PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842415

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842415

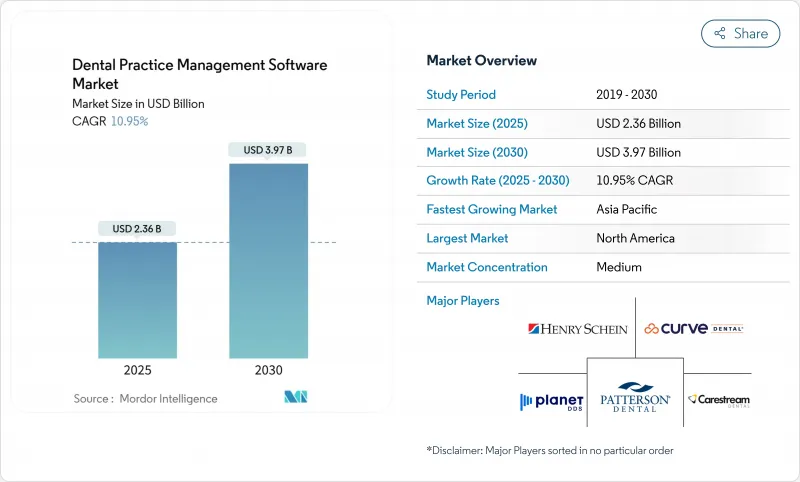

Dental Practice Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The dental practice management software market is valued at USD 2.36 billion in 2025 and is forecast to expand to USD 3.97 billion by 2030, registering a 10.95% CAGR.

Accelerated digitalization, the embrace of cloud computing, and the rapid diffusion of artificial intelligence are turning conventional workflow tools into integrated practice-intelligence hubs. Early cloud adopters report double-digit productivity gains, while AI-enabled diagnostics shorten chairside decision-making time and lift case-acceptance rates. Consolidation among dental service organizations (DSOs) is shifting purchasing power toward enterprise-scale platforms, and government incentives for electronic claims continue to speed revenue-cycle automation. At the same time, stricter data-protection rules, such as the 2025 proposed update to the HIPAA Security Rule-raise the compliance bar for every vendor.

Global Dental Practice Management Software Market Trends and Insights

Rising Global Burden of Oral Diseases Driving Preventive & Restorative Service Volumes

Escalating prevalence of caries and periodontal disease is inflating patient visits and elevating expectations for seamless chairside experiences. Practices facing heavier caseloads increasingly turn to automation that optimizes provider calendars, streamlines check-in, and shortens revenue-cycle turns. Large DSOs now employ rule-based scheduling engines that cut administrative keystrokes and free staff capacity for clinical tasks. Vendors embedding AI triage and recall prompts position themselves as essential partners to prevention-focused care models.

Growing Adoption of Digital Health Records & Interoperability Standards in Dentistry

The Office of the National Coordinator's 2024 rule endorsing USCDI v4 sets clear technical guardrails for dental data exchange. Cloud vendors have responded with APIs that map dental findings to medical EHR vocabularies, enabling bidirectional referrals and unified patient portals. Interoperability now ranks above license cost when practices replace legacy platforms, and vendors advertising open-standard compliance close contracts faster, especially in multi-specialty centers seeking medical-dental data fusion.

Data-privacy, Cyber-security & Compliance Complexities Across Regions

The 2025 HIPAA proposal mandates asset inventories, network mapping, and heightened training-requirements that weigh heavily on single-site practices with minimal IT support. Vendors with SOC 2-Type II credentials now showcase turnkey compliance dashboards to ease audit anxiety, while smaller suppliers lacking deep security expertise face escalating certification costs.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Cloud-based SaaS Models Offering Lower Up-front IT Costs

- Integration of PM Software with Imaging, CAD/CAM & Chairside Systems

- Lack of Standardized Clinical Coding and Workflow Harmonization in Dental IT

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud platforms generated the highest growth trajectory, expanding at a 14.21% CAGR, while on-premises deployments retained the largest 45.23% revenue slice in 2024. Practices cite frictionless upgrades and remote uptime monitoring as decisive benefits. The dental practice management software market size for cloud offerings is forecast to surpass on-premises revenue by 2027, underpinned by the rollout of AI modules that require elastic compute capacity. Even security-conscious organizations increasingly adopt hybrid models that sync encrypted data to the cloud nightly to meet off-site-backup mandates.

Incumbent server-based vendors are rewriting code bases to micro-services, but architectural overhauls take time. As subscription renewals approach, many practices opt to leapfrog hardware refreshes and shift workloads to browser-based consoles. Integration partners report that chairside imaging stations connect more reliably to cloud charting than to legacy local servers, shortening file-open times and supporting tele-consults during restorative planning sessions.

Subscription contracts captured 60.32% dental practice management software market share in 2024 and continue to climb, due to transparent monthly pricing and automatic feature access. The model stabilizes cash flow for both vendors and practitioners, aligning software spend with production swings. Vendors now bundle support, backups, and cybersecurity insurance into subscription tiers, effectively converting formerly optional line items into standard entitlements.

Perpetual licenses persist mainly in geographies with intermittent connectivity or data-sovereignty rules that mandate in-country hosting. Nonetheless, forward-looking distributors prioritize SaaS onboarding, offering migration credits to lighten the switching burden. As more DSOs ink multi-year enterprise agreements, subscription MRR becomes the prime valuation metric for potential M&A targets.

The Dental Practice Management Software Market Report is Segmented by Delivery Mode (On-Premises, and More), Subscription Model (Perpetual License and Subscription / SaaS), Functionality (Patient Communication & Engagement, and More), Practice Size (Solo Practices (1-2 Ops), and More), End User (Dental Clinics, Hospitals, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40.21% of global revenue in 2024, buoyed by robust DSO consolidation and payer incentives for electronic remittances. The proposed HIPAA update heightens demand for software with built-in compliance workflows, and vendors that complete third-party audits early achieve premium price realization. Canada mirrors U.S. digitization but faces bilingual interface requirements that vendors address through configurable language packs.

Asia-Pacific posts a rapid 15.23% CAGR underpinned by government e-health drives and expanding middle-class spending on cosmetic dentistry. China and India escalate chair count each year, while South Korea and Thailand cater to cross-border treatment seekers, requiring multi-currency invoicing and passport-grade identification modules. Japan remains a vanguard for AI diagnostics, where 18% of dentists already run machine-learning decision support at the operatory.

Europe sustains steady demand, anchored by stringent GDPR rules that compel end-to-end encryption and patient-consent logging. Vendors investing in native multilingual templates and open-standard interfaces secure traction across Germany, France, and the Nordic region. The Middle East and Africa, though smaller today, enjoy rising private-sector investment, especially in Gulf Cooperation Council states constructing greenfield oral-health complexes with cloud-first infrastructure. Latin America's momentum concentrates in Brazil, where regulatory reforms now permit electronic prescriptions, unlocking integrated e-Rx workflows within leading platforms.

- Henry Schein Inc. (Dentrix)

- Carestream Dental

- Curve Dental

- Planet DDS Inc. (Denticon)

- Patterson Companies Inc. (Eaglesoft)

- Open Dental Software

- NextGen Healthcare

- DentiMax LLC

- tab32

- MOGO

- ABELDent Inc.

- Software of Excellence Intl.

- ClearDent

- ACE Dental Software

- iDentalSoft

- Practice-Web Inc.

- CareStack (Good Methods Global)

- Dovetail Dental Software

- RxNT Inc.

- Exan Software (axiUm)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Burden of Oral Diseases Driving Preventive & Restorative Service Volumes

- 4.2.2 Growing Adoption of Digital Health Records & Interoperability Standards in Dentistry

- 4.2.3 Expansion of Cloud-based SaaS Models Offering Lower Up-front IT Costs

- 4.2.4 Integration of PM Software with Imaging, CAD/CAM & Chairside Systems

- 4.2.5 Government & Insurer Incentives for Electronic Claims & Revenue-Cycle Automation

- 4.2.6 Emergence of Large Multi-site Dental Networks and Corporate Dentistry Worldwide

- 4.3 Market Restraints

- 4.3.1 Data-privacy, Cyber-security & Compliance Complexities Across Regions

- 4.3.2 Lack of Standardized Clinical Coding and Workflow Harmonization in Dental IT

- 4.3.3 Resistance to Workflow Change & Low Digital Literacy Among Aging Practitioners

- 4.3.4 Limited IT Budgets and ROI Concerns Among Small Independent Practices

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Delivery Mode

- 5.1.1 On-premises

- 5.1.2 Web-based

- 5.1.3 Cloud-based

- 5.2 By Subscription Model

- 5.2.1 Perpetual License

- 5.2.2 Subscription / SaaS

- 5.3 By Functionality

- 5.3.1 Patient Communication & Engagement

- 5.3.2 Appointment Scheduling & Calendar

- 5.3.3 Billing & Invoicing

- 5.3.4 Insurance & Claims Management

- 5.3.5 Treatment Planning & Charting

- 5.3.6 Imaging & Diagnostics Integration

- 5.3.7 Analytics & Business Intelligence

- 5.4 By Practice Size

- 5.4.1 Solo Practices (1-2 Ops)

- 5.4.2 Small Group Practices (3-9 Ops)

- 5.4.3 Large Group Practices (10+ Ops)

- 5.4.4 Dental Service Organizations (DSOs)

- 5.5 By End User

- 5.5.1 Dental Clinics

- 5.5.2 Hospitals & Specialty Dental Centers

- 5.5.3 Academic & Research Institutes

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Henry Schein Inc. (Dentrix)

- 6.3.2 Carestream Dental LLC

- 6.3.3 Curve Dental Inc.

- 6.3.4 Planet DDS Inc. (Denticon)

- 6.3.5 Patterson Companies Inc. (Eaglesoft)

- 6.3.6 Open Dental Software

- 6.3.7 NextGen Healthcare Inc.

- 6.3.8 DentiMax LLC

- 6.3.9 tab32

- 6.3.10 MOGO Inc.

- 6.3.11 ABELDent Inc.

- 6.3.12 Software of Excellence Intl.

- 6.3.13 ClearDent

- 6.3.14 ACE Dental Software

- 6.3.15 iDentalSoft

- 6.3.16 Practice-Web Inc.

- 6.3.17 CareStack (Good Methods Global)

- 6.3.18 Dovetail Dental Software

- 6.3.19 RxNT Inc.

- 6.3.20 Exan Software (axiUm)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment