PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836660

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836660

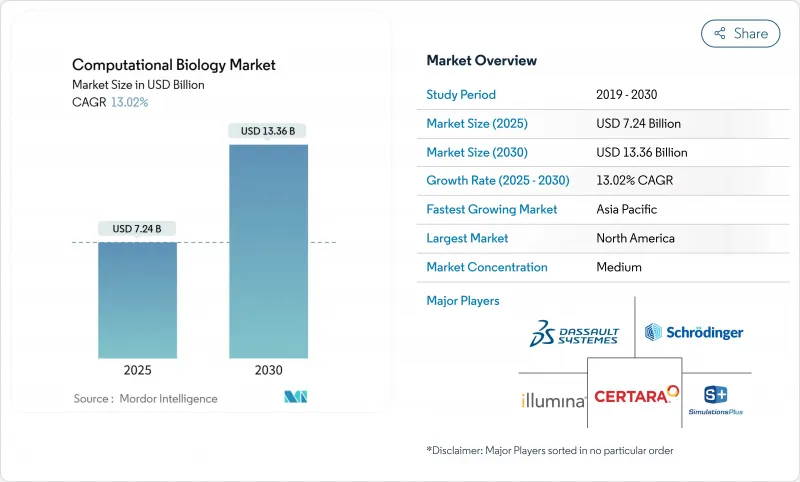

Computational Biology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The computational biology market currently generates USD 7.24 billion and is projected to reach USD 13.36 billion in 2030, advancing at a 13.02% CAGR.

This outlook signals how transformer-based genome language models, synthetic-biology digital twins, and wider AI adoption now shape every application layer of the computational biology market. A sharp rise in multi-omics datasets, ongoing shifts toward contract research services, and the need for scalable cloud infrastructure keep fueling demand. North America still anchors the computational biology market thanks to mature biotech regulation, but Asia-Pacific's supercomputer investments and expanding pharmaceutical manufacturing base are positioning the region as the next growth engine. Meanwhile, strategic acquisitions such as Siemens' USD 5.1 billion deal for Dotmatics reflect intensifying platform consolidation inside the computational biology market.

Global Computational Biology Market Trends and Insights

Rising volume of omics data & bioinformatics research

Terabyte-scale single-cell RNA-sequencing, multi-omics integration, and lower sequencing costs continue to expand data flows into the computational biology market. cut RNA-seq costs 50-70%, widening access to precision-medicine datasets. Large language models now automate 94% of common data-element mapping, driving interoperability.The resulting data network effects reinforce first-mover advantages for stakeholders controlling the largest repositories. Cloud bioinformatics platforms therefore have become mandatory infrastructure for organizations lacking on-premises high-performance computing.

Accelerated use in drug discovery & disease modeling

Protein language models like ESM-3 simulate evolutionary processes, creating novel protein candidates at a pace drug developers could not reach a few years ago. Hybrid AI-quantum systems, exemplified by Model Medicines' GALILEO, now deliver 100% hit-rate antiviral screens.Digital twins let researchers run millions of virtual experiments, compressing hypothesis-testing cycles and reducing wet-lab costs. A 479,000-trial machine-learning benchmark provides unprecedented training data for trial-design optimization. M&A activity, such as the USD 688 million Recursion-Exscientia merger, shows incumbents racing to internalize these AI advantages consolidated platforms.

Shortage of multidisciplinary talent

Demand for professionals versed in biology, software engineering, and statistics outstrips supply. Life-science employers foresee a 35% shortfall by 2030, with hiring demand growing 11.75% annually. Salary inflation and project delays follow, particularly for mid-sized biotechs that compete with tech giants entering the field. Skills-based hiring, apprenticeships, and cross-industry recruitment are interim mitigation strategies.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of clinical pharmacogenomics & pharmacokinetics studies

- Transformer-based genome language models enabling rapid annotation

- Interoperability & data-standardization gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drug discovery and disease modeling already posts the fastest 15.64% CAGR, whereas cellular and biological simulation retained a 32.52% 2024 stake in the computational biology market size. AI-enhanced target identification and lead optimization let companies such as Insilico Medicine screen millions of compounds in silico. Preclinical teams now integrate genomic, proteomic, and metabolomic data sets to raise compound-to-clinic success odds. Clinical-trial operations employ retrieval-augmented systems that reach 97.9% eligibility-screen accuracy, cutting recruitment bottlenecks. A growing number of investigators exploit digital twins to run virtual dose-response studies, shrinking wet-lab timelines. Consequently, the computational biology market experiences deeper pharmaceutical engagement at every R&D gate.

Human-body simulation software emerges as a high-potential sub-segment. Stanford's AI-driven "virtual cell" illustrates how integrated multi-omics and biophysical models can map pathway perturbations for individualized therapy strategies. This development expands the computational biology market to frontline precision-medicine clinicians. As digital twin fidelity rises, insurers begin evaluating reimbursement models for computer-optimized treatment plans, hinting at downstream revenue pools.

Databases still represent 36.46% of computational biology market share, but analysis software and services chart the fastest 14.77% CAGR. Protein and genome language models are pushing organizations to buy analytic capacity rather than maintain static archives. Vendors embed multimodal data pipelines that fuse genomic, proteomic, and clinical streams. The shift also encourages academic-industry consortia to co-develop open-source stacks; Boltz-1's AlphaFold-comparable accuracy on standard GPUs underscores how community innovation fuels wider adoption.

On-premises high-performance computing remains important for sensitive datasets; however, cloud cost curves and managed-service maturity encourage migration. Providers differentiate by auto-scaling algorithms and security certifications. Database incumbents react by building analytics layers on top of repositories to defend their install base. The net effect increases competition yet lifts overall software quality, supporting sustained growth in the computational biology market.

Computational Biology Market Report is Segmented by Application (Cellular and Biological Simulation [Computational Genomics and More], Drug Discovery and Disease Modelling [Target Identification and More], Preclinical Drug Development [Pharmacokinetics and More] and More), Tool (Databases and More), Service (In-House and More), End-User (Academics and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, commanding 42.78% 2024 revenue, benefits from deep biotech venture capital, mature regulator engagement, and a dense talent pool. The FDA's evolving AI framework gives local firms a clearer commercialization path than many peers. Thermo Fisher's USD 2 billion multiyear domestic investment underscores confidence in infrastructure scalability. Nonetheless, workforce shortages and rising cloud costs temper acceleration.

Asia-Pacific posts the highest 16.35% CAGR. Governments bankroll exaflop supercomputers-South Korea's plan targets launch by 2025-while China's distributed national centers already propel multi-omics projects. Regional pharmaceutical manufacturing booms, and genetic-diversity research programs tailor AI models to local populations, creating edge-case data assets unavailable elsewhere. Decentralized clinical-trial pilots and mRNA platform build-outs reinforce long-term demand for computational biology market capabilities.

Europe maintains steady growth anchored by cross-border consortia and robust data-privacy safeguards. Ethical-AI initiatives crank up compliance overhead, yet also foster trust among payers and regulators. Digital-twin pilots align with public-health goals to optimize resource use. Meanwhile, Latin America, Africa, and the Middle East inch forward as internet infrastructure and bioinformatics curricula expand. Partnerships with multinational pharma groups compensate for local funding gaps, ensuring gradual but persistent computational biology market penetration.

- Dassault Systemes SE

- Certara

- Chemical Computing Group

- Compugen

- Rosa

- Genedata

- Insilico Biotechnology

- Instem Plc (Leadscope Inc.)

- Nimbus Therapeutics LLC

- Strand Life Sciences

- Schrodinger Inc.

- Simulation Plus

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- Deep Genomics Inc.

- Benevolent AI

- Ginkgo Bioworks

- Atomwise Inc.

- DNAnexus Inc.

- Bio-Rad Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Volume Of Omics Data & Bioinformatics Research

- 4.2.2 Accelerated Use In Drug Discovery & Disease Modelling

- 4.2.3 Expansion Of Clinical Pharmacogenomics & Pharmacokinetics Studies

- 4.2.4 Transformer-Based Genome Language Models Enabling Rapid Annotation

- 4.2.5 Synthetic-Biology Digital Twins For In-Silico Bench-To-Bedside Workflows

- 4.2.6 Open-Source Single-Cell Lineage Tracing Algorithms

- 4.3 Market Restraints

- 4.3.1 Shortage Of Multidisciplinary Talent

- 4.3.2 Interoperability & Data-Standardization Gaps

- 4.3.3 Escalating Cloud & Compute Costs For Large-Scale Simulations

- 4.3.4 Biosecurity & Dual-Use Regulatory Scrutiny

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Application

- 5.1.1 Cellular & Biological Simulation

- 5.1.1.1 Computational Genomics

- 5.1.1.2 Computational Proteomics

- 5.1.1.3 Pharmacogenomics

- 5.1.1.4 Other Simulations (Transcriptomics/Metabolomics)

- 5.1.2 Drug Discovery & Disease Modelling

- 5.1.2.1 Target Identification

- 5.1.2.2 Target Validation

- 5.1.2.3 Lead Discovery

- 5.1.2.4 Lead Optimization

- 5.1.3 Preclinical Drug Development

- 5.1.3.1 Pharmacokinetics

- 5.1.3.2 Pharmacodynamics

- 5.1.4 Clinical Trials

- 5.1.4.1 Phase I

- 5.1.4.2 Phase II

- 5.1.4.3 Phase III

- 5.1.5 Human Body Simulation Software

- 5.1.1 Cellular & Biological Simulation

- 5.2 By Tool

- 5.2.1 Databases

- 5.2.2 Infrastructure (Hardware)

- 5.2.3 Analysis Software & Services

- 5.3 By Service

- 5.3.1 In-house

- 5.3.2 Contract

- 5.4 By End-User

- 5.4.1 Academics

- 5.4.2 Industry & Commercials

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Dassault Systemes SE

- 6.3.2 Certara

- 6.3.3 Chemical Computing Group ULC

- 6.3.4 Compugen Ltd

- 6.3.5 Rosa & Co. LLC

- 6.3.6 Genedata AG

- 6.3.7 Insilico Biotechnology AG

- 6.3.8 Instem Plc (Leadscope Inc.)

- 6.3.9 Nimbus Therapeutics LLC

- 6.3.10 Strand Life Sciences

- 6.3.11 Schrodinger Inc.

- 6.3.12 Simulation Plus Inc.

- 6.3.13 Illumina Inc.

- 6.3.14 Thermo Fisher Scientific Inc.

- 6.3.15 QIAGEN N.V.

- 6.3.16 Deep Genomics Inc.

- 6.3.17 BenevolentAI

- 6.3.18 Ginkgo Bioworks

- 6.3.19 Atomwise Inc.

- 6.3.20 DNAnexus Inc.

- 6.3.21 Bio-Rad Laboratories Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment