PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836717

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836717

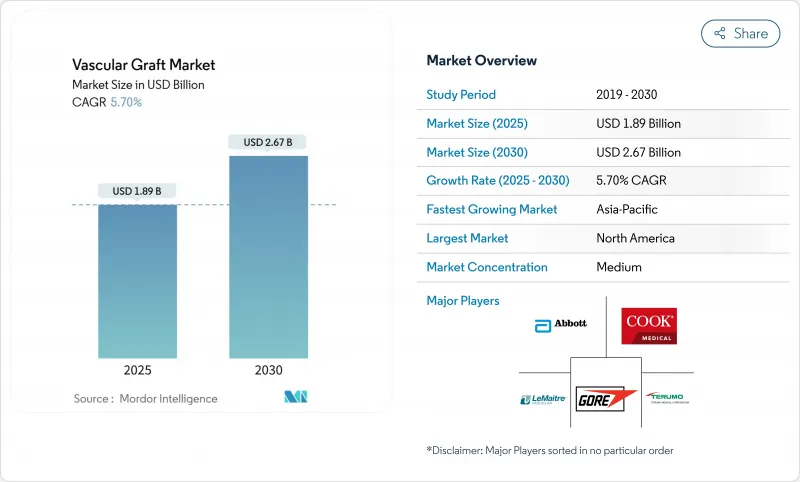

Vascular Graft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vascular graft market stands at USD 1.89 billion in 2025 and is forecast to reach USD 2.67 billion by 2030, advancing at a 7.15% CAGR.

This expansion reflects the synchronized influence of rising cardiovascular disease prevalence, routine adoption of minimally-invasive repair, and rapid material innovation that keeps synthetic and biological grafts central to contemporary vascular care. Endovascular stent grafts continue to anchor overall revenue thanks to short hospital stays and broad anatomical applicability, yet the growing acceptance of patient-specific 3D-printed bio-resorbable grafts signals a pivot toward personalized reconstruction and fewer long-term foreign-body concerns. Manufacturers leverage polymer chemistry breakthroughs, surface engineering, and embedded sensor concepts to extend patency, curb infection, and supply real-time performance data. Regionally, high procedure volumes in North America sustain global leadership, but Asia-Pacific's investment in cardiovascular infrastructure and local production capacity is reshaping competitive dynamics. Momentum is reinforced as regulators approve data-driven medical devices that supplement graft therapy with algorithmic patient selection and post-implant monitoring, further embedding graft technology within intelligent cardiovascular care pathways.

Global Vascular Graft Market Trends and Insights

Rising Prevalence of Cardiovascular Diseases

Escalating cardiovascular morbidity sustains steady procedure volumes despite plateauing growth in some mature markets. Earlier onset linked to diabetes and chronic renal disease has increased the proportion of complex, multi-vessel presentations that often require hybrid combinations of graft types. Surgeons weigh lifetime patency more heavily than initial implant cost, steering demand toward biosynthetic or drug-eluting constructs that resist thrombosis and infection. As these high-risk subpopulations expand, the vascular graft market maintains momentum even when overall surgical rates stabilize. This demographic pressure supports long-term capacity planning and encourages R&D partnerships aimed at next-generation polymer blends and endothelial-mimicking surfaces.

Growing Number of Minimally-Invasive Endovascular Interventions

Advances in imaging, delivery-system flexibility, and simulation training have shortened the learning curve for percutaneous repairs, unlocking anatomies once limited to open surgery. Hospitals favor these approaches because shorter admissions lower cost per case, while patients benefit from quicker recovery and same-day discharge in many peripheral procedures. Robust survival data from pulmonary embolism thrombectomy further validates safety, reinforcing payer confidence and widening clinical indications. As ambulatory settings take on more complex vascular work, device makers focus on grafts that deliver through smaller sheaths without compromising radial strength, fueling additional adoption.

High Average Selling Price of Next-Generation Grafts

Premium price points challenge payers that have not yet embedded long-term patency benefits into reimbursement algorithms. Large health-system purchasing alliances negotiate aggressively, eroding early profit margins and stretching the time to recoup R&D investment. In elective procedures, cost-effectiveness thresholds often favor established devices unless randomized evidence shows clear superiority, delaying widespread substitution. Emergency settings tolerate higher prices, but these account for a minority of total graft volume. Consequently, producers must balance margin expectations with tiered portfolios that serve both value-oriented and performance-driven segments.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Synthetic Graft Materials

- Expanding Adoption of Off-the-Shelf Endovascular Stent-Grafts

- Post-Implant Infection & Graft Thrombosis Risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endovascular stent grafts generated the largest share of the vascular graft market size at USD 1.02 billion in 2024, reflecting entrenched procedural familiarity and broad insurance coverage. Their platform advantage is reinforced by continuing design refinements that improve seal integrity in complex aortic arches. Nonetheless, 3D-printed bio-resorbable grafts, while representing a smaller revenue base, present the strongest upside as they address pediatric and small-caliber niches where lifelong implant avoidance is attractive. The vascular graft market continues to balance high-volume standardized devices with bespoke solutions that leverage additive manufacturing efficiencies.

Growing clinical evidence for bio-resorbable constructs draws regulatory momentum, but stringent long-term data requirements slow wide release. Peripheral vascular grafts sustain mid-single-digit growth thanks to rising diabetes prevalence, while coronary artery bypass grafts witness subdued demand as percutaneous interventions encroach on surgical indications. Hemodialysis access devices benefit from escalating end-stage renal disease prevalence and command premium pricing due to the high cost of access failure. Manufacturers prioritize modular delivery systems that allow intraoperative length adjustment, reducing inventory redundancy and simplifying supply logistics across diverse care settings.

ePTFE continues to dominate revenues, contributing almost half of the vascular graft market share in 2024 because of predictable handling characteristics and established clinical data. Polyester (Dacron) remains the go-to in large-diameter aortic repairs owing to its woven architecture and burst-pressure resilience. Yet biosynthetic hybrids, advancing at 8.19% CAGR, increasingly converge structural strength with biologic integration, capturing surgeon interest where long-term patency is crucial.

Cost considerations currently favor legacy materials, but hospital value-analysis teams are receptive to infection-resistant coatings and bio-integrative surfaces when downstream savings are demonstrable. Polyurethane-based options hold a niche role in mobile anatomical territories where flex-fatigue failure threatens rigid polymers. Regulatory pathways reward incremental improvements on familiar substrates, so innovators often layer antimicrobial or antiproliferative features onto ePTFE backbones to expedite clearance. As outcome data accumulate, hospitals may recalibrate cost-benefit analyses, unlocking broader substitution of biosynthetic options in routine indications.

The Vascular Grafts Market Report Segments the Industry Into by Product Type (Endovascular Stent Grafts, Peripheral Vascular Grafts and More), by Material (ePTFE, Polyester (Dacron) and More), by Raw Material (Aortic & Peripheral Aneurysm Repair, Peripheral Vascular Disease and More), and by Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America sustained a 39.05% stake of the vascular graft market in 2024, underpinned by widespread reimbursement, mature clinical pathways, and a sizable aging population. Academic centers nurture first-in-human trials, creating a robust pipeline of innovation that migrates rapidly into community hospitals. Large integrated delivery networks negotiate bulk procurement but reward vendors that can support enterprise-wide standardization and data capture initiatives. As a result, graft makers couple product supply with analytics dashboards that track failure trends and readmission costs.

Asia-Pacific is the fastest-growing territory with a 9.45% CAGR to 2030. Policymaker focus on cardiovascular disease as an economic and social priority unlocks funding for catheterization labs, hybrid operating theaters, and surgeon training. Domestic manufacturers exploit proximity to lower-cost supply chains, while multinationals establish regional production to sidestep import tariffs and ensure quicker regulatory sign-off. Cultural attitudes toward xenografts influence material selection, creating micro-segment opportunities across sub-regions. Urban-rural disparity prompts tiered product strategies: high-spec grafts for tertiary centers and cost-sensitive lines for district hospitals.

Europe registers steady low-single-digit growth guided by value-based procurement and stringent evidence demands. The vascular graft market here prizes long-term outcome publications, prompting suppliers to sponsor post-authorization studies that satisfy national health-technology assessment bodies. Currency volatility tied to macro-economic shifts shapes inventory hedging policies, particularly for UK-based distributors navigating post-Brexit trade procedures. Latin American markets progress unevenly; pockets such as Brazil and Colombia invest in endovascular infrastructure, yet funding cycles and currency fluctuations delay device approvals. Middle East and Africa remain small but strategic, with selected Gulf states commissioning cardiovascular centers of excellence that specify premium grafts and draw medical tourists.

- Terumo

- W. L. Gore & Associates

- B. Braun

- Getinge AB (Maquet)

- LeMaitre Vascular

- Medtronic

- Boston Scientific

- Cook Group

- Artivion Inc. (CryoLife)

- Endologix LLC

- JOTEC GmbH (CryoLife)

- MicroPort Scientific Corp.

- Suokang Medical

- Xeltis BV

- Admedus Ltd.

- BIOTRONIK

- Becton Dickinson (C. R. Bard)

- Lombard Medical Ltd.

- Shenzhen Mindray Bio-Medical

- Transverse Medical Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of cardiovascular diseases

- 4.2.2 Growing number of minimally-invasive endovascular interventions

- 4.2.3 Technological advances in synthetic graft materials

- 4.2.4 Expanding adoption of off-the-shelf endovascular stent-grafts

- 4.2.5 Surge in clinical trials for cell-seeded bio-engineered grafts

- 4.2.6 Emergence of 3-D-printed patient-specific vascular conduits

- 4.3 Market Restraints

- 4.3.1 High average selling price of next-generation grafts

- 4.3.2 Post-implant infection & graft thrombosis risk

- 4.3.3 Procurement bottlenecks for biological/allograft tissue

- 4.3.4 Stringent long-term patency evidence required by payers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value, USD)

- 5.1.1 Endovascular Stent Grafts

- 5.1.2 Peripheral Vascular Grafts

- 5.1.3 Hemodialysis Access Grafts

- 5.1.4 Coronary Artery Bypass Grafts

- 5.1.5 Others

- 5.2 By Material (Value, USD)

- 5.2.1 ePTFE

- 5.2.2 Polyester (Dacron)

- 5.2.3 Polyurethane

- 5.2.4 Biosynthetic (PET/Collagen etc.)

- 5.2.5 Biological (Allograft, Xenograft)

- 5.3 By Application (Value, USD)

- 5.3.1 Aortic & Peripheral Aneurysm Repair

- 5.3.2 Peripheral Vascular Disease

- 5.3.3 Hemodialysis Access

- 5.3.4 Coronary Artery Bypass Surgery

- 5.4 By End User (Value, USD)

- 5.4.1 Hospitals & Surgical Centers

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Vascular Clinics

- 5.5 By Geography (Value, USD)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Terumo Corporation

- 6.3.2 W. L. Gore & Associates

- 6.3.3 B. Braun Melsungen AG

- 6.3.4 Getinge AB (Maquet)

- 6.3.5 LeMaitre Vascular Inc.

- 6.3.6 Medtronic plc

- 6.3.7 Boston Scientific Corp.

- 6.3.8 Cook Medical Inc.

- 6.3.9 Artivion Inc. (CryoLife)

- 6.3.10 Endologix LLC

- 6.3.11 JOTEC GmbH (CryoLife)

- 6.3.12 MicroPort Scientific Corp.

- 6.3.13 Suokang Medical

- 6.3.14 Xeltis BV

- 6.3.15 Admedus Ltd.

- 6.3.16 Biotronik SE & Co. KG

- 6.3.17 Becton Dickinson (C. R. Bard)

- 6.3.18 Lombard Medical Ltd.

- 6.3.19 Shenzhen Mindray Bio-Medical

- 6.3.20 Transverse Medical Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment