PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836682

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836682

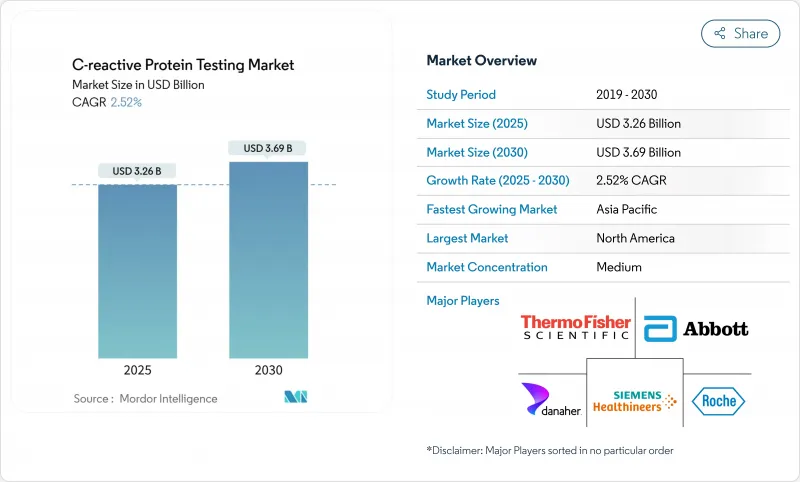

C-reactive Protein Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The C-Reactive Protein testing market reached USD 3.26 billion in 2025 and is forecast to reach USD 3.69 billion by 2030, expanding at a 2.52% CAGR.

This steady growth stems from the pivot toward precision diagnostics, where high-sensitivity assays, multi-analyte inflammation panels and point-of-care formats command pricing power. Heightened regulatory scrutiny-such as the 2025 CLIA acceptance limits that tightened analytical tolerances-favors premium platforms able to deliver trace-level accuracy. In parallel, reimbursement caps that limit repeat testing in the United States are steering laboratories toward value-based utilization models, accelerating adoption of decision-support software bundled with assays. Across mature and emerging markets alike, rapid decentralization of testing to primary care clinics, pharmacies and home-monitoring programs is redefining competitive boundaries within the C-Reactive Protein testing market.

Global C-reactive Protein Testing Market Trends and Insights

Chronic Disease & Inflammatory-Disorder Burden Accelerates CRP Testing Adoption

High prevalence of chronic inflammatory disorders is transforming how health systems use CRP. Gastroenterologists increasingly monitor ulcerative colitis remission with threshold CRP levels below 10 mg/L to adjust biologic therapy schedules. Rheumatologists rely on longitudinal CRP trends to titrate disease-modifying drugs, reducing costly imaging studies. Aging demographics mean larger patient pools need recurring tests, creating predictable demand that offsets slower volume growth from acute-care episodes. Payers also view CRP as a cost-effective surrogate marker that can triage patients toward or away from advanced imaging, preserving budgets without sacrificing care quality. Collectively these factors bolster long-run volumes in the C-Reactive Protein testing market.

High-Sensitivity CRP Endorsed in Major CVD-Risk Guidelines

The American Heart Association embedded hsCRP into its cardiovascular-kidney-metabolic health framework in 2025, formalizing its role alongside LDL-C and HbA1c. Medicare's Local Coverage Determination L34856 reimburses hsCRP up to three lifetime tests when used for lipid-lowering therapy optimization, creating a revenue baseline for laboratories. Guideline endorsement standardizes ordering behavior, reducing physician hesitation and expanding test penetration among intermediate-risk patients who previously lacked actionable biomarkers. Diagnostic manufacturers thus prioritize precision calibration at 0.1 mg/L increments and integrate decision-support analytics that translate hsCRP values into therapy algorithms, supporting premium pricing within the C-Reactive Protein testing market.

Poor Public & Physician Awareness Outside Cardiology

Despite broad evidence, many clinicians limit CRP ordering to cardiovascular contexts. Specialty societies are now publishing quick-reference algorithms clarifying when CRP outperforms ESR and procalcitonin. Until awareness improves, non-cardiology demand will lag potential, tempering growth in regions lacking continuing-medical-education resources.

Other drivers and restraints analyzed in the detailed report include:

- Rising Incidence of Endometriosis and Women's Health Screening Programs

- Surge in Point-of-Care Testing Roll-Outs at Primary-Care Settings

- Competing Multi-Analyte Inflammatory Panels With Superior Accuracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Enzyme-Linked Immunosorbent Assay held 45.35% of 2024 revenues thanks to entrenched analyzers and standardized protocols across integrated delivery networks. However, lateral-flow innovation lifted this segment's 7.25% CAGR, compressing ELISA's dominance. DNA nanotechnology tripled detection sensitivity, narrowing the accuracy gap with centralized methods and unlocking pharmacy-based testing lanes. Chemiluminescence instruments preserve relevance in high-throughput core labs where 200-sample racks and auto-reagent loading reduce labor costs. Looking ahead, ELISA bench-tops will focus on bundled multi-analyte menus and connectivity hooks, while rapid cassette suppliers court decentralized buyers. The bifurcation underscores how the C-Reactive Protein testing market rewards both high-volume lab integration and ultrafast near-patient convenience, with few middle-ground options remaining.

Growing patient preference for instant answers continues to pull testing outside hospital walls. Lateral-flow suppliers now bundle digital readers that sync to electronic health records, delivering traceable quantitative values rather than subjective color bands. In rural Southeast Asia, government immunization clinics adopted disposable cassettes to guide antibiotic stewardship without waiting days for reference-lab confirmation. Meanwhile, ELISA vendors defend share by embedding reflex-testing algorithms that auto-trigger cytokine panels when CRP surpasses 3 mg/L, positioning central labs as one-stop inflammation hubs. This dual-track evolution highlights why the C-Reactive Protein testing market remains one of diagnostics' most technology-diverse arenas.

High-sensitivity reagents captured 60.53% of 2024 revenue and are pacing a 6.85% CAGR as clinicians value sub-1 mg/L precision for preventive cardiology. Regulatory bodies mandate tighter proficiency thresholds, pushing vendors to standardize calibrators traceable to IFCC reference material. Conventional range tests still anchor acute-care workflows, diagnosing pneumonia or appendicitis where CRP exceeds 50 mg/L. Yet reimbursement differentials increasingly incentivize labs to report hsCRP for borderline cardiovascular cases, reinforcing premiumization. Suppliers therefore redesign photometric optics and reagent chemistries to hold coefficient-of-variation below 3% at 0.5 mg/L, justifying higher prices.

Muted growth in conventional assays stems from antibiotic stewardship programs that limit unnecessary bacterial screens. Still, emerging markets rely on low-cost conventional kits to meet basic clinical needs. Dual-range analyzers capable of switching analytical modes offer a hedge, letting laboratories consolidate purchasing. These dynamics keep both tiers relevant, but margin expansion clusters around high-sensitivity innovations, demonstrating how detection-range segmentation shapes competitive advantage in the C-Reactive Protein testing market.

The C-Reactive Protein Testing Market Report is Segmented by Assay Type (Enzyme-Linked Immunosorbent Assay (ELISA), Chemiluminescence Immunoassay (CLIA), and More), Detection Range (High-Sensitivity CRP and Conventional CRP), Application (Diabetes, Rheumatoid Arthritis, and More), End User (Hospitals & Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 38.82% revenue share in 2024 stems from insurer reimbursement clarity and clinician familiarity with hsCRP. Medicare's three-test lifetime cap reduces routine repeat ordering, nudging labs to focus on first-time precision and digital decision support. Consolidation among service providers-such as Quest Diagnostics' LifeLabs takeover-intensifies purchasing power, steering analyzer contracts toward end-to-end automation suites. Canadian provinces are integrating hsCRP into cardiovascular screening for individuals aged 45-75, anchoring baseline volumes across public labs.

Asia-Pacific delivers the fastest 7.21% CAGR, fueled by primary-care modernization and infectious-disease applications. China's CRP-based tuberculosis triage among HIV-positive populations achieved 72.23% sensitivity and 77.66% specificity, showcasing locally tailored use-cases. Vietnam's pharmacy pilots trimmed antibiotic misuse, bolstering government support for wider CRP rollout. Japan's healthy-aging policies subsidize hsCRP for adults in metabolic screening programs, wid¬ening the addressable base. Regional suppliers leverage domestic manufacturing incentives to lower unit costs, penetrating rural clinics previously priced out of branded assays, which expands the C-Reactive Protein testing market footprint.

Europe maintains stable demand through rigorous standardization. IFCC's laboratory medicine guideline initiatives harmonize calibrators across member states, shrinking inter-lab variability and raising clinician confidence. National Health Services in the United Kingdom added CRP to primary-care respiratory infection bundles, reimbursing tests that support antibiotic stewardship. Emerging regions in Middle East & Africa and South America collectively add single-digit share but post double-digit growth where mHealth programs piggyback CRP on multiparameter diagnostic vans servicing remote areas. Each geography thus maps distinctly onto the evolving C-Reactive Protein testing market, creating localized opportunities for agile players.

- Abbott Laboratories

- Danaher Corp (Beckman Coulter)

- Roche

- Siemens Healthineers

- Thermo Fisher Scientific

- Quest Diagnostics

- Randox Laboratories

- Getein Biotech

- HORIBA

- Boditech Med

- Aidian Oy

- QuidelOrtho

- Sekisui Diagnostics

- Becton Dickinson (BD)

- Bio-Rad Laboratories

- DiaSorin

- Shenzhen Mindray Bio-Medical

- LumiraDx

- ERBA Diagnostics

- Wako Pure Chemical (ELITech)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chronic Disease & Inflammatory-Disorder Burden Accelerates CRP Testing Adoption

- 4.2.2 High-Sensitivity CRP Endorsed In Major CVD-Risk Guidelines

- 4.2.3 Rising Incidence Of Endometriosis And Women's Health Screening Programs

- 4.2.4 Surge In Point-Of-Care (POC) Testing Roll-Outs At Primary-Care Settings

- 4.2.5 Integration Of CRP Sensors Into Connected Home-Diagnostic Platforms

- 4.2.6 Nanoparticle-Enhanced Ultrafast ELISA Microfluidic Chips Reach Commercialization

- 4.3 Market Restraints

- 4.3.1 Poor Public & Physician Awareness Outside Cardiology

- 4.3.2 Competing Multi-Analyte Inflammatory Panels With Superior Accuracy

- 4.3.3 Inter-Platform Analytical Variability Limits Longitudinal Tracking

- 4.3.4 Medicare Lifetime Three-Test Cap Curbs U.S. Repeat-Testing Volumes

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Assay Type

- 5.1.1 Enzyme-Linked Immunosorbent Assay (ELISA)

- 5.1.2 Chemiluminescence Immunoassay (CLIA)

- 5.1.3 Immunoturbidimetric Assay

- 5.1.4 Lateral-Flow Immunoassay

- 5.1.5 Other Assay Types

- 5.2 By Detection Range

- 5.2.1 High-Sensitivity CRP

- 5.2.2 Conventional CRP

- 5.3 By Application

- 5.3.1 Cardiovascular Disease

- 5.3.2 Rheumatoid Arthritis

- 5.3.3 Diabetes

- 5.3.4 Inflammatory Bowel Disease

- 5.3.5 Cancer

- 5.3.6 Sepsis & Acute Infection

- 5.3.7 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Reference & Central Laboratories

- 5.4.3 Point-of-Care Settings

- 5.4.4 Academic & Research Institutes

- 5.4.5 Home-Care Settings

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Danaher Corp (Beckman Coulter)

- 6.3.3 F. Hoffmann-La Roche AG

- 6.3.4 Siemens Healthineers

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Quest Diagnostics

- 6.3.7 Randox Laboratories

- 6.3.8 Getein Biotech

- 6.3.9 HORIBA Ltd

- 6.3.10 Boditech Med

- 6.3.11 Aidian Oy

- 6.3.12 QuidelOrtho

- 6.3.13 Sekisui Diagnostics

- 6.3.14 Becton Dickinson (BD)

- 6.3.15 Bio-Rad Laboratories

- 6.3.16 DiaSorin SpA

- 6.3.17 Shenzhen Mindray Bio-Medical

- 6.3.18 LumiraDx

- 6.3.19 ERBA Diagnostics

- 6.3.20 Wako Pure Chemical (ELITech)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment