PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836655

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836655

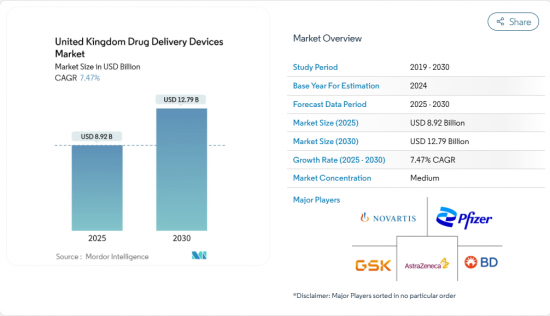

United Kingdom Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom drug delivery devices market is valued at USD 8.92 billion in 2025 and is forecast to reach USD 12.79 billion by 2030, reflecting a 7.47% CAGR during 2025-2030.

Growth is propelled by the National Health Service (NHS) drive for precision medicine, rising adoption of home-based care, and accelerated approval pathways that shorten time-to-market for innovative devices. Every 1% gain in adherence is estimated to save the NHS about GBP 500 million in avoided hospital admissions, keeping cost reduction at the center of procurement strategies. Post-Brexit regulation has shifted to UKCA marking, yet the new International Reliance procedure allows devices cleared in Australia, Canada, the European Union, or the United States to enter the United Kingdom drug delivery devices market more rapidly, sustaining the country's attractiveness for foreign innovators. Sustainability also matters: near-zero global-warming-potential (GWP) propellants in next-generation pressurised metered-dose inhalers (pMDIs) are helping manufacturers win NHS tenders while meeting carbon-reduction targets. A parallel surge in connected devices responds to medication non-adherence that costs the NHS roughly GBP 637 million each year.

United Kingdom Drug Delivery Devices Market Trends and Insights

Government initiatives for self-administration & homecare

An extra GBP 86 million added to the Disabled Facilities Grant in 2025 enables more patients to manage conditions at home, complementing the Pharmacy First scheme that now covers seven minor conditions at almost every community pharmacy. The NHS plan to distribute artificial-pancreas technology over five years exemplifies policy-driven demand for intuitive self-use systems. Such measures channel volume into the United Kingdom drug delivery devices market for pen injectors, wearable pumps, and inhalers designed for layperson operation.

Development and adoption of smart connected drug delivery devices

Connected devices are expected to post a doubt digit CAGR in United Kingdom healthcare through 2030 as electronic health-record coverage climbs toward 95% of NHS trusts. Smart inhalers reimbursed under the MedTech Funding Mandate and Bluetooth add-ons like DOSE for insulin pens show how IoT integration addresses non-adherence that leads to 22,000 premature deaths a year. The broad data backbone being built by the Digital Health and Care Plan lets these devices feed real-time dosing data directly into clinical workflows.

Stringent fragmented regulatory landscape coupled with post-Brexit challenges

Manufacturers must maintain both CE and UKCA certification until 2030, and the post-market-surveillance rules effective June 2025 widen the definition of a serious incident. Non-UK suppliers must appoint a Responsible Person, adding cost and complexity, although expansion of approved bodies and an International Reliance route offer partial relief.

Other drivers and restraints analyzed in the detailed report include:

- Biologics pipeline growth driving advanced injectors demand

- Increasing R&D investment

- High development and manufacturing cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injectable formats held 45.6% of the United Kingdom drug delivery devices market share in 2024. The prevalence of biologics and patient preference for self-injection explain this lead. Integration of sensors and wireless modules is turning prefilled pens into data-rich adherence tools. Over 2025-2030, implantable systems will post the fastest 10.86% CAGR as research centers such as OxCD3 advance ultrasound-triggered depots that release drugs over months.

The inhalation segment benefits from NHS decarbonisation targets, steering procurement toward pMDIs with near-zero GWP propellants. Transdermal patches are expanding as microneedle arrays improve permeability without needles. Nasal and ocular devices remain niche but attract specialised R&D funding, reflecting an overall diversification of the United Kingdom drug delivery devices market.

Injectables delivered 52.3% of revenue in 2024 and leverage NHS investment of GBP 204 million into modern aseptic hubs that raise throughput for large-volume syringes. Oral mucosal systems, however, are gaining ground with a 9.38% forecast CAGR thanks to muco-adhesive films that avoid first-pass metabolism and reach peak plasma levels within minutes.

The inhalation route benefits from sustainability mandates, while transdermal patches ride patient demand for painless options. Nasal administration promises direct brain delivery for neurological disorders, a white-space opportunity within the United Kingdom drug delivery devices market that could reshape therapy for Alzheimer's and Parkinson's. Ocular implants are moving from monthly injections to semestral inserts, easing clinic workload and improving adherence.

United Kingdom Drug Delivery Devices Market Report is Segmented by Device Type (Injectable Delivery Devices, Inhalation Delivery Devices, Infusion Pumps, and More), Route of Administration (Injectable, Inhalational, Transdermal, and More), Application (Diabetes, Respiratory Diseases, Oncology, and More), and End User (Hospitals, Ambulatory Surgical Centers, and More). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Pfizer

- AstraZeneca

- GlaxoSmithKline

- Novartis

- Roche

- Solventum

- Beckton Dickinson

- Baxter

- Ypsomed

- Nemera

- Gerresheimer

- AptarGroup Inc.

- Owen Mumford

- Teva Pharmaceutical Industries

- West Pharmaceutical Services

- SHL Medical

- ICU Medical

- Terumo

- Insulet

- Tandem Diabetes Care

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Initiatives and Trends for Self-Administration & Homecare

- 4.2.2 Development and Adoption Smart Connected Drug Delivery Devices

- 4.2.3 Increasing Research and Development Initiatives and Support from Government

- 4.2.4 Biologics Pipeline Growth Driving Advanced Injectors Demand

- 4.2.5 Rising Prevalence and Incidence of Chronic and Infectious Diseases

- 4.2.6 Fast-Track Approvals for Combination Products Post-Brexit

- 4.3 Market Restraints

- 4.3.1 Post Brexit Challenges Related to Delays and Cost

- 4.3.2 High Development and Manufacturing Cost Coupled with Limited Domestic Clean-Room Manufacturing Capacity

- 4.3.3 Risk and Concerns Associatied with Different Devices

- 4.3.4 NHS Pricing and Rebate Pressure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Injectable Delivery Devices

- 5.1.2 Inhalation Delivery Devices

- 5.1.3 Infusion Pumps

- 5.1.4 Transdermal Patches

- 5.1.5 Implantable Drug Delivery Systems

- 5.1.6 Ocular Inserts & Delivery Implants

- 5.1.7 Nasal & Buccal Delivery Devices

- 5.2 By Route of Administration

- 5.2.1 Injectable

- 5.2.2 Inhalation

- 5.2.3 Transdermal

- 5.2.4 Oral Mucosal (Buccal & Sublingual)

- 5.2.5 Ocular

- 5.2.6 Nasal

- 5.3 By Application

- 5.3.1 Diabetes

- 5.3.2 Respiratory Diseases

- 5.3.3 Oncology

- 5.3.4 Cardiovascular Diseases

- 5.3.5 Infectious Diseases

- 5.3.6 Neurological Disorders

- 5.3.7 Others

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Homecare Settings

- 5.4.4 Speciality Clinics

- 5.4.5 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Pfizer Inc.

- 6.4.2 AstraZeneca plc

- 6.4.3 GlaxoSmithKline plc

- 6.4.4 Novartis AG

- 6.4.5 F. Hoffmann-La Roche Ltd

- 6.4.6 Solventum

- 6.4.7 Becton, Dickinson and Company

- 6.4.8 Baxter International Inc.

- 6.4.9 Ypsomed AG

- 6.4.10 Nemera

- 6.4.11 Gerresheimer AG

- 6.4.12 AptarGroup Inc.

- 6.4.13 Owen Mumford Ltd.

- 6.4.14 Teva Pharmaceutical Industries Ltd.

- 6.4.15 West Pharmaceutical Services Inc.

- 6.4.16 SHL Medical

- 6.4.17 ICU Medical

- 6.4.18 Terumo Corporation

- 6.4.19 Insulet Corporation

- 6.4.20 Tandem Diabetes Care, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment