PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842418

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842418

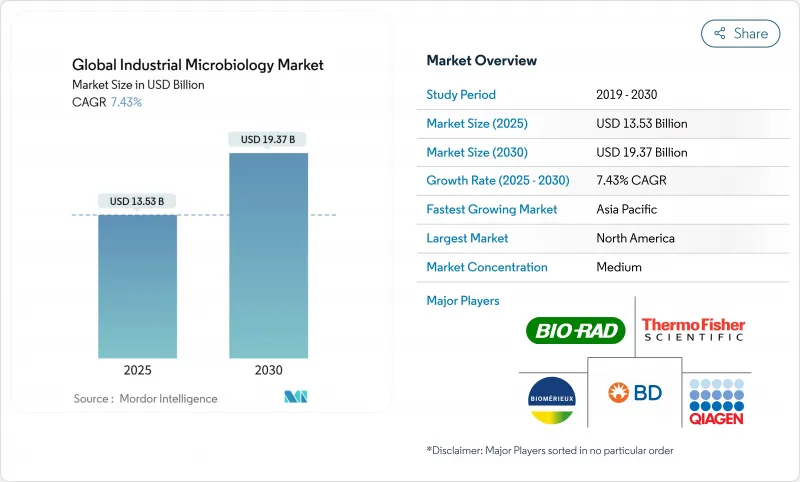

Global Industrial Microbiology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The industrial microbiology market is valued at USD 13.53 billion in 2025 and is forecast to climb to USD 19.37 billion by 2030, reflecting a 7.43% CAGR over the period.

Demand is widening beyond traditional quality-control testing as bioprocessing, precision fermentation, and ESG-driven waste-bioremediation projects create fresh revenue pools for service providers. Rapid sterility and endotoxin screening requirements originating from cultivated-meat facilities, together with stricter GMO oversight in multiple jurisdictions, are reshaping validation protocols across the global supply chain. Supplier disruptions-in particular BD's shortage of BACTEC blood-culture vials in 2024-have amplified interest in multisource procurement strategies and automated inventory tracking to secure laboratory uptime. Competitive intensity is accelerating as leading vendors pursue acquisitions, single-use bioreactor innovations, and AI-driven contamination-detection software to differentiate on speed, data integrity, and cybersecurity resilience.

Global Industrial Microbiology Market Trends and Insights

Growing Demand for Nutraceuticals & Fermented Products

Surging probiotic consumption across Asia, highlighted by Zuellig Pharma's decade-long alliance to distribute OMNi-BiOTiC strains in Indonesia, Philippines, and Taiwan, is pushing laboratories to offer localized strain-characterization services alongside metabolite profiling. The industrial microbiology market is therefore pivoting from pathogen detection toward deeper functional analytics that quantify bioactivity and regional taste preferences. Manufacturers are also tailoring formulations to match local regulatory requirements, which accelerates demand for rapid microbial-quality testing infrastructure in emerging economies. The widening palette of fermentation-derived ingredients-ranging from umami seasonings to bio-based sweeteners-is adding new QC checkpoints for contaminants and off-target metabolites. These shifts collectively sustain recurring consumable uptake and cement long-term reagent contracts for leading suppliers.

Rising Concern for Food Safety & Stringent Regulations

Recent Listeria-linked recalls involving supplement shakes prompted regulators to enforce tighter turnaround targets for contamination confirmation, spurring adoption of high-throughput PCR and whole-genome-sequencing workflows. The FDA's updated Pharmaceutical Microbiology Manual demands harmonized endotoxin and antimicrobial-effectiveness assays that integrate seamlessly with 21 CFR 11-compliant data-capture systems. Vendors such as bioMerieux responded with the 3P ENTERPRISE platform, pairing digital environmental monitoring with audit-ready electronic records. Blockchain-supported supply-chain transparency adds another documentation layer, compelling QC labs to generate tamper-proof microbial test reports. Collectively, these pressures increase spending on automated incubators, rapid readers, and middleware that can cut result cycles while meeting evolving global benchmarks.

Regulatory Conflicts Over GMOs in Food Sources

Divergent frameworks for CRISPR-edited crops create compliance complexity as the EU proposes dual regulatory pathways for new genomic techniques, while the U.S. leans on harmonization through the ICH. Testing laboratories servicing global clients must therefore maintain parallel protocols, certifications, and reporting formats, increasing operating costs and stretching skilled-labor capacity. China's heightened biosafety oversight further obliges exporters to demonstrate traceability of genetically modified microorganisms from strain lineage to final product. As patent volumes for CRISPR crops exceed 1,900 yet lack uniform treatment, QC providers in the industrial microbiology market face uncertainty when planning capital investments in GMO-specific analytical platforms. These discrepancies slow cross-border adoption of rapid microbial assays tailored to engineered organisms.

Other drivers and restraints analyzed in the detailed report include:

- Increasing R&D Spend & Biopharma Pipeline Expansion

- Expansion of Industrial Fermentation for Biofuels & Enzymes

- Supply-Chain Volatility in Specialty Culture Media Inputs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Consumables represented 52.38% of global revenue in 2024, underscoring their vital role in day-to-day operations. Reagent volumes rise with each automation cycle, and the industrial microbiology market size attached to consumables is projected to grow at 9.28% CAGR to 2030 as high-throughput instruments demand larger lot-qualified batches. Media & culture preparations expand in tandem with stricter environmental-monitoring guidelines for pharmaceutical clean rooms. RFID-enabled vials and plates improve inventory accuracy and support remote batch-release verification, deepening laboratory reliance on branded disposables.

The equipment & systems segment benefits from single-use technologies that cut cleaning validation steps by 50%, yet its share grows more gradually because capital budgets follow multi-year cycles. Filtration and centrifugation innovations favor closed-system configurations that block adventitious microbes upstream. Automated colony-counters reduce analyst hours, which translates into higher throughput and greater reagent pull-through for suppliers. Such synergies help vendors defend margins even as competition intensifies.

The food & beverage sector held 32.42% of industrial microbiology market share in 2024 on the back of global HACCP standards. However, the pharmaceutical & biotechnology segment is forecast to deliver a 10.22% CAGR through 2030, expanding the industrial microbiology market size for endotoxin, mycoplasma, and sterility testing kits. Growth is strongest in cell- and gene-therapy manufacturing, where rapid release testing can shave weeks off product lead-times.

Environmental testing is gaining traction as ESG-directed remediation funds sponsor microbiome-based clean-up of oil, heavy metals, and PFAS at industrial sites. Agricultural applications increasingly involve soil-health profiling using plant-growth-promoting rhizobacteria, while cosmetic brands invest in microbiome-friendly formulations that require live-culture stability assessments. These diversified use-cases spread risk for service providers and underpin broader instrument penetration across verticals.

The Industrial Microbiology Market is Segmented by Product Type (Equipment & Systems [Fermentation Systems, and More], Consumables [Media & Culture Preparations, and More], Reagents), by Application Area (Food & Beverage Industry, Pharmaceutical & Biotechnology Industry, and More), by Microbial Type (Bacteria, and More), by Test Type (Sterility Testing, and More), by Geography (North America, Europe, Asia-Pacific, and More).

Geography Analysis

North America's leadership stems from mature GMP enforcement and ongoing capital investment such as Thermo Fisher's USD 2 billion U.S. upgrade program, which expands local single-use media output and strengthens supply resilience. Canadian biotech clusters leverage favorable R&D tax credits to develop microbial consortia for plant-based foods, whereas Mexican producers focus on cross-border harmonization to meet USMCA food-safety audits. Cybersecurity frameworks targeting automated data systems further differentiate regional vendors that embed role-based access controls and encrypted backups.

Asia-Pacific's double-digit trajectory arises from China's state-backed biologics plants seeking global cGMP accreditation, India's vaccine and biosimilar exporters, and Japan's functional-food incumbents requiring advanced strain-stability analytics. Government support for mRNA facilities in South Korea and Australia also accelerates demand for rapid QC solutions. Regional suppliers that localize consumable production reduce lead times and skirt import duties, capturing share from established multinationals.

Europe balances regulatory rigor with green-transition incentives. The EU's push for ISCC Plus certification drives uptake of renewable-plastic consumables, as demonstrated by Sartorius' 50% fossil-plastic reduction milestone. Germany and France spearhead bioprocess-4.0 pilot plants deploying predictive microbial analytics, while the UK channels public funding into phage-therapy R&D. Divergent GMO rules, however, oblige multi-national labs to run dual protocols, mildly constraining cross-border efficiencies.

- 3M

- Agilent Technologies

- Thermo Fisher Scientific

- Merck

- Danaher

- bioMerieux

- Bio-Rad Laboratories

- Beckton Dickinson

- Sartorius

- Eppendorf

- QIAGEN

- Novozymes A/S

- Lonza Group

- Charles River

- Pall Corporation (Danaher)

- Shimadzu

- Waters Corporation

- Asiagel

- Bio-Techne

- Grant Instruments

- BD Diagnostic Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for nutraceuticals & fermented products

- 4.2.2 Rising concern for food safety & stringent regulations

- 4.2.3 Increasing R&D spend & biopharma pipeline expansion

- 4.2.4 Expansion of industrial fermentation for biofuels & enzymes

- 4.2.5 Rapid QC needs in cultivated-meat manufacturing

- 4.2.6 ESG-funded microbiome waste-bioremediation projects

- 4.3 Market Restraints

- 4.3.1 Regulatory conflicts over GMOs in food sources

- 4.3.2 Escalating product recalls heightening scrutiny

- 4.3.3 Supply-chain volatility in specialty culture media inputs

- 4.3.4 Cyber-security risks to automated microbiology data systems

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Equipment & Systems

- 5.1.1.1 Fermentation Systems

- 5.1.1.2 Bioreactors & Fermenters

- 5.1.1.3 Filtration & Centrifugation Systems

- 5.1.1.4 Others

- 5.1.2 Consumables

- 5.1.2.1 Media & Culture Preparations

- 5.1.2.2 Petri Dishes & Vials

- 5.1.2.3 Other Consumables

- 5.1.3 Reagents

- 5.1.3.1 Enzymes & Buffers

- 5.1.3.2 Others

- 5.1.1 Equipment & Systems

- 5.2 By Application Area

- 5.2.1 Food & Beverage Industry

- 5.2.2 Pharmaceutical & Biotechnology Industry

- 5.2.3 Agricultural Industry

- 5.2.4 Environmental Industry

- 5.2.5 Cosmetic / Personal-Care Industry

- 5.2.6 Other Application Areas

- 5.3 By Microbial Type

- 5.3.1 Bacteria

- 5.3.2 Yeasts & Molds

- 5.3.3 Viruses & Phages

- 5.4 By Test Type

- 5.4.1 Sterility Testing

- 5.4.2 Bioburden Testing

- 5.4.3 Endotoxin Testing

- 5.4.4 Others

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M Company

- 6.3.2 Agilent Technologies

- 6.3.3 Thermo Fisher Scientific Inc.

- 6.3.4 Merck KGaA

- 6.3.5 Danaher Corporation

- 6.3.6 bioMerieux SA

- 6.3.7 Bio-Rad Laboratories Inc.

- 6.3.8 Becton, Dickinson & Company

- 6.3.9 Sartorius AG

- 6.3.10 Eppendorf AG

- 6.3.11 QIAGEN NV

- 6.3.12 Novozymes A/S

- 6.3.13 Lonza Group AG

- 6.3.14 Charles River Laboratories

- 6.3.15 Pall Corporation (Danaher)

- 6.3.16 Shimadzu Corporation

- 6.3.17 Waters Corporation

- 6.3.18 Asiagel Corporation

- 6.3.19 Bio-Techne Corporation

- 6.3.20 Grant Instruments

- 6.3.21 BD Diagnostic Systems

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment