PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836721

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836721

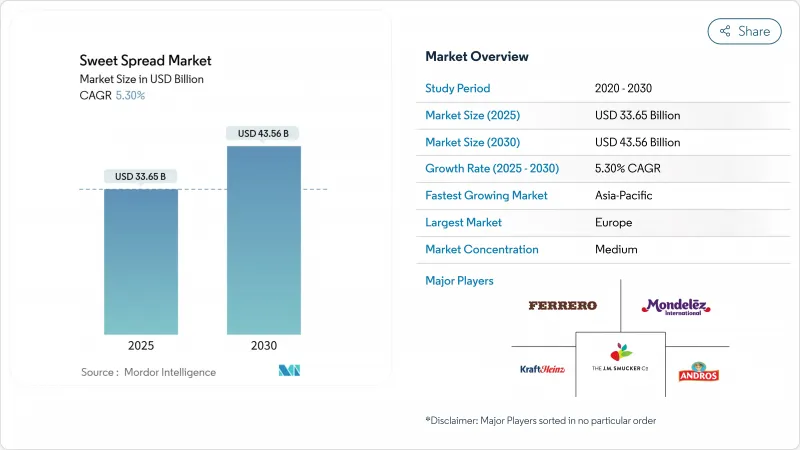

Sweet Spread - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sweet spreads market is projected to reach a valuation of USD 33.65 billion in 2025 and is expected to grow to USD 43.56 billion by 2030, registering a CAGR of 5.30% during the forecast period.

The rising demand for products that combine indulgence with nutritional benefits is driving the popularity of honey-based, nut-based, and fruit-derived formulations. The Asia-Pacific region has the fastest market growth, fueled by increasing urbanization, the growing adoption of Western-style breakfast habits, and the rapid expansion of e-commerce platforms. In contrast, Europe, while being a mature market, remains the largest regional consumer. The region is witnessing a shift toward premium offerings and lower-sugar alternatives, reflecting changing consumer preferences. On a global scale, supermarkets continue to dominate in terms of volume; however, the rapid growth of online retail, with its double-digit CAGR, is significantly influencing merchandising strategies, packaging innovations, and channel dynamics within the sweet spreads market.

Global Sweet Spread Market Trends and Insights

Rising demand for convenient breakfast options

Modern lifestyles have turned breakfast into a quick, functional routine, driving growth in the sweet spreads market as consumers seek convenient, flavorful options. In urban areas, where time is limited, demand for ready-to-eat and easy-to-prepare solutions has surged. Sweet spreads appeal to singles and families due to their versatility and ease of use, extending beyond breakfast to snacking, baking, and desserts. Manufacturers have introduced innovations like portion-controlled packs, squeezable bottles, and single-serve sachets, supporting on-the-go consumption and reducing food waste. Healthier variants, such as low-sugar and organic options, have expanded the consumer base, meeting the demand for convenience, portability, and sustainability, and solidifying sweet spreads as a staple in today's health-focused food industry.

Increasing consumer preference for natural and organic ingredients

Growing consumer skepticism toward artificial ingredients has driven a significant market shift toward natural and organic sweet spreads. This transition has given rise to a premium segment that achieves higher profit margins, even in a price-sensitive market. However, this trend extends beyond mere ingredient substitution; it reflects a broader reevaluation of consumer food values. Transparency in sourcing and minimal processing have emerged as critical factors influencing purchasing decisions. This shift is particularly prominent in honey and nut-based spreads, where consumers are increasingly attentive to sourcing practices and production methods. Brands that can substantiate their natural claims through transparent supply chains and credible third-party certifications are well-positioned to capitalize on this evolving demand, creating a competitive edge in the market.

Rising concerns over sugar content and obesity discourage frequent consumption

Rising consumer awareness of sugar's health risks is challenging the traditional sweet spreads market. Manufacturers must balance taste with nutritional standards, while regulatory actions add pressure. For instance, Peru's front-of-package warning labels have driven reformulations, and Chile's Food Labelling Law cut 'high in' sugar sweet spreads from 58.0% to 13.7%, as per a BMC Medicine study. Adding to this momentum, the FDA's updated definition of "healthy" as a nutrient content claim, which will take effect in February 2025, introduces stricter criteria for products making health claims. This regulatory landscape is pushing manufacturers to adopt innovative sugar reduction strategies, such as incorporating natural sweeteners and reformulating products to retain their taste profiles while addressing growing health concerns.

Other drivers and restraints analyzed in the detailed report include:

- Product innovations such as new flavors and health-focused variants attract diverse demographics

- Branding and marketing campaigns by companies

- Increasing raw material costs (e.g., nuts, cocoa) impact pricing and profit margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, honey held the largest market share at 35.22% and was the fastest-growing segment, with a projected CAGR of 7.23% from 2025 to 2030. This growth reflects honey's role in meeting demand for natural sweeteners and functional foods. Its dominance stems from being a natural, minimally processed sweetener with health benefits, aligning with the clean-label trend. Honey's uses in cooking, baking, and remedies expand its market reach. Regulatory support, such as guidelines from the New York State Department of Agriculture and Markets, highlights the rising importance of natural sweeteners. Innovations like 'hot honey' further drive consumer interest and market growth.

The segment's growth is driven by awareness of honey's antioxidant and immune-supporting benefits. Innovations combining honey with natural ingredients create premium options for health-conscious consumers. Regulatory changes, like the FDA's focus on 'added sugars,' strengthen honey's position. Honey's role as a market leader and growth driver solidifies its importance in the natural sweetener market.

In 2024, conventional sweet spreads dominate the market with a 71.12% share, driven by affordability and consumer familiarity. Competitive pricing and the reach of traditional retail channels make them the preferred choice for mainstream buyers. Manufacturers leverage economies of scale to keep prices low while investing in product innovations and marketing. Although the USDA highlights growing interest in organic products, conventional spreads remain dominant due to price sensitivity and established habits. They also serve as a platform for testing new flavors and formulations, aiding the development of premium variants.

The organic segment, however, is growing rapidly, with a projected CAGR of 8.01% from 2025 to 2030, outpacing conventional spreads. This growth is fueled by consumer demand for healthier, sustainable, and high-quality products. Adhering to strict production standards, organic spreads appeal to health-conscious buyers who value transparency. The USDA notes that despite economic challenges, a loyal consumer base supports organic products, driving demand. Expanding retail channels and increased awareness of organic benefits further bolster this growth.

The Sweet Spreads Market Report is Segmented by Product Type (Chocolate Spreads, Honey, Jam and Fruit Preserves and More), Nature (Conventional and Organic), Packaging Type (Jars, Tubs, and More), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Europe leads the sweet spreads market with a 32.02% share, driven by established consumption habits and a refined retail network. Western Europe emphasizes quality and authenticity, supporting premium pricing. Despite market maturity, Europe is shifting towards premiumization and functional, plant-based variants. USDA data highlights strong demand for premium products, with Germany and France leading the organic market. Regulatory changes, including sugar content and nutritional labeling, are driving product reformulations, with front-of-package warning labels prompting significant adjustments. The region fosters innovation by blending traditional appeal with health and sustainability trends.

Asia-Pacific is set to drive the sweet spreads market growth, with a projected CAGR of 7.23% from 2025 to 2030, surpassing global rates. Growth is fueled by rising incomes, urbanization, and western breakfast trends in China and India. Diverse consumer preferences and market maturity require balancing affordability with premiumization. USDA forecasts India's food processing sector to grow at a 15% CAGR, reaching USD 535 billion by 2025/26, driven by Tier-II and III cities. The Asian Development Bank's report on e-commerce in Asia-Pacific underscores the sustained momentum in online retail, offering digital opportunities for manufacturers.

North America remains a key market but faces maturity challenges. High per-capita consumption drives intense competition between established and emerging brands. Consumer preferences split between indulgent and health-focused options, creating diversification opportunities. In the U.S., nut-based spreads like peanut butter hold cultural significance, while health-centric alternatives gain traction. Regulatory changes, such as the FDA's 'added sugars' label, push for transparency, influencing formulations and marketing. Trade agreements like the U.S.-Chile Free Trade Agreement, removing tariffs on agricultural goods, create export opportunities for U.S. manufacturers.

- Ferrero International S.A.

- The J.M. Smucker Company

- Andros Group

- The Kraft Heinz Company

- Mondelez International, Inc.

- Wilkin & Sons Ltd

- Conagra Brands, Inc.

- Nestle S.A.

- The Hershey Company

- Dabur India Ltd

- Marico Limited

- Lotus Bakeries NV

- B&G Foods, Inc.

- Hero Group

- Orkla ASA

- Lindt & Sprungli AG

- Hormel Foods Corporation

- Rigoni di Asiago S.r.l.

- Hive & Wellness Australia Pty Ltd (Capilano Honey)

- Premier Foods plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for convenient breakfast options

- 4.2.2 Product innovations such as new flavors and health-focused variants attract diverse demographics

- 4.2.3 Growth of retail stores and online distribution channels improves spreads availability to consumers

- 4.2.4 Increasing consumer preference for natural and organic ingredients

- 4.2.5 Branding and marketing campaigns by companies

- 4.2.6 Adoption of western breakfast habits in developing countries

- 4.3 Market Restraints

- 4.3.1 Rising concerns over sugar content and obesity discourage frequent consumption

- 4.3.2 Increasing raw material costs (e.g., nuts, cocoa) impact pricing and profit margins

- 4.3.3 Growing competition from healthier alternatives like yogurt spreads restrains category

- 4.3.4 Shorter shelf-life for natural and preservative-free products challenges supply chains

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Chocolate Spreads

- 5.1.2 Honey

- 5.1.3 Jam and Fruit Preserves

- 5.1.4 Nut and Seed Based Spreads

- 5.1.5 Malt and Syrup-based Spreads

- 5.1.6 Others

- 5.2 By Nature

- 5.2.1 Conventional

- 5.2.2 Organic

- 5.3 By Packaging Type

- 5.3.1 Jars

- 5.3.2 Tubs

- 5.3.3 Sachets/Pouches

- 5.3.4 Others

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Ferrero International S.A.

- 6.4.2 The J.M. Smucker Company

- 6.4.3 Andros Group

- 6.4.4 The Kraft Heinz Company

- 6.4.5 Mondelez International, Inc.

- 6.4.6 Wilkin & Sons Ltd

- 6.4.7 Conagra Brands, Inc.

- 6.4.8 Nestle S.A.

- 6.4.9 The Hershey Company

- 6.4.10 Dabur India Ltd

- 6.4.11 Marico Limited

- 6.4.12 Lotus Bakeries NV

- 6.4.13 B&G Foods, Inc.

- 6.4.14 Hero Group

- 6.4.15 Orkla ASA

- 6.4.16 Lindt & Sprungli AG

- 6.4.17 Hormel Foods Corporation

- 6.4.18 Rigoni di Asiago S.r.l.

- 6.4.19 Hive & Wellness Australia Pty Ltd (Capilano Honey)

- 6.4.20 Premier Foods plc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK