PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836659

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836659

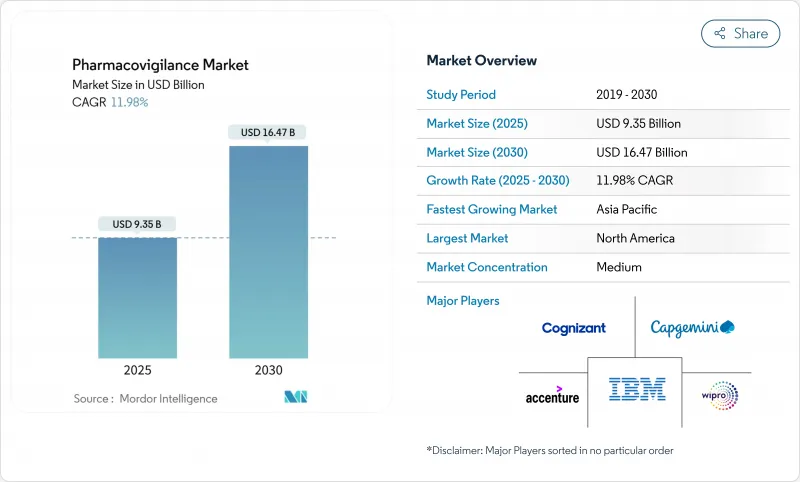

Pharmacovigilance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pharmacovigilance market is valued at USD 9.35 billion in 2025 and is forecast to reach USD 16.47 billion by 2030, advancing at an 11.98% CAGR.

Expanding drug pipelines, stricter post-marketing surveillance rules and rapid adoption of artificial intelligence (AI) across safety-monitoring workflows sustain this momentum.Pharmaceutical companies are redirecting resources toward proactive safety management as biologics, gene therapies and other complex modalities enter commercial use. Contract research organizations (CROs) equipped with cloud-based AI platforms offer cost-efficient compliance, accelerating the outsourcing shift. Post-marketing surveillance obligations enlarge data volumes, making electronic health record (EHR) mining the fastest-growing reporting method. North America retains leadership owing to mature regulatory science, but harmonization initiatives in Asia-Pacific (APAC) propel that region's double-digit growth.

Global Pharmacovigilance Market Trends and Insights

Increasing Drug Consumption & Development Pipeline

The FDA cleared 50 new molecular entities in 2024, underscoring how breakthrough approvals widen post-marketing safety duties for every sponsor. Gene therapies, CAR-T treatments and combination products pose unique risk profiles that require vigilant monitoring throughout the product life cycle. Conditional approvals further heighten real-world evidence (RWE) expectations, redirecting budgets toward continuous surveillance infrastructures. These dynamics lock pharmacovigilance teams into a long-term expansion cycle that sustains workload growth beyond clinical development.

Growing Incidence Of Adverse Drug Reactions (ADRs)

The European Medicines Agency (EMA) Pharmacovigilance Risk Assessment Committee (PRAC) recently emphasized lifelong monitoring for CAR-T recipients after observing potential secondary malignancies. Polypharmacy in elderly populations multiplies drug-drug interactions, pushing ADR case volumes higher. The pandemic-era vaccine rollout validated the importance of large-scale signal-detection networks capable of processing millions of safety reports within weeks.

Cyber-Security & Data-Privacy Risks

Cloud deployment of sensitive patient data exposes safety systems to ransomware and nation-state intrusions. Recent healthcare breaches forced several sponsors to suspend EHR integrations while audits ensured no safety signal manipulation occurred. General Data Protection Regulation (GDPR) and similar laws mandate data-minimization and localization strategies that sometimes conflict with global analytics ambitions.

Other drivers and restraints analyzed in the detailed report include:

- Outsourcing Of PV Services To CRO/BPO Vendors

- AI-Enabled Signal Detection & Predictive Analytics

- Shortage Of Specialised PV Talent & High Staff Turnover

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phase IV studies held 32.18% of pharmacovigilance market share in 2024, reflecting regulators' demand for life-long monitoring of innovative therapies. The pharmacovigilance market size attached to pre-clinical safety assessments is projected to expand at a 13.13% CAGR thanks to risk-based early-phase analytics. Adaptive trial designs shorten Phases II and III, but heighten the importance of high-fidelity signal detection once products reach broad populations. Updated ICH E6(R3) guidelines compel sponsors to embed quality-by-design metrics across all phases, ensuring traceable safety data capture from first-in-human dosing.

The pharmacovigilance market responds by integrating decentralized trials with direct-to-patient sampling and wearable sensors. AI models simulate off-target effects before first-patient dosing, giving companies a head start in risk-management planning. As conditional approvals rise, Post-Authorization Safety Studies (PASS) budgets eclipse traditional Phase III spends, locking Phase IV dominance into the long-term outlook.

Contract outsourcing controlled 55.46% of overall revenue in 2024 and is forecast to grow at 13.73% through 2030, sustaining the largest slice of the pharmacovigilance market. In-house units retain critical decision-making but increasingly rely on hybrid models where CRO platforms process routine tasks. Strategic alliances such as Parexel's multi-year AI pact with Palantir exemplify how tech-enhanced CROs cultivate competitive edge.

The pharmacovigilance industry now values scalable data lakes, natural language processing (NLP) for scientific literature and robotic process automation in intake. As a result, even large pharmaceutical companies migrate workloads to external hubs in India, Ireland and Eastern Europe, consolidating fragmented vendor lists into master service agreements that guarantee AI investment roadmaps.

The Pharmacovigilance Market Report is Segmented by Clinical Trial Phase (Preclinical, Phase I, Phase II, and More), Service Provider (In-House, Contract Outsourcing), Type of Reporting (Spontaneous Reporting, Intensified ADR Reporting, and More), End User (Hospitals, Pharmaceutical Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 44.18% of the pharmacovigilance market in 2024 due to high R&D intensity, advanced EHR penetration and clear regulatory expectations. AI pilots gain rapid acceptance as the FDA publishes step-wise validation frameworks, positioning the region as the global reference for digital pharmacovigilance.

Europe follows with mature legislation underpinning the EudraVigilance network and new AI reflection papers that encourage innovation while demanding algorithm transparency. Focus on Advanced Therapy Medicinal Products brings specialized monitoring needs, sustaining investment through 2030. The pharmacovigilance market size for EU-based PASS grows alongside orphan-drug approvals.

Asia-Pacific is projected to log a 13.64% CAGR, the fastest worldwide, as China's regulatory reforms and India's expanded clinical-trial landscape converge. ASEAN nations align labeling and electronic submission standards, simplifying multi-country safety campaigns. Investments in domestic biotech manufacturing stimulate demand for localized case-processing hubs. Middle East & Africa and South America add incremental growth where pharmacovigilance infrastructure scales with pharmaceutical import volumes and emerging manufacturing clusters.

- Accenture

- Aris Global

- BioClinica (NOW Clario)

- Capgemini

- Cognizant

- IBM

- ICON

- IQVIA

- ITClinical

- LabCorp

- Linical Accelovance

- Parexel International

- UBC (United BioSource)

- TAKE Solutions (Navitas Life Sciences)

- Wipro

- Oracle Health Sciences

- Ennov

- Extedo

- Clarivate (Drug Safety Triager)

- SGS Life Sciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Drug Consumption & Development Pipeline

- 4.2.2 Growing Incidence Of Adverse Drug Reactions (ADRS)

- 4.2.3 Outsourcing Of Pv Services To CRO/BPO Vendors

- 4.2.4 AI-Enabled Signal Detection & Predictive Analytics

- 4.2.5 Expansion Of Real-World Evidence (RWE) Platforms

- 4.2.6 Stringent Regulatory Mandates For Proactive Post-Marketing Safety Surveillance

- 4.3 Market Restraints

- 4.3.1 Cyber-Security & Data-Privacy Risks

- 4.3.2 Lack Of Global Regulatory Harmonisation & Data Standards

- 4.3.3 Shortage Of Specialised PV Talent & High Staff Turnover

- 4.3.4 Complexity Of Combination & ATMP Therapies

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Clinical Trial Phase

- 5.1.1 Pre-clinical

- 5.1.2 Phase I

- 5.1.3 Phase II

- 5.1.4 Phase III

- 5.1.5 Phase IV

- 5.2 By Service Provider

- 5.2.1 In-house

- 5.2.2 Contract Outsourcing

- 5.3 By Type of Reporting

- 5.3.1 Spontaneous Reporting

- 5.3.2 Intensified ADR Reporting

- 5.3.3 Targeted Spontaneous Reporting

- 5.3.4 Cohort Event Monitoring

- 5.3.5 EHR Mining

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Pharmaceutical Companies

- 5.4.3 CROs & Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Accenture

- 6.3.2 ArisGlobal

- 6.3.3 BioClinica (NOW Clario)

- 6.3.4 Capgemini

- 6.3.5 Cognizant

- 6.3.6 IBM

- 6.3.7 ICON plc

- 6.3.8 IQVIA

- 6.3.9 ITClinical

- 6.3.10 Labcorp

- 6.3.11 Linical Accelovance

- 6.3.12 Parexel

- 6.3.13 UBC (United BioSource)

- 6.3.14 TAKE Solutions (Navitas Life Sciences)

- 6.3.15 Wipro

- 6.3.16 Oracle Health Sciences

- 6.3.17 Ennov

- 6.3.18 Extedo

- 6.3.19 Clarivate (Drug Safety Triager)

- 6.3.20 SGS Life Sciences

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment