PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836644

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836644

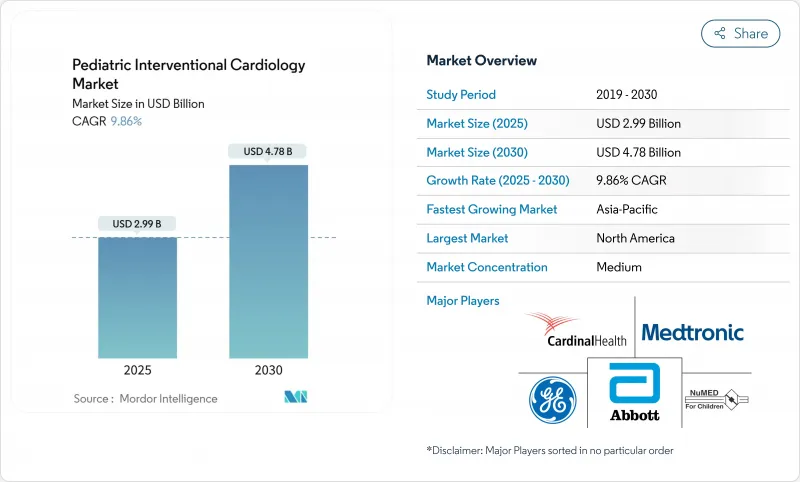

Pediatric Interventional Cardiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Pediatric Interventional Cardiology Market size is estimated at USD 2.99 billion in 2025, and is expected to reach USD 4.78 billion by 2030, at a CAGR of 9.86% during the forecast period (2025-2030).

Rapid acceptance of minimally invasive techniques for congenital heart defect (CHD) management, steady regulatory approvals, and the shift toward AI-enhanced imaging are propelling growth. North America remains the largest regional base, yet Asia-Pacific is expanding fastest as hospitals acquire hybrid cath-lab suites and local manufacturers introduce lower-cost pediatric devices. Clinical demand is reinforced by rising CHD prevalence estimated at 1.95% of all births in new U.S. insurance datasets and by a continuing move from episodic surgery to lifelong catheter-based care models. Breakthrough products such as the FDA-cleared Minima Stent System, designed to expand with the child, signal a new era of size-appropriate implants. AI-powered cath-lab software that detects rheumatic heart disease with 90% accuracy further boosts procedural confidence.

Global Pediatric Interventional Cardiology Market Trends and Insights

Rising Incidence of Congenital Heart Diseases

Newborn screening and insurance databases show CHD prevalence nearing 2% of pediatric populations, far higher than historic estimates. Enhanced prenatal echocardiography and dual-index pulse-oximetry programs have lifted early-detection sensitivity to 100% in Shanghai pilots. Earlier diagnosis extends survival, creating larger cohorts of adolescents and adults who continue to require catheter-based interventions across their lifespans.

Advancements in Miniaturized Interventional Devices

Advances in materials and engineering have cut device diameters to as little as 1.6 mm, exemplified by Medtronic's 4.7 French OmniaSecure ICD lead, which demonstrated 100% defibrillation success in trials. The balloon-expandable Minima Stent adapts to vessel growth, achieving 97.6% procedural success without major adverse events. Absorbable metal stents and RESILIA tissue valves, which showed 99.3% freedom from deterioration at eight years, aim to minimize re-intervention risk. Such technology directly targets historic shortages of child-sized hardware.

High Cost of Procedures and Devices

Hospital expenditures for CHD care surpass USD 9.8 billion annually in the United States. Pregnancy costs for women with CHD average USD 24,290 per case, a material burden versus routine obstetrics. Although CMS boosted 2025 CT angiography payments from USD 178.02 to USD 357.13, out-of-pocket exposure in emerging economies remains high, slowing adoption.

Other drivers and restraints analyzed in the detailed report include:

- Expanding R&D Pipeline for Pediatric-Specific Implants

- Regulatory Incentives and Support Programs

- Shortage of Trained Pediatric Interventional Cardiologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Closure devices captured 32.31% of pediatric interventional cardiology market share in 2024 thanks to their versatility in sealing atrial and ventricular septal defects. Their usage underpins a sizeable slice of pediatric interventional cardiology market volume, buoyed by products such as the Occlutech Atrial Flow Regulator, which posted 100% implant success. Balloon catheters keep evolving toward 1.2 mm profiles that cross tight lesions with faster deflation, while next-generation atherectomy tools remove calcium with minimal vessel trauma.

Transcatheter heart valves represent the fastest-growing segment, climbing at a 13.89% CAGR. Devices including Edwards' EVOQUE tricuspid valve and Abbott's Tendyne system now address regurgitation and calcification without sternotomy, expanding the pediatric interventional cardiology market size for valve solutions by double digits. Absorbable metal stents aim to obviate future re-interventions as children grow, and imaging consoles integrating AI and MRI guidance are cutting radiation exposure to zero for eligible cases. Collectively, these advances draw new hospitals and ambulatory centers into complex structural heart programs.

The Pediatric Interventional Cardiology Market Report Segments the Industry Into Device Type (Closure Devices, and More), Procedure (Catheter-Based Valve Implantation, Congenital Heart Defect Correction, and More), End User (Children's Hospitals & Specialty Centres, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 41.91% of 2024 revenue, propelled by FDA leadership in clearing pediatric devices, mature reimbursement, and substantial philanthropic funding for congenital programs. The pediatric interventional cardiology market size in the region expands steadily as private insurers accept AI-guided procedures and as regulatory pathways such as Breakthrough Device Designation trim approval times. Canada complements U.S. capacity through referral networks that funnel complex neonates to tertiary centers, while Mexico draws cross-border patients with lower procedural tariffs.

Europe commands a sizeable share due to cohesive public healthcare and concentrated surgical expertise in Germany, France, and the United Kingdom. Early adoption of miniaturized heart valves and routine newborn pulse-oximetry screening boost the pediatric interventional cardiology market across EU member states. Joint clinical registries accelerate real-world data generation, helping manufacturers secure post-market authorizations.

Asia-Pacific is the fastest grower at 12.53% CAGR. China's newborn screening programs have achieved 100% sensitivity for critical CHDs and lifted operative volumes, while Japan leads in transcatheter pulmonary valve replacements. Indian cardiac centers face cost constraints yet double pediatric cath-lab cases annually, supported by domestic production of lower-price closure devices. Government insurance expansions in Indonesia, Vietnam, and Thailand are unlocking procedure demand.

Middle East & Africa and South America trail but show momentum. Gulf nations invest heavily in specialty hospitals, and South Africa's dedicated pediatric cardiac units serve as regional referral hubs. Brazil and Argentina widen pediatric cath-lab access under public-private insurance models, though currency volatility tempers immediate scale. Across emerging regions, portable echocardiography and tele-consult platforms extend specialist expertise to remote clinics.

- Abbott Laboratories

- Medtronic

- Boston Scientific

- Edward Lifesciences

- GE Healthcare

- Siemens Healthineers

- BIOTRONIK

- NuMed

- W. L. Gore & Associates

- Canon

- Cardinal Health

- Cordis

- Terumo

- Merit Medical Systems

- Lepu Medical

- Balton

- MicroPort

- Lifetech Scientific

- Occlutech

- AngioDynamics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Congenital Heart Diseases (CHDs)

- 4.2.2 Advancements in Miniaturized Interventional Devices

- 4.2.3 Expanding R&D Pipeline for Pediatric-Specific Implants

- 4.2.4 Regulatory Incentives and Support Programs

- 4.2.5 Venture Capital Investment in Pediatric Med-Tech Startups

- 4.2.6 Integration of AI in Cath-Lab Imaging

- 4.3 Market Restraints

- 4.3.1 High Cost of Procedures and Devices

- 4.3.2 Reimbursement Challenges in Emerging Markets

- 4.3.3 Limited Availability of Pediatric-Sized Components

- 4.3.4 Shortage of Trained Pediatric Interventional Cardiologists

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Device Type

- 5.1.1 Closure Devices

- 5.1.2 Transcatheter Heart Valves

- 5.1.3 Atherectomy Devices

- 5.1.4 Catheters

- 5.1.5 Balloons

- 5.1.6 Stents

- 5.1.7 Imaging & Guidance Systems

- 5.1.8 Other Device Types

- 5.2 By Procedure

- 5.2.1 Catheter-Based Valve Implantation

- 5.2.2 Congenital Heart Defect Correction

- 5.2.3 Angioplasty

- 5.2.4 Coronary Thrombectomy

- 5.2.5 Hybrid Surgery-Assisted Interventions

- 5.2.6 Other Procedures

- 5.3 By End User

- 5.3.1 Paediatric Catheterisation Laboratories

- 5.3.2 Children's Hospitals & Specialty Centres

- 5.3.3 Ambulatory Surgical Centres

- 5.3.4 Research & Academic Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott

- 6.3.2 Medtronic

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Edwards Lifesciences Corporation

- 6.3.5 GE Healthcare

- 6.3.6 Siemens Healthineers

- 6.3.7 BIOTRONIK

- 6.3.8 NuMED Inc.

- 6.3.9 W. L. Gore & Associates, Inc.

- 6.3.10 Canon Medical Systems Corporation

- 6.3.11 Cardinal Health

- 6.3.12 Cordis

- 6.3.13 Terumo Corporation

- 6.3.14 Merit Medical Systems

- 6.3.15 Lepu Medical

- 6.3.16 Balton

- 6.3.17 MicroPort Scientific

- 6.3.18 Lifetech Scientific

- 6.3.19 Occlutech

- 6.3.20 AngioDynamics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment