PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836707

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836707

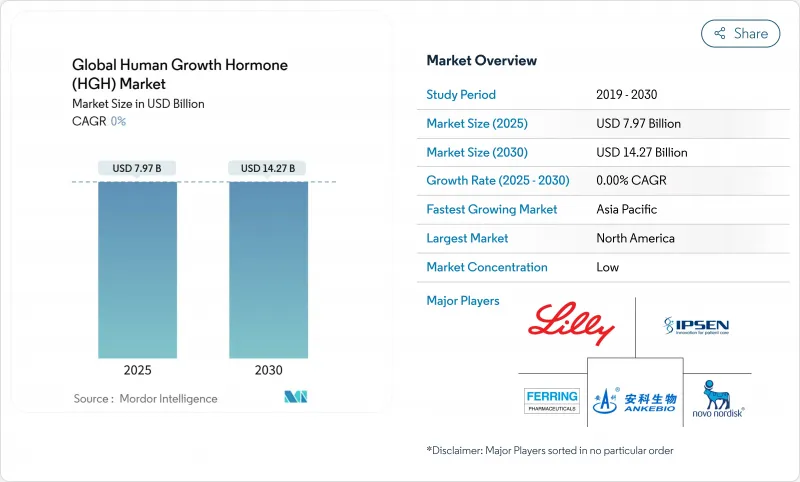

Global Human Growth Hormone (HGH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The human growth hormone market size reached USD 7.97 billion in 2025 and is forecast to touch USD 14.27 billion in 2030, advancing at a 12.30% CAGR.

Sustained progress in long-acting formulations, widening clinical indications that now span pediatric and adult populations, and multi-billion-dollar manufacturing expansions undertaken by several originator companies are the primary forces behind this growth. The competitive focus has shifted toward weekly products that reduce injection burden, while biosimilar launches simultaneously introduce aggressive price competition. Supply shortages that began in 2022 have prompted accelerated capacity projects, positioning well-capitalized firms to gain volume advantage once new lines come onstream. At the same time, digital health solutions that support adherence monitoring are being deployed to reinforce real-world outcomes and protect premium pricing within the human growth hormone market.

Global Human Growth Hormone (HGH) Market Trends and Insights

Development and Uptake of Long-Acting rhGH Formulations

Weekly products such as Skytrofa, Ngenla, and Sogroya obtained both FDA and EMA authorizations between 2020 and 2023 and are redefining adherence expectations. Clinicians view the improved convenience as a critical determinant of long-term height velocity, which is particularly meaningful in pediatric care. Health systems also register downstream cost savings tied to better adherence, though payers flag the 15-25% price premium and subject prescriptions to prior authorization. Despite cost tensions, ongoing safety surveillance has yet to identify signals that offset the compliance benefit, underpinning durable adoption prospects inside the human growth hormone market.

Rising Prevalence of Growth Hormone Deficiency and Related Disorders

Standardized IGF-1 testing, broader stimulation-test availability, and heightened physician education are lifting diagnostic rates across pediatric and adult cohorts. Adult growth hormone deficiency-once under-recognized-is now frequently screened due to its links with metabolic syndrome and cardiovascular risk. Advanced genetic sequencing helps clinicians detect Turner syndrome, Prader-Willi syndrome, and small-for-gestational-age cases earlier, which translates into longer therapy duration per patient. Research that connects adequate growth hormone levels with bone health and cognitive performance further widens the clinical rationale for continued therapy into adulthood .

Adverse Effects and Safety Concerns of Chronic rhGH Therapy

Post-marketing data draw attention to glucose intolerance, edema, and unresolved debates over potential cancer risk in adults on prolonged therapy. The PATRO biosimilar registry continues to publish safety updates that guide physician decision-making . EMA and FDA have attached rigorous long-term surveillance requirements to long-acting approvals, prompting prescribers to adopt more detailed baseline risk assessments and ongoing metabolic monitoring. While safety signals have remained manageable, the extra administrative load may deter uptake in borderline cases and moderates the overall growth trajectory of the human growth hormone market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Adult and Anti-Aging Off-Label Demand

- Continued Advances in Recombinant DNA and Protein-Engineering Platforms

- High Therapy Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Growth hormone deficiency generated the largest revenue pool and held 43.53% of total 2024 sales, confirming its entrenched clinical standing. The breadth of clinical data, standardized dosing algorithms, and long-standing reimbursement support sustain its leadership. Nonetheless, idiopathic short stature is recording a 12.87% CAGR through 2030 and is compressing the gap. Endocrinologists are expanding the qualifying height-standard-deviation window, and payers are gradually conceding coverage following favorable long-term efficacy publications. Turner syndrome and Prader-Willi syndrome supply stable but lower-volume demand, supported by orphan-drug policies that guarantee continued access. Chronic renal insufficiency as a use case is receding in relative importance as transplantation outcomes improve.

Continued indication diversification promotes portfolio strategies that tailor dosing devices, titration software, and support programs to each distinct cohort. Companies that align product presentation with condition-specific pathways stand to reinforce their positions within the human growth hormone market. Growth hormone deficiency accounted for 43.53% of the human growth hormone market size in 2024, underlining its weight in corporate planning.

Subcutaneous delivery maintained 65.45% share during 2024, enjoying decades of physician familiarity, reliable bioavailability, and integrated nurse-training infrastructure. Its scale attracts biosimilar competition, which increases price transparency but still preserves moderate margin because clinical inertia keeps daily injectables entrenched. Intravenous or intramuscular administration is confined to inpatient settings.

Oral / buccal candidates, led by LUM-201, promise a 13.24% CAGR that could meaningfully disrupt the current hierarchy once phase 3 data mature. If efficacy endpoints match injectable standards, payers may support rapid substitution due to superior adherence potential. For now, subcutaneous devices are evolving toward thinner needles and digital diary integration, which may slow near-term oral encroachment.

The Human Growth Hormone Market Report Segments the Industry Into by Application (Growth Hormone Deficiency, Turner Syndrome, and More), Route of Administration (Subcutaneous, Intravenous, and More), Formulation (Short-Acting and Long-Acting), by Distribution Channel (Hospitals Pharmacies, and More), Patient Type (Adult and Pediatric), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 42.15% of global turnover in 2024. United States payers granted relatively broad coverage after evidence linked improved adherence with long-run cost containment, which accelerated early adoption of Skytrofa, Ngenla, and Sogroya. Canada followed with health-technology assessments that accepted weekly dosing on quality-of-life grounds within the public system. Mexico is beginning to expand insurance formularies, though cost sensitivity caps near-term penetration of premium products.

Europe contributes a sizable portion of the human growth hormone market through harmonized EMA approvals and well-structured orphan-drug incentives. Germany leads uptake of long-acting molecules and maintains robust post-marketing registries that influence safety perceptions across the continent. France and the United Kingdom enforce strict cost-effectiveness thresholds, which intensify biosimilar competition and moderate net price. Eastern European countries gradually add rhGH to reimbursement lists, leveraging pooled procurement to gain price concessions.

Asia-Pacific is growing fastest at 14.23% CAGR. China registers strong demand following insurance-catalog additions and domestic manufacturing that compresses price. Japan's mature specialist network supports stable high-value consumption, and longitudinal patient registries contribute pivotal safety data. India, despite infrastructure gaps, shows meaningful growth as private insurance penetration rises and diagnostics improve. Local capacity investments by multinational firms aim to shorten supply lead-times and insulate the human growth hormone market against global shortages.

- Novo Nordisk

- Pfizer

- Eli Lilly and Company

- Sandoz International GmbH (Novartis)

- Ipsen

- EMD Serono Inc. (Merck KGaA)

- Roche

- Ascendis Pharma A/S

- Opko Health

- Ferring Pharmaceuticals

- Teva Pharmaceutical Industries

- GeneScience Pharmaceuticals

- AnkeBio

- LG Life Sciences Ltd

- Sinobioway Hygene Biomedicine

- Aeterna Zentaris Inc.

- Strongbridge Biopharma plc

- Hanmi Pharmaceutical Co. Ltd

- Yamo Pharmaceuticals

- Cadila Healthcare Ltd (Zydus Lifesciences)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Development & uptake of long-acting rhGH formulations

- 4.2.2 Rising prevalence of growth hormone deficiency (GHD) & related disorders

- 4.2.3 Expanding adult & anti-aging off-label demand

- 4.2.4 Continued advances in recombinant DNA and protein-engineering platforms

- 4.2.5 Gradual inclusion of hGH treatments in public and private reimbursement formularies

- 4.2.6 Rare-disease fast-track incentives accelerating pipeline (under-reported)

- 4.3 Market Restraints

- 4.3.1 Adverse effects & safety concerns of chronic rhGH therapy

- 4.3.2 High therapy cost

- 4.3.3 Regulatory uncertainty

- 4.3.4 Counterfeit & grey-market hGH eroding brand trust (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Growth Hormone Deficiency

- 5.1.2 Turner Syndrome

- 5.1.3 Idiopathic Short Stature

- 5.1.4 Prader-Willi Syndrome

- 5.1.5 Small for Gestational Age

- 5.1.6 Chronic Renal Insufficiency

- 5.2 By Route of Administration

- 5.2.1 Subcutaneous

- 5.2.2 Intravenous

- 5.2.3 Intramuscular

- 5.2.4 Oral / Buccal

- 5.3 By Formulation

- 5.3.1 Short-acting

- 5.3.2 Long-acting

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail & Specialty Pharmacies

- 5.4.3 Online Pharmacies

- 5.5 By Patient Type

- 5.5.1 Pediatric

- 5.5.2 Adult

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Novo Nordisk A/S

- 6.3.2 Pfizer Inc.

- 6.3.3 Eli Lilly and Company

- 6.3.4 Sandoz International GmbH (Novartis)

- 6.3.5 Ipsen SA

- 6.3.6 EMD Serono Inc. (Merck KGaA)

- 6.3.7 F. Hoffmann-La Roche Ltd

- 6.3.8 Ascendis Pharma A/S

- 6.3.9 OPKO Health Inc.

- 6.3.10 Ferring BV

- 6.3.11 Teva Pharmaceutical Industries Ltd

- 6.3.12 GeneScience Pharmaceuticals Co. Ltd

- 6.3.13 AnkeBio Co. Ltd

- 6.3.14 LG Life Sciences Ltd

- 6.3.15 Sinobioway Hygene Biomedicine Co. Ltd

- 6.3.16 Aeterna Zentaris Inc.

- 6.3.17 Strongbridge Biopharma plc

- 6.3.18 Hanmi Pharmaceutical Co. Ltd

- 6.3.19 Yamo Pharmaceuticals

- 6.3.20 Cadila Healthcare Ltd (Zydus Lifesciences)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment