PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836689

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836689

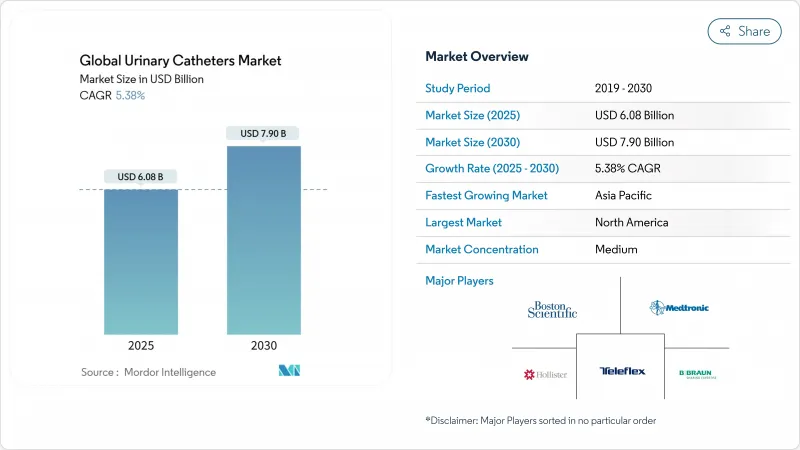

Global Urinary Catheters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The urinary catheters market reached USD 6.08 billion in 2025 and is forecast to climb to USD 7.90 billion by 2030, reflecting a 5.38% CAGR across the period 2025-2030.

Growth is supported by population ageing, rising urinary incontinence prevalence, and continuous product innovation that blends antimicrobial coatings with digital monitoring features. Value-based care incentives are steering hospitals toward premium catheters that cut infection risk, while home-care adoption is accelerating as reimbursement expands. Regulatory demands such as the EU Medical Device Regulation and the planned DEHP phase-out are encouraging sustainable biomaterials, lifting development costs but also opening niches for eco-friendly designs. Competitive intensity is heightening as large incumbents acquire, partner or launch new coating chemistries to retain share in an increasingly outcomes-driven market landscape.

Global Urinary Catheters Market Trends and Insights

Rising Prevalence of Urinary Incontinence

Nursing homes report 76.5% incontinence prevalence, underscoring sustained demand for indwelling, intermittent and external devices . Functional incontinence now comprises 45.5% of cases, widening the addressable pool beyond older adults. Associated complications such as dermatitis and falls elevate care costs, positioning catheters as essential therapeutic tools rather than disposable commodities. Annual nursing-home expenditures tied to incontinence approach USD 5 billion, prompting insurers to back products that lower secondary morbidities. Higher diagnosis rates in skilled-nursing facilities versus home-care settings accentuate the importance of robust infection-resistant designs. As prevalence rises among community-dwelling seniors, manufacturers see clear momentum in supplying self-catheterization kits bundled with digital education.

Growing Geriatric Population

Benign prostatic hyperplasia (BPH) cases more than doubled from 1990 to 2022, reaching 112.5 million and affecting 80% of men older than 70. Spinal cord injury incidence of 23.77 per million adds decades-long catheter dependence, while population growth contributes nearly 95% of the uplift in case volumes. These overlapping morbidities create complex multi-indication scenarios that demand device portfolios tuned to neurogenic bladder, post-operative retention and chronic dysfunction in the same patient. As health systems grapple with multimorbidity in ageing cohorts, procurement priorities tilt toward versatile platforms that streamline inventory while satisfying diverging clinical needs.

High Risk & Cost Burden of CAUTI

Intensive-care CAUTI rates average 8.83% and extend hospital stays, attracting financial penalties under value-based purchasing. Hospitals are rolling out nurse-led removal algorithms that trimmed retention from 30% to 6.7% in hip-fracture patients, demonstrating that prevention can erode procedure volume. Wide disparity between high- and low-income countries means adoption curves for antimicrobial catheters remain uneven. Payors favor devices with robust infection data, yet spending caps push providers to shorten catheter duration, dampening unit sales even as premium ASPs hold.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Coatings & Biomaterials

- Increasing Surgical Procedure Volumes

- Availability of Non-Catheter Therapies for Incontinence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Indwelling Foley devices retained 52.13% revenue in 2024 and remain the cornerstone of acute in-patient care. Intermittent catheters, however, are forecast to grow 5.91% annually, propelled by evidence of lower infection incidence and higher patient comfort. External catheters occupy a niche yet benefit from high user-satisfaction scores and clear reimbursement coding in the United States.

Design competition now hinges on hydrophilic coatings, integrated lubrication packets and antimicrobial alloys. ConvaTec reports that hydrophilic models already contribute 60% of Continence Care turnover, and new HCPCS reimbursement codes effective 2026 are expected to boost premium adoption. Engineering advances such as micro-hole drainage channels lower residual volumes to under 6 mL, a benchmark that supports patient safety in both hospital and home settings.

Female users generated 65.52% of 2024 demand due to a 61% prevalence of urinary incontinence in women older than 50. Male demand is projected to advance 6.23% CAGR through 2030 as BPH and post-prostatectomy care require intermittent or temporary devices.

Innovation pathways diverge by anatomy. ConvaTec launched a women-specific intermittent line that is scaling across Europe following strong clinician acceptance. For male patients, clean intermittent self-catheterization yields fewer complications after BPH surgery versus indwelling alternatives. External male systems designed around latex-free sheaths are carving a preventive role by eliminating insertion trauma altogether, positioning the urinary catheters market for differential growth across gender lines.

The Urinary Catheters Market Report Segments the Industry Into by Product Type (Indwelling (Foley) Catheters, Intermittent Catheters, and More), Application (Benign Prostate Hyperplasia (BPH), Urinary Incontinence, and More), End User (Hospitals, Home-Care Settings, and More), Gender (Male and Female) and Geography. The Report Offers the Value (in USD) for the Above Segments.

Geography Analysis

North America contributed 40.61% of 2024 sales, underpinned by Medicare reimbursement for premium external systems and an estimated USD 11 billion national spend on urologic disorders. Streamlined 510(k) pathways facilitate innovation: recent clearances include wireless urodynamic platforms that eliminate diagnostic catheters, yet still spur follow-on treatment device uptake.

Europe is shaped by stringent regulation. Half of local manufacturers trimmed product lines due to MDR certification costs, concentrating share with well-capitalized multinationals. The DEHP restriction effective July 2030 accelerates the shift to bioplastic substrates despite 20-40% higher input costs . Device makers with early-stage green portfolios are likely to capture hospital tenders that favor sustainability metrics embedded in purchasing frameworks.

Asia-Pacific is on track for a 7.45% CAGR, propelled by rising procedure volumes, expanding insurance coverage and a domestic medtech sector expected to top USD 225 billion by 2030. China's spinal cord injury caseload grew 63% since 1990, translating into sustained intermittent-catheter demand. Emerging hubs such as Taiwan show double-digit gains in catheter imports, benefiting firms that pair off-shore manufacturing with localized regulatory know-how. Diverse reimbursement rules, however, require tailored go-to-market playbooks to avoid pricing misalignment.

- Coloplast

- Becton Dickinson & Company (incl. C. R. Bard)

- B. Braun

- Teleflex

- Hollister

- Boston Scientific

- Convatec

- Amsino International

- CompactCath Inc.

- Cure Medical

- Cardinal Health

- Bactiguard AB

- Pennine Healthcare

- Go Medical Industries

- Medical Device Innovations Group

- Medtronic

- UroDev Medical

- WellSpect Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of urinary incontinence

- 4.2.2 Growing geriatric population

- 4.2.3 Technological advances in coatings & biomaterials

- 4.2.4 Increasing surgical procedure volumes

- 4.2.5 E-commerce-enabled rise in self-catheterisation

- 4.2.6 Introduction of female external urine-management devices

- 4.3 Market Restraints

- 4.3.1 High risk & cost burden of CAUTI

- 4.3.2 Availability of non-catheter therapies for incontinence

- 4.3.3 Emerging single-use plastics regulation

- 4.3.4 Limited reimbursement for premium smart/antimicrobial catheters

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Indwelling (Foley) Catheters

- 5.1.2 Intermittent Catheters

- 5.1.3 External/Condom Catheters

- 5.2 By Gender

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Application

- 5.3.1 Urinary Incontinence

- 5.3.2 Benign Prostate Hyperplasia

- 5.3.3 Spinal Cord Injury

- 5.3.4 Post-operative Urinary Retention

- 5.3.5 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Long-term Care Facilities

- 5.4.3 Home-care Settings

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Coloplast A/S

- 6.3.2 Becton Dickinson & Company (incl. C. R. Bard)

- 6.3.3 B. Braun Melsungen AG

- 6.3.4 Teleflex Inc.

- 6.3.5 Hollister Inc.

- 6.3.6 Boston Scientific Corp.

- 6.3.7 ConvaTec Group PLC

- 6.3.8 Amsino International

- 6.3.9 CompactCath Inc.

- 6.3.10 Cure Medical LLC

- 6.3.11 Cardinal Health

- 6.3.12 Bactiguard AB

- 6.3.13 Pennine Healthcare

- 6.3.14 Go Medical Industries

- 6.3.15 Medical Device Innovations Group

- 6.3.16 Medtronic plc

- 6.3.17 UroDev Medical

- 6.3.18 WellSpect Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment