PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836667

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836667

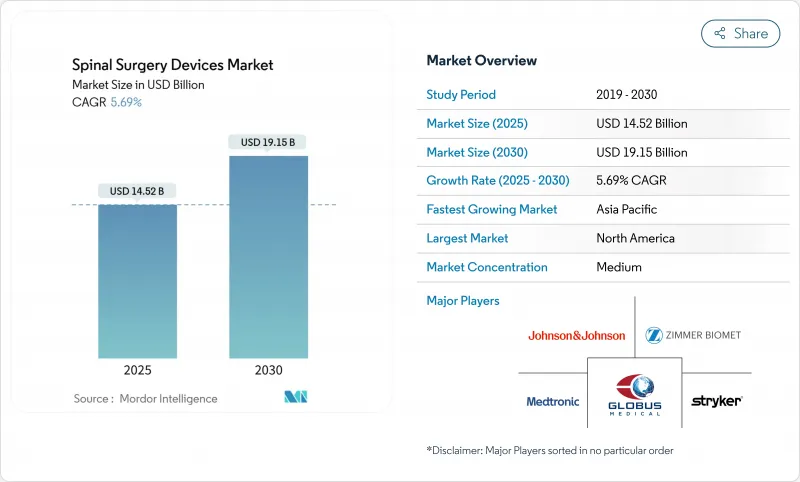

Spinal Surgery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The spine surgery devices market size reached USD 14.52 billion in 2025 and is forecast to climb to USD 19.15 billion by 2030, advancing at a 5.69% CAGR.

This expansion reflects rising surgical volumes tied to population aging, an increasing burden of degenerative spine conditions, and continuous device innovation. Robust demand persists for fusion instrumentation that remains the clinical mainstay for instability and deformity, yet surgeons are steadily adopting motion-preserving alternatives to mitigate adjacent-segment disease. Precision technologies-robotic guidance, real-time navigation, and 3-D printing-are shortening operating times and improving construct accuracy, creating clear hospital ROI arguments. Outpatient migration strengthens as payors reward minimally invasive approaches that lower complication rates and accelerate recovery, driving facility-level competition to invest in advanced platforms.

Global Spinal Surgery Devices Market Trends and Insights

Growing prevalence of degenerative spine disorders & obesity

Low-back-pain DALYs climbed from 5.5 million in 1990 to 9.8 million in 2021 and are projected to exceed 11.6 million by 2050, signaling sustained demand for surgical intervention. The >= 65-year cohort is set to reach 89 million by 2050, and roughly 27.5 million people already live with spinal deformities. High BMI accelerates adjacent-segment degeneration following fusion, fueling uptake of motion-preservation implants. Medicare volume forecasts through 2050 indicate steady growth in instrumented procedures, amplifying pressure on surgical capacity. Providers, therefore, embrace minimally invasive strategies capable of treating larger caseloads without compromising outcomes.

Rising adoption of minimally-invasive & robotic-assisted spine procedures

Robotic platforms achieve clinical acceptance rates approaching 97% among surgical trainees while trimming complex-case operating times by up to 62 minutes. Complete endoscopic cervical surgery delivers more than 85% patient satisfaction with fewer complications than open surgery. Hospitals report SGD 1,500 cost savings per patient when deploying robotics in multilevel cases. CMS continues to broaden ASC procedure lists, signaling policy momentum toward outpatient spine even though dedicated spine codes await approval. Health systems differentiate by coupling mini-access techniques with precision guidance to drive measurable value.

High procedure & implant cost; limited payor coverage in emerging markets

France cut orthopedic implant reimbursement by 25%, targeting EUR 231 million savings and triggering device shortages. Cost-utility analysis places allograft cervical fusion at USD 2,492 per QALY versus USD 3,328 for PEEK cages, challenging premium strategies. Latin American access to minimally invasive platforms remains constrained by high capital outlays and fragmented insurance coverage. Vendors respond with value-engineered designs that retain core clinical benefits while trimming upfront spend.

Other drivers and restraints analyzed in the detailed report include:

- Breakthroughs in real-time AR/VR navigation & 3-D printed implants

- Continuous advancements in implant materials

- Stringent multi-jurisdictional regulatory clearance timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spinal Fusion Devices held a 38.46% revenue share in 2024 within the spine surgery devices market. Interbody techniques such as ALIF and TLIF underpin this dominance, offering reproducible biomechanics and broad surgeon familiarity. Arthroplasty solutions, however, are climbing at a 6.75% CAGR, driven by evidence that motion preservation mitigates adjacent-segment degeneration. Lumbar disc replacement now delivers comparable pain reduction to fusion while preserving mobility. The spine surgery devices market size for motion-preservation implants is projected to scale rapidly as long-term outcomes further validate their safety profile.

Clinical demand for biologically active surfaces fuels material innovation across both fusion and motion segments. Nano-textured titanium and porous PEEK aim to lower the 10% non-union rate observed in multi-level fusion. Vendors bundle these features with outcome-tracking software to create comprehensive value propositions that incentivize premium list pricing while addressing surgeon concerns over fusion reliability.

Open procedures still generated 56.58% of 2024 revenues, reflecting their necessity for deformity corrections and extensive reconstructions. Yet minimally invasive spine surgery advances at a 5.91% CAGR, propelled by patient demand for faster recovery and payer pressure to reduce inpatient stays. Medicare outpatient data revealed a 193% surge in spine cases from 2010-2021, underscoring procedural migration to settings that reward efficiency.

Endoscopic discectomy adoption illustrates this shift: its volume rose 8.58% between 2017-2021 while open microdiscectomy fell 27.78%. Hospitals invest in robotic and navigation platforms that extend MIS applicability to complex pathology, supporting the spine surgery devices market's transition toward smaller incisions without sacrificing corrective potential.

The Spine Surgery Devices Market Report is Segmented by Device Type (Spinal Decompression Devices and More), Procedure Type (Open Spine Surgery and More), Surgical Technology (Robotic-Assisted Systems and More), Surgery Setting (Hospitals and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 44.36% of global revenue in 2024, advancing at 4.86% CAGR to 2030. Supportive reimbursement, robust clinical research networks, and early adoption of precision technologies underpin regional leadership. FDA guidance offers predictable clearance pathways that encourage continuous device iteration. Market players intensify R&D around AI-enabled planning to preserve competitive moats.

Asia-Pacific marks the fastest trajectory at 6.46% CAGR, propelled by expanding surgical capacity and rising middle-class demand for advanced care. Urban centers in China and India invest in robotic suites, yet adoption disparities persist across rural regions. Local manufacturing partnerships help offset import tariffs and build price-appropriate portfolios, positioning vendors to capture incremental volumes as infrastructure matures.

Europe sustains a 5.38% CAGR despite regulatory headwinds from MDR. Countries tighten cost controls; France's reimbursement cuts already reduce implant availability. Suppliers that validate superior outcomes can maintain premium pricing, but must navigate lengthened certification timelines. South America and MEA grow at 5.82% and 6.01% CAGRs, respectively, buoyed by public-health initiatives and private-sector investment. Limited payor coverage still constrains high-end system penetration, steering suppliers toward modular, lower-cost constructs that preserve essential functionality.

- Alphatec Spine

- AMTEC Co., Ltd.

- Aspen Medical Products

- B. Braun

- Baumer S.A.

- Camber Spine

- CoreLink Surgical

- Exactech

- Globus Medical

- HighRidge Inc.

- Johnson & Johnson

- Medtronic

- Orthofix-SeaSpine Holdings

- Orthopedic Implant Company (OIC)

- RTI Surgical

- SpineWave

- Stryker

- Vincula Biomedica

- Xtant Medical

- Zimmer Biomet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing prevalence of degenerative spine disorders & obesity

- 4.2.2 Rising adoption of minimally-invasive & robotic?assisted spine procedures

- 4.2.3 Breakthroughs in real-time AR/VR navigation & 3-D printed implants

- 4.2.4 ASC-friendly reimbursement for outpatient spinal surgeries

- 4.2.5 Continuous advancements in implant materials

- 4.2.6 AI-driven predictive analytics improving surgical planning & outcomes

- 4.3 Market Restraints

- 4.3.1 High procedure & implant cost; limited payor coverage in emerging markets

- 4.3.2 Stringent multi-jurisdictional regulatory clearance timelines

- 4.3.3 Supply-chain pressure on titanium & PEEK feedstocks

- 4.3.4 Data-security and liability concerns surrounding cloud-connected robotic and AR navigation systems

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Device Type

- 5.1.1 Spinal Decompression Devices

- 5.1.1.1 Corpectomy Systems

- 5.1.1.2 Discectomy Systems

- 5.1.1.3 Facetectomy Systems

- 5.1.1.4 Foraminotomy Systems

- 5.1.1.5 Laminotomy Systems

- 5.1.2 Spinal Fusion Devices

- 5.1.2.1 Cervical Fusion

- 5.1.2.2 Interbody Fusion

- 5.1.2.3 Thoracolumbar Fusion

- 5.1.2.4 Others

- 5.1.3 Arthroplasty / Disc Replacement Devices

- 5.1.4 Fracture Repair & VCF Devices

- 5.1.5 Motion-Preservation / Non-fusion Devices

- 5.1.1 Spinal Decompression Devices

- 5.2 By Procedure Type

- 5.2.1 Open Spine Surgery

- 5.2.2 Minimally-Invasive Spine Surgery (MISS)

- 5.3 By Surgical Technology

- 5.3.1 Robotic-Assisted Systems

- 5.3.2 AR/VR-Navigated Systems

- 5.3.3 Traditional Navigation & Imaging-Guided

- 5.4 By Surgery Setting

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgery Centers (ASCs)

- 5.4.3 Specialty Orthopedic & Spine Clinics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Alphatec Spine

- 6.4.2 AMTEC Co., Ltd.

- 6.4.3 Aspen Medical Products

- 6.4.4 B. Braun Melsungen AG

- 6.4.5 Baumer S.A.

- 6.4.6 Camber Spine

- 6.4.7 CoreLink Surgical

- 6.4.8 Exactech

- 6.4.9 Globus Medical

- 6.4.10 HighRidge Inc.

- 6.4.11 Johnson & Johnson Services, Inc.

- 6.4.12 Medtronic plc

- 6.4.13 Orthofix-SeaSpine Holdings

- 6.4.14 Orthopedic Implant Company (OIC)

- 6.4.15 RTI Surgical

- 6.4.16 SpineWave

- 6.4.17 Stryker Corporation

- 6.4.18 Vincula Biomedica

- 6.4.19 Xtant Medical

- 6.4.20 Zimmer Biomet Holdings

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment