PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836715

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836715

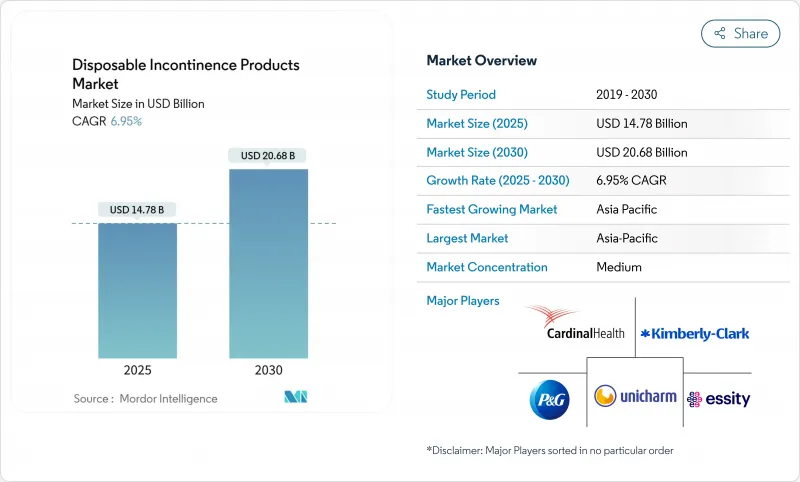

Disposable Incontinence Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The disposable incontinence products market generated USD 14.78 billion in 2025 and is projected to reach USD 20.68 billion in 2030, reflecting a 6.95% CAGR.

At its current growth rate, the disposable incontinence products market is benefitting from longer life expectancy, wider chronic kidney disease (CKD) screening, and upgrades to reimbursement codes that expand coverage for hydrophilic catheters and other advanced devices. Protective garments remain the mainstay purchase in long-term care facilities, yet smart catheter designs and biodegradable nonwovens are widening clinician choice. Intensifying plastic-waste regulations in Europe are accelerating the shift toward recyclable packaging, while direct-to-consumer (D2C) platforms improve product access and brand loyalty in home-care settings. The disposable incontinence products market is also finding steady demand from hospital systems that integrate incontinence management into CKD and benign prostatic hyperplasia (BPH) care pathways.

Global Disposable Incontinence Products Market Trends and Insights

Rising Prevalence of Renal & Urological Disorders

CKD afflicts 35.5 million Americans, and prevalence rises to 50.94% among people aged 90 and older in Saudi Arabia. CKD's direct link with diabetes and hypertension magnifies long-term demand for high-capacity absorbent products and catheter kits with infection-prevention coatings. Institutional purchasers now embed incontinence supplies into CKD care bundles, guaranteeing baseline order volumes that stabilize the disposable incontinence products market. Predictable chronic-care volumes allow suppliers to optimize production lines and negotiate multiyear contracts. The driver remains strongest in higher-income regions where CKD diagnostic coverage is highest, yet emerging markets are closing the gap as national health surveys expand.

Aging Population & Higher Life Expectancy

Asia-Pacific's older-adult cohort will nearly double to 1.2 billion by 2050, raising the region's incontinence case load sharply. Many seniors lack consistent health-plan coverage, so governments are directing larger budget shares to elder-care subsidies. The demographic shift pushes demand for both premium breathable diapers in urban nursing homes and affordable pull-ups in rural clinics. Manufacturers rely on forward demand visibility to plan capacity investments across China, India, and Indonesia. As family-based care models evolve into paid in-home services, subscription programs for bulk deliveries of protective garments are gaining traction, further widening the disposable incontinence products market.

Dermatitis & Infection Risks From Prolonged Product Use

The U.S. FDA continues to record adverse-event filings that associate external catheters with skin irritation and urinary-tract infections. Infection fears lower compliance among cost-conscious patients who attempt to reuse single-use items. Facilities counter by specifying breathable backing films and silver-ion coatings in tender documents, which raises product costs. Skin-friendly innovations partially offset the restraint but add complexity to regulatory submissions. The issue is more acute in tropical regions where humidity accelerates bacterial growth, pressing manufacturers to tailor product guidelines and training materials accordingly.

Other drivers and restraints analyzed in the detailed report include:

- Advances in Super-Absorbent & Breathable Nonwovens

- E-Commerce & D2C Brands Expanding Access

- Patchy Reimbursement in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Protective garments generated 53.55% of the disposable incontinence products market share in 2024, reflecting widespread adoption in hospitals, nursing homes, and at-home care routines. Demand is insulated from short-term economic swings because garments offer a familiar, low-training solution across mild-to-severe incontinence profiles. Innovations such as four-layer breathable panels and odor-lock gels extend wear time, thereby lowering daily change frequency for budget-tight facilities. Urinary catheters, while holding a smaller base, are advancing at a 9.25% CAGR as hydrophilic coatings reduce urethral trauma and new HCPCS reimbursement codes increase affordability. External catheter designs optimized for female anatomy are also winning regulatory clearance, opening untapped outpatient segments.

The disposable incontinence products market size for catheter solutions is forecast to rise steadily, supported by smart catheters that transmit real-time flow data to clinician dashboards. Disposable under-pads attract institutional buyers aiming to protect mattresses and wheelchairs against incidental leaks, while pull-up pants resonate with ambulatory adults seeking garment-like aesthetics. Leg urine bags gain share in home infusion programs where mobility is critical. Material upgrades in biodegradable polymers lower disposal costs, appealing to countries with landfill-tax regimes. The product-type landscape remains dynamic as cross-category hybrids-such as integrated diaper-catheter kits-enter clinical trials, promising further differentiation.

The Disposable Incontinence Products Market Report is Segmented by Product Type (Protective Garments [Disposable Adult Diapers, and More], Urine Bags, Urinary Catheters [Intermittent Catheters, and More]), Application (Chronic Kidney Failure, Benign Prostatic Hyperplasia, and More), End-User (Hospitals & Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the disposable incontinence products market with a 42.72% revenue share in 2024, anchored by Medicare coding stability and mature long-term-care networks. Updated HCPCS codes effective January 2025 classify hydrophilic catheters in higher-reimbursement shells, prompting hospitals to upsell advanced variants. U.S. policy also widened coverage to lymphedema compression treatment items, signaling an overall device-friendly stance. Canada's public health-insurance redesign expands home-support allowances, giving home-care suppliers greater wallet share. Mexico's Seguro Popular replacement, INSABI, is channelling new funds to state clinics, creating a multi-tiered tender landscape. Sustainability mandates such as California's SB 54, which enforces a 25% single-use plastic reduction by 2032, push brands to launch recyclable diaper wrappers that feed circular-economy pilots.

Asia-Pacific registered a 10.22% CAGR, the fastest globally, powered by population aging and higher CKD screening in China, Japan, and South Korea. China's device makers are leveraging cost advantages to court Latin American buyers, exporting both pull-ups and catheter kits under CE-mark equivalency. Indonesia's domestic factories benefit from government grants tied to local-content rules, supplying lower-priced diapers to public hospitals while premium imports capture the private-hospital tier. India's e-pharmacies have started stocking discrete male guards and female pads, accelerating D2C penetration and adding volume to the disposable incontinence products market. Australia's National Disability Insurance Scheme further boosts uptake of reusable pelvic-floor trainers that complement single-use absorbents.

Europe remains a mature yet evolving arena where the EU Packaging and Packaging Waste Regulation mandates fully recyclable packaging by 2030 and a 5% plastic-waste reduction by the same year. Manufacturers must balance sustainability upgrades with strict Medical Device Regulation (MDR) documentation that now covers reprocessed single-use devices. Germany leads volume consumption, yet France's eco-tax credits tilt purchasing toward compostable liners. The United Kingdom's NHS Supply Chain is piloting outcome-based contracts that tie reimbursements to dermatitis reduction metrics, potentially reshaping supplier scorecards. Nordic countries, already leaders in recyclable diaper adoption, offer case studies that other EU states may emulate, further influencing the disposable incontinence products market trajectory.

- Becton, Dickinson & Co. (C.R. Bard)

- Cardinal Health

- Coloplast

- Kimberly-Clark Worldwide

- Abena

- Hollister

- Convatec

- First Quality Enterprises

- HARTMANN Group

- Medline Industries

- Essity

- Procter & Gamble

- Unicharm Corp.

- Teleflex

- B. Braun

- Boston Scientific

- Ontex Group

- TZMO SA

- Principle Business Enterprises

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Renal & Urological Disorders

- 4.2.2 Aging Population & Higher Life Expectancy

- 4.2.3 Advances In Super-Absorbent & Breathable Nonwovens

- 4.2.4 E-Commerce & D2C Brands Expanding Access

- 4.2.5 2026 HCPCS Codes For Hydrophilic Catheters (Reimbursement Boost)

- 4.2.6 Adoption Of AI-Enabled Smart Diapers In Long-Term Care

- 4.3 Market Restraints

- 4.3.1 Dermatitis & Infection Risks From Prolonged Product Use

- 4.3.2 Patchy Reimbursement In Emerging Economies

- 4.3.3 Sustainability Regulations On Single-Use Plastics & Landfill Waste

- 4.3.4 Shift Toward Reusable Pelvic-Floor Wearables & Stimulation Devices

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Protective Garments

- 5.1.1.1 Disposable Adult Diapers

- 5.1.1.2 Disposable Under-pads

- 5.1.1.3 Disposable Pull-up Pants

- 5.1.1.4 Other Garments

- 5.1.2 Urine Bags

- 5.1.2.1 Leg Urine Bags

- 5.1.2.2 Bedside Urine Bags

- 5.1.3 Urinary Catheters

- 5.1.3.1 Indwelling (Foley) Catheters

- 5.1.3.2 Intermittent Catheters

- 5.1.3.3 External Catheters

- 5.1.1 Protective Garments

- 5.2 By Application

- 5.2.1 Chronic Kidney Failure

- 5.2.2 Benign Prostatic Hyperplasia (BPH)

- 5.2.3 Bladder Cancer

- 5.2.4 Kidney Stone

- 5.2.5 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Long-Term Care Facilities

- 5.3.3 Homecare Settings

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton, Dickinson & Co. (C.R. Bard)

- 6.3.2 Cardinal Health

- 6.3.3 Coloplast

- 6.3.4 Kimberly-Clark

- 6.3.5 Abena

- 6.3.6 Hollister

- 6.3.7 ConvaTec

- 6.3.8 First Quality Enterprises

- 6.3.9 HARTMANN Group

- 6.3.10 Medline Industries

- 6.3.11 Essity

- 6.3.12 Procter & Gamble

- 6.3.13 Unicharm Corp.

- 6.3.14 Teleflex Inc.

- 6.3.15 B. Braun Melsungen AG

- 6.3.16 Boston Scientific

- 6.3.17 Ontex Group

- 6.3.18 TZMO SA

- 6.3.19 Principle Business Enterprises

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment