PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836637

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836637

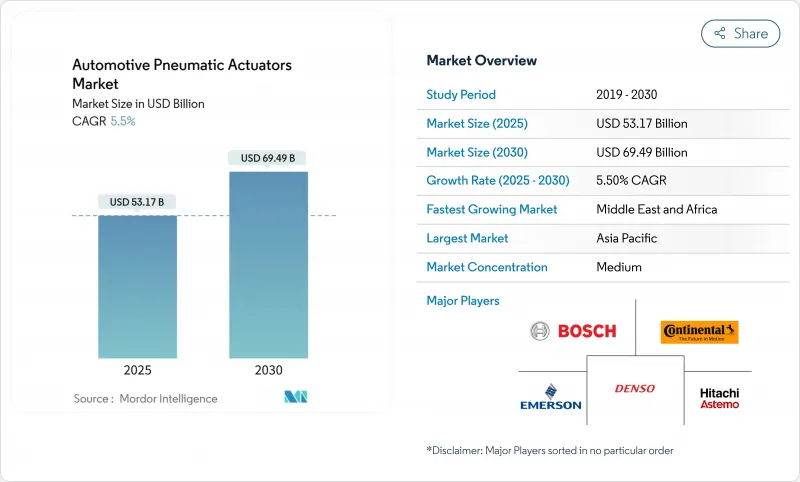

Automotive Pneumatic Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Pneumatic Actuators Market size is estimated at USD 53.17 billion in 2025, and is expected to reach USD 69.49 billion by 2030, at a CAGR of 5.50% during the forecast period (2025-2030).

Despite competition from energy-efficient electric actuators, vehicle makers continue to rely on pneumatic devices for safety, powertrain, and chassis functions. Stricter emission regulations and the growing adoption of ADAS drive demand, with Asia-Pacific leading due to strong supply chains. At the same time, the Middle East and Africa, as well as South America, see rapid growth from expanding local assembly programs.

Global Automotive Pneumatic Actuators Market Trends and Insights

Stricter emission norms driving precise air-fuel control

The US EPA's Phase 3 heavy-duty standards enacted in 2024 tighten NOx thresholds, compelling diesel makers to refine EGR and dosing strategies that rely on high-resolution pneumatic valves. Similar Euro 7 drafts trigger demand peaks in Europe. Field-valid testing replaces laboratory cycles, forcing actuators to sustain precision under real-world vibration and temperature excursions. Suppliers with electro-pneumatic packages that close the digital feedback loop enjoy distinct bidding advantages. The regulatory timetable accelerates award decisions, locking in revenue visibility for the forecast period.

Increasing global vehicle production

Rising light-duty and heavy-duty volumes lift baseline demand across all pneumatic applications because every unit assembled carries multiple actuator points. The Japan Automobile Manufacturers Association confirmed that OEM schedules for 2025 still embed pneumatic solutions in brake, throttle, and EGR circuits to assure fuel efficiency and compliance. Platform sharing further magnifies volumes because a single actuator family can now be fitted across sibling models, raising economies of scale for suppliers. Western manufacturers are repositioning final-assembly footprints toward Southeast Asia, which encourages actuator makers to co-locate module lines. The production rebound therefore secures near-term growth in the automotive pneumatic actuators market even as electric rivals sharpen their cost proposition.

Shift toward energy-efficient electric actuators

Electromechanical systems convert battery power into motion with up to 80% efficiency, dwarfing the 20% ceiling of air-driven counterparts. The delta becomes more pronounced in electric cars, where every watt saved extends range. Line-builders are also migrating their welding robots and material-handling arms to electric cylinders for tighter path accuracy. Yet pneumatics still dominates the highest-force nodes, such as heavy truck drum brakes, where compressed air is already integral to the vehicle platform. Consequently suppliers are channeling R&D toward mixed-technology actuators that preserve pressure-based force while embedding low-energy position control.

Other drivers and restraints analyzed in the detailed report include:

- ADAS proliferation demanding accurate actuation

- Lightweighting trend for fuel economy

- Complexity & high maintenance cost of pneumatics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Brake chambers and parking brake caliper units commanded 31.50% share of the automotive pneumatic actuators market in 2024. Their presence is mandated across every passenger and commercial vehicle variant, cementing baseline volume. Electromechanical parking brakes are penetrating luxury sedans, but heavy truck drum brakes still rely on air chambers that deliver high clamping force at low unit cost. Turbocharger wastegate actuators follow as the fastest riser, posting a 6.70% CAGR because downsized gasoline engines depend on accurate boost management to meet power and emission targets. Throttle valves, HVAC blend doors, and EGR butterflies retain mid-single-digit growth, each backed by regulatory or comfort imperatives.

Pneumatic fuel-injection rail regulators survive in certain flex-fuel layouts popular in Brazil, while door-lock plungers remain common in cost-sensitive hatchbacks. Across the board, suppliers experiment with smart pressure sensors embedded in actuator bodies to supply health data back to the vehicle control network. The enhancements prolong relevance of pneumatically powered devices even as direct electric motor drives tighten competitive gaps. Overall, the application mix underscores why the automotive pneumatic actuators market maintains double-digit billion-dollar revenues: it spans mandatory safety, emissions, and comfort functions that every vehicle must carry.

Passenger cars generated 56.70% of 2024 revenue, reflecting sheer production volume across global plants. Yet heavy commercial vehicles are projected to pace the automotive pneumatic actuators market size expansion with a 5.90% CAGR. Fleet operators prize the durability of air-brake and air-suspension circuits under intense duty cycles, while stricter CO2 quotas push for optimized compressor management rather than wholesale technology swaps. Light commercial vans track e-commerce parcel demand and achieve a robust CAGR on the back of city-logistics growth. Construction and mining equipment are, chiefly for high-temperature exhaust-flap controllers and robust steering stabilizers.

Two-wheelers remain a micro-segment concentrated in select Asian economies, yet scooter OEMs are trialing low-pressure air servos for automatic clutch actuation. The diversity highlights a bifurcation: suburban passenger cars gravitate toward compact electric drives for NVH advantages, whereas high-payload vehicles sustain pneumatics for force density and proven maintainability. That divergence shapes future platform strategies of tier-1 suppliers, compelling them to produce modular families that scale from micro to heavy-duty ratings without rewriting qualification protocols.

The Automotive Pneumatic Actuator Market is Segmented by Application Type (Throttle Actuators, Fuel Injection Actuators, Brake Actuators, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Actuator Mechanism (Single-Diaphragm Pneumatic and More), Sales Channel (OEM and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific generated 45.50% of global revenue in 2024, underpinned by China's multi-brand passenger car output and Japan's high-precision valve competence. The region is forecast to post a 7.10% CAGR as supply bases in Vietnam, Thailand, and India climb the value curve, making in-region sourcing attractive for global nameplates. Electro-pneumatic R&D centers in South Korea exploit the country's advanced semiconductor ecosystem to integrate pressure MEMS sensors onto actuator PCBs, heightening competitive edge. Notwithstanding electric-vehicle penetration, cost-optimized sub-compact segments still install pneumatically driven HVAC and turbo wastegate units, securing volume for suppliers.

Middle East & Africa stands out as the fastest-growing cluster at a robust CAGR of 7.80%. Saudi Vision 2030 industrial policy lures CKD assembly lines, each demanding localized actuator content for commercial trucks that service construction booms. The UAE leverages free-zone logistics to re-export spare parts kits deeper into African markets. Turkey's customs-union access to Europe boosts its component exports, compelling pneumatic suppliers to expand Izmir and Bursa facilities. These dynamics re-orient procurement away from trans-continental shipping toward near-market production, shortening lead times and cutting freight emissions.

In South America, flex-fuel engine architectures unique to the region stimulate EGR and fuel-rail actuator demand because ethanol blends alter combustion stoichiometry daily. Local content rules push multinational suppliers to site elastomer curing presses in Minas Gerais rather than import seal stacks. Argentine heavy-truck assembly rebounds after currency stabilization measures, adding lift for high-capacity brake chambers. Currency volatility and political risk temper the outlook, yet installed base inertia keeps the automotive pneumatic actuators market resilient in the hemisphere.

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Emerson (ASCO Valve)

- Hitachi Astemo Ltd

- CTS Corporation

- Schrader Duncan Ltd

- Rotex Automation

- Nucon Industries Pvt Ltd

- Magneti Marelli SpA

- Mitsubishi Electric Corp

- Del-Tron Precision Inc

- Procon Engineering

- Valeo SA

- Aisin Corporation

- Mahle GmbH

- BorgWarner Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter emission norms driving precise air-fuel control

- 4.2.2 Increasing global vehicle production

- 4.2.3 ADAS proliferation demanding accurate actuation

- 4.2.4 Lightweighting trend for fuel economy

- 4.2.5 Hydrogen ICE valve-timing adoption

- 4.2.6 OTA-enabled actuator software monetisation

- 4.3 Market Restraints

- 4.3.1 Shift toward energy-efficient electric actuators

- 4.3.2 Complexity & high maintenance cost of pneumatics

- 4.3.3 Shortage of high-grade elastomers for seals

- 4.3.4 Tier-1 decarbonisation curbing pneumatic R&D

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Application Type

- 5.1.1 Throttle Actuators

- 5.1.2 Fuel Injection Actuators

- 5.1.3 Brake Actuators

- 5.1.4 Exhaust Gas Recirculation Actuators

- 5.1.5 Turbocharger Wastegate Actuators

- 5.1.6 HVAC Actuators

- 5.1.7 Door Lock Actuators

- 5.1.8 Others

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Medium and Heavy Commercial Vehicles

- 5.2.4 Off-Highway Vehicles

- 5.2.5 Two-Wheelers

- 5.3 By Actuator Mechanism

- 5.3.1 Single-Diaphragm Pneumatic

- 5.3.2 Vacuum-Boost Pneumatic

- 5.3.3 Electro-pneumatic (EP)

- 5.3.4 Servo-pneumatic

- 5.3.5 Rack-and-Pinion

- 5.3.6 Rotary-Vane

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 Denso Corporation

- 6.4.4 Emerson (ASCO Valve)

- 6.4.5 Hitachi Astemo Ltd

- 6.4.6 CTS Corporation

- 6.4.7 Schrader Duncan Ltd

- 6.4.8 Rotex Automation

- 6.4.9 Nucon Industries Pvt Ltd

- 6.4.10 Magneti Marelli SpA

- 6.4.11 Mitsubishi Electric Corp

- 6.4.12 Del-Tron Precision Inc

- 6.4.13 Procon Engineering

- 6.4.14 Valeo SA

- 6.4.15 Aisin Corporation

- 6.4.16 Mahle GmbH

- 6.4.17 BorgWarner Inc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment