.10 DIC Corp.(Earthrise Nutritionals)

- 6.4.11 Roquette Freres

- 6.4.12 Dupont-IFF (Danisco)

- 6.4.13 Evonik Industries AG

- 6.4.14 Fermentalg SA

- 6.4.15 Parry Nutraceuticals (Murugappa)

- 6.4.16 Solabia Group

- 6.4.17 Cellana Inc.

- 6.4.18 Alltech Inc.

- 6.4.19 Syngenta Group

- 6.4.20 Qingdao Seawin Biotech

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK