PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836636

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836636

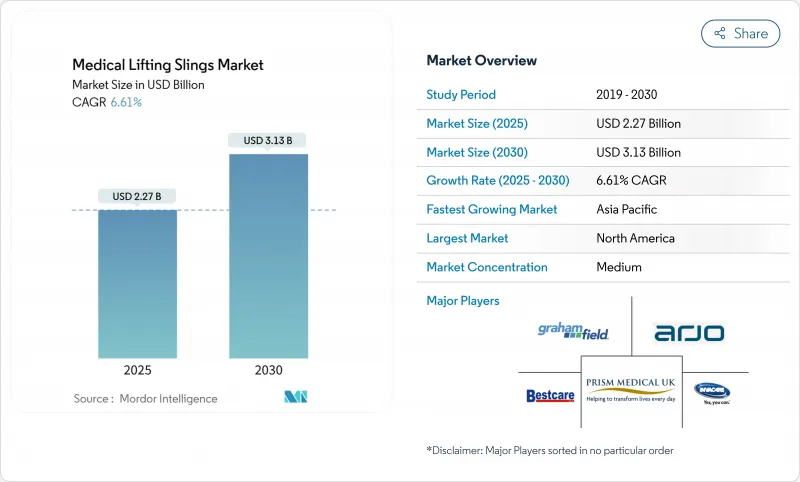

Medical Lifting Slings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The medical lifting sling market is valued at USD 2.27 billion in 2025 and is projected to reach USD 3.13 billion by 2030, registering a 6.61% CAGR through the forecast period.

Demand stems from aging demographics, rising chronic disease incidence, and workplace safety mandates that push healthcare providers toward mechanized patient-handling solutions. Hospitals continue replacing manual transfers to limit musculoskeletal injuries and meet OSHA and FDA standards, while smart sling innovations and antimicrobial fabrics widen functional appeal. Heightened labor shortages also accelerate technology adoption, with the United States alone set to add 2.1 million healthcare jobs by 2032. Finally, reimbursement improvements for durable medical equipment (DME) boost patient access, especially in home and long-term care settings.

Global Medical Lifting Slings Market Trends and Insights

Rapidly Ageing Population & Chronic Lifestyle Diseases

Across developed economies, older adults and patients with diabetes or cardiovascular disease require frequent assisted transfers, driving sustained demand for the medical lifting sling market. Mechanical slings reduce caregiver injuries and elevate patient safety, particularly in long-term care environments where bariatric and complex positioning needs are common.

Shift to Home-Healthcare & Long-Term Care Settings

Medicare's 2025 home health payment update raises reimbursements 2.7% and obliges agencies to assess mobility-care capacity before accepting referrals, stimulating purchases of compact, caregiver-friendly devices. The medical lifting sling market responds with portable frames and intuitive sling designs suited for non-professional users.

High Upfront Cost & Limited Staff Training

Sling systems demand capital expenditure and ongoing education; under-trained staff often underuse installed devices, limiting near-term uptake despite long-run safety payoffs.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Safe-Patient-Handling Regulations in Hospitals

- Reimbursement Expansion for Durable Medical Equipment

- Patient Discomfort & Cultural Reluctance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seating and full-body products held 37.35% of 2024 revenue due to versatility across departments, yet bariatric and bari-plus models are climbing at an 11.25% CAGR as obesity prevalence rises. The medical lifting sling market size for bariatric solutions is forecast to expand swiftly because patients exceeding 180 kg require reinforced fabrics and wider geometry. Standing and universal U-shape variants satisfy rehabilitation centers, whereas transfer sheets enhance lateral moves in ICUs. Pediatric and specialty slings occupy niche volume but enjoy stable demand from children's hospitals.

The product mix exemplifies tailored care: facilities match sling characteristics to body habitus, medical condition, and transfer scenario. Suppliers differentiate through ergonomic padding, pressure-distribution fabrics, and modular loop-strap systems. Smart sensors integrated into certain bariatric devices capture usage metrics, easing audits for safe-patient-handling compliance and deepening data-driven purchasing within the medical lifting sling market.

Polyester contributes 68.53% share because of durability and wash-fastness, anchoring cost-efficient fleet management in large hospitals. Antimicrobial technical fabrics register a 10.85% CAGR as silver-ion or copper-fiber treatments deliver >=99% bacterial log-kill without compromising breathability. Mesh and spacer fabrics improve airflow to protect fragile skin, while nylon reinforces bariatric weight loads. Quilted blends provide comfort during extended immobilization. Environmental targets push suppliers to develop recyclable composites, although price premiums restrain near-term conversion outside high-infection-risk units.

Technical advances support infection-control savings: fewer laundering cycles and shorter turnaround times translate to operational efficiencies, strengthening hospital value propositions within the broader medical lifting sling market.

The Medical Lifting Slings Market Report is Segmented by Product (Standing Slings, Universal U-Shape Slings, Seating / Full-Body Slings, and More), Material (Polyester, Padded, Nylon, and More), Usage Type (Disposable and Reusable), End User (Hospitals & Surgical Centres, Rehabilitation Centres, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generates 34.82% of global revenue. Mature reimbursement, strict OSHA enforcement, and a growing senior population sustain equipment renewal cycles. Canada's public health insurers fund ceiling lifts in long-term care, while Mexico accelerates DME procurement under universal coverage initiatives. Regulatory updates mandating 17-inch low transfer heights spur design upgrades, bolstering the region's contribution to the medical lifting sling market.

Asia-Pacific achieves the fastest 11.82% CAGR as China, Japan, and India upscale hospital infrastructure and adopt Western safe-handling standards. Demographic aging collides with smaller family units, increasing institutional-care reliance and fueling purchases of modern lifting slings. Local producers emphasize cost-effective polyester and nylon blends, yet premium imported antimicrobial fabrics are winning share in top-tier urban hospitals, enlarging the medical lifting sling market footprint.

Europe maintains moderate growth. Universal healthcare and EU worker-safety directives keep baseline demand stable, while Eastern European modernization adds incremental volume. Brexit prompts U.K. providers to re-validate CE-marked devices, creating short-term uncertainty yet medium-term opportunities for agile suppliers. Population aging and rising bariatric admissions underpin steady needs across the medical lifting sling market.

- Arjo

- Baxter International (Hillrom Services Inc.)

- Invacare

- Drive DeVilbiss Healthcare

- Etac AB (Molift)

- Joerns Healthcare

- Guldmann

- Bestcare

- Medline Industries

- GF Health Products

- Prism Medical Ltd.

- Sunrise Medical

- Vancare Inc.

- Handicare Group AB

- NAUSICAA Medical

- Winncare Group

- HoverTech International

- SPH Medical

- Med-Mizer Inc.

- UpLyft Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly Ageing Population & Chronic Lifestyle Diseases

- 4.2.2 Shift To Home-Healthcare & Long-Term Care Settings

- 4.2.3 Stricter Safe-Patient-Handling Regulations In Hospitals

- 4.2.4 Reimbursement Expansion For Durable Medical Equipment

- 4.2.5 Rental / Subscription Models Unlocking SMB Adoption

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost & Limited Staff Training

- 4.3.2 Patient Discomfort & Cultural Reluctance

- 4.3.3 Infection-Control Mandates Favouring Single-Use Slings

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Standing Slings

- 5.1.2 Seating / Full-Body Slings

- 5.1.3 Universal U-shape Slings

- 5.1.4 Bariatric & Bari-plus Slings

- 5.1.5 Transfer Sheets & Slide Slings

- 5.1.6 Specialty & Paediatric Slings

- 5.2 By Material

- 5.2.1 Polyester

- 5.2.2 Padded / Quilted

- 5.2.3 Mesh / Spacer-fabric

- 5.2.4 Nylon

- 5.2.5 Technical Textiles

- 5.3 By Usage Type

- 5.3.1 Disposable (Single-patient)

- 5.3.2 Reusable / Launderable

- 5.4 By End User

- 5.4.1 Hospitals & Surgical Centres

- 5.4.2 Home-Care & Long-Term-Care Facilities

- 5.4.3 Rehabilitation Centres

- 5.4.4 Emergency Medical Services / Ambulance

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 ARJO

- 6.3.2 Baxter International (Hillrom Services Inc.)

- 6.3.3 Invacare Corporation

- 6.3.4 Drive DeVilbiss Healthcare

- 6.3.5 Etac AB (Molift)

- 6.3.6 Joerns Healthcare LLC

- 6.3.7 Guldmann Inc.

- 6.3.8 Bestcare LLC

- 6.3.9 Medline Industries LP

- 6.3.10 GF Health Products Inc.

- 6.3.11 Prism Medical Ltd.

- 6.3.12 Sunrise Medical LLC

- 6.3.13 Vancare Inc.

- 6.3.14 Handicare Group AB

- 6.3.15 NAUSICAA Medical

- 6.3.16 Winncare Group

- 6.3.17 HoverTech International

- 6.3.18 SPH Medical

- 6.3.19 Med-Mizer Inc.

- 6.3.20 UpLyft Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment