PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836664

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836664

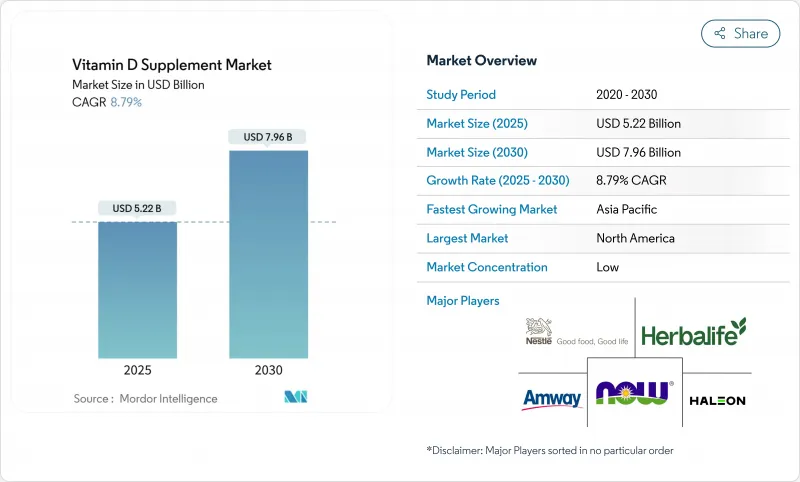

Vitamin D Supplement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Vitamin D Supplements Market size is estimated at USD 5.22 billion in 2025, and is expected to reach USD 7.96 billion by 2030, at a CAGR of 8.79% during the forecast period (2025-2030).

The market demonstrates robust growth due to increasing consumer awareness regarding vitamin D deficiency and its implications for overall health. The market expansion is primarily attributed to the growing scientific evidence supporting vitamin D's crucial role in immune system modulation, cognitive function enhancement, and skeletal health maintenance. The medical community's revised guidelines advocating higher vitamin D serum levels have significantly influenced market dynamics, particularly in regions with limited sunlight exposure. Additionally, the aging population, rising prevalence of osteoporosis, and increased focus on preventive healthcare contribute substantially to market growth.

Global Vitamin D Supplement Market Trends and Insights

Rising Vitamin D Deficiency Drives Global Market Growth and Expansion

The global vitamin D supplement market is experiencing significant growth, primarily driven by the widespread prevalence of vitamin D deficiency across populations and age groups. Vitamin D, which is essential for calcium absorption, immune function, and bone health, has gained increased attention as medical evidence links its deficiency to various health conditions, including osteoporosis, cardiovascular diseases, diabetes, autoimmune disorders, and compromised immunity. Modern urban lifestyles with limited sun exposure, particularly in densely populated areas and high-latitude regions, have resulted in millions of people failing to meet recommended daily vitamin D levels through natural synthesis or diet. Moreover, government agencies and international organizations have recognized vitamin D deficiency as a significant public health concern and implemented supportive measures. The National Health Service (NHS) in the United Kingdom advocates daily vitamin D supplementation, particularly during autumn and winter months. Similarly, Health Canada requires vitamin D fortification in milk and promotes supplementation, especially for older adults. These official endorsements validate the importance of vitamin D supplementation and enhance consumer confidence in supplements as a necessary health intervention.

Growing Elderly Population Fuels Increased Demand for Bone Health Supplements Worldwide

The global aging population trend is increasing the demand for vitamin D supplements, particularly those targeting bone and joint health. Research demonstrates that vitamin D supplementation in older adults supports both osteoporosis prevention and functional mobility maintenance while reducing disability risks. Companies are developing products that address bone health, mobility, and mental well-being for older consumers. The market features age-specific formulations designed to overcome absorption challenges and meet higher dosage requirements of elderly populations, establishing a premium market segment. This demographic shift is evidenced by World Bank data, which reports that the United States population aged 65 and over increased from 16.92% in 2022 to 17.43% in 2023, further accelerating the demand for specialized vitamin D supplements .

Counterfeit Products Impact Market Growth of Vitamin D Supplements Market

The presence of counterfeit and substandard vitamin D supplements poses a significant market constraint by eroding consumer trust and risking negative health effects. According to the United States Pharmacopeia's 2024 policy position, the dietary supplements market expanded from 4,000 products in 1994 to approximately 80,000 products in 2024, creating substantial challenges for quality control and regulatory oversight. This market expansion has enabled some manufacturers to introduce products containing inconsistent or insufficient vitamin D levels, particularly in regions with weak regulatory enforcement. Quality issues are most evident in expanding online marketplaces, where product authenticity verification remains difficult. While the industry has implemented solutions such as blockchain traceability, authentication systems, and consumer awareness programs, these measures increase operational costs, particularly affecting smaller manufacturers. The counterfeit supplement problem is more severe in developing markets with emerging regulatory frameworks, which may restrict market growth in areas with high vitamin D deficiency rates and market expansion opportunities.

Other drivers and restraints analyzed in the detailed report include:

- Medical Community Support and Recommendations Strengthen Vitamin D Market Development

- Pandemic-Driven Health Concerns Boost Global Vitamin D Consumption and Sales

- Competition From Fortified Functional Foods Diverts Consumer Spending from Standalone Supplements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The form factor landscape is transforming, with gummies showing the highest growth rate at a CAGR of 12.34% from 2025-2030. However, capsules and softgels remain the market leaders, holding a 42.17% share in 2024. This evolution reflects consumer preferences for convenient and enjoyable supplement consumption methods that fit easily into daily routines. Gummies have gained particular popularity among Gen Z and Millennial consumers who seek alternatives to traditional supplements. Their appeal extends beyond taste, addressing pill fatigue and swallowing difficulties that impact supplement adherence across age groups.

Tablets retain substantial market presence due to their cost-effectiveness and stability benefits. Liquid formulations are increasing in popularity for their versatility and absorption advantages, especially in pediatric and geriatric applications. Powders have established a position in sports nutrition, frequently combined with protein and performance supplements. Innovation across form factors focuses on clean-label formulations, including reduced-sugar gummies, plant-based tablet excipients, and organic liquid formulations. This expansion of delivery formats is growing the market by attracting consumers who previously avoided supplements due to format limitations or compliance issues.

The vitamin D supplements market is dominated by Vitamin D3 (cholecalciferol), which accounts for 86.12% market share in 2024. The segment is expected to grow at a CAGR of 8.94% from 2025-2030. D3's market leadership is attributed to its higher bioavailability and effectiveness, as studies show it is more efficient in increasing and sustaining serum 25-hydroxyvitamin D levels compared to D2. Research indicates D3's benefits extend beyond bone health to immune function, cardiovascular health, and cognitive performance. While Vitamin D2 (ergocalciferol) remains available through prescriptions and plant-based products, its market share decreases as vegan D3 alternatives become more available.

The market shows advancement in delivery systems and formulation technologies to improve absorption and effectiveness. Companies are implementing microencapsulation techniques to enhance vitamin D3's stability and prevent degradation across various product forms. Oil-based formulations are becoming more prevalent due to their enhanced absorption characteristics. Production methods are also evolving, as demonstrated by Nutriearth's development of natural vitamin D3 oil that replicates the body's natural synthesis process without chemical extraction, which recently received marketing approval in Canada. These technological improvements are expanding D3's presence across product categories and consumer segments, supporting continued market growth despite its established market position.

The Vitamin D Supplement Market is Segmented by Product Type (Vitamin D2 and Vitamin D3), Form (Tablets, Gummies, Powders, and More), Source (Synthetic, Animal-Based, and More), Health-Focus Positioning (Bone and Joint Health, Prenatal Care, and More), Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 30.11% market share in 2024, supported by high consumer awareness, healthcare spending, and comprehensive regulatory standards. The region's market position stems from its adoption of innovative delivery formats and specialized formulations, particularly in direct-to-consumer channels. The United States market shows distinct segmentation across price points, with premium brands focusing on quality, bioavailability, and targeted benefits. Canada's vitamin D market is strengthened by regulatory policies ensuring product safety and efficacy, particularly during winter months with limited sunlight. The region's aging population drives demand for bone health supplements, while preventive health trends expand consumption across age groups.

Europe maintains a significant market share, with growth varying across countries based on deficiency rates, regulations, and consumer preferences. The European Union's regulatory framework guides market development while prioritizing consumer safety. The United Kingdom and Germany dominate in market value, while Nordic countries demonstrate high per capita consumption due to geographical factors and deficiency awareness. European markets show strong development in plant-based vitamin D products, reflecting consumer demand for sustainable options.

Asia-Pacific shows the highest growth rate at 9.86% CAGR from 2025-2030, driven by health awareness, increasing incomes, and recognition of vitamin D deficiency. China's market expansion is led by Caltrate through product launches and market activation. India presents growth opportunities owing to vitamin D deficiency, while Japan's market is characterized by an aging population and a focus on preventive health, supporting premium vitamin D products. Japan's elderly population segment (aged 65 years and older) constituted 29.6% of the total population in 2023, according to the World Bank . E-commerce development enhances access to international brands and specialized products. Regional manufacturers compete through locally adapted formulations, including combination supplements addressing common nutritional gaps in Asian diets.

- Nestle S.A.

- Haleon plc

- NOW Foods

- Amway Corporation

- Herbalife Nutrition Ltd.

- Bayer AG

- Church & Dwight Co., Inc. (Vitafusion)

- Otsuka Holdings Co. Ltd.

- BioGaia AB

- Unilever PLC

- Biostime Pharmaceuticals

- Jamieson Wellness Inc.

- Nordic Naturals

- Vitabiotics Ltd

- Swanson Health Products

- J.R. Carlson Laboratories, Inc.

- Ddrops Company

- Botanycl Ltd

- BetterYou Ltd

- Dr. Willmar Schwabe GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Vitamin D Deficiency Drives Global Market Growth and Expansion

- 4.2.2 Growing Elderly Population Fuels Increased Demand for Bone Health Supplements Worldwide

- 4.2.3 Medical Community Support and Recommendations Strengthen Vitamin D Market Development

- 4.2.4 Pandemic-Driven Health Concerns Boost Global Vitamin D Consumption and Sales

- 4.2.5 Public Health Programs and Educational Initiatives Increase Vitamin D Awareness Globally

- 4.2.6 Growing Consumer Demand for Plant-based Supplements is Supporting the Market Growth

- 4.3 Market Restraints

- 4.3.1 Counterfeit Products Impact Market Growth of Vitamin D Supplements Market

- 4.3.2 Competition From Fortified Functional Foods Diverts Consumer Spending from Standalone Supplements

- 4.3.3 High Cost of Premium Supplements Reduces Affordability in Low-Income Markets

- 4.3.4 Supply Chain Disruptions Affecting Raw Material Availability and Distribution of Vitamin D Products

- 4.4 Supply-Chain

- 4.5 Regulatory Outlook (FDA, FTC, USP)

- 4.6 Technological Outlook (Micro-encapsulation, Vegan Fermentation)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD)

- 5.1 By Product Type

- 5.1.1 Vitamin D2

- 5.1.2 Vitamin D3

- 5.2 By Form

- 5.2.1 Tablets

- 5.2.2 Capsules and Softgels

- 5.2.3 Gummies

- 5.2.4 Powders

- 5.2.5 Liquid

- 5.2.6 Others

- 5.3 By Source

- 5.3.1 Synthetic

- 5.3.2 Animal-Based

- 5.3.3 Plant-Based/Vegan

- 5.4 By Health-Focus Positioning

- 5.4.1 Bone and Joint Health

- 5.4.2 Immune Support

- 5.4.3 Prenatal Care

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets/Hypermarkets

- 5.5.2 Specialty and Health Stores

- 5.5.3 Online Retailers

- 5.5.4 Other Distribution Channels

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Indonesia

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 South Africa

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, New Product, Partnerships)

- 6.3 Market Ranking

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Nestle S.A.

- 6.4.2 Haleon plc

- 6.4.3 NOW Foods

- 6.4.4 Amway Corporation

- 6.4.5 Herbalife Nutrition Ltd.

- 6.4.6 Bayer AG

- 6.4.7 Church & Dwight Co., Inc. (Vitafusion)

- 6.4.8 Otsuka Holdings Co. Ltd.

- 6.4.9 BioGaia AB

- 6.4.10 Unilever PLC

- 6.4.11 Biostime Pharmaceuticals

- 6.4.12 Jamieson Wellness Inc.

- 6.4.13 Nordic Naturals

- 6.4.14 Vitabiotics Ltd

- 6.4.15 Swanson Health Products

- 6.4.16 J.R. Carlson Laboratories, Inc.

- 6.4.17 Ddrops Company

- 6.4.18 Botanycl Ltd

- 6.4.19 BetterYou Ltd

- 6.4.20 Dr. Willmar Schwabe GmbH & Co. KG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK