PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836640

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836640

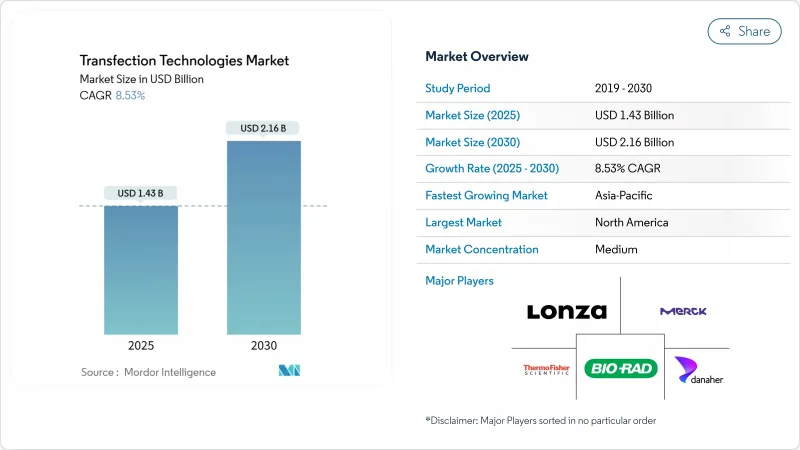

Transfection Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Transfection Technologies Market size is estimated at USD 1.43 billion in 2025, and is expected to reach USD 2.16 billion by 2030, at a CAGR of 8.53% during the forecast period (2025-2030).

This trajectory reflects a rapid pivot from small-scale laboratory protocols toward scalable, cGMP-compliant platforms demanded by the gene and cell therapy sector. Uptake is paced by 37 FDA-approved gene therapy products that require high-efficiency, low-toxicity delivery of DNA, RNA, or protein cargos into primary cells. Instrument makers are automating electroporation, microfluidics, and lipid-nanoparticle workflows to satisfy commercial batch sizes that now exceed 200 billion cells. Top vendors differentiate through closed, single-use consumables that shorten validation cycles for mRNA vaccines, allogeneic CAR-T therapies, and in vivo CRISPR products. Regionally, United States and Canada maintain strong regulatory and manufacturing ecosystems, yet capital flows into Singapore, Japan, and China indicate a coming rebalance toward Asia-Pacific production hubs.

Global Transfection Technologies Market Trends and Insights

Rising Incidence of Chronic Diseases

Cancer, neurological disorders, and inherited hematologic conditions are rising worldwide, pushing healthcare systems toward curative approaches based on gene transfer and genome editing. CAR-T pipelines alone require transfection platforms capable of 90% efficiency in primary T cells while maintaining >=85% viability, a threshold now achieved with optimized electroporation buffers. Focused ultrasound-assisted CRISPR delivery is demonstrating precise in-brain editing without viral vectors, signalling new therapeutic frontiers. High treatment prices-CASGEVY lists at USD 2.2 million-justify capital investment in advanced instruments that compress production timelines from weeks to days.

Expanding R&D in Cell and Gene-Based Therapies

Global clinical activity exceeded 1,200 active trials in 2024, creating a robust funnel for commercial launches that rely on scalable, repeatable transfection protocols. Allogeneic cell banks magnify demand because a single manufacturing run can treat hundreds of patients, intensifying the focus on closed electroporation systems with process analytical technology. Long-term supply contracts-such as Lonza's agreement to produce CASGEVY-illustrate how platform providers convert R&D momentum into multi-year revenue streams.

High Capital Cost of Instruments

State-of-the-art electroporation skids exceed USD 500,000, placing advanced automation out of reach for many early-stage firms. Annual service contracts and single-use cartridges amplify total cost of ownership. Equipment-as-a-service models now spread that outlay over multi-year operating budgets, yet uptake remains modest. Contract development and manufacturing organizations relieve the burden, but slot constraints can delay IND filings by six months. Microfluidic chips fabricated through inexpensive laser engraving show promise to undercut capital costs while sustaining >=90% transfection efficiency in suspension cells.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Synthetic Biology Workflows

- Government Bio-foundry Programmes

- Cytotoxicity and Low Efficiency of Legacy Reagents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Kits and reagents maintained their dominant position with 56.35% market share in 2024, reflecting the recurring revenue nature of consumables and the specialized formulation requirements for emerging applications. However, instruments represent the fastest-growing segment at 9.22% CAGR through 2030, driven by automation imperatives in cell therapy manufacturing and the need for scalable platforms that can handle diverse cell types with consistent performance.

Industrial buyers evaluate platforms on cross-cell-type performance, integration with MES software, and validated cleaning protocols. Thermo Fisher's 5 L DynaDrive bioreactor pairs with its neon electroporation device to form an end-to-end solution that trims process development time by 27%. As a result, the transfection technologies market size for instrument sub-segments is projected to expand faster than legacy reagent lines, capturing an incremental USD 420 million by 2030.

The Transfection Technologies Market Report is Segmented by Product Type (Kits and Reagents, Instruments, and Accessories), Application (Biomedical Research, Therapeutic Delivery, Protein Production, and More), End User (Academic and Research Institutes, Pharmaceutical and Biotechnology Companies and More) and Geography (North America, Europe, Asia Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.86% of 2024 revenue thanks to strong venture investment, FDA guidance that clarifies chemistry-manufacturing-control expectations, and a network of specialized CDMOs. The region's dominance in mRNA vaccine scale-up taught process engineers to apply lipid-nanoparticle formulations to therapeutic payloads beyond infectious disease. Nevertheless, labor shortages and high facility overheads sustain interest in lights-out manufacturing suites that reduce operator exposure.

Asia-Pacific is the fastest-growing territory, expanding at a 10.23% CAGR. Singapore's Cell Therapy Facility offers subsidized GMP suites, while Japan's Moonshot R&D program subsidizes electroporation studies that ensure higher delivery rates in induced pluripotent stem cells. China's synthetic-biology parks push for 1,000-strain per month design capacity, driving bulk procurement agreements for lipid-nanoparticle reagents.

Europe remains a mature but cautiously expanding arena. Germany leverages messenger-RNA manufacturing expertise from its vaccine boom to pivot toward rare-disease therapeutics, while EMA guidance on genetically modified cells harmonizes quality expectations across member states. Stringent GMO regulations slow agricultural applications, yet attractive research funding offsets some regulatory friction.

- Thermo Fisher Scientific

- Lonza Group

- QIAGEN

- Merck

- Bio-Rad Laboratories

- Promega

- Agilent Technologies

- MaxCyte

- Altogen Biosystems

- Polyplus-transfection

- SignaGen Laboratories

- Mirus Bio

- Horizon Discovery (PerkinElmer)

- Takara Bio

- Precision NanoSystems

- OriGene Technologies

- Lipocalyx GmbH

- InvivoGen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of chronic diseases

- 4.2.2 Expanding R&D in cell- & gene-based therapies

- 4.2.3 Growing demand for synthetic biology workflows

- 4.2.4 Government bio-foundry programmes

- 4.2.5 mRNA-vaccine scale-up needs high-throughput transfection

- 4.2.6 Automation and standardization of manufacturing processes

- 4.3 Market Restraints

- 4.3.1 High capital cost of instruments

- 4.3.2 Cytotoxicity and low efficiency of legacy reagents

- 4.3.3 Complex cGMP plasmid supply chain bottlenecks

- 4.3.4 Regulatory scrutiny on gene-editing payloads

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Kits and Reagents

- 5.1.2 Instruments

- 5.1.3 Accessories

- 5.2 By Application

- 5.2.1 Biomedical Research

- 5.2.2 Therapeutic Delivery

- 5.2.3 Protein Production

- 5.2.4 Synthetic Biology and Genome Engineering

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Academic and Research Institutes

- 5.3.2 Pharmaceutical and Biotechnology Companies

- 5.3.3 CROs and CMOs

- 5.3.4 Hospitals and Clinical Laboratories

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Lonza Group

- 6.3.3 Qiagen NV

- 6.3.4 Merck KGaA

- 6.3.5 Bio-Rad Laboratories

- 6.3.6 Promega Corporation

- 6.3.7 Agilent Technologies

- 6.3.8 MaxCyte Inc.

- 6.3.9 Altogen Biosystems

- 6.3.10 Polyplus-transfection SA

- 6.3.11 SignaGen Laboratories

- 6.3.12 Mirus Bio LLC

- 6.3.13 Horizon Discovery (PerkinElmer)

- 6.3.14 Takara Bio Inc.

- 6.3.15 Precision NanoSystems

- 6.3.16 OriGene Technologies

- 6.3.17 Lipocalyx GmbH

- 6.3.18 InvivoGen

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment