PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836699

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836699

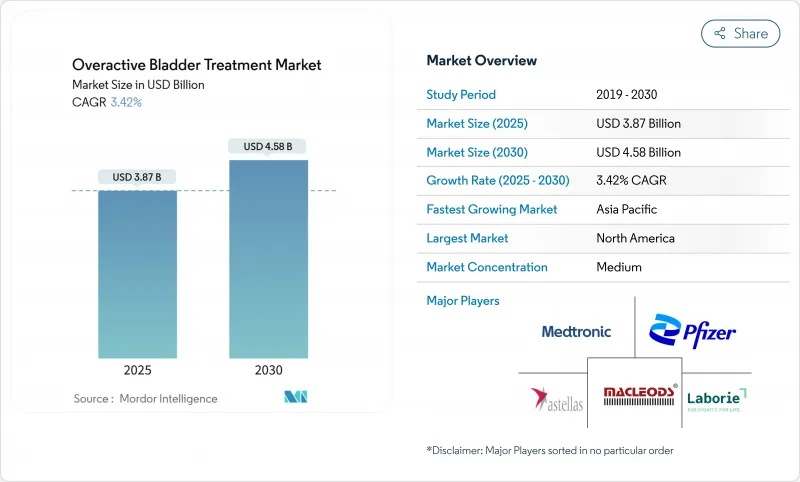

Overactive Bladder Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The overactive bladder treatment market was valued at USD 3.87 billion in 2025 and is forecast to reach USD 4.58 billion by 2030, advancing at a 3.42% CAGR.

Demand is sustained by population aging, the clinical shift toward B3-adrenergic agonists, and expanding device-based options. Anticholinergics still provide scale advantages but face cognitive-safety headwinds that accelerate prescribing changes. B3-agonists gain share on the back of new approvals, while reimbursement expansion for neuromodulation and botulinum toxin widens access to third-line care. Digital diagnostics further broaden reach, especially in regions with urologist shortages, and corporate consolidation is reshaping competitive dynamics in both pharma and devices.

Global Overactive Bladder Treatment Market Trends and Insights

Aging Population & Rising Prevalence of Urinary Disorders

People aged 65 years and older experience overactive bladder prevalence above 30%, compared with 16-18% in general adult cohorts. In Japan, roughly 12.4 million adults require symptom management, prompting payers to prioritize cost-effective care models. Similar demographic shifts in China, South Korea, and European countries enlarge the overactive bladder treatment market while encouraging health-system investment in urological capacity. As national insurance schemes expand to cover continence services, demand for pharmacologic and device-based therapies rises across all economic strata.

Adoption of B3-Adrenergic Agonists With Favorable Cognition Profile

Long-term studies link oxybutynin to a 12% higher dementia risk in women older than 65, accelerating clinician pivot toward B3-agonists. A 1.49-million-participant Japanese cohort confirmed lower cognitive risk with mirabegron and vibegron. The December 2024 FDA approval of vibegron for men with benign prostatic hyperplasia-related symptoms opens a new addressable population and reinforces the safety narrative.

Cognitive Safety Concerns of Chronic Anticholinergic Use

A Korean national cohort revealed increased dementia incidence with anticholinergics versus B3-agonists, triggering formulary re-ranking across insurance plans. U.S. Medicare now favors cognitive-sparing options, constraining legacy drug volumes while directing investment toward novel mechanisms. Clinicians adopt shared-decision tools that weigh symptom relief against cognitive risk, slowing anticholinergic unit sales.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Reimbursement for Neuromodulation & Botulinum Toxin in Asia

- Growth in Tele-Urology & Digital Diagnostics

- Patent Cliffs for Leading Antimuscarinics Dampening R&D Spend

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The overactive bladder treatment market size for anticholinergics reached USD 1.71 billion in 2024, equal to 44.35% of total revenue. Cost advantage and guideline familiarity sustain their lead, yet mounting cognitive concerns restrain growth. B3-agonists captured 22.9% in 2024 and are forecast to expand at an 8.25% CAGR, outpacing all other modalities. Vibegron's new indication for men with benign prostatic hyperplasia underpins this surge, while mirabegron's long-term data reinforce safety perceptions. Botulinum toxin retains niche status but boasts 74.5% complete pad discontinuation over 15 years, attracting refractory cases. Boston Scientific's 2024 purchase of Axonics intensifies competition in sacral neuromodulation, promising next-generation lead technology and rechargeable IPGs that lengthen device life cycles.

Clinical practice increasingly trials hybrid protocols-such as duloxetine-tolterodine-returning 77.4% patient satisfaction in mixed incontinence cohorts. Plant-derived candidates, including rhynchophylline, enter exploratory trials focused on M3 receptor modulation, adding a low-cost innovation layer. As patent cliffs depress traditional R&D spend, alliances between digital diagnostic firms and pharma players accelerate patient identification, amplifying therapy uptake across the overactive bladder treatment market.

Idiopathic presentations generated USD 2.94 billion in 2024, translating to a 75.53% share within the overactive bladder treatment market. Streamlined work-ups and primary-care familiarity underpin consistent demand. Neurogenic cases, valued at USD 0.95 billion in 2024, will grow 6.85% annually through 2030, fueled by heightened surveillance in spinal cord injury, Parkinson's disease, and multiple sclerosis populations. Ultrasound-guided botulinum toxin injections reduce procedural risks, broadening provider adoption. Premium pricing for device-based regimens and complex pharmacologic formulations offsets smaller volumes, lifting revenue per patient and improving manufacturer margins.

Policy makers note that aggressive neurogenic management curbs urinary tract infections and renal complications, generating downstream savings. These economic arguments help justify payer coverage for high-ticket interventions such as sacral and tibial nerve stimulation, fortifying the neurogenic revenue pool in the overactive bladder treatment market.

The Overactive Bladder Treatment Market Report is Segmented by Therapy (Anticholinergics, Botulinum Toxin Injections, Intravesical Instillation, and More), Disease Type (Idiopathic Overactive Bladder and Neurogenic Overactive Bladder), Route of Administration (Oral, Transdermal, and More), End User (Hospitals, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America produced USD 1.50 billion in 2024, equivalent to 38.82% of the overactive bladder treatment market. Robust insurance coverage and early uptake of B3-agonists sustain revenue, while Medicare's clear algorithms for neuromodulation keep device channels healthy. Hospital system consolidation encourages formulary leverage, ensuring rapid deployment of new cognitive-sparing molecules once licensed.

Europe contributed USD 1.13 billion in 2024, buttressed by the July 2024 pan-EU authorization for vibegron. Harmonized labeling streamlines launch costs and unifies pharmacovigilance reporting. National health services, particularly in Germany and the Nordics, pilot bundled payments that reward longitudinal symptom control, benefiting device makers.

Asia-Pacific, valued at USD 0.87 billion in 2024, is on track for a 7.81% CAGR to 2030, the fastest expansion among all regions. Japan's advanced aging profile and clinical trial infrastructure elevate guideline compliance, while Taiwan and South Korea report 68.5% persistence on mirabegron versus 60.4% for antimuscarinics. China and India ramp diagnostic capacity through public-private partnerships, framing overactive bladder as a treatable disorder rather than a normal aging outcome. Improved device reimbursement and local manufacturing hubs shrink acquisition costs, deepening penetration of neuromodulation platforms within the overactive bladder treatment market.

- Abbvie

- Astellas Pharma

- Pfizer

- Medtronic

- Endo International

- Hisamitsu Pharmaceutical

- Teva Pharmaceutical Industries

- Urovant Sciences (Sumitovant)

- Laborie Medical Technologies

- Macleods Pharmaceuticals Ltd.

- Johnson & Johnson

- Coloplast

- Axonics, Inc.

- Boston Scientific

- Alembic Pharmaceuticals Ltd.

- Vensica Medical

- Idorsia Pharmaceuticals Ltd.

- Organon

- Cogentix Medical

- Kyorin Pharmaceutical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging Population & Rising Prevalence Of Urinary Disorders

- 4.2.2 Adoption Of Beta-3-Adrenergic Agonists With Favorable Cognition Profile

- 4.2.3 Expanding Reimbursement For Neuromodulation & Botox In Asia

- 4.2.4 Growth In Tele-Urology & Digital Diagnostics

- 4.2.5 AI-Assisted Discovery Accelerating Novel Small-Molecule Pipeline

- 4.2.6 Clinical Validation Of Plant-Derived Anti-Muscarinic Compounds

- 4.3 Market Restraints

- 4.3.1 Cognitive Safety Concerns Of Chronic Anticholinergic Use

- 4.3.2 Patent Cliffs For Leading Antimuscarinics Dampening R&D Spend

- 4.3.3 Limited Urologist Density In Low-Income Regions

- 4.3.4 Fragmented Payer Coverage For ?3-Agonists In US & EU

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapy

- 5.1.1 Anticholinergics

- 5.1.2 Beta-3-Adrenergic Agonists

- 5.1.3 Botulinum Toxin Injections

- 5.1.4 Neuromodulation & Sacral Stimulation

- 5.1.5 Intravesical Instillation

- 5.1.6 Combination Therapy

- 5.1.7 Herbal & Nutraceuticals

- 5.1.8 Other Emerging Therapies

- 5.2 By Disease Type

- 5.2.1 Idiopathic Overactive Bladder

- 5.2.2 Neurogenic Overactive Bladder

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Transdermal

- 5.3.3 Injectable

- 5.3.4 Implantable / Device-based

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Specialty Clinics & Urology Centers

- 5.4.3 Homecare & Telehealth

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc.

- 6.3.2 Astellas Pharma Inc.

- 6.3.3 Pfizer Inc.

- 6.3.4 Medtronic plc

- 6.3.5 Endo International plc

- 6.3.6 Hisamitsu Pharmaceutical Co., Inc.

- 6.3.7 Teva Pharmaceutical Industries Ltd.

- 6.3.8 Urovant Sciences (Sumitovant)

- 6.3.9 Laborie Medical Technologies

- 6.3.10 Macleods Pharmaceuticals Ltd.

- 6.3.11 Johnson & Johnson (Ethicon)

- 6.3.12 Coloplast A/S

- 6.3.13 Axonics, Inc.

- 6.3.14 Boston Scientific Corp.

- 6.3.15 Alembic Pharmaceuticals Ltd.

- 6.3.16 Vensica Medical

- 6.3.17 Idorsia Pharmaceuticals Ltd.

- 6.3.18 Organon & Co.

- 6.3.19 Cogentix Medical

- 6.3.20 Kyorin Pharmaceutical Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment