PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836701

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836701

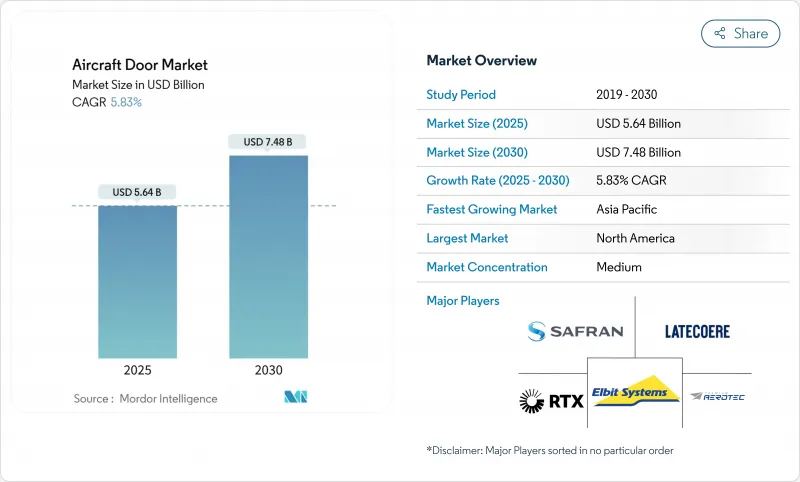

Aircraft Door - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft door market size was valued at USD 5.64 billion in 2025 and is forecasted to reach USD 7.48 billion by 2030, expanding at a 5.83% CAGR.

Growth has been anchored in record commercial backlogs at Airbus and Boeing, expanding global fleets, and stricter safety expectations that push airlines to upgrade door systems. Rising eVTOL production plans, an aftermarket surge linked to an aging global fleet, and the pivot toward electric actuation have further lifted demand. North American dominance rests on its deep OEM and MRO base, while Asia-Pacific's supply-chain investments signal the next demand wave. Meanwhile, composite designs that strip 20% of door weight, plus real-time monitoring mandated by regulators, are reshaping product specifications.

Global Aircraft Door Market Trends and Insights

Fleet expansion and aircraft deliveries surge

Record unfilled orders-8,658 at Airbus and 5,595 at Boeing in late-2024-created multiyear visibility for the aircraft door market. The backlog would take roughly 14 years to clear at current build rates, pushing suppliers to lock in long-term capacity. Airbus projected more than 42,000 deliveries over 20 years, forcing door suppliers to expand factories and adopt faster production methods, such as Fraunhofer IWU's four-hour thermoplastic process that yields 4,000 doors annually. MRO providers have followed suit, with facilities adding taller hangar doors to handle widebody traffic.

Lightweight composite adoption for fuel-efficiency

Advanced CFRP and thermoplastic composites cut door weight by up to 20%, trimming fuel burn and extending maintenance intervals. Collins Aerospace's one-piece thermoplastic door demonstrated a production cut from 110 hours to 4 hours by replacing mechanical fasteners with welding. Hexcel's rapid-curing HexPly M51 prepreg supports higher takt rates while retaining structural integrity. These materials integrate easily with electric actuators, reinforcing the industry's move toward a more electric aircraft (MEA) architecture.

High R&D and certification cost barrier

Enhanced FAA scrutiny multiplied testing protocols and raised prototype costs, discouraging smaller entrants. Each material or actuation shift invites new certification pathways, lengthening programs, and tilting bargaining power toward large tier-1 integrators that can spread compliance expense across wide product lines.

Other drivers and restraints analyzed in the detailed report include:

- Stricter passenger-safety and evacuation mandates

- Passenger-to-freighter conversion boom

- Raw-material price and supply-chain volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The fixed-wing segment held 91.42% of the share of the aircraft door market in 2024, underpinned by narrowbody aircraft, which held 62% of the global fleet. That dominance is likely to widen as airlines favor single-aisles for medium-haul routes. Business and general aviation expanded as private travel stayed resilient, encouraging MRO upgrades. Military programs offered steady volumes because US defense spending reached USD 886 billion in 2024.

The eVTOL segment's 8.34% CAGR has drawn new entrants such as Eve Air Mobility, which chose Latecoere as its door supplier for deliveries beginning in 2026. Certification frameworks now include vertical take-off constraints that require lighter, wider apertures and intuitive locking. As these aircraft integrate electric propulsion, demand for doors compatible with distributed power management will accelerate.

Passenger doors captured 45.95% of 2024 revenue, led by wide single-leaf designs that simplify evacuation and cabin seating flow. Passenger doors will advance at a 5.48% CAGR to 2030 as airlines retrofit sensors and noise-dampening panels. Cargo doors ranked next, backed by P2F conversions and express-parcel trade that spurred wide apertures capable of handling ULD pallets. Emergency exits gained attention following mid-flight events, triggering latch design overhauls.

Service, utility, and cockpit doors filled niche requirements but benefited from composite material migration. The aircraft door market size for passenger doors accounted for 46% share in 2024, while cargo door retrofits commanded premium pricing. A growing share of the aircraft door market incorporates origami-inspired folding designs like the Zen Privacy Door, which simplifies assembly and cuts part counts.

The Aircraft Door Market Report is Segmented by Application (Fixed-Wing, Rotary-Wing, and EVTOL Aircraft), Door Type (Passenger, Cargo, Emergency Exit, Service/Utility, Landing Bay, and Cockpit), End Use (OEM and Aftermarket), Mechanism (Hydraulic, Electric, and Pneumatic), and Geography (North America, Europe, Asia-Pacific, South America, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38.32% of 2024 revenue for the aircraft door market, supported by Boeing, a dense MRO network, and sustained defense budgets. FAA directives often set global precedents, so domestic suppliers refine products first and then export. The region's airline fleets showed a higher average age, boosting aftermarket door replacements. eVTOL certification timelines in the United States drove domestic door suppliers to produce prototypes that pass rotary and fixed-wing criteria.

Asia-Pacific posted the fastest 6.79% CAGR outlook. China's domestic traffic recovery, India's Make-in-India initiative, and A220's door contract with Dynamatic Technologies shifted supply chains eastward. Regional fleets skew young but are growing quickly; door OEMs are establishing in-region composite lay-up plants to reduce logistics costs. Japan's push for fully automated passenger boarding bridges illustrates how airport infrastructure synchronizes with door technology.

Europe remained a technology driver, anchored by Airbus' final-assembly lines and its leadership in sustainable aviation. EASA's emphasis on composite flammability and crashworthiness standards increased certification burdens, indirectly supporting European materials firms. European composite suppliers' aircraft door market share will rise as thermoplastic demand increases. Middle East and Africa expanded capacity via Gulf carrier freighter orders, adding large cargo door opportunities that complement regional maintenance hubs.

- Safran SA

- Collins Aerospace (RTX Corporation)

- LATECOERE S.A

- Mitsubishi Heavy Industries, Ltd.

- Saab AB

- Terma Group

- SICAMB S.p.A

- Elbit Systems Ltd.

- Spirit AeroSystems Inc.

- Korea Aerospace Industries, Ltd.

- DAHER

- Kaman Corporation

- NIPPI Corporation

- Premium AEROTEC GmbH (Airbus SE)

- Aernnova Group

- Dynamatic Technologies Limited

- NORCO Holdings Ltd.

- Barnes Group Inc.

- Astronics PECO Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fleet expansion and aircraft deliveries surge

- 4.2.2 Lightweight composite adoption for fuel-efficiency

- 4.2.3 Stricter passenger-safety and evacuation mandates

- 4.2.4 Passenger-to-freighter conversion boom

- 4.2.5 Urban-air-mobility (eVTOL) door innovations

- 4.2.6 Aging-fleet MRO door replacements

- 4.3 Market Restraints

- 4.3.1 High R&D and certification cost barrier

- 4.3.2 Raw-material price and supply-chain volatility

- 4.3.3 Lengthy regulatory approval cycles

- 4.3.4 Heightened OEM risk-aversion post door-failure incidents

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Fixed-Wing

- 5.1.1.1 Commercial Aviation

- 5.1.1.1.1 Narrow-body Aircraft

- 5.1.1.1.2 Wide-Body Aircraft

- 5.1.1.1.3 Regional Transport Aircraft

- 5.1.1.2 Business and General Aviation

- 5.1.1.2.1 Business Jets

- 5.1.1.2.2 Light Aircraft

- 5.1.1.3 Military Aviation

- 5.1.1.3.1 Combat Aircraft

- 5.1.1.3.2 Transport Aircraft

- 5.1.1.3.3 Special Mission Aircraft

- 5.1.2 Rotary Wing

- 5.1.2.1 Commercial Helicopter

- 5.1.2.2 Military Helicopter

- 5.1.3 eVTOL Aircraft

- 5.1.1 Fixed-Wing

- 5.2 By Door Type

- 5.2.1 Passenger

- 5.2.2 Cargo

- 5.2.3 Emergency Exit

- 5.2.4 Service/Utility

- 5.2.5 Landing Bay

- 5.2.6 Cockpit

- 5.3 By End Use

- 5.3.1 OEM

- 5.3.2 Aftermarket (MRO/Retrofit)

- 5.4 By Mechanism

- 5.4.1 Hydraulic

- 5.4.2 Electric

- 5.4.3 Pneumatic

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Safran SA

- 6.4.2 Collins Aerospace (RTX Corporation)

- 6.4.3 LATECOERE S.A

- 6.4.4 Mitsubishi Heavy Industries, Ltd.

- 6.4.5 Saab AB

- 6.4.6 Terma Group

- 6.4.7 SICAMB S.p.A

- 6.4.8 Elbit Systems Ltd.

- 6.4.9 Spirit AeroSystems Inc.

- 6.4.10 Korea Aerospace Industries, Ltd.

- 6.4.11 DAHER

- 6.4.12 Kaman Corporation

- 6.4.13 NIPPI Corporation

- 6.4.14 Premium AEROTEC GmbH (Airbus SE)

- 6.4.15 Aernnova Group

- 6.4.16 Dynamatic Technologies Limited

- 6.4.17 NORCO Holdings Ltd.

- 6.4.18 Barnes Group Inc.

- 6.4.19 Astronics PECO Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment