PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836677

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836677

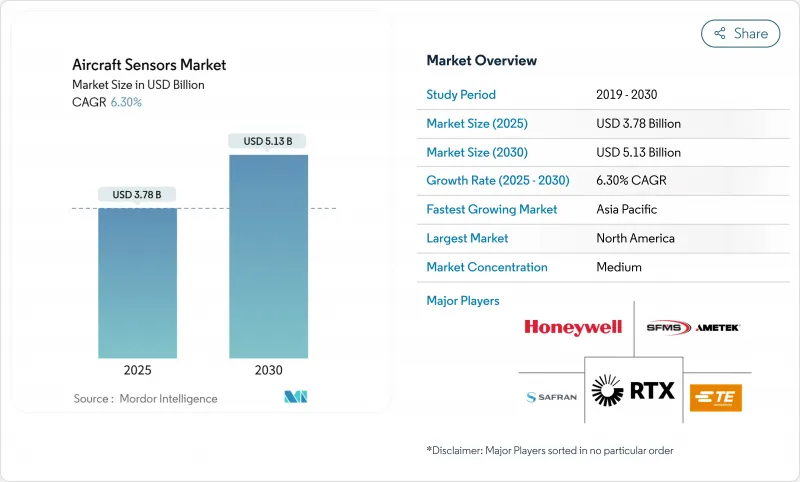

Aircraft Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft sensors market size stood at USD 3.78 billion in 2025 and is forecasted to climb to USD 5.13 billion by 2030, advancing at a 6.30% CAGR.

This trajectory reflects sustained fleet expansion, the migration to fly-by-wire control systems, and rising adoption of predictive maintenance services. Operators are compelled to upgrade sensing suites after the Federal Aviation Administration (FAA) tightened airborne collision-avoidance rules in 2024, while engine makers introduced higher-temperature sensors that support sustainable aviation fuel (SAF) combustion. Radar-based weather and hazard-avoidance products gained momentum as carriers sought to mitigate climate-driven turbulence risk. Military buyers accelerated modernization, funding a USD 270 million infrared upgrade for the F-22 Raptor and expanding orders for autonomous platforms that depend on dense, rugged sensor networks. Suppliers that combined sensor hardware with cloud analytics captured premium contracts, yet global shortages of aerospace-grade semiconductors stretched lead times and intensified qualification hurdles.

Global Aircraft Sensors Market Trends and Insights

Accelerated Adoption of Fly-by-Wire and Health-Monitoring Architectures

Aircraft programs shifted from mechanical linkages to electronic flight-control systems that rely on triple-redundant sensors for every critical parameter. Collins Aerospace demonstrated its Enhanced Power and Cooling System on the F-35, doubling thermal capacity to support energy-intensive sensor loads. Airlines integrated structural-health-monitoring suites that cut downtime by 30% when combined with predictive analytics from real-time sensor streams. Sensor fusion software stitched pressure, inertial, and radar feeds into a unified flight picture, improving autopilot responsiveness and enabling single-pilot operations.

Shift to SAF-Ready Engines Driving High-Accuracy Thermal Sensing

SAF blends alter combustor temperature profiles, prompting engine makers to specify thermocouples capable of surviving 1,400°F environments-nearly triple the limit of erstwhile transducers. The US Department of Energy's SAF Grand Challenge targeted 3 billion gallons of annual output by 2030, stimulating demand for fuel-quality and emissions sensors across supply chains. Airlines are deploying SAF-equipped digital fuel-flow meters and exhaust-gas sensors to verify carbon-reduction claims required for tax credits.

Persistent Supply-Chain Crunch of Aerospace-Grade ASICs

Lead times for radiation-tolerant processors and mixed-signal ASICs lengthened to 40 weeks, overshadowing pre-pandemic norms of 12 weeks. Aviation represented less than 2% of global chip demand, leaving it low on foundry priority lists. Consultancies reported that 66% of aerospace Tier-1s struggled with allocation shortfalls in 2025. Airframers stocked safety-critical devices, yet inventory buffers raised working-capital needs and delayed retrofit schedules.

Other drivers and restraints analyzed in the detailed report include:

- FAA Mandate on Airborne Collision-Avoidance Upgrades

- Mainstream Drivers-as-a-Service Platforms for Connected Fleets

- Certification Backlog Slowing New Sensor Design-ins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed-wing programs dominated demand, capturing 72.54% of the aircraft sensors market share in 2024 on the strength of commercial jet deliveries. The aircraft sensors market size for fixed-wing applications is projected to exceed USD 3 billion by 2030 at a 5.8% CAGR. Within that total, military aviation sensors are advancing 8.30% annually as defense ministries retrofit legacy fighters with wide-area infrared, radar, and electronic-warfare suites. Lockheed Martin's F-22 upgrade illustrated the premium paid for 360-degree passive surveillance.

Rotorcraft and tilt-rotor fleets embraced multispectral cameras and lidar for obstacle avoidance during low-altitude operations. Collins Aerospace's perception-sensing system enabled automated landing in degraded visual conditions. Cross-pollination of software-defined sensor processors between rotorcraft and fighter jets cut non-recurring engineering costs, compressing time-to-market for export variants. As autonomous cargo drones scale, demand for lightweight inertial and barometric modules will reinforce the expansion of the aircraft sensors market across all airframe classes.

Pressure devices remained foundational underlying pitot-static, environmental-control, and engine-oil systems with stable, high-volume shipments. Still, radar units registered the steepest growth at 9.75% CAGR as airlines sought advanced turbulence prediction and de-icing advisory features. The aircraft sensors market size for radar is forecast to reach USD 1.2 billion by 2030, reflecting both retrofit and line-fit programs. ACAS Xa requirements further boosted airborne surveillance radars for regional jets.

Edge-AI packages integrated radar, lidar, and optical inputs on a single board, reducing wiring by 20% and enabling condition-based antenna calibration. MEMS accelerometers and proximity detectors benefited from automotive cost curves yet continued to undergo supplemental screening to meet RTCA DO-160 vibration profiles. Temperature and flow sensor designers added cybersecurity wrappers to satisfy imminent FAA network-security mandates, raising bill-of-materials cost but cementing long-term service revenue prospects.

The Aircraft Sensors Market Report is Segmented by Aircraft Type (Fixed-Wing and Rotary-Wing), Sensor Type (Temperature, Pressure, Position, Flow, Torque, Radar, and More), Application (Fuel, Hydraulic and Pneumatic Systems, Engine and Auxiliary Power Unit (APU), and More), End User (OEM and Aftermarket/MRO), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.52% of global demand in 2024, benefiting from major airlines' elevated Pentagon outlays and fleet-modernization campaigns. Domestic sensor suppliers leveraged early engagement with the FAA to shape standards, enhancing export prospects once rules were adopted abroad. Yet the reliance on offshore chip fabrication prompted Washington to allocate USD 52 billion under the CHIPS Act to bolster local microelectronics capacity.

Asia-Pacific recorded the highest growth rate at 7.85% CAGR as carriers expanded narrowbody fleets and governments funded Indigenous sensor programs to mitigate export-control risks. China's aviation services value was forecast to hit USD 61 billion by 2043, eclipsing every single country market. Japanese and Korean manufacturers collaborated on MEMS inertial modules for urban-air-mobility vehicles, while India advanced roadmaps for domestically produced air-data sensors to support regional jet projects.

Europe remained a technology bellwether, enforcing stringent sustainability and cybersecurity rules that fostered sensor innovation. Thales completed the Cobham Aerospace Communications acquisition, reinforcing avionics portfolios that blend sensors and secure datalinks. EASA's harmonization with the FAA facilitated reciprocal acceptance of approvals, but suppliers still navigated separate documentation streams. The region emphasized SAF validation instrumentation and non-CO2 emissions monitoring as part of its Fit-for-55 climate package.

- TE Connectivity Corporation

- Honeywell International Inc.

- Meggitt PLC

- AMETEK Aerospace, Inc.

- Thales Group

- Collins Aerospace (RTX Corporation)

- Curtiss-Wright Corporation

- Safran SA

- Hydra-Electric Company

- PCB Piezotronics, Inc. (Amphenol Corporation)

- Precision Sensors (United Electric Controls)

- Moog Inc.

- Garmin Ltd.

- TT Electronics plc

- Woodward, Inc.

- EMCORE Corporation

- Bosch General Aviation Technology GmbH (Robert Bosch GmbH)

- Eaton Corporation plc

- Crane Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated adoption of fly-by-wire and health-monitoring architectures

- 4.2.2 Shift to SAF-ready engines driving high-accuracy thermal sensing

- 4.2.3 FAA mandate on airborne collision-avoidance upgrades

- 4.2.4 Mainstream drivers-as-a-service platforms for connected fleets

- 4.2.5 Additive-manufactured sensor housings reducing unit cost

- 4.2.6 Edge-AI-enabled self-calibrating sensors lowering MRO spend

- 4.3 Market Restraints

- 4.3.1 Persistent supply-chain crunch of aerospace-grade ASICs

- 4.3.2 Certification backlog slowing new sensor design-ins

- 4.3.3 Cyber-hardening requirements inflating BOM cost

- 4.3.4 Export-control tightening on MEMS IMUs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Aircraft Type

- 5.1.1 Fixed-Wing

- 5.1.1.1 Commercial Aviation

- 5.1.1.1.1 Narrowbody Aircraft

- 5.1.1.1.2 Widebody Aircraft

- 5.1.1.1.3 Regional TJets

- 5.1.1.2 Business and General Aviation

- 5.1.1.2.1 Business Jets

- 5.1.1.2.2 Light Aircraft

- 5.1.1.3 Military Aviation

- 5.1.1.3.1 Fighter Aircraft

- 5.1.1.3.2 Transport Aircraft

- 5.1.1.3.3 Special Mission Aircraft

- 5.1.2 Rotary-Wing

- 5.1.2.1 Commercial Helicopters

- 5.1.2.2 Military Helicopters

- 5.1.1 Fixed-Wing

- 5.2 By Sensor Type

- 5.2.1 Pressure

- 5.2.2 Temperature

- 5.2.3 Position

- 5.2.4 Flow

- 5.2.5 Torque

- 5.2.6 Radar

- 5.2.7 Accelerometers

- 5.2.8 Proximity

- 5.2.9 Other Sensors

- 5.3 By Application

- 5.3.1 Fuel,Hydraulic and Pneumatic Systems

- 5.3.2 Engine and Auxiliary Power Unit (APU)

- 5.3.3 Cabin and Cargo Environmental Controls

- 5.3.4 Flight Control Systems

- 5.3.5 Flight Decks

- 5.3.6 Landing Gear Systems

- 5.3.7 Weapon Systems

- 5.3.8 Others

- 5.4 By End User

- 5.4.1 OEM

- 5.4.2 Aftermarket/MRO

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Mexico

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 France

- 5.5.3.3 Germany

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arbaia

- 5.5.5.1.2 Israel

- 5.5.5.1.3 United Arab Emirates

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TE Connectivity Corporation

- 6.4.2 Honeywell International Inc.

- 6.4.3 Meggitt PLC

- 6.4.4 AMETEK Aerospace, Inc.

- 6.4.5 Thales Group

- 6.4.6 Collins Aerospace (RTX Corporation)

- 6.4.7 Curtiss-Wright Corporation

- 6.4.8 Safran SA

- 6.4.9 Hydra-Electric Company

- 6.4.10 PCB Piezotronics, Inc. (Amphenol Corporation)

- 6.4.11 Precision Sensors (United Electric Controls)

- 6.4.12 Moog Inc.

- 6.4.13 Garmin Ltd.

- 6.4.14 TT Electronics plc

- 6.4.15 Woodward, Inc.

- 6.4.16 EMCORE Corporation

- 6.4.17 Bosch General Aviation Technology GmbH (Robert Bosch GmbH)

- 6.4.18 Eaton Corporation plc

- 6.4.19 Crane Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment