PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836652

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836652

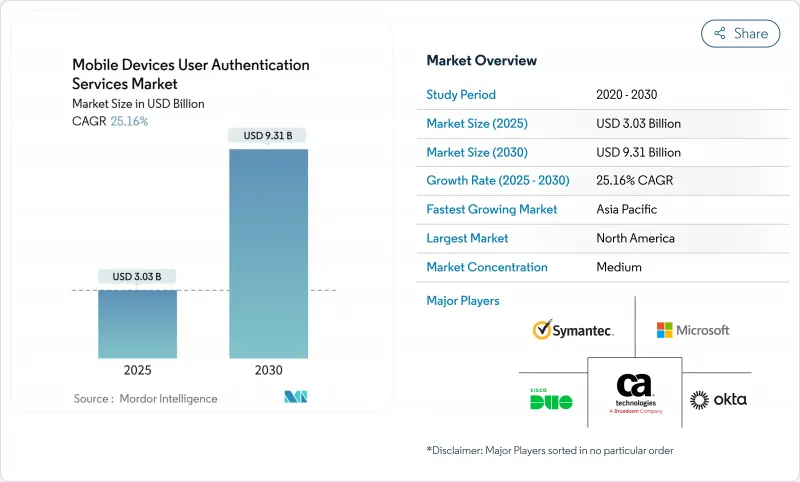

Mobile Devices User Authentication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mobile devices user authentication services market size is valued at USD 3.03 billion in 2025 and is on track to reach USD 9.31 billion by 2030, and is forecast to expand at a 25.16% CAGR.

Structural demand is shifting from passwords toward phishing-resistant verification, reflected in the 550% jump in passkey roll-outs during 2024 and the 26% CAGR expected for passwordless platforms between 2025-2030. Heightened regulatory scrutiny-ranging from Europe's Strong Customer Authentication (SCA) rules to the U.S. Department of Defense Zero Trust Roadmap-is catalyzing multi-factor deployments that satisfy regional compliance needs while raising the performance bar for vendors. Competitive strategies now center on ecosystem integration: platform leaders push broad identity fabrics while specialists capture growth pockets in hardware keys, behavioral analytics, and carrier APIs. Against this backdrop, enterprises recognise the economic upside of passwordless authentication, with JumpCloud reporting that device-level biometrics reduce credential management overhead and breach costs in equal measure.

Global Mobile Devices User Authentication Services Market Trends and Insights

Adoption of Passwordless & WebAuthn Standards Across Mobile-First Enterprises

Seventy percent of organisations either plan to adopt or have already introduced passwordless authentication, illustrating how WebAuthn shifts the security baseline. Native support from platform incumbents such as Microsoft Entra ID embeds passkey functionality directly into device hardware, eradicating shared-secret risk while simplifying user journeys. Consumer familiarity with passkeys rose to 57% in 2025, up from 39% three years earlier, signalling readiness for large-scale transition.Momentum will intensify as banks, airlines and travel portals adopt FIDO-compliant flows in 2025, confirming passwordless as a mainstream control for high-value mobile transactions. Vendors able to orchestrate cross-platform credential mobility stand to win disproportionate share in the mobile devices user authentication services market.

Surge in FinTech and Mobile Banking (SCA Compliance) Driving MFA Roll-outs

European Banking Authority guidance ruling out device-unlock biometrics as a standalone SCA accelerates multi-factor adoption, forcing issuers to build layered verification that combines biometrics, possession factors, and dynamic risk checks. The expected PSD3 proposal will further prohibit mobile-only flows, prompting banks to embed out-of-band authenticators. Spillover into adjacent digital commerce is material; e-commerce, ride-hailing, and gig-work platforms adopt banking-grade controls to satisfy consumer trust and regulatory parity. These converging demands underpin double-digit growth in the mobile devices user authentication services market across financial and quasi-financial ecosystems.

SMS OTP Latency & Failure in Carrier-Fragmented Regions

Global spend on SMS OTP exceeds USD 1.6 billion even though delivery rates fall below enterprise thresholds in multi-operator markets, triggering cart abandonment and failed logins. Regulators in Singapore, India and the United States aim to retire SMS OTP by 2025, amplifying urgency for alternatives. NIST now discourages SMS as a secure factor, while leading exchanges such as Coinbase confirm that 95% of account takeovers leveraged SIM-swap attacks. Transition costs may temporarily restrain small businesses, but declining push notification and passkey expenses neutralise the barrier over time.

Other drivers and restraints analyzed in the detailed report include:

- Mid-Range Smartphone Biometric Hardware Penetration in Asia

- Enterprise Zero-Trust Security Architecture Accelerating Mobile Authenticator Adoption

- Biometric Data Privacy Concerns under GDPR

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

MFA dominated revenue with 56% in 2024, reflecting early defences against credential theft. Passwordless now sets the growth pace at 26% CAGR, powered by platform-level FIDO support and rising passkey familiarity. The mobile devices user authentication services market size for passwordless flows is projected to reach USD 3.8 billion by 2030, nearly doubling its 2025 base. Hardware security keys, while niche, address high-assurance needs in telecom and defence, expanding at double-digit rates as unit economics improve. Behavioural and passive authentication add continuous verification, reducing user prompts and aligning with zero-trust mandates. Vendors marrying hardware keys with invisible behavioural layers are well-positioned to capture enterprise up-sell budgets.

Fingerprints, facial recognition, and voice match account for the bulk of biometric adoption, yet behaviour-centric models grow faster by embedding in existing mobile SDKs. Number matching and device reputation analytics reduce MFA fatigue, closing an exploit path that attackers manipulate. The combination of these trends repositions the mobile devices user authentication services market as an enabler of seamless digital experience rather than a checkpoint, strengthening the business case for board-level investment

Cloud Authentication-as-a-Service delivered 60% revenue in 2024, driven by rapid SaaS roll-outs and elastic scaling advantages. The hybrid edge-plus-cloud option grows at 23% CAGR as regulated industries safeguard data residency while using cloud identity innovation. Organisations deploying Microsoft's hybrid Kerberos trust model demonstrate latency reductions and policy coherence when authenticating local Windows Hello credentials through both on-premises directory and cloud endpoint. The mobile devices user authentication services market share for on-premise architectures will slide below 15% by 2030, yet it persists wherever sovereign data mandates remain strict.

Hybrid adoption follows migration waves: firms lift simple web workloads first, then layer cloud-native FIDO brokers, leaving heritage mainframe authentications on-site until retirement. This staged transition sustains multi-year service revenue for integrators and lengthens average contract duration. Vendors offering policy-driven orchestration across trust planes achieve stickier relationships while minimising rip-and-replace risk for clients.

The Mobile Devices User Authentication Market is Segmented by Authentication Type (Passwords and PINs, Two-Factor Authentication, and More), Deployment Mode (Cloud-Based, On-Premise, and More), Authentication Channel (SMS OTP, Push Notification, and More), Enterprise Size (SMEs, Large Enterprises), End-User Vertical (BFSI, Consumer Electronics, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of 2024 sectoral revenue, anchored by regulatory catalysts like the Cybersecurity and Infrastructure Security Agency Zero Trust Maturity Model that champions continuous verification. Half of U.S. enterprises have already deployed some form of passwordless authentication, creating a reference base that accelerates late-mover adoption. Vendor presence is dense, with Microsoft, Okta, and Yubico shaping standards while niche players pioneer behaviour analytics. Public-sector contracts, notably the Department of Defense FY27 mandate, provide long-term volume visibility and drive spill-over purchases in adjacent civilian agencies. The mobile devices user authentication services market, therefore, remains highly competitive yet expandable as zero-trust programmes scale.

Asia is the fastest-growing theatre at 28.7% CAGR through 2030, propelled by smartphone ubiquity and government digital identity schemes. Chinese OEM integration of advanced biometric sensors combined with India's Aadhaar-linked payments ecosystem creates massive authentication throughput. ASEAN-5 markets add incremental momentum via e-government and digital banking roll-outs, even though data privacy legislation is still maturing, injecting both growth and complexity. Carrier-backed SIM authentication APIs fill infrastructure gaps in low-bandwidth geographies, enlarging the addressable demand for the mobile devices user authentication services market while embedding telecom groups deeper into the value chain.

Europe balances strict GDPR compliance with rapid SCA uptake. The European Banking Authority's clarification on digital wallets elevates multi-factor requirements across commerce and sets a playbook that other verticals can emulate. Anticipated PSD3 rules will forbid mobile-only flows, favouring vendors with orchestration engines capable of dynamic factor step-ups. Northern Europe demonstrates highest penetration due to early digital identity schemes, while the United Kingdom, Germany and France post robust growth as Open Banking and eID frameworks mature. Cross-border harmonisation under the forthcoming EU Digital Identity Wallet will unlock new use cases, maintaining Europe as a lucrative yet compliance-heavy segment of the mobile devices user authentication services market.

- Symantec Corporation

- Broadcom Inc. (CA Technologies)

- Cisco Systems Inc. (Duo Security)

- Microsoft Corporation

- Okta Inc.

- Thales Group (Gemalto)

- RSA Security LLC (Dell Technologies)

- OneSpan Inc.

- Entrust Corporation

- HID Global Corporation

- IDEMIA

- NEC Corporation

- Ping Identity Holding Corp.

- ForgeRock Inc.

- Authy (Twilio Inc.)

- Yubico AB

- Trustwave Holdings Inc.

- Micro Focus International plc

- Google LLC

- IBM Corporation

- Nexus Group

- SecurEnvoy Ltd.

- Aware Inc.

- Fujitsu Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Passwordless and WebAuthn Standards Across Mobile-First Enterprises

- 4.2.2 Surge in FinTech and Mobile Banking (SCA Compliance) Driving MFA Roll-outs

- 4.2.3 Mid-Range Smartphone Biometric Hardware Penetration in Asia

- 4.2.4 Carrier-Backed SIM-Based Authentication APIs in Emerging Markets

- 4.2.5 Global Regulatory Mandates (PSD2, CCPA, HIPAA) Boosting Authentication Spend

- 4.2.6 Enterprise Zero-Trust Security Architecture Accelerating Mobile Authenticator Adoption

- 4.3 Market Restraints

- 4.3.1 SMS OTP Latency and Failure in Carrier-Fragmented Regions

- 4.3.2 Biometric Data Privacy Concerns under GDPR

- 4.3.3 High Integration Cost for Legacy SME Mobile Applications

- 4.3.4 Interoperability Gaps among Proprietary Mobile Auth SDKs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Investment Analysis

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Authentication Type

- 5.1.1 Passwords and PINs

- 5.1.2 Two-Factor Authentication

- 5.1.3 Multi-Factor Authentication

- 5.1.4 Biometric Authentication

- 5.1.5 Behavioral and Passive Authentication

- 5.1.6 Risk-Based / Contextual Authentication

- 5.1.7 Soft Tokens and Authenticator Apps

- 5.1.8 Hardware Security Keys / FIDO Tokens

- 5.2 By Deployment Mode

- 5.2.1 Cloud-Based Authentication as-a-Service

- 5.2.2 On-Premise

- 5.2.3 Hybrid (Edge + Cloud)

- 5.3 By Authentication Channel

- 5.3.1 SMS OTP

- 5.3.2 Push Notification

- 5.3.3 In-App Biometric API

- 5.3.4 SIM / Silent Mobile Network Authentication

- 5.3.5 Email OTP / Magic Link

- 5.4 By Enterprise Size

- 5.4.1 SMEs (< 1,000 Employees)

- 5.4.2 Large Enterprises

- 5.5 By End-user Vertical

- 5.5.1 BFSI

- 5.5.2 Consumer Electronics and E-Commerce

- 5.5.3 Government and Public Sector

- 5.5.4 Telecommunications and IT Services

- 5.5.5 Healthcare and Life Sciences

- 5.5.6 Manufacturing and Industrial IoT

- 5.5.7 Education and eLearning

- 5.5.8 Travel and Hospitality

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Nordics

- 5.6.3.1.1 Sweden

- 5.6.3.1.2 Norway

- 5.6.3.1.3 Finland

- 5.6.3.2 Germany

- 5.6.3.3 United Kingdom

- 5.6.3.4 France

- 5.6.3.5 Italy

- 5.6.3.6 Spain

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 ASEAN-5

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of APAC

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.2 Turkey

- 5.6.5.3 Israel

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Kenya

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)}

- 6.4.1 Symantec Corporation

- 6.4.2 Broadcom Inc. (CA Technologies)

- 6.4.3 Cisco Systems Inc. (Duo Security)

- 6.4.4 Microsoft Corporation

- 6.4.5 Okta Inc.

- 6.4.6 Thales Group (Gemalto)

- 6.4.7 RSA Security LLC (Dell Technologies)

- 6.4.8 OneSpan Inc.

- 6.4.9 Entrust Corporation

- 6.4.10 HID Global Corporation

- 6.4.11 IDEMIA

- 6.4.12 NEC Corporation

- 6.4.13 Ping Identity Holding Corp.

- 6.4.14 ForgeRock Inc.

- 6.4.15 Authy (Twilio Inc.)

- 6.4.16 Yubico AB

- 6.4.17 Trustwave Holdings Inc.

- 6.4.18 Micro Focus International plc

- 6.4.19 Google LLC

- 6.4.20 IBM Corporation

- 6.4.21 Nexus Group

- 6.4.22 SecurEnvoy Ltd.

- 6.4.23 Aware Inc.

- 6.4.24 Fujitsu Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment