PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836642

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836642

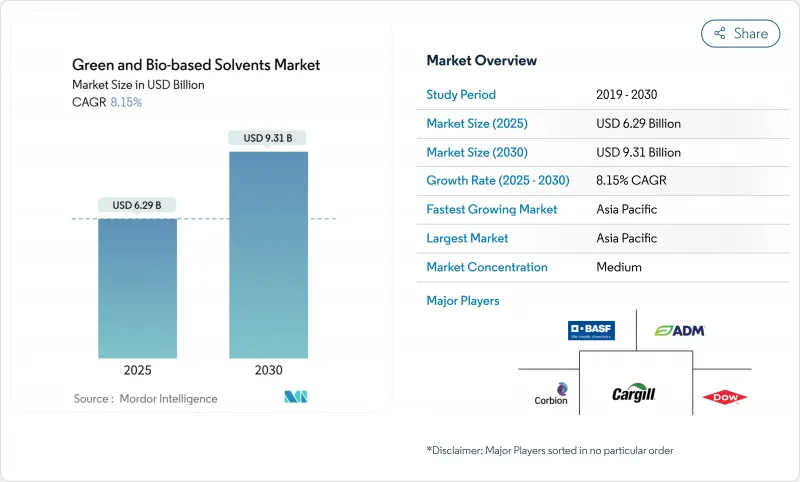

Green And Bio-based Solvents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Green And Bio-based Solvents Market size is estimated at USD 6.29 billion in 2025, and is expected to reach USD 9.31 billion by 2030, at a CAGR of 8.15% during the forecast period (2025-2030).

Tightening VOC-emission rules, crude-oil price swings, and broad corporate sustainability targets are pushing users to switch away from petroleum-based solvents. Demand also gains from a widening pool of renewable feedstocks that lowers long-term supply risk and from expanding tax credits that offset part of the still-higher production costs. Asia Pacific supplies the strongest pull on new volumes because rapid industrial growth intersects with ambitious green-chemistry policies in China and India.

Global Green And Bio-based Solvents Market Trends and Insights

Stringent VOC-emission Regulations

Regulatory agencies are tightening solvent rules across coatings, adhesives, and consumer products. Canada's 2024 limits cover 130 product classes and pair with EU REACH updates that restrict persistent and toxic substances, forcing formulators to redesign product lines. Replacement programs favor bio-alcohols and esters that meet the same performance specs without breaching new VOC caps. The policy tilt is reinforced by the EU Chemicals Strategy for Sustainability, which is widening the scope of hazardous-substance restrictions.

Volatility in Crude-oil Prices Fueling Bio-alternatives

Crude benchmarks jumped by double-digit percentages several times in 2024, narrowing the cost gap between bio-solvents and petro-solvents. Many buyers responded by writing dual-sourcing clauses that trigger automatic substitution when oil surpasses pre-set thresholds. Waste-oil imports into the United States doubled, proving that low-carbon waste feedstocks can hold price advantages even when crude oil eases. Price-hedge strategies reduce working-capital swings, making long-term contracts for bio-solvents more attractive to purchasing managers. The lesson for suppliers is clear: cost competitiveness now depends as much on managing feedstock spread risk as on absolute production costs.

Higher Production Costs

Fermentation reactors, costly purification steps, and lower plant utilization rates still give bio-solvents an unfavorable cost curve versus entrenched petro-equivalents. Recent process modernization trimmed bio-propylene glycol conversion costs by 25%, but the gap remains material outside incentive-rich jurisdictions. Many producers solve for economy by pairing bio-solvents with higher-value co-products, spreading fixed costs across multiple revenue streams. Others design drop-in molecules that allow customers to avoid re-tooling downstream processes, thereby lowering total cost of change. Until more brownfield petro-chemical assets convert, the green and bio-based solvents market faces selective price resistance, particularly in commoditized applications.

Other drivers and restraints analyzed in the detailed report include:

- Corporate ESG Pledges and Green Procurement Mandates

- Increasing Government Incentives and Tax Credits

- Feedstock Supply Volatility and Agri-price Swings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bio-alcohols generated the largest revenue slice in 2024, taking a 37.2% share of the green and bio-based solvents market. Mature ethanol fermenters, widespread agricultural feedstock supply, and flexible downstream blending lines support this position. Ethyl lactate's 9.56% CAGR underscores the pivot into niche molecules with superior solvency power and biodegradability, attributes prized in pharmaceutical synthesis and electronic-grade cleaning.

The Green and Bio-Based Solvents Market Report Segments the Industry by Type (Bio-Alcohols, Bio-Glycols, Bio-Diols, and More), Application (Paints and Coatings, Industrial and Domestic Cleaning, Printing Inks, Adhesives and Sealants, and More), End-User Industry (Automotive, Construction, Agriculture, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia Pacific led the green and bio-based solvents market with a 45.2% revenue share in 2024 and posts the highest 8.77% CAGR through 2030. China's dual-carbon strategy forces refineries and downstream resin producers to curb VOC releases, creating immediate pull for renewable solvents.

North America benefits from the intersection of strict federal and state air-quality rules and a mature biofuel infrastructure. Europe stands out for policy ambition. The Green Deal, the Circular Economy Action Plan, and country-level plastic taxes all favor renewable solvents.

South America and Africa remain smaller in revenue but hold long-run value because they combine cheap feedstock availability with rising environmental awareness. Capacity build-outs, however, depend on regulatory clarity and infrastructure upgrades, both of which lag the front-runner regions.

- ADM

- BASF

- Bio Brands LLC

- Bioeutectics

- Braskem

- Cargill, Incorporated

- Corbion

- Covation Biomaterials

- Dow

- Elevance Renewable Sciences Inc.

- Florachem Corp.

- Florida Chemical Company

- Galactic

- Gevo

- GFBIOCHEMICALS

- LyondellBasell Industries Holdings B.V.

- Merck

- Peter Cremer Holding GmbH & Co. KG

- Sekab

- Solvay

- Vertec BioSolvents Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent VOC-emission regulations

- 4.2.2 Volatility in crude-oil prices fuelling bio-alternatives

- 4.2.3 Corporate ESG pledges and green procurement mandates

- 4.2.4 Increasing Government incentives and tax credits for bio-chemicals

- 4.2.5 Global Expansion of Renewable Feedstock Availability

- 4.3 Market Restraints

- 4.3.1 Higher production costs

- 4.3.2 Feed-stock supply volatility and agri-price swings

- 4.3.3 Limited compatibility with legacy solvent-recovery units

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Patent Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Bio-alcohols

- 5.1.1.1 Bio-ethanol

- 5.1.1.2 Bio-methanol

- 5.1.1.3 Bio-propanol

- 5.1.1.4 Bio-butanol

- 5.1.2 Bio-glycols

- 5.1.2.1 Bio-based Propylene Glycol

- 5.1.2.2 Bio-based Ethylene Glycol

- 5.1.3 Bio-diols

- 5.1.4 Ethyl Lactate

- 5.1.5 D-Limonene

- 5.1.6 Methyl Soyate

- 5.1.7 Other Types

- 5.1.1 Bio-alcohols

- 5.2 By Application

- 5.2.1 Paints and Coatings

- 5.2.2 Industrial and Domestic Cleaning

- 5.2.3 Printing Inks

- 5.2.4 Adhesives and Sealants

- 5.2.5 Pharmaceuticals

- 5.2.6 Cosmetics and Personal Care

- 5.2.7 Agriculture

- 5.2.8 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Construction

- 5.3.3 Pharmaceutical and Healthcare

- 5.3.4 Food and Beverages

- 5.3.5 Consumer Goods

- 5.3.6 Agriculture

- 5.3.7 Electronics

- 5.3.8 Others

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of APAC

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ADM

- 6.4.2 BASF

- 6.4.3 Bio Brands LLC

- 6.4.4 Bioeutectics

- 6.4.5 Braskem

- 6.4.6 Cargill, Incorporated

- 6.4.7 Corbion

- 6.4.8 Covation Biomaterials

- 6.4.9 Dow

- 6.4.10 Elevance Renewable Sciences Inc.

- 6.4.11 Florachem Corp.

- 6.4.12 Florida Chemical Company

- 6.4.13 Galactic

- 6.4.14 Gevo

- 6.4.15 GFBIOCHEMICALS

- 6.4.16 LyondellBasell Industries Holdings B.V.

- 6.4.17 Merck

- 6.4.18 Peter Cremer Holding GmbH & Co. KG

- 6.4.19 Sekab

- 6.4.20 Solvay

- 6.4.21 Vertec BioSolvents Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment