PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836702

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836702

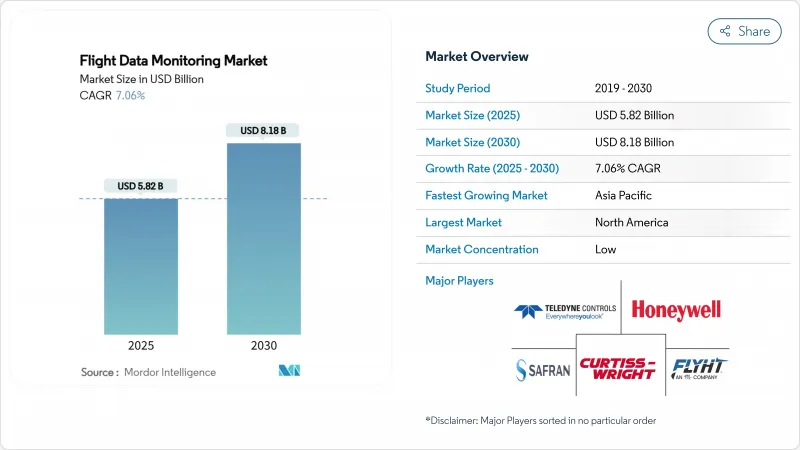

Flight Data Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The flight data monitoring market size is valued at USD 5.82 billion in 2025 and is forecasted to reach USD 8.18 billion by 2030, advancing at a 7.06% CAGR.

Airlines and operators now treat flight data as a strategic asset that unlocks cost savings through predictive analytics and fuel-efficiency algorithms. Regulatory harmonization-from ICAO's real-time distress tracking rule to the FAA's 25-hour cockpit voice recorder mandate-compresses adoption timelines while creating a standardized global baseline. The shift toward centralized, cloud-based analysis supports on-ground platforms that eliminate aircraft weight penalties and make advanced analytics economically attractive. Technology suppliers respond with AI-ready devices and open data architectures, enabling operators to integrate performance, maintenance, and safety dashboards on a common interface. North America retains first-mover advantage through established data-sharing frameworks, yet Asia-Pacific records the fastest expansion as its aviation infrastructure scales and urban air mobility projects gather momentum.

Global Flight Data Monitoring Market Trends and Insights

Global Mandates Accelerating Adoption of Onboard Flight Data Monitoring Systems

Regulatory bodies are aligning performance and recording standards, transforming compliance from a patchwork into a synchronized global framework. ICAO's Amendment 48 to Annex 6 obliges aircraft above 27,000 kg to transmit position data every minute during distress events beginning January 2025, forcing upgrades that blend flight recording and real-time connectivity. In parallel, the FAA's 25-hour cockpit voice recorder rule, effective May 2024, has created a USD 800 million retrofit wave as carriers outfit legacy fleets with compliant recorders. This harmonization simplifies certification, lowers per-unit costs, and removes the previous geographic barriers that had kept small operators on the sidelines. Manufacturers can scale single product lines across continents, while operators benefit from a universally accepted safety baseline that streamlines leasing, resale, and cross-border wet-lease arrangements.

Airlines Prioritizing Predictive Maintenance to Reduce Operational Disruptions and Costs

Operators increasingly apply multi-flight data sets to predict component wear and avert unscheduled maintenance events. NASA studies show that condition-based maintenance can cut direct maintenance costs by up to 30% compared with interval scheduling. Lockheed Martin's HercFusion platform, trained on roughly 3 million flight hours, demonstrated a 3% uptick in mission availability and a 15% cut in fuel burn for C-130 operators. Airbus extends the model with its Skywise Fleet Performance+ suite, which allows easyJet to pre-empt system failures that historically triggered cancellations, thereby protecting revenue and passenger trust. These performance gains turn flight data monitoring from a cost center into a strategic profit lever and accelerate enterprise-wide adoption.

High Upfront Installation and Integration Costs Limiting Adoption Among Smaller Operators

Charter firms and regional airlines often operate on slim margins and older airframes that require extensive modification. The FAA estimates Part 135 SMS compliance will cost the segment USD 47.4 million each year, highlighting the capital burden for small fleets. Retrofits demand downtime, specialized labor, and certification paperwork that many small operators schedule only when forced. The result is a market bifurcation: large carriers move toward fleet-wide predictive analytics, while smaller outfits stay in compliance-only mode, missing efficiency benefits until hardware prices decline or leasing models emerge.

Other drivers and restraints analyzed in the detailed report include:

- Deployment of Lightweight, Cloud-Enabled FDM Solutions for UAVs and Smaller Platforms

- Integration of Real-Time FDM Data into AI Platforms for Performance and Fuel Optimization

- Data Privacy and Ownership Concerns Delaying Broader Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Onboard devices retained a 68.22% share in 2024, anchoring the flight data monitoring market size to core flight safety demands. They supply time-critical data such as exceedance alerts to pilots and dispatchers. Yet on-ground platforms are growing at an 8.10% CAGR because airlines prefer centralized clouds that process multi-year histories across fleets. This architecture removes weight from the aircraft and enables advanced AI that would be impractical to host onboard. Increasing bandwidth availability and secure satellite links allow near-real-time downlink for after-action review minutes after touchdown. Airlines consolidate multiple OEM formats into common databases, improving cross-type benchmarking while cutting licensing costs. Honeywell and NXP's collaboration couples high-performance onboard processors with cloud APIs so operators can choose which analytics reside in the aircraft versus the data center. Regulatory bodies accept this hybrid design, accelerating certification for mixed fleets and letting low-cost carriers access sophisticated analytics without heavy avionics upgrades. Ground architectures also align with sustainability agendas because they prolong hardware lifecycles. Rather than retrofitting each aircraft for new algorithms, airlines update server-side software, slashing upgrade expense and e-waste.

Fixed-wing aircraft contributed 59.92% of the flight data monitoring market size in 2024, reflecting the broad global fleet of passenger and cargo jets that already carry recorders and quick-access devices. This installed base continues to purchase incremental upgrades, but its growth sits below the overall market average. In contrast, the unmanned aerial vehicle segment is expanding at a 10.01% CAGR because regulators are finalizing frameworks that open commercial corridors for inspection, logistics, and urban-air-mobility missions. Weight and power limits on drones push suppliers toward low-profile sensors, edge processors, and cellular or satellite data pipes. Lessons learned here now influence retrofit projects in legacy turboprops and helicopters, demonstrating reverse technology transfer. Rotary-wing fleets in emergency medical services and offshore energy remain niche yet steady adopters, drawn by the need to monitor engine health and exceedances in high-cycle missions. GE Aerospace's collaboration with Kratos Defense illustrates cross-pollination: innovations developed initially for cost-sensitive unmanned systems are being repackaged for manned regional jets. Platform convergence ensures that analytics created for one airframe class are portable across multiple types, reinforcing vendor ecosystems and reducing operator switching costs.

UAV growth also reshapes supply chains because non-traditional aviation firms-software startups, cellular operators, and logistics brands-purchase monitoring as a service rather than buying hardware outright. This subscription outlook compresses refresh cycles, encouraging vendors to migrate from one-time equipment sales toward recurring analytics revenues. The trend ultimately benefits airlines because it finances faster algorithmic innovation that spills into fixed-wing and rotary-wing fleets. As national authorities publish specific-category operating rules, they often make flight data monitoring compulsory for autonomous or remotely piloted commercial missions, locking in future demand.

The Flight Data Monitoring Market Report is Segmented by Installation Type (On-Board and On-Ground), Platform (Fixed-Wing, Rotary-Wing, and More), Component (Hardware, Software and Analytics, and Services), End User (Commercial Airlines, Cargo and Freight Operators. Business Jet Operators, UAV Service Providers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustains leadership through advanced regulatory and operational environments, accounting for 30.33% of 2024 spending. Operators benefit from mature supply chains and the FAA's Safety Management System regulations, which incentivize comprehensive data capture and benchmarking across carriers. Airlines deploy AI-augmented analytics to boost dispatch reliability, cut fuel burn, and satisfy investors requesting environmental disclosures. The region's dense legacy fleet also assures a strong retrofit pipeline as carriers swap quick-access recorders for connectivity-enabled units. Collaborative frameworks such as the Aviation Safety Information Analysis and Sharing program amplify the return on each additional data set by revealing macro-level risk trends.

Asia-Pacific posts the fastest expansion at 7.67% CAGR through 2030, fueled by double-digit annual passenger growth in India and Southeast Asia alongside China's strategic investments in urban air mobility. Governments fund digital-aviation sandboxes, easing the certification burden for aircraft with standardized monitoring devices. Low-cost carriers in the region use fuel-optimization modules to defend razor-thin margins. At the same time, full-service airlines deploy predictive maintenance to preserve schedule integrity during rapid fleet ramp-ups. National vision plans often tie air-traffic expansion to sustainability metrics, giving flight data monitoring an essential role in validating carbon-reduction claims.

Europe maintains steady uptake due to EASA's risk-based oversight approach. The Data4Safety expansion in October 2024 integrated nine additional member states and eight airports, dramatically enlarging the pan-European safety data pool. Airlines align monitoring investments with environmental policies that price carbon and reward fuel efficiency. GDPR compliance remains a hurdle, but vendors address this through privacy-by-design architectures, encouraging broader participation. Cross-border operations benefit from common technical standards, allowing low-cost carriers to allocate aircraft anywhere in their networks without reengineering hard-wired data modules.

- Teledyne Controls (Teledyne Technologies Incorporated)

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Safran SA

- Curtiss-Wright Corporation

- Flight Data Systems

- FLYHT Aerospace Solutions Ltd.

- Metro Aviation

- Brazos Safety Systems, LLC

- Groupe NSE

- Gogo Business Aviation (Gogo Inc.)

- Airbus SE

- General Electric Company

- Collins Aerospace (RTX Corporation)

- Spidertracks Ltd. (Vellox Group)

- Scaled Analytics Inc.

- Aerobytes Ltd.

- Helinalysis Ltd.

- Leonardo S.p.A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global mandates accelerating adoption of onboard flight data monitoring systems

- 4.2.2 Airlines prioritizing predictive maintenance to reduce operational disruptions and costs

- 4.2.3 Deployment of lightweight, cloud-enabled FDM solutions for UAVs and smaller platforms

- 4.2.4 Integration of real-time FDM data into AI platforms for performance and fuel optimization

- 4.2.5 Insurance-linked incentives encouraging airlines to adopt FDM programs

- 4.2.6 Growing emphasis on post-incident transparency and automated incident investigation

- 4.3 Market Restraints

- 4.3.1 High upfront installation and integration costs limiting adoption among smaller operators

- 4.3.2 Data privacy and ownership concerns delaying broader adoption

- 4.3.3 Limited technical standardization across aircraft platforms and avionics

- 4.3.4 Lack of in-house analytics expertise to extract actionable insights

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Installation Type

- 5.1.1 Onboard

- 5.1.2 On-ground

- 5.2 By Platform

- 5.2.1 Fixed-wing

- 5.2.2 Rotary-wing

- 5.2.3 Unmanned Aerial Vehicles (UAV)

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software and Analytics

- 5.3.3 Services

- 5.4 By End User

- 5.4.1 Commercial Airlines

- 5.4.2 Cargo and Freight Operators

- 5.4.3 Business Jet Operators

- 5.4.4 Helicopter EMS and Offshore Services

- 5.4.5 Defense and Homeland Security

- 5.4.6 UAV Service Providers

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Teledyne Controls (Teledyne Technologies Incorporated)

- 6.4.2 Honeywell International Inc.

- 6.4.3 L3Harris Technologies, Inc.

- 6.4.4 Safran SA

- 6.4.5 Curtiss-Wright Corporation

- 6.4.6 Flight Data Systems

- 6.4.7 FLYHT Aerospace Solutions Ltd.

- 6.4.8 Metro Aviation

- 6.4.9 Brazos Safety Systems, LLC

- 6.4.10 Groupe NSE

- 6.4.11 Gogo Business Aviation (Gogo Inc.)

- 6.4.12 Airbus SE

- 6.4.13 General Electric Company

- 6.4.14 Collins Aerospace (RTX Corporation)

- 6.4.15 Spidertracks Ltd. (Vellox Group)

- 6.4.16 Scaled Analytics Inc.

- 6.4.17 Aerobytes Ltd.

- 6.4.18 Helinalysis Ltd.

- 6.4.19 Leonardo S.p.A

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment