PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836680

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836680

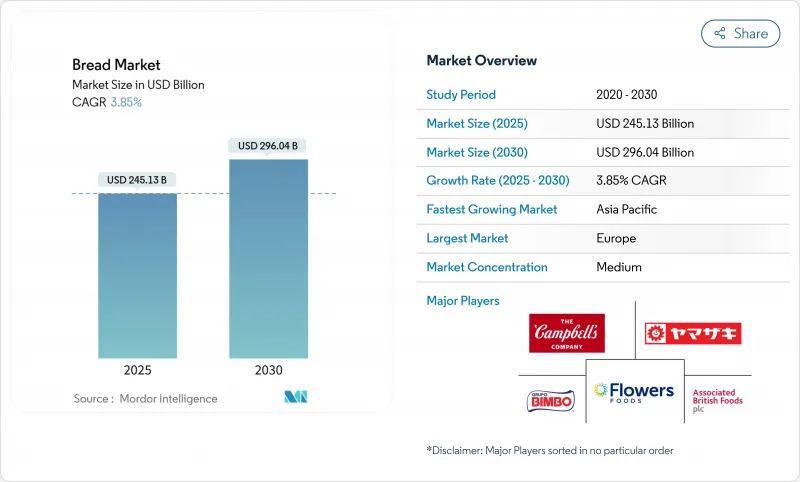

Bread - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bread market's current valuation stands at USD 245.13 billion in 2025 and is projected to reach USD 296.04 billion by 2030, translating into a steady 3.85% CAGR.

Europe anchors demand with deeply rooted consumption habits, while Asia represents the fastest-growing geography as urban households purchase more packaged toast and single-serve rolls. Premiumisation remains a defining lens: high-protein formulas, gluten-free variants, and organic certification allow bakers to lift average selling prices even when volume gains taper in mature regions. Leading producers are also hedging wheat purchases and raising capital expenditure on cold-chain logistics to balance cost volatility with differentiation. Collectively, these moves show that the bread market is evolving from scale-only competition to a blend of efficiency, nutrition science, and supply-chain agility.

Global Bread Market Trends and Insights

Rising Demand for Functional and Fortified Breads Boosts Demand

Consumers are increasingly choosing bread products that offer health benefits beyond basic nutrition, which is driving significant changes in product development. This trend has evolved from focusing on protein enrichment to emphasizing fiber fortification. Manufacturers are actively incorporating ingredients like bamboo fiber to create bread with high fiber content, ensuring that the taste and texture remain appealing to consumers. These health-oriented bread products are typically priced 20-30% higher than regular bread, which has led to faster growth in value compared to volume. Major manufacturers, such as Flowers Foods, are addressing this growing demand by introducing products like Nature's Own Keto Soft White Buns and Dave's Killer Bread Amped-Up Protein Bars. As formulation technologies continue to improve and consumers become more health-conscious, this trend is expected to grow further in the medium term, creating more opportunities for innovation in the market.

Rapid Urbanization Driving Packaged Bread Adoption

Urbanization in Asia is significantly transforming bread consumption habits. As per a UN-Habitat report, Asia is home to 54% of the world's urban population, translating to over 2.2 billion individuals. Projections indicate that by 2050, Asia's urban populace will swell by another 1.2 billion, marking a 50% increase . People are increasingly moving away from the traditional practice of buying fresh bread daily and are instead opting for packaged bread with a longer shelf life. This shift is particularly prominent in China, India, and Japan, where rapid urban population growth, busier lifestyles, and changing retail environments are driving this change. The packaged bread segment in these countries is expanding at a much faster rate than the overall bread market, creating substantial new demand opportunities for manufacturers.

Modern retail formats, such as supermarkets and convenience stores, along with advancements in cold chain infrastructure, are playing a crucial role in this growth. These developments are enabling packaged bread products to reach tier-2 and tier-3 cities, areas that were previously underserved by bread manufacturers. As a result, more consumers in these regions now have access to packaged bread, further fueling its demand. The impact of urbanization on bread consumption is gradual but steady. These trends are expected to persist throughout the forecast period and beyond, indicating a long-term structural shift in the bread market.

Volatility in Global Wheat Prices Compressing Margins

Global wheat price volatility is squeezing margins across the bread value chain, with smaller producers grappling most due to fluctuating input costs. Wheat production's sensitivity to weather means that droughts, floods, or extreme temperatures can curtail yields, tightening supply and driving up prices. For example, in 2024, the U.S. Department of Agriculture (USDA) highlighted that adverse weather in the European Union slashed wheat production estimates by about 3.7 million metric tons (MMT) to 130.5 MMT, fueling global price surges .

Additionally, India's move to restrict wheat exports for domestic price stabilization curtailed global supply, amplifying price volatility. This decision hit bread manufacturers in the Middle East, who depended on Indian wheat, resulting in elevated production costs and squeezed margins. Given that wheat constitutes 30-40% of production costs, its price swings have a direct bearing on profitability and curtail investment prospects. The immediate repercussions of these price fluctuations are clear in operating margins, and the persistent supply-demand imbalance indicates this strain will continue throughout the forecast period. Yet, as producers adjust to demand signals, the situation may gradually stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Artisanal In-store Bakeries

- Government Wheat Subsidy Programs Increasing Affordability

- Cold-chain Gaps Limiting Frozen Bread Distribution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, wheat bread commands a dominant 57.54% share of the market. This significant market share highlights its widespread consumer preference and strong positioning within the global bread market. Wheat bread's popularity can be attributed to its perceived health benefits, including higher fiber content and essential nutrients compared to white bread. Additionally, the growing trend of health-conscious eating and the increasing demand for whole-grain products have further propelled its adoption. Manufacturers are also innovating within this segment by introducing fortified and organic wheat bread variants, catering to diverse consumer preferences. The segment's robust performance underscores its critical role in driving the overall growth of the global bread market.

Despite wheat bread commanding a dominant market share, gluten-free bread is making significant inroads, projected to grow at an 8.40% CAGR from 2025 to 2030. This surge is driven by a combination of medical necessity, such as celiac disease and gluten intolerance, and lifestyle preferences, as more consumers perceive gluten-free products as healthier alternatives. Studies by the University of Nebraska reveal that around 25% of Americans are now embracing gluten-free diets, further contributing to the growing demand for gluten-free bread.

In 2024, leavened bread holds 57.65% of the market share, maintaining its leading position due to its versatility and strong consumer preferences. Loaves are a key part of daily consumption, especially in sandwiches, which are popular across regions. However, their growth is slower compared to the unleavened/flat bread segment, which is growing at a 4.42% CAGR from 2025 to 2030, twice the overall market rate. Companies like Lancaster Colony are driving innovation with gluten-free frozen bread that closely matches traditional bread in texture and taste. Burger buns and sandwich slices show steady growth, while ciabatta and baguettes are seeing moderate growth in foodservice.

The unleavened/flat bread segment is growing quickly due to demand for convenience, less food waste, and high-quality products available on demand. Advances in freezing technology, such as OctoFrost's Multi-Level Impingement Freezer, have improved product quality by addressing issues like dehydration and deformation. Rolls and specialty items like brioche are gaining market share, with brioche standing out for its versatility and premium appeal. Grupo Bimbo's acquisition of St Pierre Groupe highlights the importance of this subsegment. Other product types are losing market share as consumers focus on mainstream options with clear benefits.

The Bread Market Report Segments the Industry Into Product Type (Leavened Bread and Unleavened/Flat Bread), Ingredient (Wheat Bread, Rye Bread and Others), Nature (Conventional Bread, Free-From Bread), Distribution Channel (Off-Trade and On-Trade), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe claimed a 29.82% share of the global bread market in 2024. With its rich bread traditions and an evolved retail landscape, Europe is a key player on the world stage. The UK, Germany, and France dominate the continent, showcasing unique consumption patterns. A report from the Federation of Bakers highlights that while bread consumption holds steady in Western Europe, there's a pronounced disparity between nations. Notably, Germans and Austrians top the list, each indulging in roughly 80 kg of bread per person each year . By 2025, trends indicate a shift towards local authenticity in bakeries, with consumers increasingly valuing regional grains and time-honored recipes.

Asia is poised as the region with the most rapid growth, projecting a 4.83% CAGR from 2025 to 2030. This surge is attributed to urbanization, a tilt towards Western diets, and rising disposable incomes. Within Asia, China, India, and Japan take the lead, each charting distinct growth paths. The packaged bread sector is booming, spurred by urban dwellers favoring convenience over traditional fresh options. E-commerce is a game-changer in this evolution, expanding the reach of bread products both geographically and demographically. However, economic headwinds persist, with HSBC flagging a "crisis of value" in China and Southeast Asia, reshaping food purchasing habits.

North America, with its health-centric product innovations and robust retail framework, commands a significant market share. The region's bread market is seeing increased demand for gluten-free, organic, and low-carb options, reflecting a shift towards healthier lifestyles. Retailers and manufacturers are focusing on clean-label products to meet consumer preferences for ingredient transparency. While Canada and Mexico are smaller players, they are aligning with U.S. trends and showing growth. Canada is experiencing rising demand for artisanal and specialty breads, while Mexico is seeing growth in fortified bread products targeting nutritional deficiencies. These trends highlight the region's adaptability and potential for sustained growth.

- Grupo Bimbo S.A.B. de C.V.

- Associated British Foods plc

- Yamazaki Baking Co., Ltd.

- Flowers Foods, Inc.

- Barilla Group

- Campbell Soup Company

- Joseph's Bakery

- Lewis Bakeries, Inc.

- Premier Foods Group Limited

- Finsbury Food Group plc

- Almarai Company

- Warburtons Ltd.

- George Weston Foods Ltd.

- Bridor Group

- Lantmannen Unibake

- Paris Baguette (SPC Group)

- Britannia Industries Limited

- Damascus Bakeries

- Aryzta AG

- Goodman Fielder Pty Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Functional and Fortified Breads Boosts Demand

- 4.2.2 Rapid Urbanization Driving Packaged Bread Adoption

- 4.2.3 Expansion of Artisanal In-store Bakeries

- 4.2.4 Government Wheat Subsidy Programs Increasing Affordability

- 4.2.5 E-commerce Penetration Increasing Direct-to-Consumer Frozen Bread Sales

- 4.2.6 Technological Advances in Baking Improve Shelf Life and Production Efficiency

- 4.3 Market Restraints

- 4.3.1 Volatility in Global Wheat Prices Compressing Margins

- 4.3.2 Safety Concerns and Product Recalls

- 4.3.3 Cold-chain Gaps Limiting Frozen Bread Distribution

- 4.3.4 Growing Popularity of Low-Carb Diets Negatively Impacts Bread Consumption

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Leavened Bread

- 5.1.1.1 Loaves

- 5.1.1.2 Baguettes

- 5.1.1.3 Burger Buns

- 5.1.1.4 Sandwich Slices

- 5.1.1.5 Ciabatta

- 5.1.1.6 Other Product Types

- 5.1.2 Unleavened / Flat Bread

- 5.1.2.1 Tortilla

- 5.1.2.2 Pita

- 5.1.2.3 Chapati/Roti/Paratha

- 5.1.2.4 Others

- 5.1.1 Leavened Bread

- 5.2 By Ingredient Type

- 5.2.1 Wheat Bread

- 5.2.2 Rye Bread

- 5.2.3 Multigrain Bread

- 5.2.4 Other Ingredients

- 5.3 By Nature

- 5.3.1 Conventional Bread

- 5.3.2 Free-From Bread

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Convenience/Grocery Stores

- 5.4.1.2 Specialist Retailers

- 5.4.1.3 Supermarkets/Hypermarkets

- 5.4.1.4 Online Retail

- 5.4.1.5 Other Channels

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Grupo Bimbo S.A.B. de C.V.

- 6.4.2 Associated British Foods plc

- 6.4.3 Yamazaki Baking Co., Ltd.

- 6.4.4 Flowers Foods, Inc.

- 6.4.5 Barilla Group

- 6.4.6 Campbell Soup Company

- 6.4.7 Joseph's Bakery

- 6.4.8 Lewis Bakeries, Inc.

- 6.4.9 Premier Foods Group Limited

- 6.4.10 Finsbury Food Group plc

- 6.4.11 Almarai Company

- 6.4.12 Warburtons Ltd.

- 6.4.13 George Weston Foods Ltd.

- 6.4.14 Bridor Group

- 6.4.15 Lantmannen Unibake

- 6.4.16 Paris Baguette (SPC Group)

- 6.4.17 Britannia Industries Limited

- 6.4.18 Damascus Bakeries

- 6.4.19 Aryzta AG

- 6.4.20 Goodman Fielder Pty Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK