PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836691

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836691

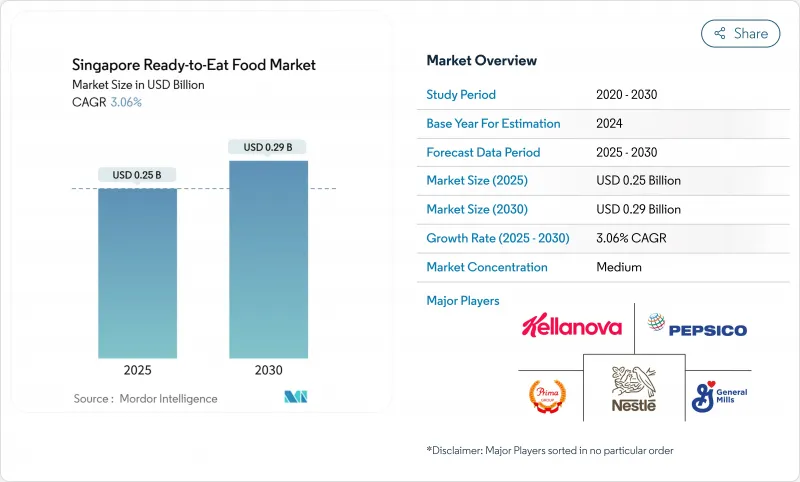

Singapore Ready-to-Eat Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Singapore Ready-to-Eat Food Market, valued at USD 0.25 billion in 2025, is expected to reach USD 0.29 billion by 2030, growing at a CAGR of 3.06%.

The market's growth is shaped by Singapore's multicultural environment, where consumers are increasingly experimenting with diverse cuisines and seeking convenient meal solutions that align with their busy lifestyles. Modern consumers, particularly Millennials and Generation Z, demand healthier, personalized, and natural products without compromising on taste or nutritional value. While these demographics drive demand for premium ready-to-eat options, they often lack the time or culinary skills for traditional meal preparation, creating opportunities for high-quality convenience foods that can be consumed at any mealtime. This combination of convenience, health consciousness, and cultural diversity positions Singapore's ready-to-eat food market for sustained growth in the coming years.

Singapore Ready-to-Eat Food Market Trends and Insights

Rising Adoption of Western Diets Increases Ready-To-Eat Food Consumption

Singapore's cultural shift toward Western dietary patterns is driving the ready-to-eat (RTE) food market growth, particularly among younger consumers who value convenience over traditional cooking methods. This transition is evident in the increased consumption of processed breakfast cereals, instant meals, and snack foods. The trend is further amplified by Singapore's status as a regional financial hub, with its expanding expatriate population rising from 1.47 million in 2021 to 1.86 million in 2024, according to the Singapore Department of Statistics . Both expatriate communities and local professionals demonstrate similar consumption patterns, often choosing packaged convenience foods over traditional hawker center meals. This market dynamic drives manufacturers to introduce Western-style ready meals while incorporating local flavor preferences, as Singapore continues to serve as a strategic testing ground for regional expansion.

Dual-Income Households Seek Time-Efficient Meal Solutions

Singapore's high labor force participation rate, particularly among women, creates sustained demand for time-saving meal solutions. The prevalence of dual-income households, coupled with service sector employment involving irregular hours, makes traditional cooking schedules impractical. According to the Singapore Department of Statistics, the median monthly household employment income among resident employed households increased by 3.9% from SGD 10,869 in 2023 to SGD 11,297 in 2024 . This rise in disposable income, combined with evolving household formation patterns favoring smaller family units, drives the demand for premium ready-to-eat options. These products offer restaurant-quality experiences in convenient packaging formats while maintaining nutritional quality, effectively substituting traditional meal preparation during weekdays.

Rising Health Awareness Reduces Consumer Demand for Processed Ready-to-Eat Food

Health-conscious consumers in Singapore increasingly scrutinize processed food consumption, driven by government health campaigns and rising awareness of diet-related diseases. The Singapore Food Agency's regulatory framework for food additives and the Health Promotion Board's initiatives, including the Healthier Choice Symbol and Nutri-Grade marks, reflect growing consumer concerns about preservatives and artificial ingredients. These measures, along with the promotion of low-sodium salt and the prohibition of partially hydrogenated oils, challenge manufacturers to balance shelf stability with clean-label demands. This health consciousness particularly impacts traditional ready-meal categories that rely on sodium and preservatives for flavor and shelf life, potentially reducing the consumption of ultra-processed foods in the market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Organic and Vegan Ready-To-Eat Food Options Meet Consumer Demand

- E-Commerce Growth Accelerates Ready-To-Eat Food Sales

- Traditional Preference for Fresh-Cooked Meals Limits Ready-to-Eat Food Market Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ready meals dominate Singapore's convenience food market with a 35.66% share in 2024, demonstrating the segment's maturity in delivering complete meal solutions. This prominence is particularly evident among dual-income households where traditional cooking becomes impractical, as Ready Meals provide balanced nutrition without preparation effort. The segment's success is further complemented by instant soups and snacks, which are projected to grow at a 7.04% CAGR through 2030, effectively meeting the demands of Singapore's snacking culture and irregular eating patterns.

Other segments, including instant breakfast/cereals and baked goods, maintain steady demand through health-conscious positioning and alignment with cafe culture. The convenience food market's evolution in Singapore demonstrates a clear shift toward premiumization, where consumers willingly pay higher prices for quality products that offer both convenience and nutritional benefits. This trend spans across all segments, from complete meal solutions to snacks and breakfast options, as consumers increasingly seek products that balance convenience with health considerations.

The Singapore Ready-To-Eat Meals Market Report is Segmented by Product Type (Instant Breakfast/Cereals, Instant Soups and Snacks, Ready Meals, Baked Goods, Meat Products, and Other Product Types) and Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialty Stores, Online Retail Stores, and Other Distribution Channels). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle S.A.

- General Mills Inc.

- PepsiCo Inc.

- Kellanova

- Prima Limited

- Conagra Brands Inc.

- Kraft Heinz Company

- McCain Foods Ltd.

- Unilever plc

- Nomad Foods Ltd.

- Hormel Foods Corp.

- Thai Union Group PCL

- Campbell Soup Company

- Nissin Foods Holdings Co. Ltd.

- Mondelez International Inc.

- Tyson Foods Inc.

- CJ CheilJedang Corp.

- Maruha Nichiro Corp.

- Ajinomoto Co., Inc.

- Charoen Pokphand Foods PCL (CP Foods)

- OTS Holdings Ltd.

- QAF Limited

- Impossible Foods Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Western Diets Increases Ready-To-Eat Food Consumption

- 4.2.2 Dual-Income Households Seek Time-Efficient Meal Solutions

- 4.2.3 Expanding Organic and Vegan Ready-To-Eat Food Options Meet Consumer Demand

- 4.2.4 Diverse Product Innovation Expands Consumer Market Reach

- 4.2.5 Modern Lifestyle Changes Create Demand for Convenient Food Options

- 4.2.6 E-Commerce Growth Accelerates Ready-To-Eat Food Sales

- 4.3 Market Restraints

- 4.3.1 Rising Health Awareness Reduces Consumer Demand for Processed Ready-to-Eat Food

- 4.3.2 Consumer Trust Declines Due to Preservatives and Additives in Products

- 4.3.3 Limited Cold Chain Infrastructure Restricts Distribution to Rural Markets

- 4.3.4 Traditional Preference for Fresh-Cooked Meals Limits Ready-to-Eat Food Market Growth

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Instant Breakfast/Cereals

- 5.1.2 Instant Soups and Snacks

- 5.1.3 Ready Meals

- 5.1.4 Baked Goods

- 5.1.5 Meat Products

- 5.1.6 Other Product Types

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience/Grocery Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 General Mills Inc.

- 6.4.3 PepsiCo Inc.

- 6.4.4 Kellanova

- 6.4.5 Prima Limited

- 6.4.6 Conagra Brands Inc.

- 6.4.7 Kraft Heinz Company

- 6.4.8 McCain Foods Ltd.

- 6.4.9 Unilever plc

- 6.4.10 Nomad Foods Ltd.

- 6.4.11 Hormel Foods Corp.

- 6.4.12 Thai Union Group PCL

- 6.4.13 Campbell Soup Company

- 6.4.14 Nissin Foods Holdings Co. Ltd.

- 6.4.15 Mondelez International Inc.

- 6.4.16 Tyson Foods Inc.

- 6.4.17 CJ CheilJedang Corp.

- 6.4.18 Maruha Nichiro Corp.

- 6.4.19 Ajinomoto Co., Inc.

- 6.4.20 Charoen Pokphand Foods PCL (CP Foods)

- 6.4.21 OTS Holdings Ltd.

- 6.4.22 QAF Limited

- 6.4.23 Impossible Foods Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK