PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836709

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836709

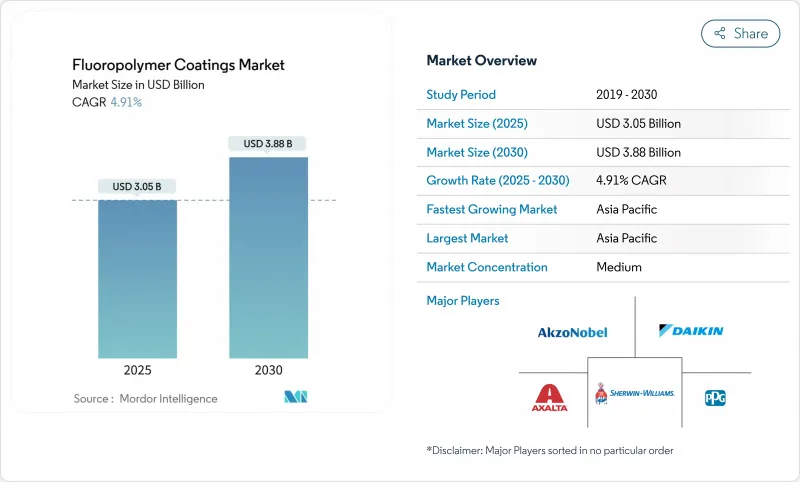

Fluoropolymer Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Fluoropolymer Coatings Market size is estimated at USD 3.05 billion in 2025, and is expected to reach USD 3.88 billion by 2030, at a CAGR of 4.91% during the forecast period (2025-2030).

Rising demand for high-performance surface protection in corrosive, high-temperature, and electrically demanding environments continues to underpin growth even as regulators tighten oversight of per- and polyfluoroalkyl substances (PFAS). Expanded investments in offshore wind farms, electric-vehicle powertrains, and lithium-ion battery gigafactories are anchoring mid-term momentum, while hydrogen pipeline build-outs promise long-term volume opportunities.

Global Fluoropolymer Coatings Market Trends and Insights

Increased Demand for Anti-corrosive Coatings in Offshore Wind Turbine Towers

Surging offshore wind installations are elevating performance requirements beyond conventional epoxy systems. Fluoropolymer formulations now integrate organic-inorganic hybrids that resist seawater, salt spray, and ice accumulation that can cut turbine output by 30%. Coating lifetimes are projected to stretch to 10 - 12 years, doubling the maintenance window for next-generation floating platforms deployed in deeper waters. Prototype sol-gel systems deliver strong metal adhesion, reducing under-film corrosion and cutting downtime expenses for operators who target 25-year service lives.

Fast-growing Adoption of Low-Friction Coatings in Electric-Vehicle Powertrains

Electrified drivetrains operate at higher rpm, temperature, and voltage than internal-combustion engines, amplifying tribological stress. Fluoropolymer layers reduce surface energy, minimize arcing, and protect copper conductors in 800 V e-axles, raising overall drivetrain efficiency by 3-5%. Leading OEMs specify PTFE-modified coatings on bearings and spline gears to enable downsized lubrication systems, extending part life and boosting range. Standardization of these solutions across mid-segment EV models will accelerate coating volumes by the latter half of the decade.

Volatile Supply and Pricing of Fluorspar-derived HF Acid

China controls well over half of mined fluorspar and tightens export quotas to retain value-added production, squeezing external producers of HF acid. Spot prices rose sharply again in 2024, prompting larger fluoropolymer makers to lock multi-year contracts and build stockpiles. Smaller coaters face margin erosion, shortened order books, and greater exposure to delivery disruptions, encouraging mergers aimed at negotiating power and supply-chain resilience.

Other drivers and restraints analyzed in the detailed report include:

- Growth of High-temperature Non-stick Coatings in Smart Cookware

- Expansion of PVDF-lined Lithium-ion Battery Gigafactories

- Strict Environmental Policies and Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PTFE maintained 44% of fluoropolymer coatings market share in 2024 because its 260 °C service temperature and chemical inertness serve harsh duties in semiconductor etching tools, food-grade conveyors, and chemical reactors.

PVDF, posting the fastest 5.33% CAGR, is leveraged in lithium-ion cathode binders, separator films, and semiconductor clean-room hardware where its dielectric strength and solvent compatibility are critical. Capacity expansions in North America and Europe lock in regional security of supply, while localized production minimizes carbon footprints and tariffs, further entrenching PVDF's trajectory.

Liquid formulations held 63% of fluoropolymer coatings market size. Waterborne variants that slash VOCs without compromising film integrity are helping manufacturers comply with stringent emission rules in California and the EU.

Powder coatings deliver near-zero VOCs and over-spray recyclability, propelling a 5.5% CAGR through 2030. Developments such as CARC-qualified powder topcoats offer chemical-agent resistance for military assets while cutting application time, broadening powder use into aerospace, maritime, and heavy equipment segments formerly dominated by liquid systems.

The Fluoropolymer Coatings Market Report Segments the Industry by Resin Type (Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), and More), Coating Technology (Liquid and Powder), Substrate (Metal, Plastic, and Composite and Others), Application (Industrial, Building and Construction, Automotive, Food Processing, Cookware, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia Pacific accounted for 44% of fluoropolymer coatings market share in 2024, driven by China's extensive fluorochemicals base and massive renewable-energy build-out. India follows with incentives that stimulate electronics and PV manufacturing, creating sustained coating demand for anti-corrosive plant equipment. Japan and South Korea maintain leadership in semiconductors, pushing the region's technology frontier and thereby steadying premium coating consumption.

North America benefits from reshoring that promotes domestic PVDF and PTFE production, insulating battery and aerospace primes from supply shocks. Federal incentives catalyze hydrogen projects that call for ETFE-lined balance-of-plant hardware, further bolstering demand.

Europe balances high environmental standards with industrial necessity. Offshore-wind tower builders in Germany and the United Kingdom specify long-life fluoropolymer layers to minimize expensive North Sea maintenance campaigns. Nevertheless, the looming PFAS restriction forces formulators to examine closed-loop recycling and lower-emission manufacturing to secure long-term viability.

- AkzoNobel N.V.

- Arkema SA

- Axalta Coating Systems LLC

- Beckers Group

- Berger Paints India Ltd.

- Daikin Industries, Ltd.

- Dongyue Group Co., Ltd.

- Endura Coatings

- Hempel A/S

- Jiangsu Chenguang Fluoropolymer Co., Ltd.

- Jotun

- NIC Industries Inc.

- PPG Industries, Inc.

- Praxair Surface Technologies, Inc.

- Precision Coating Company, LLC (Integer Holdings Corporation)

- Solvay SA

- The Chemours Company

- The Sherwin-Williams Company

- Tnemec Company Inc.

- Walter Wurdack Inc.

- Whitford Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Anti-corrosive Coatings in Offshore Wind Turbine Towers

- 4.2.2 Fast-growing Adoption of Low-Friction Coatings in Electric Vehicle Powertrain Components

- 4.2.3 Growth of High-temperature Non-stick Coatings in Smart Cookware

- 4.2.4 Expansion of PVDF-lined Lithium-ion Battery Gigafactories in the North America and Europe

- 4.2.5 Surge in Hydrogen Pipeline Projects Driving ETFE and FEP Coatings

- 4.3 Market Restraints

- 4.3.1 Volatile Supply and Pricing of Fluorspar-derived HF Acid Due to Chinese Export Quotas

- 4.3.2 Competition from Low-priced Protective Coatings Available in the Industry

- 4.3.3 Strict Environmental Policies and Regulations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polytetrafluoroethylene (PTFE)

- 5.1.2 Polyvinylidene Fluoride (PVDF)

- 5.1.3 Fluorinated Ethylene Propylene (FEP)

- 5.1.4 Ethylene Tetrafluoroethylene (ETFE)

- 5.1.5 Perfluoroalkoxy Alkanes (PFA)

- 5.1.6 Polyvinyl Fluoride (PVF)

- 5.1.7 Other Resin Types

- 5.2 By Coating Technology

- 5.2.1 Liquid

- 5.2.2 Powder

- 5.3 By Substrate

- 5.3.1 Metal

- 5.3.2 Plastic

- 5.3.3 Composite and Others

- 5.4 By Application

- 5.4.1 Industrial

- 5.4.2 Building and Construction

- 5.4.3 Automotive

- 5.4.4 Food Processing

- 5.4.5 Aviation and Aerospace

- 5.4.6 Electrical

- 5.4.7 Cookware

- 5.4.8 Other Applications

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Merger and Acquisition, JV, Capacity Expansions)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Arkema SA

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 Beckers Group

- 6.4.5 Berger Paints India Ltd.

- 6.4.6 Daikin Industries, Ltd.

- 6.4.7 Dongyue Group Co., Ltd.

- 6.4.8 Endura Coatings

- 6.4.9 Hempel A/S

- 6.4.10 Jiangsu Chenguang Fluoropolymer Co., Ltd.

- 6.4.11 Jotun

- 6.4.12 NIC Industries Inc.

- 6.4.13 PPG Industries, Inc.

- 6.4.14 Praxair Surface Technologies, Inc.

- 6.4.15 Precision Coating Company, LLC (Integer Holdings Corporation)

- 6.4.16 Solvay SA

- 6.4.17 The Chemours Company

- 6.4.18 The Sherwin-Williams Company

- 6.4.19 Tnemec Company Inc.

- 6.4.20 Walter Wurdack Inc.

- 6.4.21 Whitford Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Sustainable and Eco-Friendly Coatings