PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836651

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836651

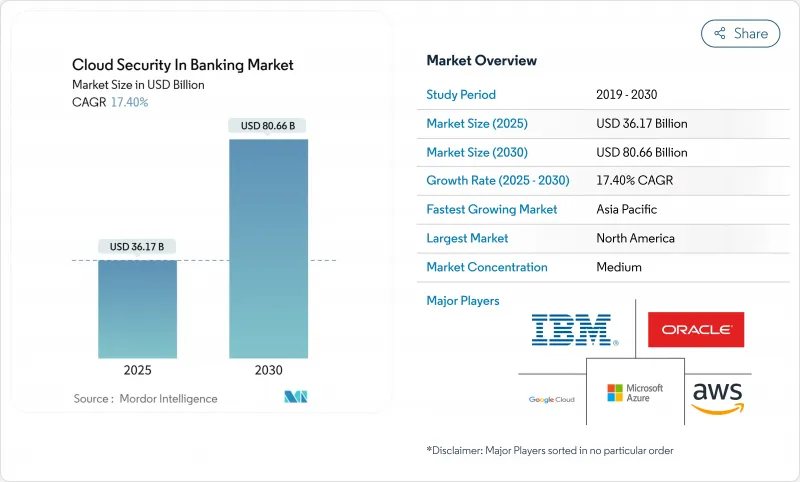

Cloud Security In Banking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cloud security in banking market stood at USD 36.17 billion in 2025 and is forecast to reach USD 80.66 billion by 2030, reflecting a 17.4% CAGR.

This expansion mirrors banks' pivot toward cloud-native architectures that cut operating costs, improve agility, and satisfy regulators demanding proven operational resilience. Demand is also rising because ransomware incidents targeting financial workloads climbed to 78% in 2024, pushing chief information security officers to accelerate zero-trust adoption and deeper third-party risk oversight. Consolidation among security vendors is giving banks access to broad platforms that combine API protection, identity governance, and AI-powered fraud analytics. In parallel, public cloud providers are embedding pre-configured compliance tooling that simplifies audits under measures such as the EU's Digital Operational Resilience Act (DORA), which came into force in January 2025. Although North America retained a 37.2% share in 2024, Asia-Pacific is advancing the fastest on the back of national data-localization rules and mobile-first consumer banking, contributing a 17.8% regional CAGR to 2030.

Global Cloud Security In Banking Market Trends and Insights

Growing Volume and Sophistication of Cyber-Attacks on Banking Workloads

Financial institutions faced 78% ransomware hit rates in 2024, double the prior year. Attackers are now exploiting API abuse, container misconfigurations, and third-party software flaws-in 1 incident, a cloud misconfiguration exposed nearly 500,000 JPMorgan Chase customers, underlining the new perimeter-free threat surface. Average breach costs reach USD 10 million per incident, prompting urgent migration to behavior analytics-driven zero-trust controls that verify every session and asset. Major banks are embedding continuous compliance scanning and threat-hunting into DevSecOps pipelines to shrink exposure windows from days to hours. Global payments rail SWIFT is piloting federated-learning models with Google Cloud that flag anomalous transactions without moving sensitive data, showing how AI can detect fraud while protecting privacy. As organized crime monetizes access to stolen banking credentials on dark-net markets, proactive cloud segmentation and least-privilege IAM have become board-level priorities.

Real-Time Compliance Automation Requirements (Basel III, DORA, etc.)

The EU's DORA obliges 22,000 financial entities to report severe cyber incidents within 24 hours and test exit plans for critical cloud suppliers, pushing banks to deploy automated evidence-collection engines that feed regulators in near real time. U.S. regulators are moving in the same direction: the Treasury's 2025 cloud resilience report urges continuous control monitoring for systemic institutions. Cloud vendors now bundle mapping templates for Basel III, PCI DSS, and GDPR into dashboards, cutting manual audit workloads by 40%. Banks with global footprints are standardizing on unified compliance fabrics so a single policy set satisfies overlapping jurisdictions-particularly valuable when customer data flows span EU, U.S. and Asia. Early adopters report faster product launches because embedded governance eliminates lengthy security-review cycles, turning compliance from a blocker into a revenue enabler.

Data Residency Conflicts with Multi-Tenant Public Clouds

GDPR, China's CSL, and India's DPDP Act oblige banks to localize data, conflicting with global multi-tenant setups. Sovereign-cloud variants from hyperscalers promise metadata isolation and local key custody, yet still lack the granular placement controls some regulators demand. Smaller APAC markets often enforce data-center-in-country rules that erode economies of scale, nudging banks toward hybrid topologies where sensitive datasets stay on-prem or in local private regions. Resulting architectural complexity inflates cost and elevates configuration-error risk, adding drag to widespread cloud adoption plans. Policymakers are consulting with industry to refine residency stipulations so cyber resilience benefits outweigh jurisdictional concerns, but resolution is unlikely before the end of the decade.

Other drivers and restraints analyzed in the detailed report include:

- Cost Avoidance Through Serverless and Container-Native Security Controls

- Expansion of Open-Banking APIs Driving Zero-Trust Adoption

- Shortage of Cloud-Security-Skilled Talent in Banks' SOC Teams

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud Identity and Access Management accounted for 29.2% of the cloud security in the banking market share in 2024, reflecting banks' shift from perimeter controls to identity-centric guardrails that authenticate users, services, and APIs at a millisecond scale. As distributed work models persist, IAM consolidates single sign-on, privileged access management, and device posture checks, forming the backbone of zero-trust programs. Vendors are now embedding continuous risk scoring and passwordless flows that trim login friction-a critical user-experience factor in consumer banking.

Cloud Encryption is the fastest segment, posting an 18.2% CAGR through 2030. Quantum-threat awareness and stricter data-protection statutes are pushing banks to deploy hardware security modules and centralized key orchestration. The cloud security in the banking market size for encryption-focused products is forecast to rise alongside pilots of quantum-safe algorithms across payment rails, positioning cryptography as both a compliance must-have and a competitive differentiator. Multi-party computation and format-preserving encryption are gaining traction, letting institutions analyze data without decrypting it, a breakthrough for cross-border fraud analytics and AI model training.

Public-cloud implementations captured 62.4% of the cloud security in the banking market size in 2024, underscoring confidence in hyperscaler defenses, dedicated financial-services regions, and shared-responsibility blueprints. Providers such as AWS and Microsoft report double-digit growth in bank workloads, aided by artifacts like PCI DSS on-demand audit packs that slice assessment times. However, sovereign-cloud and regional-cloud variants illustrate that one model will not fit every jurisdiction, and exit-strategy testing demanded by U.K. supervisors underscores residual concentration risk.

Hybrid-cloud installations are expanding at a 20.1% CAGR because they let banks meet data residency mandates while still bursting to public fabric for analytics surges. Containers and service meshes deliver workload portability, enabling stress-exit drills that shift traffic off a compromised provider within hours. As regulators scrutinize single-vendor dependencies, multi-cloud toolchains are becoming broad metrics for operational resilience, accelerating procurement of abstraction layers that secure and orchestrate across providers.

Cloud Security in Banking Market is Segmented by Software Type (Cloud Identity and Access Management, Cloud Email Security, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid Cloud), Security Service (Data Security, Application Security, and More), Banking Type (Retail/Consumer Banking, Corporate and Investment Banking, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominated the cloud security in the banking market with a 37.2% share in 2024. Long-standing regulator-vendor dialog, mature private-public threat-sharing, and USD 17 billion in annual tech spending at JPMorgan Chase underline the depth of local demand. The U.S. Treasury's 2025 cloud-resilience study formally encourages critical institutions to adopt multi-cloud while implementing real-time monitoring pipelines, accelerating orders for unified security stacks that can span providers. Canadian regulators now reference zero-trust and secure-API norms explicitly in open-banking guidance, signaling further investment momentum.

Asia-Pacific delivers the fastest CAGR at 17.8% to 2030 as regulators balance data-localization with innovation. Japan's consortium of regional banks adopted a shared hybrid platform running on IBM and Kyndryl infrastructure, illustrating collaborative approaches to cost-effective yet compliant security. Singapore's national digital ID roll-out and Malaysia's RMiT standard also drive the adoption of IAM and real-time monitoring, respectively. China's multi-level protection scheme (MLPS 2.0) compels encryption, continuous monitoring, and onshore key custody, prompting providers to launch local-only regions with hardware attestation.

Europe is accelerating due to DORA and PSD2/PSD3. Italian bank Credem Banca migrated to a specialist security cloud that embeds encryption and real-time incident notification, achieving 20% faster regulatory reporting. The Thales 2024 study notes that 65% of European firms rank cloud security as their second-largest cyber priority, evidencing board-level focus. Multi-cloud resilience drills and sovereign-cloud pilots are now contractual requirements, spurring demand for orchestration layers that enforce policies across Amazon, Microsoft, and Google environments without manual rule duplication.

List of Companies Covered in this Report:

- AWS (Amazon.com, Inc.)

- Google Cloud Platform (Alphabet Inc.)

- Microsoft Azure (Microsoft Corporation)

- IBM Cloud Security (IBM Corporation)

- Oracle Cloud (Oracle Corporation)

- Salesforce, Inc.

- Palo Alto Networks, Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- CrowdStrike Holdings, Inc.

- Zscaler, Inc.

- Proofpoint Inc.

- Okta, Inc.

- Ping Identity Corporation

- SailPoint Technologies Holdings Inc.

- Netskope, Inc.

- Imperva, Inc.

- Qualys, Inc.

- Rapid7, Inc.

- Sophos Ltd.

- Illumio Inc.

- Akamai Technologies Inc.

- Thales Group (Vormetric)

- Temenos AG

- nCino, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing volume and sophistication of cyber-attacks on banking workloads

- 4.2.2 Real-time compliance automation requirements (Basel III, DORA, etc.)

- 4.2.3 Cost avoidance through serverless and container-native security controls

- 4.2.4 Expansion of open-banking APIs driving zero-trust adoption

- 4.2.5 AI-powered fraud detection bundled with cloud security suites

- 4.3 Market Restraints

- 4.3.1 Data residency conflicts with multi-tenant public clouds

- 4.3.2 Shortage of cloud-security-skilled talent in banks' SOC teams

- 4.3.3 Hidden dependency risk in third-party fintech integrations

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Software Type

- 5.1.1 Cloud Identity and Access Management (IAM)

- 5.1.2 Cloud Email Security

- 5.1.3 Cloud Intrusion Detection and Prevention (IDPS)

- 5.1.4 Cloud Encryption

- 5.1.5 Cloud Network Security

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid Cloud

- 5.3 By Security Service

- 5.3.1 Data Security

- 5.3.2 Application Security

- 5.3.3 Network Security

- 5.3.4 Security Monitoring and Orchestration (SIEM/SOAR)

- 5.3.5 Identity, Authentication and Fraud Analytics

- 5.4 By Banking Type

- 5.4.1 Retail/Consumer Banking

- 5.4.2 Corporate and Investment Banking

- 5.4.3 Card and Payment Service Providers

- 5.4.4 Digital-Only/Neobanks

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Malaysia

- 5.5.4.6 Singapore

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AWS (Amazon.com, Inc.)

- 6.4.2 Google Cloud Platform (Alphabet Inc.)

- 6.4.3 Microsoft Azure (Microsoft Corporation)

- 6.4.4 IBM Cloud Security (IBM Corporation)

- 6.4.5 Oracle Cloud (Oracle Corporation)

- 6.4.6 Salesforce, Inc.

- 6.4.7 Palo Alto Networks, Inc.

- 6.4.8 Fortinet Inc.

- 6.4.9 Check Point Software Technologies Ltd.

- 6.4.10 Trend Micro Inc.

- 6.4.11 CrowdStrike Holdings, Inc.

- 6.4.12 Zscaler, Inc.

- 6.4.13 Proofpoint Inc.

- 6.4.14 Okta, Inc.

- 6.4.15 Ping Identity Corporation

- 6.4.16 SailPoint Technologies Holdings Inc.

- 6.4.17 Netskope, Inc.

- 6.4.18 Imperva, Inc.

- 6.4.19 Qualys, Inc.

- 6.4.20 Rapid7, Inc.

- 6.4.21 Sophos Ltd.

- 6.4.22 Illumio Inc.

- 6.4.23 Akamai Technologies Inc.

- 6.4.24 Thales Group (Vormetric)

- 6.4.25 Temenos AG

- 6.4.26 nCino, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment