PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836684

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836684

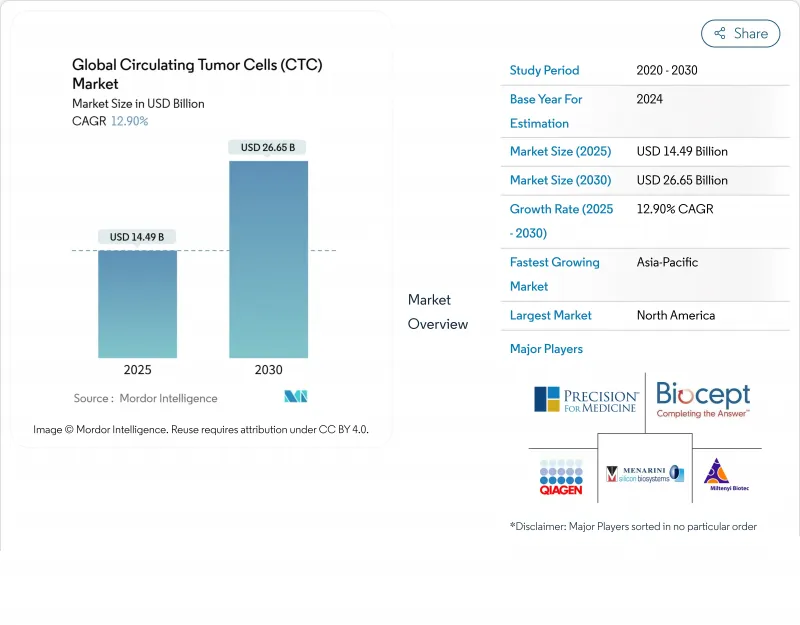

Circulating Tumor Cells (CTC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The circulating tumor cells market stands at USD 12.85 billion in 2025 and is on track to reach USD 25.36 billion by 2030, supported by a 14.56% CAGR across 2025-2030.

Demand rises as oncologists shift from invasive tissue biopsies to real-time liquid biopsy tools that capture tumor heterogeneity, trace resistance patterns, and guide rapid therapy changes. Momentum builds around microfluidic platforms that secure higher cell-capture yields without compromising viability, while artificial-intelligence image analysis drives faster interpretation and better accuracy. Asia Pacific registers the strongest uptrend because rising cancer incidence, public screening programs, and venture capital funding shorten technology adoption cycles. Strategy leaders favor alliances with pharmaceutical sponsors so that CTC assays become embedded companion diagnostics, creating long-term reagent demand and locking in the circulating tumor cells market across hospital networks.

Global Circulating Tumor Cells (CTC) Market Trends and Insights

Increasing Prevalence of Cancer

Cancer incidence is projected to climb 76.6% and deaths 89.7% by 2050, with the burden most acute in developing regions where mortality-to-incidence ratios can be 2.5 times higher. The United States anticipates 2.04 million new cases and 618,120 deaths in 2025. This trend fuels adoption of CTC tests that deliver early alerts and track therapeutic efficacy more quickly than periodic imaging. Hospitals and outpatient centers integrate these assays into routine follow-up schedules, boosting recurring revenues across the circulating tumor cells market.

Rising Demand for Precision Medicine and Companion Diagnostics

The FDA lists more than 60 cleared companion diagnostics, many of which incorporate liquid biopsy markers. UnitedHealthcare now reimburses CTC tests when tissue sampling is not feasible. Clinicians value intact cells because they reveal phenotypic and genotypic traits that guide therapy selection at each treatment cycle, reinforcing platform relevance in the circulating tumor cells market.

High Cost of CTC Instruments and Consumables

Capital investments for automated platforms range between USD 250,000 and USD 500,000 and reagent packs often exceed USD 1,000 per assay. These expenses exceed budget ceilings in many public hospitals, delaying adoption. Vendors combat sticker shock with leasing contracts and reagent-rental models, yet the economic hurdle persists and weighs on near-term uptake in the circulating tumor cells market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Improvements in CTC Isolation and Detection

- Expanding Venture Capital and Government Funding

- Technical Complexity and Lack of Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Detection and enrichment systems generated 59.2% of circulating tumor cells market revenue in 2024. These platforms form the backbone of every workflow because they separate rare tumor cells from billions of blood cells. The circulating tumor cells market size for detection technologies is poised to rise steadily as microfluidic chip designs capture intact cells with higher viability. Novel laser-induced forward-transfer microfiltration reaches 88% capture with 81.3% viability, supporting single-cell sequencing studies.

The analysis/characterization segment grows the fastest at a 16.96% CAGR to 2030. Advances in single-cell multi-omics allow simultaneous DNA, RNA, and protein profiling in individual CTCs revealing drivers of resistance that tissue biopsies may overlook. AI image classifiers shorten turnaround times and reduce manual review errors, making advanced analytics accessible to community labs. Together these capabilities deepen the clinical value proposition and sustain premium pricing inside the circulating tumor cells market.

Kits and reagents held 63.54% of circulating tumor cells market revenue in 2024 because every test requires single-use antibody cocktails, magnetic beads, and staining dyes. Manufacturers roll out reagent bundles targeting epithelial-mesenchymal transition markers which expands utility across metastatic disease.

Software and services rise the quickest at a 15.84% CAGR through 2030. Cloud platforms host secure image libraries, machine-learning models, and automated reporting dashboards. Academic groups share annotated cell images to refine algorithms which improves sensitivity in low-signal samples. Subscription analytics create fresh revenue layers and reinforce customer lock-in within the circulating tumor cells market.

The Circulating Tumor Cells (CTC) Market Report is Segmented by Technology (CTC Enrichment Methods, CTC Analysis/Characterization), Product (Kits and Reagents, Instruments and Devices, Blood Collection Tubes, Software and Services), Specimen (Blood, Bone Marrow, and More), Application (Clinical, Research, and More), End User (Hospitals and Clinics, Diagnostic Laboratories, Research & Academic Institutes, and More), and Geography.

Geography Analysis

North America commanded 44.28% of circulating tumor cells market revenue in 2024. The region benefits from sophisticated oncology centers, robust payer frameworks, and wide research funding. The FDA continually enlarges its companion diagnostic list which inspires hospital adoption. Rising cancer incidence, projected at two million new US cases in 2025, ensures consistent test volume. Canada shows parallel trends with provincial programs piloting liquid biopsy reimbursement to offset imaging costs.

Europe ranks second. Research networks like the European Liquid Biopsy Society coordinate protocol standardization and proficiency testing across Germany, France, and the United Kingdom. These countries host public-private consortia that evaluate CTC counts alongside radiology data to refine response criteria. Eastern European health ministries modernize oncology departments and increasingly import turnkey CTC analyzers which lifts regional revenues within the circulating tumor cells market.

Asia Pacific is the fastest climber, locked on a 16.06% CAGR to 2030. China directs state and venture capital toward microfluidic manufacturing which lowers platform cost for domestic hospitals. The City University of Hong Kong microfluidics system has already spread to fifty hospitals and inspires further provincial rollouts. Japan and South Korea incorporate continuous centrifugal chips in national cancer centers, while India's private labs invest in reagent-rental models to expand access. Government screening mandates and population size amplify growth potential across the circulating tumor cells market.

The Middle East and Africa along with South America represent emerging opportunities. Saudi Arabia and the United Arab Emirates build specialist cancer institutes equipped with CTC suites as part of national health strategies. Brazil adds liquid biopsy modules to leading oncology hospitals in Sao Paulo and Rio de Janeiro. International aid programs bundle compact CTC analyzers with training workshops to improve diagnostic equity and lay the foundation for longer-term expansion.

- Acro Biosystems

- Advanced Cell Diagnostics, Inc.

- ANGLE plc (Parsortix)

- Biolidics Limited

- Bio-Techne

- BioView

- Cell Microsystems (Fluxion Biosciences, Inc.)

- CellCarta

- Creatv MicroTech, Inc.

- Exact Sciences

- LungLIfe AI, Inc.

- Menarini

- Miltenyi Biotec

- NeoGenomics Laboratories

- Oncocyte Corporation

- Precision Medicine Group, LLC (ApoCell, Inc.)

- QIAGEN

- RareCyte, Inc.

- Sysmex Corporation (Sysmex Inostics GmbH)

- Thermo Fisher Scientific

- Yishan Biotechnology Co., Ltd. (Surexam)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Cancer

- 4.2.2 Rising Demand for Precision Medicine and Companion Diagnostics

- 4.2.3 Technological Improvements in CTC Isolation and Detection

- 4.2.4 Expanding Venture Capital and Government Funding for Oncology Diagnostics

- 4.2.5 AI-Enabled Microfluidic Chips and Single-Cell Multi-Omics Sequencing

- 4.3 Market Restraints

- 4.3.1 High Cost of CTC Instruments and Consumables

- 4.3.2 Technical Complexity and Lack of Standardization

- 4.3.3 Competitive Threat from ctDNA and Other Liquid Biopsy Analytes

- 4.3.4 Limited Awareness and Skilled Workforce in Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 CTC Enrichment Methods

- 5.1.1.1 Positive Enrichment

- 5.1.1.2 Negative Enrichment

- 5.1.1.3 Size-Based Isolation

- 5.1.1.4 Density-Based Separation

- 5.1.1.5 Immunomagnetic Separation

- 5.1.1.6 Microfluidic Chip-Based

- 5.1.1.7 Other Enrichment Methods

- 5.1.2 CTC Detection Methods

- 5.1.2.1 Immunocytochemical Technology

- 5.1.2.2 Molecular (RNA)-Based Technology

- 5.1.2.3 Imaging-Based Technology

- 5.1.2.4 PCR-Based Technology

- 5.1.2.5 SERS-Based Technology

- 5.1.2.6 Other Detection Methods

- 5.1.3 CTC Analysis/Characterization

- 5.1.3.1 Single-Cell Sequencing

- 5.1.3.2 Protein Expression Analysis

- 5.1.3.3 Epigenetic Profiling

- 5.1.1 CTC Enrichment Methods

- 5.2 By Product

- 5.2.1 Kits & Reagents

- 5.2.2 Instruments and Devices

- 5.2.3 Blood Collection Tubes

- 5.2.4 Software and Services

- 5.3 By Specimen

- 5.3.1 Blood

- 5.3.2 Bone Marrow

- 5.3.3 Other Body Fluids (CSF, Urine)

- 5.4 By Application

- 5.4.1 Clinical

- 5.4.1.1 Early Cancer Screening

- 5.4.1.2 Prognostic and Predictive Biomarkers

- 5.4.1.3 Therapy Monitoring and Minimal Residual Disease

- 5.4.2 Research

- 5.4.2.1 Drug Development and Companion Diagnostics

- 5.4.2.2 Cancer Stem Cell and EMT Studies

- 5.4.3 Other Applications

- 5.4.1 Clinical

- 5.5 By End User

- 5.5.1 Hospitals and Clinics

- 5.5.2 Diagnostic Laboratories

- 5.5.3 Research and Academic Institutes

- 5.5.4 Biopharmaceutical Companies

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 ACROBiosystems

- 6.4.2 Advanced Cell Diagnostics, Inc.

- 6.4.3 ANGLE plc (Parsortix)

- 6.4.4 Biolidics Limited

- 6.4.5 Bio-Techne

- 6.4.6 BioView

- 6.4.7 Cell Microsystems (Fluxion Biosciences, Inc.)

- 6.4.8 CellCarta

- 6.4.9 Creatv MicroTech, Inc.

- 6.4.10 Exact Sciences Corporation

- 6.4.11 LungLIfe AI, Inc.

- 6.4.12 Menarini Silicon Biosystems

- 6.4.13 Miltenyi Biotec

- 6.4.14 NeoGenomics Laboratories

- 6.4.15 Oncocyte Corporation

- 6.4.16 Precision Medicine Group, LLC (ApoCell, Inc.)

- 6.4.17 QIAGEN

- 6.4.18 RareCyte, Inc.

- 6.4.19 Sysmex Corporation (Sysmex Inostics GmbH)

- 6.4.20 Thermo Fisher Scientific Inc.

- 6.4.21 Yishan Biotechnology Co., Ltd. (Surexam)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment