PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836703

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836703

Military Fiber Optic Cables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

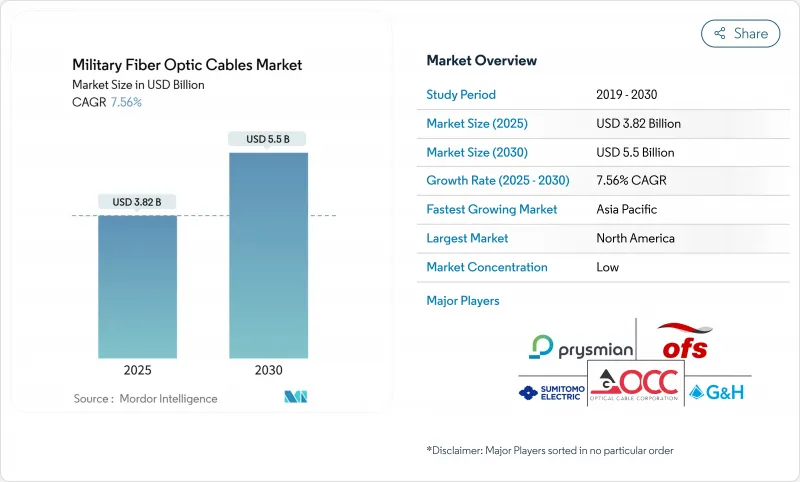

The military fiber optic cables market stands at USD 3.82 billion in 2025 and is projected to reach USD 5.5 billion by 2030, registering a 7.56% CAGR.

Growth reflects the swift replacement of copper links with fiber solutions that withstand electromagnetic interference while carrying far higher data loads. Investments in fiber-optic drones, directed-energy weapons, and 5G-enabled tactical networks are reshaping battlefield connectivity, prompting armies to refit legacy platforms with high-bandwidth optical backbones. Defense ministries also view fiber as a hedge against jamming and cyber risks, since light-based signals resist interception and radiate no electromagnetic signature. Procurement spending is further supported by multi-domain sensor fusion programs that push data rates above 100 Gbps on ships, vehicles, and aircraft.

Global Military Fiber Optic Cables Market Trends and Insights

Battlefield demand for loss-less, EMI-immune data links

Electronic warfare has saturated modern battlefields, so fiber-optic lines now replace copper to keep signals intact under jamming. Ukrainian forces operate fiber-tethered FPV drones that penetrate 41 km while streaming high-resolution video unaffected by interference. NATO planners observed these results, and the US Army plans 1,100 similar systems to close capability gaps. These combat-proven accelerators accelerate the procurement of rugged micro-fiber reels and quick-deploy connectors for squads and command posts. The military fiber optic cables market benefits directly as each drone uses multi-kilometre spools and replacement kits that must meet MIL-spec pull and bend limits. Demand is reinforced by national mandates to harden forward bases against electronic attack.

Militarisation of 5G tactical networks

Private 5G roll-outs at bases in the United States, Spain, Germany, and Norway depend on dense fiber backhaul that handles multi-gigabit traffic while meeting strict latency and security targets. Spending on defence 5G infrastructure will total USD 1.5 billion during 2024-2027, with roughly one-third flowing to optical cabling and terminations. Programs adopt Open RAN interfaces, so suppliers must certify fibers for diverse radio units and edge clouds. The military fiber optic cables market thus gains sustained orders for single-mode trunk lines, field-deployable indoor/outdoor patch cords, and hardened MPO connectors able to survive fuel spills and vehicle loads.

Field-level repair complexity

Splicing fibers in remote combat zones is labour-intensive and tool-heavy, so cut lines can idle critical sensors. Military trials "crimp & cleave" connectors that install in under three minutes, trading 0.5 dB extra loss for rapid restoration. Training backlogs persist, and shortages of certified technicians slow large-scale roll-outs. Vendors answer with pre-terminated reels and colour-coded boots that reduce human error. While these advances ease the issue, the military fiber optic cables market still faces delayed contracts until armies field enough maintenance teams.

Other drivers and restraints analyzed in the detailed report include:

- Surge in ISR sensor density

- Directed-energy weapons integration

- Supply chain security vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-mode lines command the largest military fiber optic cables market share at roughly 54.50% in 2024 and are forecast to maintain a mid-single-digit CAGR through 2030. Their narrow core enables ultra-long links on destroyers, airborne early warning aircraft, and underground fiber trunks interconnecting forward operating bases. A useful consequence is that each single-mode run often carries spare dark fibers, creating latent capacity that future-proofs the investment.

Second, multi-mode occupies a smaller slice today, yet is predicted to outpace overall market growth with an 8.75% CAGR. Cost-effective transceivers, tolerance of wider launch conditions, and recent breakthroughs in radiation-hard multimode fiber suggest wider deployment inside armored vehicles and aircraft cabins. This uptick implies that vendors offering hybrid cable bundles-combining both core types-gain a commercial edge by simplifying logistics for integrators.

Glass commands about 90.45% of the military fiber optic cables market, thanks to its unmatched bandwidth and robustness. Naval architects favour glass for topside and below-decks runs because its thermal window aligns with maritime shock standards. The inferred benefit for suppliers is volume stability: fleet refit cycles assure ongoing demand independent of new-build schedules.

Plastic optical fiber (POF) may hold less than a tenth of the market value, but it is advancing at roughly 10.47% CAGR owing to flexibility and quick field termination. Embedded wear sensors in bearings and hatch seals illustrate niche yet recurring orders. POF's progress suggests that a diversified materials portfolio gives contractors a hedge against glass-specific geopolitical supply risks.

The Military Fiber Optic Cables Market Report is Segmented by Cable Type (Single-Mode and Multi-Mode), Material Type (Glass Optical Fiber, and More), Deployment Platform (Land Systems, and More), Installation Environment (Tactical Field-Deployable, and More), Application (Radar and Electronic Warfare, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 34.47% revenue in 2024 due to sustained defense budgets and technology leadership. Programs such as the 1,100-unit fiber drone rollout highlight how procurement scales quickly once performance is proven. Research at national laboratories advances coherently combined lasers and bend-insensitive, rugged fibers, securing the region's technical edge. The military fiber optic cables market size in North America further widens as each new platform standardises on optical backbones.

Asia-Pacific records the fastest 9.31% CAGR to 2030 as India, Japan, South Korea, and Australia step up modernisation. India's Network For Spectrum contracts worth USD 207 million cover 57,015 km of fiber builds. Regional carriers partner on the ALPHA cable that offers 18 Tbps per pair, giving navies resilient routes. Defense ministries invest in 5G-backed training ranges that depend on dense optical fronthaul. These initiatives raise the military fiber optic cables market profile across the region.

Europe maintains solid demand, led by NATO projects that secure undersea infrastructure and cross-border land routes. The Baltic Sentry mission uses naval drones to patrol pipelines and cables, triggering orders for impact-proof fiber bundles. Sweden and Finland opened a SEK 75 million (USD 7.8 million) three-cable land corridor able to carry 3 Pbps, reinforcing regional resilience. As EU forces converge on common architectures, suppliers with pan-European approvals gain share in the military fiber optic cables market.

- Prysmian S.p.A.

- OFS Fitel, LLC

- Lynxeo SAS

- Sumitomo Electric Industries, Ltd.

- Optical Cable Corporation

- Corning Incorporated

- Gooch & Housego PLC

- Timbercon, Inc.

- W. L. Gore & Associates, Inc.

- Infinite Electronics, Inc.

- Sterlite Technologies Limited

- TE Connectivity plc

- L3Harris Technologies, Inc.

- Amphenol Corporation

- Radiall LLC

- Rosenberger Hochfrequenztechnik GmbH & Co KG

- Cinch Connectivity Solutions, Inc.

- Fujikura Ltd.

- Leoni AG

- Yangtze Optical Fibre and Cable Joint Stock Limited Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Battlefield demand for loss-less, EMI-immune data links

- 4.2.2 Militarisation of 5G tactical networks

- 4.2.3 Surge in ISR sensor density

- 4.2.4 Directed-energy weapons integration

- 4.2.5 Miniaturised rugged fiber terminations

- 4.2.6 NATO STANAG shift towards fiber-centric avionics architectures

- 4.3 Market Restraints

- 4.3.1 Field-level repair complexity

- 4.3.2 Supply chain security vulnerabilities

- 4.3.3 High lifecycle cost vs copper

- 4.3.4 Vulnerability to bend-loss under dynamic vibration in armored vehicles

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cable Type

- 5.1.1 Single-mode

- 5.1.2 Multi-mode

- 5.2 By Material Type

- 5.2.1 Glass Optical Fiber

- 5.2.2 Plastic Optical Fiber

- 5.3 Deployment Platform

- 5.3.1 Land Systems

- 5.3.2 Airborne Systems

- 5.3.3 Naval and Sub-sea Systems

- 5.4 By Installation Environment

- 5.4.1 Tactical Field-Deployable

- 5.4.2 Harsh-Environment Armored

- 5.4.3 Under-water / Submarine

- 5.5 By Application

- 5.5.1 C3ISR and Tactical Communications

- 5.5.2 Radar and Electronic Warfare

- 5.5.3 Guided and Directed-Energy Weapons

- 5.5.4 On-board Data Networks / Avionics

- 5.5.5 Others (Power-over-Fiber, Sensors)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 Singapore

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Israel

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Prysmian S.p.A.

- 6.4.2 OFS Fitel, LLC

- 6.4.3 Lynxeo SAS

- 6.4.4 Sumitomo Electric Industries, Ltd.

- 6.4.5 Optical Cable Corporation

- 6.4.6 Corning Incorporated

- 6.4.7 Gooch & Housego PLC

- 6.4.8 Timbercon, Inc.

- 6.4.9 W. L. Gore & Associates, Inc.

- 6.4.10 Infinite Electronics, Inc.

- 6.4.11 Sterlite Technologies Limited

- 6.4.12 TE Connectivity plc

- 6.4.13 L3Harris Technologies, Inc.

- 6.4.14 Amphenol Corporation

- 6.4.15 Radiall LLC

- 6.4.16 Rosenberger Hochfrequenztechnik GmbH & Co KG

- 6.4.17 Cinch Connectivity Solutions, Inc.

- 6.4.18 Fujikura Ltd.

- 6.4.19 Leoni AG

- 6.4.20 Yangtze Optical Fibre and Cable Joint Stock Limited Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment