PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836725

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836725

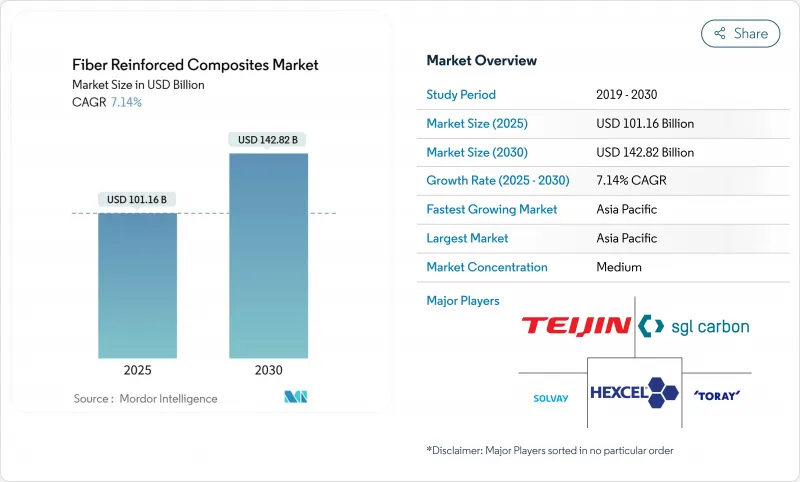

Fiber Reinforced Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fiber reinforced composites market reached USD 101.16 billion in 2025 and is projected to advance to USD 142.81 billion by 2030, registering a 7.14% CAGR.

Robust demand originates from aviation programmes that allocate more than 50% of structural weight to composites, notably the Boeing 787 and Airbus A350 platforms. Automakers pursuing Corporate Average Fuel Economy compliance and electric-vehicle range gains accelerate adoption of lightweight carbon laminates, while the wind sector's push toward 100-meter blades further enlarges the fiber reinforced composites market. Process automation deepens competitiveness, with automated fiber placement lines resolving labour shortages and consistency challenges. Regionally, Asia-Pacific leads on the back of China's large-scale manufacturing capacity, although local overcapacity pressures linger even as India's nascent aerospace ecosystem scales.

Global Fiber Reinforced Composites Market Trends and Insights

Growing Aerospace Composite Demand

Commercial programmes target 50% composite content to secure 15-20% fuel-burn reductions, and eVTOL designs push that ratio even higher. Hexcel's commercial aerospace revenue jumped 21.3% in 2024 on wide-body build rates, yet supply chain tightness tempers near-term deliveries. NASA's HiCAM effort aims to multiply output rates for thermoset and thermoplastic fuselages, signaling a structural demand uplift. Parallel R&D on fully composite cryogenic tanks for liquid-hydrogen propulsion opens new sub-segments for the fiber reinforced composites market. Together, these shifts cement aerospace as a medium-term growth catalyst.

Wind-Turbine Blade Length Upsizing

Blade lengths now exceed 100 meters, demanding carbon spar caps to retain stiffness without weight penalties. The U.S. Big Adaptive Rotor project underscores this trajectory, while hybrid natural-synthetic fibre blends improve lifecycle sustainability. New polyurethane-carbon pultrusion lines from Dow achieve 90% in-line cure, boosting throughput for oversized laminates. Global capacity is forecast to reach 981 GW by 2030, yet recycling end-of-life blades remains unresolved, inviting circular-economy innovation.

High Raw-Material & Processing Costs

Energy-intensive carbonisation drives elevated input costs, although lignin-based precursors from the University of Manchester suggest 3-5 X savings potential. Traditional AFP systems list at USD 3-6 million, but modular leasing models lower the entry barrier. SGL Carbon's 35.2% sales drop in fiber units shows sensitivity to volatile commodity pricing. Recycled carbon fibre, requiring far less energy, can relieve some pressure while preserving mechanical properties.

Other drivers and restraints analyzed in the detailed report include:

- Automotive Lightweighting Mandates

- Infrastructure Rehab with FRP Rebar

- Difficulties in Recycling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, glass fibers dominated the market with a 61.87% share, driven by cost efficiencies and robust supply chains in the construction, automotive, and wind energy sectors. While holding a smaller share, carbon fibers are projected to grow at a CAGR of 8.04% through 2030, supported by increasing demand in the aerospace and high-performance automotive industries. Aramid fibers, known for their impact resistance and thermal stability, are primarily used in protective equipment and aerospace components. Despite their higher costs, Boron fibers are utilized in specialized aerospace applications. The adoption of natural fibers is increasing through hybrid composites that combine synthetic and natural fibers, offering environmental benefits while maintaining performance. For example, bamboo and sisal fibers are used in wind turbine blades.

Advancements in manufacturing are transforming fiber production economics. The CARBOWAVE project has introduced microwave-assisted carbon fiber production, reducing energy consumption by up to 70%, potentially altering cost structures and environmental impacts. Saudi Arabia has established the first industrial-scale facility for graphene-enriched carbon fiber production, targeting aerospace, automotive, and construction applications, with projected revenues exceeding USD 1.6 billion by 2030. Basalt fibers are emerging as a sustainable alternative, offering superior mechanical properties and environmental resistance compared to natural fiber composites. Additionally, their cost advantages over carbon fibers make them suitable for offshore wind applications requiring durability in harsh environments.

In 2024, polymer systems accounted for 70.45% of the revenue, while metal matrix options are projected to achieve a 7.50% CAGR, highlighting their sustained importance in the fiber-reinforced composites market, particularly for aerospace thermal-management applications. Ceramic matrix composites developed by GE enhance jet engine operating temperatures, improving fuel efficiency by up to 20%. Additionally, carbon-carbon materials are critical for components exposed to hypersonic re-entry and fusion reactors, where endurance at 2,000 °C is essential.

Rapid-cycle thermoplastics, such as polycarbonate, PEKK, and PEEK, are gaining traction due to their recyclability and capability for one-minute press molding. Covestro has introduced continuous-fiber polycarbonate panels targeting the consumer electronics sector. Furthermore, NREL has demonstrated a bio-based epoxy that reduces greenhouse gas emissions by 40% compared to petrochemical-based resins while maintaining production cost efficiency. Mitsubishi Chemical has also developed a ceramic composite capable of withstanding temperatures of 1,500 °C, meeting JAXA specifications for launch vehicles and creating new revenue opportunities in the defense and space sectors.

The Fiber Reinforced Composites Market Report Segments the Industry by Fiber Type (Carbon Fibers, Glass Fibers and More), Matrix (Polymer Matrix Composites, Metal Matrix Composites, and More), Manufacturing Process (Pultrusion, Filament Winding, and More), End-User Industry (Aerospace and Defense, Automotive, and More) and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 41.05% of 2024 sales and is set to post an 8.38% CAGR, ensuring that the fiber reinforced composites market remains anchored in the region. China's HRC invested USD 33.8 million in Changshu to expand serial thermoset and thermoplastic part output, while India's Kineco Exel now supplies pultruded carbon planks to Vestas from its Goa site. Taiwan's Swancor has localised resin plate supply for offshore projects, deepening the regional value chain.

North America leverages an entrenched aerospace base and fuel-economy regulation to maintain demand. GKN Aerospace doubled assembly capacity in Chihuahua, Mexico, adding 200 jobs to serve Gulfstream and HondaJet programmes. Safran expanded LEAP engine capacity in Queretaro, underscoring Mexico's rise as a composites manufacturing node. MIT researchers developed "nanostitching" with carbon nanotubes, lifting interlaminar shear by 62% and hinting at further light-weighting gains.

Europe champions recycling mandates and low-carbon material innovation. The Clean Sky 2 FRAMES project validated xenon flashlamp AFP heating for PEEK and PEKK wingskins, while Strata and Solvay opened the first MENA prepreg plant for Boeing 777X parts in Al Ain, UAE. Brazil's composites turnover rose 5.6% to USD 560 million in 2024, pointing to latent growth potential across South America.

- Avient Corporation

- Covestro AG

- Hexcel Corporation

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Owens Corning

- Plasan

- SABIC

- SGL Carbon

- Solvay

- Teijin Limited

- Toray Industries Inc.

- TPI Composites

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing aerospace composite demand

- 4.2.2 Wind-turbine blade length upsizing

- 4.2.3 Automotive lightweighting mandates

- 4.2.4 Infrastructure rehab with FRP rebar

- 4.2.5 Rapid-layup thermoplastic UD tape lines

- 4.2.6 Carbon-capture derived acrylonitrile feedstock

- 4.3 Market Restraints

- 4.3.1 High raw-material & processing costs

- 4.3.2 Difficulties in Recycling

- 4.3.3 Performance defects due to wate absorption and low fire resistance

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Fiber Type

- 5.1.1 Carbon Fibers

- 5.1.2 Glass Fibers

- 5.1.3 Aramid Fibers

- 5.1.4 Boron Fibers

- 5.1.5 Other Fiber Types (Basalt Fibers, Natural Fibers, etc.)

- 5.2 By Matrix

- 5.2.1 Polymer Matrix Composites

- 5.2.2 Metal Matrix Composites

- 5.2.3 Ceramic Composites

- 5.2.4 Carbon-Carbon Composites

- 5.2.5 Hybrid Composites

- 5.3 By Manufacturing Process

- 5.3.1 Lay-Up (Hand/Spray)

- 5.3.2 Filament Winding

- 5.3.3 Pultrusion

- 5.3.4 Resin Transfer Molding

- 5.3.5 Automated Fiber Placement & Tape Laying

- 5.3.6 Compression & Injection Molding

- 5.3.7 3D Printing / Additive Manufacturing

- 5.4 By End-user Industry

- 5.4.1 Aerospace & Defense

- 5.4.2 Automotive

- 5.4.3 Wind Energy

- 5.4.4 Building & Construction

- 5.4.5 Electrical & Electronics

- 5.4.6 Sporting Goods

- 5.4.7 Other End-user Industries (Marine, Oil and Gas, etc.)

- 5.5 By Geography (Value)

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Avient Corporation

- 6.4.2 Covestro AG

- 6.4.3 Hexcel Corporation

- 6.4.4 Huntsman Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Owens Corning

- 6.4.7 Plasan

- 6.4.8 SABIC

- 6.4.9 SGL Carbon

- 6.4.10 Solvay

- 6.4.11 Teijin Limited

- 6.4.12 Toray Industries Inc.

- 6.4.13 TPI Composites

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Growing Innovation on Bio-based Resin Systems