PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836708

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836708

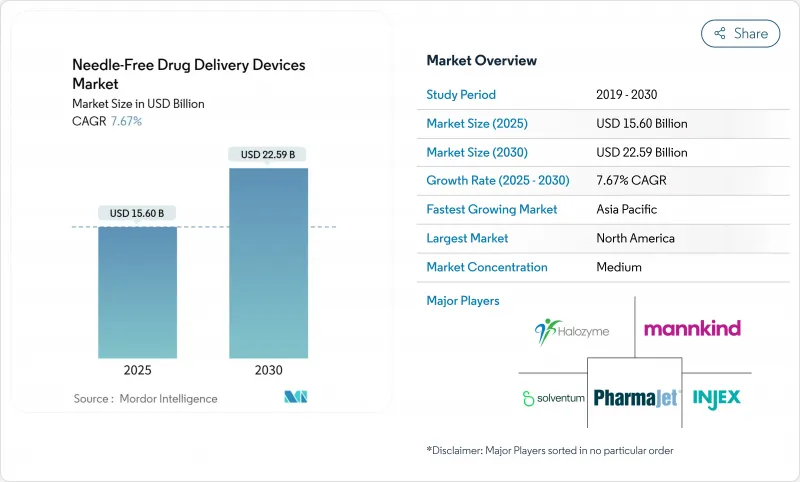

Needle-Free Drug Delivery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The needle free drug delivery devices market is valued at USD 15.60 billion in 2025 and is forecast to reach USD 22.59 billion by 2030, expanding at a 7.67% CAGR.

Robust demand for self-administration, rising biologics pipelines, and sustained investment in digital-health integrations are powering this upward trajectory. North America contributes the largest regional share, while Asia-Pacific is growing fastest as healthcare access broadens and chronic-disease incidence rises. Jet injectors maintain a dominant device position, yet microneedle patches are scaling rapidly as 3D printing and biodegradable materials unlock new formulation possibilities. Oncology therapies anchor the highest application growth as precision-medicine strategies demand delivery platforms that minimize systemic toxicity and elevate adherence. Regulatory complexity remains the primary headwind, though firms that master evolving guidance can secure durable competitive advantages.

Global Needle-Free Drug Delivery Devices Market Trends and Insights

High Burden of Chronic and Lifestyle Disorders

Global prevalence of diabetes, cancer, and cardiovascular disease is resetting delivery priorities toward safer, pain-free platforms. In 2024, U.S. healthcare facilities recorded 600,000-800,000 needlestick injuries, each costing USD 500-3,000 in follow-up care. Needle free injectors reduce sharps exposure and align with chronic-disease protocols requiring lifelong therapy. Manufacturers now design devices expressly for chronic use cases, such as wearable injectors that maintain flow rates for up to 72 hours. These patient-centric designs underpin sustained demand within the needle free drug delivery devices market.

Rising Patient Preference for Self-Administration & Home-Care Solutions

Home-based models are reshaping care economics, and 87.5% of users of the enFuse on-body system report confidence in self-therapy. Health systems benefit from lower facility overhead, while patients gain autonomy. Human-factors engineering-ergonomic triggers, tactile feedback, and intuitive graphical prompts-has become a critical differentiator, enabling firms to capture share in the expanding needle free drug delivery devices market.

Stringent Regulatory Framework

The U.S. FDA's 2024 Essential Drug Delivery Outputs guidance introduced rigorous verification protocols for combination products, extending development cycles and raising costs. Divergent rules in the EU and Asia compel firms to engineer region-specific versions, fragmenting R&D budgets. Smaller innovators feel the strain most acutely, slowing novel entrants into the needle-free drug delivery devices market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements

- Premium Pricing & Inadequate Reimbursement in Cost-Sensitive Settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Jet injectors captured 61.3% of 2024 revenue, reflecting their vaccine-ready versatility and capacity to handle high-viscosity biologics. This dominance secures a sizeable portion of the needle-free drug delivery devices market for mature players. Microneedle patches, however, are projected to expand at 10.63% CAGR, fueled by dissolvable polymers that leave no sharps waste and enhanced permeability, which have been proven to raise bioavailability by up to 40%.

Form-factor innovation is redefining competitive boundaries. Laser-assisted systems and electroporation devices serve niche protein and gene-therapy pipelines, underscoring the breadth of the needle-free drug delivery devices market. 3D-printed molds let manufacturers iterate microstructure rapidly, trimming prototype cycles and reinforcing first-mover advantages.

Disposable formats hold 66.8% share, but environmental mandates and cost-containment pressures spur a 9.15% CAGR for reusable devices. Life-cycle analyses indicate potential 85% waste reduction versus single-use injectors. The needle free drug delivery devices market increasingly rewards designs featuring detachable drug cartridges and autoclavable housings.

User-centered evaluations reveal higher confidence scores when tactile cues and mobile-app tutorials guide dose delivery. Smart sensors embedded in reusable systems transmit administration data to cloud dashboards, expanding value beyond sustainability to adherence intelligence.

Needle-Free Drug Delivery Devices Market Report is Segmented by Device Type (Jet Injectors, Inhalers, Transdermal Patches, and More), Usability (Disposable and Reusable Systems), Product Fill Type (Prefilled and Filable Injectors), Site of Delivery (Intradermal, Subcuatneous and More), Application (Insulin Delivery, Vaccine Delivery and More) and Geography. The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 38.6% of 2024 revenue thanks to entrenched biopharma R&D, high chronic-disease prevalence, and reimbursement for advanced delivery systems. The FDA approved 32% more combination products in 2024 versus 2023, signaling a favorable pipeline for the needle-free drug delivery devices market. Clinical data from MIT showed microneedle patches deliver biologics with 40% higher bioavailability than conventional subcutaneous routes. Digital-health maturity underpins rapid uptake of connected injectors that broadcast adherence metrics to provider dashboards.

Asia-Pacific is the fastest-growing arena at 10.50% CAGR as China and India scale chronic-care infrastructure. Local firms increasingly develop proprietary jet injectors and microneedles, signaling a shift from contract manufacturing to innovation leadership. Japan's super-aged demographic drives demand for low-force actuators suited to frail skin, influencing regional design cues. Regulatory harmonization under Asia-Pacific Economic Cooperation frameworks eases cross-border rollout but still requires country-specific dossiers, adding strategic nuance for entrants aiming to capture share in the needle free drug delivery devices market.

Europe sustains meaningful scale with value-based reimbursement that rewards demonstrable clinical benefit. Germany tops regional revenue, buoyed by domestic pharma giants and a payer environment receptive to outcome-linked pricing. Sustainability imperatives spur R&D into recyclable housings and bio-derived polymers, aligning with EU Green Deal targets. Autoinjectors are replacing glass prefilled syringes as safety-engineered designs mitigate accidental sticks. The European Medicines Agency's focus on patient-reported outcomes elevates importance of ergonomic testing during approvals, encouraging holistic device design across the needle free drug delivery devices market.

- Ferring Pharmaceuticals

- Owen Mumford

- PharmaJet

- Mika Medical

- MannKind

- Crossject SA

- Akra Dermojet

- Sol-Millennium Medical Group

- Medical International Technology Inc. (MIT)

- LTS Lohmann Therapie-Systeme

- Injex Pharma AG

- Bioject Medical Technologies Inc.

- Portal Instruments Inc.

- Vaxxas Pty Ltd.

- Micron Biomedical Inc.

- NuGen Medical Devices Inc.

- Endo International

- IntegriMedical Pvt Ltd.,

- ENABLE INJECTIONS

- CeQur Simplicity

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden of Chronic and Lifestyle Disorders

- 4.2.2 Rising Patient Preference for Self-Administration and Home-care Solutions

- 4.2.3 Technological Advancements

- 4.2.4 High Burden of Needle-stick Injuries

- 4.2.5 Rising Vaccination Initiatives and Immunization Programes

- 4.2.6 Accelerating Pharma-Device Co-development Alliance

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Framework

- 4.3.2 Limitations Associated with use of Microneedle Patches

- 4.3.3 Premium pricing and inadequate reimbursement in cost-sensitive settings

- 4.3.4 Limited Drug Formulation Compatibility and Risk Associated with Reusable Needle Free Drug Delivery Devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Device Type

- 5.1.1 Jet Injectors

- 5.1.2 Inhalers

- 5.1.3 Transdermal Patches

- 5.1.4 Micro-Needle Patches

- 5.1.5 Oral Needle-Free Systems

- 5.1.6 Novel Needle-Free Technologies (Electroporation, Laser-based)

- 5.2 By Usability

- 5.2.1 Disposable Systems

- 5.2.2 Reusable Systems

- 5.3 By Product Fill Type

- 5.3.1 Prefilled Injectors

- 5.3.2 Fillable Injectors

- 5.4 By Site of Delivery

- 5.4.1 Intradermal

- 5.4.2 Subcutaneous

- 5.4.3 Intramuscular

- 5.5 By Application

- 5.5.1 Insulin Delivery

- 5.5.2 Vaccine Delivery

- 5.5.3 Pain Management

- 5.5.4 Pediatric Injections

- 5.5.5 Oncology Therapies

- 5.5.6 Other Applications

- 5.6 By End User

- 5.6.1 Hospitals & Clinics

- 5.6.2 Home-Care Settings

- 5.6.3 Research & Academic Institutes

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ferring B.V.

- 6.4.2 Owen Mumford Ltd.

- 6.4.3 PharmaJet Inc.

- 6.4.4 Mika Medical Co.

- 6.4.5 MannKind Corporation

- 6.4.6 Crossject SA

- 6.4.7 Akra Dermojet

- 6.4.8 Sol-Millennium Medical Group

- 6.4.9 Medical International Technology Inc. (MIT)

- 6.4.10 LTS Lohmann Therapie-Systeme AG

- 6.4.11 Injex Pharma AG

- 6.4.12 Bioject Medical Technologies Inc.

- 6.4.13 Portal Instruments Inc.

- 6.4.14 Vaxxas Pty Ltd.

- 6.4.15 Micron Biomedical Inc.

- 6.4.16 NuGen Medical Devices Inc.

- 6.4.17 Endo International plc

- 6.4.18 IntegriMedical Pvt Ltd.,

- 6.4.19 ENABLE INJECTIONS

- 6.4.20 CeQur Simplicity

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment