PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836653

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836653

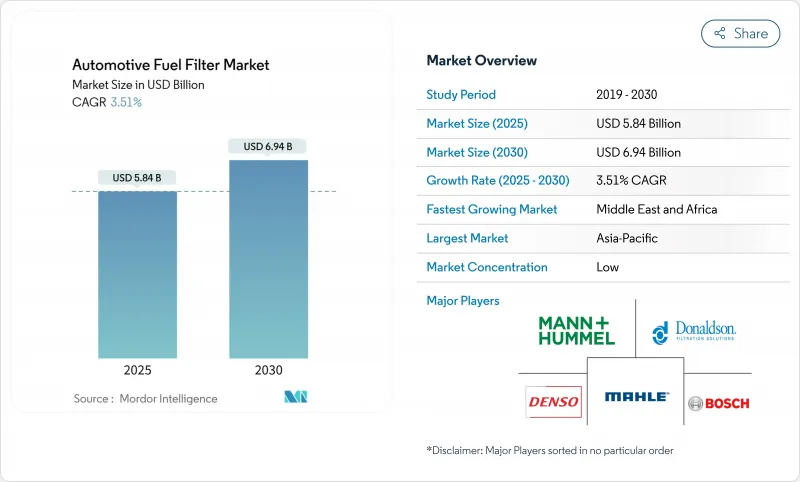

Automotive Fuel Filter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive fuel filter market was worth USD 5.84 billion in 2025 and is forecast to reach USD 6.94 billion by 2030, reflecting a moderate 3.51% CAGR.

Global demand remains resilient as ageing vehicle fleets, stricter emission rules, and sustained production of internal-combustion vehicles in emerging economies offset the structural headwinds of electrification. Diesel applications preserve a sizeable revenue base because ultra-low-sulphur fuel legislation compels advanced water-separator designs, while bio-fuel blends and compressed natural gas create a parallel growth corridor for specialised filters. Rapid vehicle output in Asia-Pacific and Africa underpins original-equipment demand, whereas North America and Europe shift focus toward the replacement cycle. Digital retail, counterfeit risks, and sealed "lifetime" modules are reshaping competitive strategies across all tiers of the automotive fuel filter market.

Global Automotive Fuel Filter Market Trends and Insights

Ageing Global Vehicle Parc Expanding Replacement Demand

Global fleets are staying on the road for longer as household budgets tighten and new-car inventories fluctuate. Average passenger-car age in major OECD markets now exceeds 13 years, and extended maintenance schedules drive more frequent filter replacement to protect sensitive injectors. Light trucks and SUVs, which contain complex high-pressure fuel delivery systems, add to parts turnover. Dealers, independent garages, and e-commerce platforms leverage this aftermarket tailwind, enlarging the customer pool for the automotive fuel filter market. Parts distributors increasingly bundle fuel filters with other service kits to capture basket value and defend share in a price-sensitive environment.

Tighter Tail-Pipe Emission Norms Driving Advanced Filtration

Euro 6e rules took effect for new internal-combustion models in September 2023, and draft Euro 7 standards propose even lower particulate thresholds, forcing filter media to achieve sub-5-micron efficiency without sacrificing dirt-holding capacity. Comparable China VI and Bharat VI mandates require multi-stage filtration and robust water separation. Suppliers collaborate closely with engine OEMs to align filter specifications with after-treatment systems, while testing protocols have become stricter to validate durability across varying sulfur levels. Down-tier manufacturers face rising certification costs that may accelerate consolidation inside the automotive fuel filter market.

Accelerating EV Penetration Cannibalizing ICE Filter Volumes

Battery-electric vehicles eliminate the need for fuel filtration, and their share of world car sales is projected to reach 50% by 2030. As manufacturers convert assembly lines and governments introduce zero-emission mandates, the serviceable market for fuel filters in mature regions declines. Workshops that once relied on high-margin replacement parts now pivot toward battery diagnostics and software updates. The automotive fuel filter market, therefore, grows largely where electrification rollouts are slower or where hybrid powertrains still incorporate auxiliary fuel modules.

Other drivers and restraints analyzed in the detailed report include:

- Rising New-Vehicle Output in Asia-Pacific and Africa

- Surge in Bio-Fuel Blends Requiring Compatibility Upgrades

- Volatile Steel and Polymer Input Prices Squeezing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diesel applications generated the highest revenue in 2024, holding 48.37% of the automotive fuel filter market share because trucks, off-highway machinery, and many SUVs require robust water-separator technology. Growth is sustained by ultra-low-sulfur mandates that expose tanks to condensation and microbial contamination. Fleet operators prize filters that trap particles down to 2 microns while collecting free water. Engineers are adapting elastomers and sealants to resist ester-induced swelling and methane-specific contaminants. Alternative fuels represent the fastest-growing segment at 9.38% CAGR through 2030. CNG buses in India and municipal fleets in Brazil underpin early volume, yet the segment's technical requirements differ sharply from diesel, leading to specialised SKUs that command premium pricing.

The gasoline category, although pressured by electric-vehicle uptake, retains importance in ageing car parks across North America and parts of Europe where average mileage remains high. High-pressure gasoline direct injection systems demand sub-5-micron filtration and chemical resistance to ethanol. Suppliers see steady replenishment orders from independent workshops that align filter swaps with scheduled oil changes, reinforcing aftermarket stickiness. Diesel manufacturers also innovate around selective catalytic reduction, embedding sensors to alert operators when differential pressure rises beyond specification. This diagnostic trend ensures consistent pull-through for replacement parts and supports overall revenue stability in the automotive fuel filter market.

Cellulose remained the most widely used medium, contributing 44.19% of 2024 revenue thanks to low production cost and abundant feedstock. Yet its innate hydrophilicity and limited temperature resistance challenge its suitability for bio-fuel blends. Producers therefore coat cellulose fibres with hydrophobic agents while boosting pleat counts to raise dirt-holding capacity. Synthetic composites, polyester, polypropylene, and multi-layer nanofibers form the fastest-growing cohort at a 5.72% CAGR. These media achieve longer service intervals, lower differential pressure, and compatibility with aggressive fuel chemistries. Water-separator cartridges increasingly incorporate dual-zone designs, pairing a pleated synthetic layer with a coalescing fleece that forces micro-droplets to form larger beads before drainage.

Suppliers invest in plasma treatment and surface grafting to tailor fibre polarity. One widely adopted method bonds fluorinated silanes onto polyester, achieving water contact angles above 150° and resisting surfactant-rich diesel. In premium segments, melt-blown nanofibre layers augment base media to block particles below 1 micron, essential for ultra-high-pressure common-rail diesel pumps. Fabricators with in-house melt-blown assets gain scale advantages because they capture more value from vertically integrated membrane production.

The Automotive Fuel Filters Market Report is Segmented by Fuel Type (Gasoline, Diesel, and Alternative Fuels), Filter Media (Cellulose, Synthetic (Glass and Polyester), and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific retained a commanding 41.85% share of the automotive fuel filter market in 2024, driven by prolific vehicle production across China, India, Thailand, and Indonesia. India's Production Linked Incentive initiative has mobilized trillions of rupees in capex commitments, and policy planners expect component exports to follow similar trajectories. Local suppliers co-locate near OEM clusters to lower logistics costs and tap skilled labour pools. Even as China intensifies its new-energy-vehicle push, legacy gasoline and diesel platforms still dominate suburban and rural fleets, creating a steady replacement cycle. Domestic component brands strengthen export footprints into the Middle East, Eastern Europe, and South America, where their cost-to-performance ratio resonates.

The Middle East and Africa region is the fastest-growing territory, forecast at 5.11% CAGR through 2030. Gulf Cooperation Council states allocate hydrocarbons windfalls to road construction, freight corridors, and public-transport modernisation, which enlarges the rolling stock of buses and commercial trucks. Low ambient humidity often accelerates fuel tank condensation, elevating the importance of reliable water-separation features. Importers source filters from Europe and Asia but increasingly explore onshore assembly to stimulate jobs and shorten lead times. Sub-Saharan Africa's young vehicle parc, coupled with lenient emission schedules, allows conventional diesel to remain prevalent, cushioning the automotive fuel filter market against electric encroachment.

North America and Europe exhibit modest growth as electrification incentives and sealed modules shrink volumes. Nevertheless, stringent particulate regulations and widespread adoption of gasoline direct injection force premium media upgrades, preserving average selling prices. Workshops promote bundled service packages to offset declining unit demand. Remanufactured filter programs gain popularity among eco-conscious drivers who seek lower environmental footprints without compromising warranty.

- MANN+HUMMEL

- Donaldson Company, Inc.

- MAHLE GmbH

- Robert Bosch GmbH

- DENSO CORPORATION

- Cummins Inc. (Fleetguard)

- Parker Hannifin Corp (Racor)

- Sogefi Group

- Hengst SE

- UFI Filters

- Baldwin Filters

- Fram Group

- K&N Engineering Inc.

- ACDelco (General Motors)

- Champion Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing global vehicle parc expanding replacement demand

- 4.2.2 Tighter Tail-Pipe Emission Norms Driving Advanced Filtration

- 4.2.3 Rising new-vehicle output in Asia-Pacific and Africa

- 4.2.4 Surge in bio-fuel blends requiring compatibility upgrades

- 4.2.5 Ultra-low-sulfur diesel boosting water-separator filter demand

- 4.2.6 Growth of high-pressure GDI and CRDI systems demanding Below 5 µm filtration

- 4.3 Market Restraints

- 4.3.1 Accelerating EV penetration cannibalizing ICE filter volumes

- 4.3.2 Volatile steel and polymer input prices squeezing margins

- 4.3.3 OEM shift toward sealed "lifetime" fuel modules curbing aftermarket

- 4.3.4 Proliferation of counterfeit low-cost filters in developing nations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Fuel Type

- 5.1.1 Gasoline

- 5.1.2 Diesel

- 5.1.3 Alternative Fuels

- 5.2 By Filter Media

- 5.2.1 Cellulose

- 5.2.2 Synthetic (Glass and Polyester)

- 5.2.3 Multi-layer Composites

- 5.2.4 Water-Separator / Coalescer Elements

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.1.1 Hatchback

- 5.3.1.2 Sedan

- 5.3.1.3 Sport Utility Vehicle

- 5.3.1.4 Multi-Purpose Vehicle

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.3.4 Two-Wheelers

- 5.3.5 Off-Highway

- 5.3.5.1 Agricultural Machinery

- 5.3.5.2 Construction and Mining Machinery

- 5.3.1 Passenger Cars

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.4.2.1 Organized Retailers

- 5.4.2.2 Independent Garages

- 5.4.2.3 Online Platforms

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 MANN+HUMMEL

- 6.4.2 Donaldson Company, Inc.

- 6.4.3 MAHLE GmbH

- 6.4.4 Robert Bosch GmbH

- 6.4.5 DENSO CORPORATION

- 6.4.6 Cummins Inc. (Fleetguard)

- 6.4.7 Parker Hannifin Corp (Racor)

- 6.4.8 Sogefi Group

- 6.4.9 Hengst SE

- 6.4.10 UFI Filters

- 6.4.11 Baldwin Filters

- 6.4.12 Fram Group

- 6.4.13 K&N Engineering Inc.

- 6.4.14 ACDelco (General Motors)

- 6.4.15 Champion Laboratories

7 Market Opportunities and Future Outlook

- 7.1 White-space & Unmet-need Assessment