PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836683

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836683

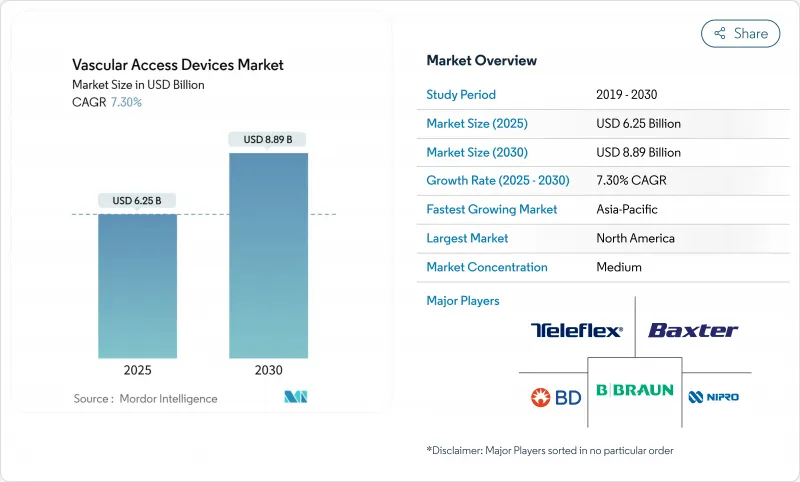

Vascular Access Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global vascular access devices market stands at USD 6.25 billion in 2025 and is forecast to reach USD 8.89 billion by 2030, advancing at a 7.30% CAGR.

This expansion reflects healthcare providers' pivot toward value-based innovation that prioritizes infection prevention, material durability and procedural efficiency. A rising chronic disease burden, broader adoption of ultrasound-guided insertion and the shift to outpatient care models collectively underpin sustained demand. At the same time, advances in hydrophilic biomaterials and antimicrobial coatings intensify product differentiation, while supply-chain reshoring helps manufacturers mitigate raw-material risk. Competitive dynamics therefore favor firms able to pair scale manufacturing with rapid technology roll-outs, keeping the vascular access devices market on a steady growth trajectory.

Global Vascular Access Devices Market Trends and Insights

Rising burden of chronic diseases & high IV-therapy demand

Chronic conditions such as diabetes and heart failure are driving long-term intravenous treatment requirements worldwide. Home infusion now serves more than 3.2 million Americans annually, with spending exceeding USD 110 billion and rising 5-7% each year. Durable midline catheters and extended-dwell peripheral devices lower complication risk, supporting broader outpatient management. Hydrophilic biomaterials like Access Vascular's MIMIX reduce failure rates and can save a 1,000-bed hospital USD 1.8 million a year. These economics elevate vascular access devices from commodity supplies to essential infrastructure.

Growth in chemotherapy procedures & hospitalization

Personalized oncology regimens increasingly depend on central venous catheters that tolerate vesicant drugs while permitting frequent sampling . Peripherally inserted central catheters (PICCs) improve outpatient flexibility, cutting treatment delays and hospital stays. Chlorhexidine-impregnated dressings have trimmed bloodstream infections by 52% in trials, underpinning premium pricing for infection-resistant devices .

Catheter-associated bloodstream infections (CLABSI)

Intensive-care units still record 4.9 infections per 1,000 catheter days, with every episode adding treatment cost and mortality risk. Digital dashboards cut CLABSI rates by up to 73% but require capital investment. Chlorhexidine dressings reduce catheter colonization by 54%. Hospitals consequently favor integrated infection-control bundles, squeezing commodity vendors that lack advanced coatings.

Other drivers and restraints analyzed in the detailed report include:

- Increasing pediatric & neonatal vascular access

- Adoption of ultrasound-guided DIVA solutions

- Stringent regulatory scrutiny & product recalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Central devices captured 56.78% of vascular access devices market share in 2024. PICCs remain the workhorse for oncology and critical-care settings, whereas tunneled catheters support year-long therapies. Hospitals value their reliable flow and lower reinsertion frequency, even as reimbursement pressures intensify scrutiny of infection risk and dwell time.

Peripheral catheters, however, are the fastest-growing class at a 7.89% CAGR. Extended-dwell designs bridge the gap between standard PIVCs and PICCs, reducing cost and complication rates for intermediate therapies. FDA-cleared devices such as B. Braun's Introcan Safety 2 extend median dwell to 5.7 days. Ultrasound-guided placement has broadened clinical acceptance, and antimicrobial polyurethane upgrades further differentiate offerings. As outpatient infusion volumes swell, peripheral innovations are positioned to gain additional vascular access devices market traction.

Medication administration commanded 39.89% of 2024 revenue, underlining the indispensable role of safe intravenous drug delivery. Complex biologics, chemotherapy cocktails and high-osmolar solutions necessitate robust central lines and ports capable of repeated access without integrity loss. Coated lumens and pressure-tolerant hubs have become standard, supporting price premiums.

Diagnostics and testing is forecast to grow at a 7.97% CAGR as precision-medicine protocols demand serial biomarker sampling. Point-of-care devices shorten turnaround times, spurring hospitals to favor catheters with low hemolysis rates and easy blood-draw access. Manufacturers integrating multi-lumen configurations and AI-optimized geometries offer tangible workflow savings, strengthening competitive positioning within the vascular access devices market.

The Vascular Access Device Market is Segmented by Device Type (Central Vascular Access Devices and Peripheral Vascular Access Devices), Application (Medication or Drug Administration, Fluid and Nutrition Administration, and More), End User (Hospitals & Clinics, and More), Material (Polyurethane, Silicone, and Others), and Geography (North America and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40.21% of 2024 revenue on the back of sophisticated healthcare infrastructure and an insurance mix that rewards infection-reduction technologies. BD invested more than USD 10 million in 2024 to expand U.S. catheter production, adding hundreds of millions of units annually and reinforcing domestic supply resilience. Terumo earmarked USD 30 million for Angio-Seal capacity in Puerto Rico, underscoring the region's manufacturing pull.

Asia-Pacific is projected to post an 8.23% CAGR through 2030, reflecting rising chronic disease prevalence and healthcare spending. China's shift to value-based procurement is exerting price pressure, yet local champions eye export markets to offset domestic margin compression. Japan-headquartered Terumo reported that its Rika mid-clamp platform is now installed in 98 centers across the region, nearing its 100-site milestone.

Europe maintains a robust installed base driven by strict infection-prevention mandates and early HTA adoption. Meanwhile, Middle Eastern health-system build-outs and South American economic recovery create pockets of high growth, especially where public insurers support outpatient infusion. Ongoing geopolitical frictions and raw-material constraints are encouraging firms to develop multi-hub sourcing models so the vascular access devices market can meet varied regional demand without disruption.

- Beckton Dickinson

- Teleflex

- ICU Medical (inc. Smiths Medical)

- B. Braun

- Baxter

- Fresenius

- Medtronic

- Terumo Corp.

- Nipro Medical Corp.

- Siemens Healthineers

- AngioDynamics

- Cook Group

- Access Vascular Inc.

- Vygon

- Merit Medical Systems

- Delta Med SpA

- Poly Medicure Ltd.

- Argon Medical Devices

- Vyaire Medical

- Sam Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising burden of chronic diseases & high IV-therapy demand

- 4.2.2 Growth in chemotherapy procedures & hospitalization

- 4.2.3 Increasing pediatric & neonatal vascular access

- 4.2.4 Adoption of ultrasound-guided DIVA solutions

- 4.2.5 Expansion of home & community infusion therapy

- 4.2.6 Favorable reimubursement policies and guidelines

- 4.3 Market Restraints

- 4.3.1 Catheter-associated bloodstream infections (CLABSI)

- 4.3.2 Stringent regulatory scrutiny & product recalls

- 4.3.3 Alternate long-acting drug-delivery routes

- 4.3.4 Medical-grade PU & silicone supply constraints

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Central Vascular Access Devices

- 5.1.1.1 Peripherally-Inserted Central Catheters (PICCs)

- 5.1.1.2 Non-tunnelled Catheters

- 5.1.1.3 Tunnelled Catheters

- 5.1.1.4 Other Central Vascular Access Devices

- 5.1.2 Peripheral Vascular Access Devices

- 5.1.2.1 Peripheral IV Catheters (PIVC)

- 5.1.2.2 Midline Catheters

- 5.1.2.3 Other Peripheral Vascular Access Devices

- 5.1.1 Central Vascular Access Devices

- 5.2 By Application

- 5.2.1 Medication or Drug Administration

- 5.2.2 Fluid and Nutrition Administration

- 5.2.3 Blood and Blood-Product Transfusion

- 5.2.4 Diagnostics and Testing

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgery Centers

- 5.3.3 Others

- 5.4 By Material

- 5.4.1 Polyurethane

- 5.4.2 Silicone

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Becton, Dickinson and Company (BD)

- 6.3.2 Teleflex Inc.

- 6.3.3 ICU Medical (inc. Smiths Medical)

- 6.3.4 B. Braun SE

- 6.3.5 Baxter International Inc.

- 6.3.6 Fresenius Medical Care AG & Co. KGaA

- 6.3.7 Medtronic plc

- 6.3.8 Terumo Corp.

- 6.3.9 Nipro Medical Corp.

- 6.3.10 Siemens Healthineers

- 6.3.11 AngioDynamics Inc.

- 6.3.12 Cook Medical

- 6.3.13 Access Vascular Inc.

- 6.3.14 Vygon SA

- 6.3.15 Merit Medical Systems

- 6.3.16 Delta Med SpA

- 6.3.17 Poly Medicure Ltd.

- 6.3.18 Argon Medical Devices

- 6.3.19 Vyaire Medical

- 6.3.20 Sam Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment