PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836711

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836711

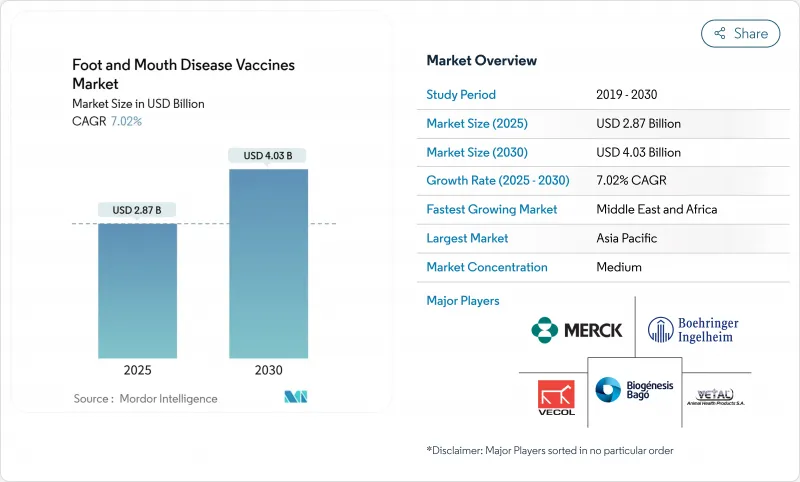

Foot And Mouth Disease Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The foot and mouth disease vaccines market stands at USD 2.87 billion in 2025 and is projected to reach USD 4.03 billion by 2030, registering a 7.02% CAGR.

Strong demand reflects the move from reactive outbreak control toward routine preventive immunization as climate change pushes the virus into once-temperate zones. Intensified livestock trade, new government vaccine banks, and the wider use of DIVA technologies are reinforcing predictable procurement cycles that favor volume manufacturing. Regional antigen banks in Asia-Pacific and the Middle East are streamlining bulk purchases, while subcutaneous delivery formats improve farmer compliance and reduce animal stress. Supply-chain constraints around cold storage and surge capacity remain the main brakes on growth, especially in remote regions of Africa and South America.

Global Foot And Mouth Disease Vaccines Market Trends and Insights

Rising Transboundary & Zoonotic Outbreaks

The January 2025 case in Germany, the country's first since 1988, triggered import bans across five continents and proved that a single incursion can shut billion-dollar trade channels . Molecular tracing showed the SAT2 XIV topotype arriving from East Africa, underscoring how modern logistics erase historical barriers. Libya's 2024 losses, where delayed vaccine arrival decimated Misrata herds, highlighted the cost of reactive strategies. Neighboring Austria responded by closing multiple border posts, signaling that containment now relies on regional vaccination readiness rather than local quarantine alone. Climate-linked shifts that lengthen viral survival in cooler zones suggest that preventive vaccination in once-free areas will continue to enlarge the foot and mouth disease vaccines market.

Growing Demand for Animal-Protein & Herd Size

Expanding middle-class diets in Asia and Africa increase the economic risk of FMD, compelling authorities to safeguard production. East Africa houses 40% of the continent's livestock, yet routine coverage is under 15%, a gap now targeted by the USD 17.68 million AgResults quadrivalent program that boosts six-month immunity. China's dairy expansion, with 6.05% BVDV positivity across 13 provinces, mirrors similar scale-up imperatives where vaccination becomes foundational to export licensing . South Africa's 2024 campaign vaccinated 634,000 cattle, showing how food-security mandates are turning sporadic inoculations into annual routines. Export premiums enjoyed by FMD-free nations prove that vaccination outlays pay for themselves via price uplift, ensuring capital flows back into wider coverage programs.

Cold-Chain & Storage Cost Burden

Maintaining 2-8 °C integrity is difficult where power grids are unreliable. Trials in Nepal found that temperature excursions cut potency and that bulky coolers hamper last-mile transport. FAO guidelines reiterate that cold-chain failure is the chief reason rural campaigns underperform. Freeze-drying can solve this, but current costs limit adoption in price-sensitive markets despite research showing 3-6% moisture content retains infectivity. As only 5% of cattle in sub-Saharan Africa receive systematic vaccination against 146.1% coverage in South America, cold-chain gaps materially restrict the foot and mouth disease vaccines market.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Vaccination Programs & Mandates

- Trade-Friendly DIVA and Recombinant Vaccine Roll-outs

- Serotype-Matching Regulatory Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated 56.61% of 2024 revenue from inactivated formulations, yet modified live platforms are forecast to rise 7.89% annually. The rise stems from stronger, longer-lasting immunity and the growing availability of DIVA-compliant attenuated strains. Next-generation adjuvants reduce adverse reactions while improving both humoral and cellular responses, positioning live vaccines as the preferred choice in regions confronting emergent serotypes. In contrast, inactivated doses rely on mature regulatory pathways but face waste risk when antigenic drift outpaces production cycles. Emerging mRNA and recombinant protein methods promise rapid strain updates and could redefine the foot and mouth disease vaccines market over the next decade.

Second-generation products link formulation with route efficiency. Freeze-dried pellets, oil emulsion stabilizers, and nanoparticle carriers are under study to extend shelf life and minimize cold-chain reliance, directly addressing high-growth but infrastructure-poor geographies. Manufacturers able to balance potency, stability, and DIVA compatibility stand to capture an outsized share of the expanding foot and mouth disease vaccines market.

Intramuscular injection remained dominant with 76.45% revenue share in 2024, securing the largest slice of the foot and mouth disease vaccines market size for delivery technologies. Nevertheless, subcutaneous delivery is rising at 7.97% CAGR as it requires less precision, lowers carcass blemish risk, and aligns with welfare regulations. Long-acting subcutaneous depots could soon halve dosing frequency, driving compliance in pastoral systems where veterinary visits are sporadic.

Formulation customizations for subcutaneous use include modified emulsion viscosities and higher antigen loads to compensate for slower uptake. Companies that tailor vaccines for both routes can appeal to large commercial feedlots prioritizing speed as well as smallholder farmers needing flexible techniques, broadening total addressable volumes within the foot and mouth disease vaccines market.

The Foot and Mouth Disease Vaccines Market is Segmented by Product (Modified/ Attenuated Live, and More), Route of Administration (Intramuscular and Subcutaneous), Animal Type (Cattle, Pigs, and More), Distribution Channel (Veterinary Hospitals and Clinics, Government Institutions, and More), and Geography (Asia-Pacific. Middle East and Africa, South America and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 50.43% of the foot and mouth disease vaccines market in 2024. China's dairy provinces, where 6.05% of tested herds showed BVDV antibodies, signal how intensification fuels vaccination budgets. India's Haryana surveillance recorded 5.3% NSP seroreactors, yet high protective titers against serotypes O, A, and Asia-1 point to program effectiveness. Indonesia's receipt of 4 million doses from Australia demonstrates cross-border cooperation to stabilize supply. Although coverage is nearing saturation in tier-one producers, growth continues in emerging Southeast Asian economies shifting toward export-oriented livestock models.

The Middle East & Africa region leads growth at an 8.02% CAGR. Libya's 2024 losses emphasized vulnerability when vaccine shipments lag demand. South Africa's campaign that vaccinated 634,000 cattle, including 97,000 in Eastern Cape, illustrates the pivot from selective to blanket immunization. Eastern Africa's AgResults project is developing quadrivalent doses that secure six-month immunity, closing performance gaps that previously discouraged farmer uptake. Ethiopia's large but under-served herd underscores latent volume that could materialize if cold-chain financing and regulatory fast-tracking improve.

South America shows mature penetration but faces climate-driven threats to disease-free status. Brazil's experience proves vaccination can unlock exports; yet shifting weather patterns may re-introduce risk, renewing demand. North American and European markets, once considered post-FMD, have acknowledged new exposure. Germany's 2025 case and Canada's subsequent USD 57.5 million bank reveal how temperate regions are adding proactive capacity. The geographic redistribution of risk is enlarging the overall foot and mouth disease vaccines market beyond its historical endemic base.

- Biogenesis Bago

- Boehringer Ingelheim

- Brilliant Bio Pharma

- China Animal Husbandry (CAHIC)

- Indian Immunologicals

- Limor de Colombia

- Merck & Co. Inc. / MSD Animal Health

- VECOL S.A.

- VETAL Animal Health

- Biovet

- Ceva

- Zoetis

- Jinyu Bio-technology

- Cavsavac (Biopharma Morocco)

- Intervac

- Shchelkovo Agrohim

- Indian Immunologicals

- Phibro Animal Health

- Selevac

- Inovet

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising transboundary & zoonotic outbreaks

- 4.2.2 Growing demand for animal-protein & livestock herd size

- 4.2.3 Government-funded vaccination programs & mandates

- 4.2.4 Trade-friendly DIVA/recombinant vaccine roll-outs

- 4.2.5 Regional antigen banks securing bulk procurement

- 4.2.6 Climate-driven FMD migration into temperate zones

- 4.3 Market Restraints

- 4.3.1 Cold-chain & storage cost burden

- 4.3.2 Serotype-matching regulatory delays

- 4.3.3 Antigenic drift causing inventory obsolescence

- 4.3.4 Limited surge capacity for high-potency vaccines

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Modified/ Attenuated Live

- 5.1.2 Inactivated (Killed)

- 5.1.3 Others

- 5.2 By Route of Administration

- 5.2.1 Intramuscular

- 5.2.2 Subcutaneous

- 5.3 By Animal Type

- 5.3.1 Cattle

- 5.3.2 Pigs

- 5.3.3 Sheep & Goats

- 5.3.4 Others

- 5.4 By Distribution Channel

- 5.4.1 Veterinary Hospitals and Clinics

- 5.4.2 Government Institutions

- 5.4.3 Others

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 South Korea

- 5.5.1.4 Rest of APAC

- 5.5.2 Middle East and Africa

- 5.5.2.1 GCC

- 5.5.2.2 South Africa

- 5.5.2.3 Rest of Middle East and Africa

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Argentina

- 5.5.3.3 Rest of South America

- 5.5.4 Rest of the World

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Biogenesis Bago

- 6.3.2 Boehringer Ingelheim

- 6.3.3 Brilliant Bio Pharma

- 6.3.4 China Animal Husbandry (CAHIC)

- 6.3.5 Indian Immunologicals

- 6.3.6 Limor de Colombia

- 6.3.7 Merck & Co. Inc. / MSD Animal Health

- 6.3.8 VECOL S.A.

- 6.3.9 VETAL Animal Health

- 6.3.10 Biovet

- 6.3.11 Ceva Sante Animale

- 6.3.12 Zoetis

- 6.3.13 Jinyu Bio-technology

- 6.3.14 Cavsavac (Biopharma Morocco)

- 6.3.15 Intervac

- 6.3.16 Shchelkovo Agrohim

- 6.3.17 Indian Immunologicals Ltd

- 6.3.18 Phibro Animal Health

- 6.3.19 Selevac

- 6.3.20 Inovet

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment