PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836713

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836713

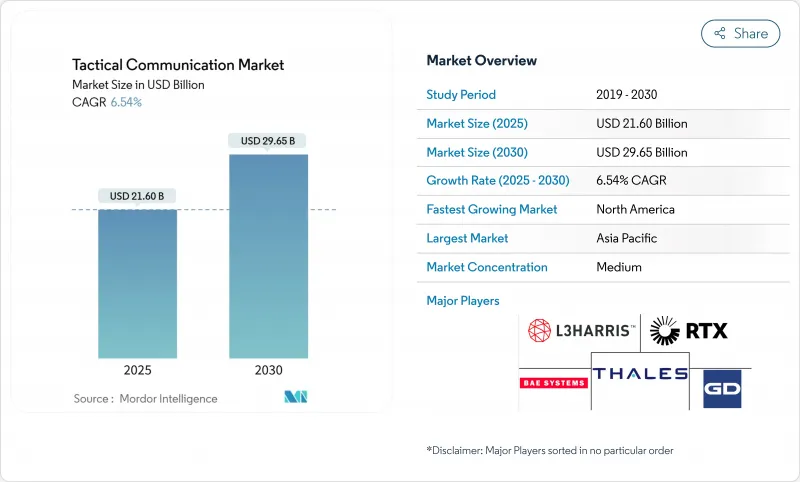

Tactical Communication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The tactical communications market size stood at USD 21.60 billion in 2025 and will advance at a 6.54% CAGR to USD 29.65 billion by 2030.

Rising defense digitalization, expanding budgets, and a clear pivot toward network-centric warfare sustain demand across all major buying regions. Hardware still rules spending, yet service-heavy integration and training workstreams record faster growth as software-defined architectures proliferate. Land forces remain the largest buyers, but space platforms now capture the strongest growth wave thanks to low-orbit constellations that extend Link 16 and direct-to-cell services into every theater. Commercial SATCOM's entrance, paired with mesh networking advances, keeps competitive pressure high and compresses technology cycles for incumbents. Asia-Pacific leads revenue today, while North America grows the quickest on the back of Pentagon spectrum-sharing pilots and zero-trust mandates.

Global Tactical Communication Market Trends and Insights

Rising Defense Modernization and Network-Centric Warfare

Multi-domain operations now guide every major force-structure plan, which places integrated communications at the center of combat power. JADC2 prototypes turn radios into distributed sensors that feed AI engines for faster targeting.Interoperability advances such as RIC-U allow coalition units to share traffic without downgrading security. Special operations units insist on ultra-secure, low-probability-of-detect links, a need underscored by recent field lessons in Ukraine. Cognitive spectrum tools predict and bypass jamming, raising survivability in contested bands. European ministries accelerated USD-level procurements of Falcon IV radios after witnessing electronic-warfare attrition rates in Eastern Europe.

Growing Global Defense Expenditure

World military outlays hit USD 2.718 trillion in 2024, up 9.4%, releasing extra funds for tactical radios, waveforms, and encryption modules. East Asian budgets crossed USD 433 billion, with Beijing's C4ISR push driving nearly one-third of new communications awards. The United States earmarked USD 143.2 billion for R&D in 2025, a sizable share of which targets resilient networks and cyber-secure assets. Europe redirected rising budgets toward jam-resistant systems after battlefield disruptions in Ukraine. Contract data shows a near-linear tie between spending spikes and award volume; L3Harris booked nearly USD 2 billion of new orders in 2024-2025 alone.

Spectrum Congestion and Limited Bandwidth Allocation

Civil 5G auctions now crowd frequencies once reserved for defense, squeezing room for new tactical channels. The US temporarily lost auction authority, stalling relief for spectrum-hungry operators. Pentagon proposals to vacate 420 MHz bands illustrate trade-offs between commercial revenue and mission readiness. DARPA's coexistence research offers partial fixes but cannot guarantee zero interference in live combat. Dynamic access schemes need cognitive radios, yet roll-out speed lags procurement cycles. Multinational coalitions face extra friction because partner nations allocate bands differently, complicating interoperability.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Secure, Resilient, High-Throughput Links

- AI-Driven Cognitive Radios for Dynamic Spectrum Use

- High Cyber-Hardening Costs Under Zero-Trust Mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Land systems accounted for 47.90% of the tactical communications market size in 2024, underscoring armies' persistent need for secure voice and data at the platoon level. Recent US Army field tests replace standalone radios with unified edge nodes that blend SATCOM, MANET, and LTE links in one chassis. Armored vehicle upgrades now include multi-channel transceivers so crews can roam between bands without manual retuning. Complementary airborne nodes turn CMV-22 Ospreys into ad hoc command posts, extending carrier strike group coverage during E-2D downtime. Naval requests for AN/SRQ-4 gear illustrate blue-water appetite for over-horizon helicopter links that reach 100 nautical miles.

Space platforms captured only a single-digit share but remain the fastest-growing slice, expanding at a 9.23% CAGR to 2030. Link 16 messages routed through low-orbit satellites now reach far beyond line-of-sight and cut relay latency by half. Direct-to-cell initiatives, championed by SpaceX and Lynk, threaten to disrupt expensive legacy SATCOM frameworks. Defense ministries experiment with enterprise SATCOM models that pool military and commercial beams for resilience. France's EUR 1 billion contract with Eutelsat demonstrates sovereign drive to secure bandwidth against geopolitical pressure. As launches get cheaper, proliferated constellations give planners redundancy that terrestrial nodes cannot match.

Hardware retained a 59.23% share in 2024, anchored by handhelds, vehicular kits, antennas, and Type-1 encryption modules. Software-defined architectures extend platform life because a new waveform now only needs a firmware push rather than a board swap, trimming ownership costs. Antennas evolve toward electronically steered designs that auto-select the best band based on terrain or interference. Encryption upgrades remain non-negotiable as zero-trust deadlines approach, driving demand for NSA-certified devices.

Services rise at an 8.11% CAGR, reflecting a shift from simple box sales to lifetime capability contracts. Integration services tie together terrestrial, satellite, and private 5G nodes into one operating picture, a skill set in short supply. The US Army's C2 Fix program bundles radios with field installation, network tuning, and embedded training to shorten adoption curves. Predictive maintenance models use AI log crunching to schedule part swaps before failure, cutting mission downtime. Training curricula now teach soldiers to run waveform diagnostics and security checks as part of pre-mission prep.

The Tactical Communication Market Report is Segmented by Platform (Land, Airborne, and More), Component (Hardware, and More), Technology (SATCOM, and More), Frequency Band (HF (3-30 MHz), and More), Communication Type (Data, and More), End-User (Defense Forces, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific produced 34.16% of 2024 revenue, buoyed by China's broad modernization and East Asia's 7.8% budget jump to USD 433 billion. Beijing's anti-access investment fuels orders for encrypted VHF sets and high-capacity SATCOM backup routes. Australia channels AUKUS funds into undersea mesh gateways, while India scales mountain-graded SDR kits for Himalayan patrols. Regional buyers often demand sovereignty over crypto modules, prompting local production partnerships.

North America logs the fastest CAGR at 5.92% through 2030. Pentagon pilots test spectrum-sharing tech at Utah ranges to free commercial mid-band while protecting tactical pipelines. Zero-trust migration inflates radio refresh budgets, and large Army Manpack awards flow to domestic vendors. Canada procures L3Harris multi-channel sets for arctic deployment, whereas Mexico outfits special forces with mesh handhelds for anti-cartel missions. The region's industrial depth accelerates product iterations that often debut before foreign counterparts.

Europe's growth curve steepened once Ukraine exposed analogous vulnerabilities. The Netherlands ordered EUR 1 billion (USD 1.15 billion) of Falcon IV radios under project FOXTROT to standardize across land and maritime units. Nordic nations pilot 5G-to-SDR hybrids for arctic resilience, and NATO procurement frameworks simplify cross-border buys. Middle Eastern clients prioritize jam-resistant downlinks for UAV fleets, while African states invest in mesh systems for wide-area border patrol despite budget limits. European projects increasingly specify open-architecture APIs, pressuring vendors to publish interface specs.

- Thales Group

- L3Harris Technologies, Inc.

- Northrop Grumman Corporation

- RTX Corporation

- General Dynamics Corporation

- BAE Systems plc

- Ultra Electronics Holdings

- Terma Group

- Rafael Advanced Defense Systems Ltd.

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- Curtiss-Wright Corporation

- Rohde & Schwarz India Pvt. Ltd.

- CAES (Honeywell International Inc.)

- Leonardo S.p.A

- Saab AB

- Comtech Telecommunications Corp.

- HENSOLDT AG

- Silvus Technologies

- Bharat Electronics Ltd.

- Israel Aerospace Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising defense modernization and network-centric warfare

- 4.2.2 Growing global defense expenditure

- 4.2.3 Demand for secure, resilient, high-throughput links

- 4.2.4 5G-NTN and private LTE enabling high-bandwidth ISR

- 4.2.5 AI-driven cognitive radios for dynamic spectrum use

- 4.2.6 Miniaturized SWaP-C soldier-worn mesh devices

- 4.3 Market Restraints

- 4.3.1 Spectrum congestion and limited bandwidth allocation

- 4.3.2 High cyber-hardening costs under zero-trust mandates

- 4.3.3 Export controls and ITAR slow multinational programs

- 4.3.4 Interoperability issues with legacy analog systems

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Platform

- 5.1.1 Land

- 5.1.2 Airborne

- 5.1.3 Naval

- 5.1.4 Space

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.1.1 Transceivers/Transmitters

- 5.2.1.2 Receivers

- 5.2.1.3 Antennas

- 5.2.1.4 Encryption Devices

- 5.2.1.5 Headsets and Microphones

- 5.2.1.6 Other Hardware

- 5.2.2 Software

- 5.2.2.1 Waveform Software

- 5.2.2.2 Encryption Software

- 5.2.2.3 Network Management Software

- 5.2.3 Services

- 5.2.3.1 Integration

- 5.2.3.2 Maintenance and Support

- 5.2.3.3 Training

- 5.2.1 Hardware

- 5.3 By Technology

- 5.3.1 SATCOM

- 5.3.2 VHF/UHF

- 5.3.3 HF

- 5.3.4 Data Link

- 5.3.5 Other Technologies (MANET, LTE and 5G Tactical)

- 5.4 By Frequency Band

- 5.4.1 HF (3-30 MHz)

- 5.4.2 VHF (30-300 MHz)

- 5.4.3 UHF (300 MHz-3 GHz)

- 5.4.4 L-band

- 5.4.5 S-band

- 5.4.6 C-band and Above

- 5.5 By Communication Type

- 5.5.1 Secure Voice

- 5.5.2 Data

- 5.5.3 Video

- 5.5.4 Other

- 5.6 By End User

- 5.6.1 Defense Forces

- 5.6.1.1 Army

- 5.6.1.2 Navy

- 5.6.1.3 Air Force

- 5.6.1.4 Special Operations

- 5.6.2 Homeland Security

- 5.6.2.1 Law Enforcement

- 5.6.2.2 Emergency Services

- 5.6.2.3 Border Security

- 5.6.1 Defense Forces

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Russia

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 India

- 5.7.3.3 Japan

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Thales Group

- 6.4.2 L3Harris Technologies, Inc.

- 6.4.3 Northrop Grumman Corporation

- 6.4.4 RTX Corporation

- 6.4.5 General Dynamics Corporation

- 6.4.6 BAE Systems plc

- 6.4.7 Ultra Electronics Holdings

- 6.4.8 Terma Group

- 6.4.9 Rafael Advanced Defense Systems Ltd.

- 6.4.10 Lockheed Martin Corporation

- 6.4.11 Elbit Systems Ltd.

- 6.4.12 Curtiss-Wright Corporation

- 6.4.13 Rohde & Schwarz India Pvt. Ltd.

- 6.4.14 CAES (Honeywell International Inc.)

- 6.4.15 Leonardo S.p.A

- 6.4.16 Saab AB

- 6.4.17 Comtech Telecommunications Corp.

- 6.4.18 HENSOLDT AG

- 6.4.19 Silvus Technologies

- 6.4.20 Bharat Electronics Ltd.

- 6.4.21 Israel Aerospace Industries Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment