PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836638

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836638

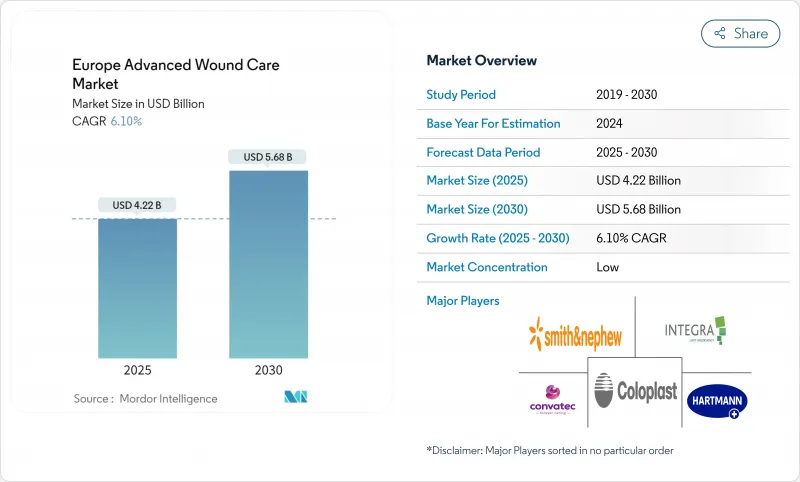

Europe Advanced Wound Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe advanced wound care management market stands at USD 4.22 billion in 2025 and is projected to rise to USD 5.68 billion by 2030, registering a 6.10% CAGR throughout the forecast period.

Healthy demand stems from growing chronic disease incidence, supportive reimbursement reforms, and rapid uptake of evidence-based technologies that shorten healing cycles while lowering readmissions. Technology convergence across biomaterials, negative-pressure platforms, and real-time analytics is accelerating product differentiation, while hospital budget pressures push clinicians toward solutions with verifiable total-cost-of-care reductions. Demographic ageing and steadily climbing surgical volumes intensify the clinical imperative for faster, infection-free recovery, reinforcing sustained investment in product innovation and integrated care pathways across the Europe advanced wound care management market.

Europe Advanced Wound Care Market Trends and Insights

Increasing Incidences of Chronic Wounds & Diabetic Ulcers

Chronic wounds affect 2.21 per 1,000 population across Europe and impose sizable fiscal pressure on care systems. Spain's primary care network alone spent EUR 34,991,854 on chronic wound management over three years, of which treatment materials accounted for EUR 8,455,787 . Diabetic foot ulcers show 6.3% prevalence among diabetic patients and cost the NHS close to GBP 7,800 per case. These metrics prompt large-scale clinical adoption of advanced dressings and negative-pressure devices that close wounds faster and cut downstream expenditure. Consequently, demand for innovative modalities keeps expanding in the Europe advanced wound care management market as payers embrace value-based coverage structures that reward proven healing outcomes.

Rising Geriatric Population Base

Older Europeans face higher rates of pressure ulcers, venous insufficiency, and delayed tissue repair, spurring sustained need for sophisticated wound solutions. Governments align elderly-care strategies with effective wound prevention and treatment to lower hospitalization days and preserve independence. Countries with mature social insurance platforms reimburse advanced dressings more readily, helping clinicians deploy moisture-managing foams, collagen matrices, and antimicrobial films at earlier care stages. This demographic tailwind secures a long-run growth pillar for the Europe advanced wound care management market amid ageing curves that remain steep.

High Treatment Costs for Advanced Modalities

Premium pricing restricts access in cost-sensitive markets, where individual claims for bioengineered skin substitutes can exceed USD 1 million . Payers experiment with outcomes-based contracts that refund only when predefined healing milestones are reached, but adoption remains uneven. Start-ups face funding gaps until robust real-world evidence substantiates cost-effectiveness, slowing introduction of breakthrough solutions. These fiscal pressures temper uptake across parts of the Europe advanced wound care management market despite strong clinical merit.

Other drivers and restraints analyzed in the detailed report include:

- Increase in Surgical Procedures Volume

- Technological Advances in NPWT & Bio-engineered Dressings

- Fragmented & Inconsistent Reimbursement Across EU-27

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound dressings accounted for 45.37% of the Europe advanced wound care management market share in 2024, underscoring their central role in daily clinical protocols across settings. This segment's resilience reflects the wide availability of foam, hydrogel, and antimicrobial film formats that provide moisture balance, microbial control, and patient comfort. Foam and silicone-coated super-absorbent variants gain ground because they prevent maceration during extended wear. Collagen and alginate alternatives, valued for regenerative properties, regain clinician interest as environmental regulations favor natural polymers. Although dressings maintain the largest revenue contribution, therapy devices are projected to expand at a 6.93% CAGR through 2030, propelled by portable negative-pressure systems and bioactive platforms with integrated sensors.

Device providers highlight evidence of faster closure and shortened nursing time to justify higher capital expense. New disposable-canister NPWT lines enable cost-effective deployment in community care, while emerging ultrasound-based debridement units show promise in stubborn biofilm disruption. Vendors co-develop clinical pathways with hospital networks to embed protocols and lock in longer term contracts. Active wound care products such as growth factors and skin substitutes claim a niche but premium share, and their uptake depends on successful value-based reimbursement pilots. Sustained research funding and clinician training continue to shape adoption curves inside the Europe advanced wound care management industry, keeping competitive pressure high on both dressings and devices.

The Europe Advanced Wound Care Market Report Segments the Industry Into by Product (Wound Dressings, Active Wound Care, Therapy Devices, Other Advance Wound Care Products), by Wound Type (Chronic Wound, Acute Wound), and Geography (Germany, United Kingdom, France, Italy, Spain, Rest of Europe). Get Five Years of Historical Data and Five-Year Forecasts.

List of Companies Covered in this Report:

- 3M

- B. Braun

- Cardinal Health

- Coloplast

- ConvaTec Group plc

- Integra LifeSciences

- Molnlycke AB

- Hartmann Group

- Smith+Nephew plc

- Johnson & Johnson

- Medtronic

- Lohmann & Rauscher GmbH

- Urgo Medical

- Essity (BSN medical)

- MiMedx Group Inc.

- Baxter

- Hollister

- Derma Sciences (Integra)

- KCI (Acelity)

- Advancis Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing incidences of chronic wounds & diabetic ulcers

- 4.2.2 Rising geriatric population base in Europe

- 4.2.3 Increase in volume of surgical procedures

- 4.2.4 Technological advances in NPWT & bio-engineered dressings

- 4.2.5 Growing Technological Advancements

- 4.2.6 Increasing Demand for Faster Recovery of Wounds

- 4.3 Market Restraints

- 4.3.1 High treatment costs for advanced modalities

- 4.3.2 Fragmented & inconsistent reimbursement across EU-27

- 4.3.3 Supply-chain constraints on collagen/alginate inputs due to new environmental rules

- 4.3.4 Slow uptake of AI-driven wound assessment owing to GDPR-linked data-privacy hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Dressings

- 5.1.1.1 Film Dressings

- 5.1.1.2 Foam Dressings

- 5.1.1.3 Hydrogel Dressings

- 5.1.1.4 Collagen Dressings

- 5.1.1.5 Other Dressings

- 5.1.2 Active Wound Care

- 5.1.2.1 Skin Substitutes

- 5.1.2.2 Growth Factors

- 5.1.3 Therapy Devices

- 5.1.3.1 Negative Pressure Wound Therapy

- 5.1.3.2 Pressure Relief Devices

- 5.1.3.3 Hyperbaric Oxygen Equipment

- 5.1.3.4 Compression Therapy

- 5.1.3.5 Other Therapy Devices

- 5.1.4 Other Advanced Wound-Care Products

- 5.1.1 Wound Dressings

- 5.2 By Wound Type

- 5.2.1 Chronic Wound

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Arterial & Venous Ulcer

- 5.2.1.4 Other Chronic Wound

- 5.2.2 Acute Wound

- 5.2.2.1 Surgical Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wound

- 5.3 By End User

- 5.3.1 Hospitals & In-patient Facilities

- 5.3.2 Ambulatory Surgical Centres (ASCs)

- 5.3.3 Home-care Settings

- 5.3.4 Long-term & Nursing Homes

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 3M Company

- 6.3.2 B. Braun SE

- 6.3.3 Cardinal Health Inc.

- 6.3.4 Coloplast A/S

- 6.3.5 ConvaTec Group plc

- 6.3.6 Integra LifeSciences

- 6.3.7 Molnlycke AB

- 6.3.8 Paul Hartmann AG

- 6.3.9 Smith+Nephew plc

- 6.3.10 Johnson & Johnson (Ethicon)

- 6.3.11 Medtronic plc

- 6.3.12 Lohmann & Rauscher GmbH

- 6.3.13 Urgo Medical

- 6.3.14 Essity (BSN medical)

- 6.3.15 MiMedx Group Inc.

- 6.3.16 Baxter International Inc.

- 6.3.17 Hollister Incorporated

- 6.3.18 Derma Sciences (Integra)

- 6.3.19 KCI (Acelity)

- 6.3.20 Advancis Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment