PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836688

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836688

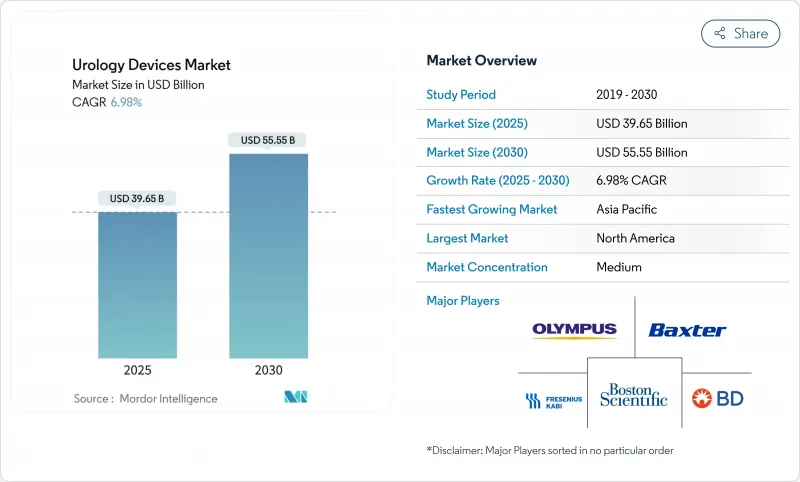

Urology Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The urology devices market is valued at USD 39.65 billion in 2025 and is forecast to reach USD 55.55 billion by 2030, expanding at a 6.98% CAGR.

Rising life expectancy is enlarging the patient base for urological disorders, while minimally invasive and robotic technologies shorten recovery times and lift procedure volumes. Home-based dialysis and self-catheterization are migrating treatments away from hospitals, and single-use devices are lowering infection risks that once constrained outpatient growth. Robotics, thulium fiber lasers, and AI-guided imaging systems justify premium pricing, and regulatory agencies in the United States and Europe are accelerating approvals for breakthrough platforms such as burst wave lithotripsy and AI-assisted robotic systems. Against this backdrop, the urology devices market continues to draw investment even as venture funding in broader med-tech contracts.

Global Urology Devices Market Trends and Insights

High Incidence of Urologic Conditions

Kidney stones affect about 40 million men in the United States, underpinning sustained demand for lithotripsy devices and disposable ureteroscopes. Benign prostatic hyperplasia eventually impacts 8 of every 10 men, broadening the addressable base for minimally invasive treatments. Urinary incontinence afflicts roughly 30 million adults, fueling uptake of neuromodulation implants. Because these conditions require repeated or lifelong interventions, they provide recurring revenue streams that stabilize the urology devices market throughout economic cycles.

Rising Geriatric Population

Longer life expectancy is boosting the share of older adults who often present with multifactorial urological issues. Health-system planners are reallocating procedure volumes from inpatient wards to ambulatory settings in order to manage cost pressures while accommodating elderly patients' need for shorter stays . Manufacturers respond by designing devices that suit frail physiology and support at-home monitoring, reinforcing the long-run expansion of the urology devices market.

Stringent Global Approval and Post-Market Surveillance Requirements

The FDA's forthcoming Quality System Regulation amendments align with ISO 13485 but force manufacturers to retrofit documentation and audit practices, raising compliance costs. Post-market surveillance under 21 CFR Part 822 demands long-horizon follow-up studies, a burden that weighs heaviest on small innovators. Similar toughened regimes from ANVISA and the EU delay launches and reduce the pace at which the urology devices market can absorb new entrants.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Minimally Invasive and Robotic Surgery

- Preference for Single-Use Endoscopes and Catheters

- High Capital and Procedure Costs of Advanced Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Instruments account for 67.58% of the urology devices market in 2024 because robotic systems, dialysis machines, and thulium lasers require sizable upfront purchases. Consumables and accessories are growing at an 8.54% CAGR as single-use ureteroscopes and catheters create predictable reorder cycles. Endoscopic visualization towers, lithotripters, and urodynamic carts anchor capital budgets, but revenue predictability now tilts toward disposables that match every case. The instruments subcategory remains pivotal when facilities pursue high-complexity surgeries that demand integrated imaging and navigation. Dialysis consoles like Fresenius 5008X, cleared to deliver high-volume hemodiafiltration, illustrate how incremental upgrades sustain replacement demand. On the consumables side, biodegradable ureteral stents and antimicrobial coatings are differentiating brands without adding reprocessing burdens.

In this context, the urology devices market size for consumables is on track to carve a larger revenue slice, especially in regions where cost-per-procedure transparency drives buyer preference. Instruments will keep dominating absolute value, but their growth rate will trail that of accessories because budget committees lengthen approval cycles for large capital outlays. Facilities that own older holmium YAG lasers increasingly redeploy them to lower-acuity cases while allocating fresh capital to thulium platforms, reinforcing a barbell spending pattern inside the urology devices market.

Minimally invasive surgery devices held 46.13% share of the urology devices market size in 2024, yet robotic systems are producing the steepest curve at a 10.66% CAGR. New entrants such as Medtronic's Hugo are broadening customer choice beyond Intuitive Surgical and, by offering modular components, lowering adoption thresholds. AI modules layer computer vision onto optics, translating video feeds into actionable prompts that help shorten learning curves. Burst wave lithotripsy, delivered via compact ultrasound emitters, is further expanding the non-invasive toolkit and may cannibalize traditional shock-wave systems over the next decade.

Looking ahead, additive manufacturing is enabling patient-specific implants such as biodegradable ureteral stents with controlled elution profiles. Integration between imaging AI and robotic arms is expected to automate sub-steps like calyx entry during percutaneous nephrolithotomy, refining efficiency benchmarks. The convergence of these modalities should deepen overall penetration and protect pricing power across the urology devices market.

The Urology Devices Market Report is Segmented by Product (Instruments [Dialysis Devices and More], Consumables & Accessories [Biopsy Devices and More]), Technology (Minimally-Invasive Surgery Devices, Robotic Urologic Surgery Systems and More), Diseases (Kidney Diseases, Urinary Stones, and More), End User (Hospitals & Clinics, Dialysis Centres and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserved 39.11% global share in 2024 due to robust reimbursement, rapid regulatory pathways, and a well-entrenched installed base of robotic platforms. The FDA's Breakthrough Device Program expedites access for technologies such as burst wave lithotripsy, allowing early revenue capture that feeds back into R&D budgets. The United States is also reallocating routine diagnostics into ambulatory venues, giving manufacturers new channels to place compact endoscopy towers. Canada and Mexico generate incremental growth through cross-border purchasing agreements that standardize device specifications and shorten procurement cycles.

Asia-Pacific is the fastest climber with a 9.12% CAGR through 2030. Aging populations in China, Japan, and South Korea expand procedure demand while public-sector reforms unlock capital budgets for advanced lasers and imaging. Olympus chose South Korea to launch next-generation BPH devices, a sign that multinational firms view the region as a proving ground for premium technologies. Venture financing pullbacks have lowered valuations, which may spur consolidation that helps well-capitalized incumbents accumulate regional footprints.

Europe is a mature but policy-driven market in which environmental legislation can reshape material choices overnight. The anticipated PFAS prohibition challenges suppliers of ePTFE-based catheters and vascular grafts, prompting accelerated research into fluorine-free coatings. Germany, France, and Italy remain demand anchors, yet hospitals here are steeply discounting high-volume consumables, pushing vendors to extract margin from value-added services. South America holds pockets of growth led by Brazil, where ANVISA's e-labeling push may lower localization costs, easing compliance for exporters. The Middle East invests heavily in specialist hospitals while many African states prioritize low-cost dialysis and catheterization solutions, presenting tiered opportunities for the urology devices market.

- Baxter

- Boston Scientific

- Beckton Dickinson

- Cook Group

- Stryker

- Fresenius

- Intuitive Surgical

- Karl Storz

- Medtronic

- Olympus

- Coloplast

- Teleflex

- Cardinal Health

- Siemens Healthineers

- Dornier MedTech

- Richard Wolf

- Lumenis

- ConvaTec Group plc

- Terumo

- HuiZhou MIMED Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Incidence Of Urologic Conditions

- 4.2.2 Rising Geriatric Population

- 4.2.3 Technological Advancements In Minimally-Invasive & Robotic Surgery

- 4.2.4 Preference For Single-Use Endoscopes & Catheters

- 4.2.5 AI-Enabled Imaging & Navigation Improving Procedural Throughput

- 4.2.6 Home-Based Dialysis & Self-Catheterization Enabled By Tele-Urology

- 4.3 Market Restraints

- 4.3.1 Stringent Global Approval & Post-Market Surveillance Requirements

- 4.3.2 High Capital & Procedure Costs Of Advanced Systems

- 4.3.3 Sustainability Pressure On Single-Use Plastics & PFAS Coatings

- 4.3.4 Shortage Of Trained Urology Surgeons & Nurses In Emerging Markets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Instruments

- 5.1.1.1 Dialysis Devices

- 5.1.1.2 Endoscopes & Endovision Systems

- 5.1.1.3 Lasers & Lithotripsy Devices

- 5.1.1.4 Robotic Surgical Systems

- 5.1.1.5 Urodynamic Systems

- 5.1.1.6 Imaging & Navigation Devices

- 5.1.1.7 Bladder Management Devices

- 5.1.1.8 Other Instruments

- 5.1.2 Consumables & Accessories

- 5.1.2.1 Dialysis Consumables

- 5.1.2.2 Guidewires & Urinary Catheters

- 5.1.2.3 Stents (Ureteral & Urethral)

- 5.1.2.4 Biopsy Devices

- 5.1.2.5 Disposable Ureteroscopes

- 5.1.2.6 Continence Care Products

- 5.1.2.7 Other Consumables & Accessories

- 5.1.1 Instruments

- 5.2 By Technology

- 5.2.1 Minimally-Invasive Surgery Devices

- 5.2.2 Robotic Urologic Surgery Systems

- 5.2.3 AI-enabled Imaging & Navigation

- 5.2.4 3-D Printed & Patient-specific Implants

- 5.2.5 Other Emerging Technologies

- 5.3 By Disease

- 5.3.1 Kidney Diseases

- 5.3.2 Urological Cancer & BPH

- 5.3.3 Urinary Stones (Urolithiasis)

- 5.3.4 Pelvic Organ Prolapse

- 5.3.5 Urinary Incontinence

- 5.3.6 Other Diseases

- 5.4 By End-User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Dialysis Centres

- 5.4.3 Ambulatory Surgical Centres

- 5.4.4 Home-care Settings

- 5.4.5 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Baxter International Inc.

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Becton, Dickinson and Company

- 6.3.4 Cook Medical Incorporated

- 6.3.5 Stryker Corporation

- 6.3.6 Fresenius Medical Care AG & Co. KGaA

- 6.3.7 Intuitive Surgical Inc.

- 6.3.8 KARL STORZ SE & Co. KG

- 6.3.9 Medtronic plc

- 6.3.10 Olympus Corporation

- 6.3.11 Coloplast A/S

- 6.3.12 Teleflex Incorporated

- 6.3.13 Cardinal Health Inc.

- 6.3.14 Siemens Healthineers AG

- 6.3.15 Dornier MedTech GmbH

- 6.3.16 Richard Wolf GmbH

- 6.3.17 Lumenis Ltd.

- 6.3.18 ConvaTec Group plc

- 6.3.19 Terumo Corporation

- 6.3.20 HuiZhou MIMED Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment