PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836697

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836697

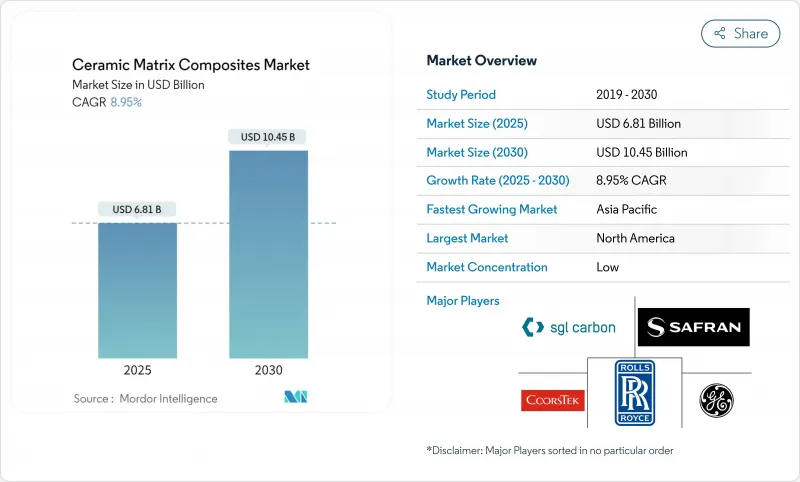

Ceramic Matrix Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global ceramic matrix composites market is valued at USD 6.81 billion in 2025 and is forecast to reach USD 10.45 billion by 2030, registering an 8.95% CAGR through the period.

Expansion rests on the material's ability to combine the toughness of metals with the heat resistance of ceramics, a balance that unlocks performance gains for aerospace engines, hypersonic systems, and industrial gas turbines. Investment in lightweight propulsion, stricter fuel-burning standards, adoption of variable-fuel turbines, and the search for longer-life high-temperature parts shape the current demand outlook. Cost-down progress in automated fiber placement and reactive melt infiltration is compressing cycle times and closing the cost gap with nickel super-alloys, while government grants for advanced-materials plants are de-risking capacity additions. A wider set of end users-from chemical processors to fusion-energy developers-now specify CMCs, reflecting a more diversified opportunity mix that supports long-term growth resilience.

Global Ceramic Matrix Composites Market Trends and Insights

Increasing Defense-Grade Thermal Barrier Applications

Defense agencies now treat thermal capability as a primary design filter. Hypersonic munitions programs in the United States require materials that remain structurally stable above 2,000 °C, a threshold that eliminates most super-alloys. Lockheed Martin's test series highlights the need for CMCs in electronics ruggedization and aero-shell protection. The premium prices defense contractors accept for survivability accelerate early CMC qualification, generating learning curves that benefit other sectors. Carbon-fiber reinforced silicon carbide composites have demonstrated reusable performance after multiple high-heat cycles, an advantage that shifts life-cycle cost equations.

Lightweight Vehicle Platforms Demand

Electric and autonomous vehicle programs pursue aggressive mass-reduction targets because every kilogram saved improves driving range and cooling efficiency. Ceramic matrix composites weigh up to 65% less than nickel-based alloys yet retain functional strength at exhaust temperatures. Demonstration ceramic gas turbines in Japan reached thermal efficiencies above 40% while cutting component weight by double-digit percentages. Automotive production volumes push suppliers toward near-net-shape processes such as automated fiber placement that convert hours-long layups into minute-level cycles.

High Production Cost vs. Super-Alloys

CMC parts still cost 3-5 times more than comparable metallic parts due to high-temperature fiber draw and lengthy infiltration steps. The SCANCUT project cut machining time by 70% through novel milling paths, and similar automation breakthroughs are narrowing the gap. Total cost of ownership improves as CMC lifetimes lengthen, but initial acquisition price remains a hurdle for price-sensitive power and automotive users. GE's USD 200 million Alabama facility targets cost parity at scale geaerospace.

Other drivers and restraints analyzed in the detailed report include:

- Growing Renewable Gas-Turbine Retrofits

- Hypersonic Vehicle R&D Acceleration

- Complex Multi-Step Manufacturing Routes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SiC/SiC composites held 55.19% ceramic matrix composites market share in 2024 and are projected to grow at an 11.05% CAGR to 2030. Integration of finer pitch fibers delivering strengths above 2 GPa has expanded their structural envelope. The ceramic matrix composites market size for SiC/SiC applications is forecast to rise sharply as new jet engine cores qualify shrouds, combustor liners, and nozzle extensions. Carbon/carbon systems maintain niches in rocket nozzles where oxidation can be controlled, and oxide/oxide grades gain traction in industrial heat exchangers that value inherent oxidation stability over peak temperature.

Process advances include nano-engineered interphases that mitigate fiber damage during thermal cycling. Mitsubishi Chemical Group's carbon-fiber-based C/SiC, qualified for 1,500 °C exposure, shows how hybrid chemistries extend temperature ceilings for space vehicles. The additive deposition of SiC slurry onto woven preforms makes complex cooling passages not feasible with legacy layups. Such innovations maintain the lead of the SiC/SiC family and attract investment from turbine primes.

The Ceramic Matrix Composites Market Report Segments the Industry by Product Type (C/C, C/SiC, Oxide/Oxide, and More), End-User Industry (Automotive, Aerospace, Defense, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Due to dense aerospace and defense ecosystems, North America commanded 37.96% of the ceramic matrix composites market revenue in 2024. The region houses vertically integrated supply chains that span SiC fiber draw, component layup, machining, and engine assembly. Government initiatives like the Institute for Advanced Composites Manufacturing Innovation funnel grants toward pilot lines, underpinning local capacity. Rolls-Royce and GE place multi-year orders that smooth demand cycles and justify further plant expansions.

Asia-Pacific delivers the fastest 10.84% CAGR through 2030 as China and Japan escalate strategic materials programs. National plans seek supply independence for high-performance fibers, with milestone targets set for 2035. Automotive electrification also stimulates regional demand for lightweight, thermally resilient parts. Lower labor costs and proactive subsidies enable competitive export pricing, positioning the region as a significant consumer and global ceramic matrix composites market supplier.

Europe maintains a steady share through turbine retrofits that support renewable-heavy grids and through new aircraft engine demonstrators such as Rolls-Royce UltraFan. EU research networks pool public and private funds to mature oxide-oxide grades suitable for industrial furnaces, widening application scope. Strict emission regulations create a positive policy environment for efficiency-raising materials like CMCs, reinforcing European demand.

- 3M

- applied thin films inc.

- CeramTec GmbH

- COIC

- CoorsTek Inc.

- General Electric Company

- KYOCERA Corporation

- LANCER SYSTEMS

- Mitsubishi Chemical Group Corporation

- Pratt & Whitney

- Rolls-Royce

- Safran

- SGL Carbon

- Starfire Systems Inc.

- TORAY INDUSTRIES, INC.

- UBE Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing defense-grade thermal barrier applications

- 4.2.2 Lightweight vehicle platforms demand

- 4.2.3 Increasing Application of Ceramic Matrix Composites in Defense Sector

- 4.2.4 Growing renewable gas-turbine retrofits

- 4.2.5 Hypersonic vehicle R&D acceleration

- 4.3 Market Restraints

- 4.3.1 High production cost vs. super-alloys

- 4.3.2 Complex multi-step manufacturing routes

- 4.3.3 Stricter fibre-dust emission norms

- 4.4 ValueChain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 C/C

- 5.1.2 C/SiC

- 5.1.3 Oxide/Oxide

- 5.1.4 SiC/SiC

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace

- 5.2.3 Defense

- 5.2.4 Energy & Power

- 5.2.5 Electrical & Electronics

- 5.2.6 Other End-User Industries (Medical, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 Nordic Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 applied thin films inc.

- 6.4.3 CeramTec GmbH

- 6.4.4 COIC

- 6.4.5 CoorsTek Inc.

- 6.4.6 General Electric Company

- 6.4.7 KYOCERA Corporation

- 6.4.8 LANCER SYSTEMS

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 Pratt & Whitney

- 6.4.11 Rolls-Royce

- 6.4.12 Safran

- 6.4.13 SGL Carbon

- 6.4.14 Starfire Systems Inc.

- 6.4.15 TORAY INDUSTRIES, INC.

- 6.4.16 UBE Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment